Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – June 20, 2020

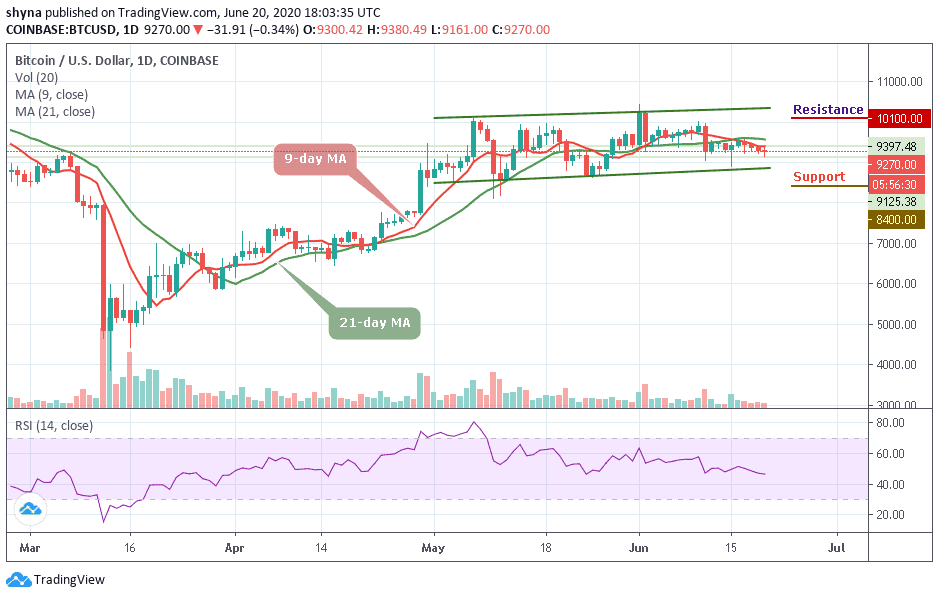

Bitcoin resumed consolidation after the last breakdown on June 11. Before now the market has fallen to $9,084 low and price corrected upward above $9,300. BTC/USD pair is consolidating with the appearance of indecisive candlesticks.

Key Levels:

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

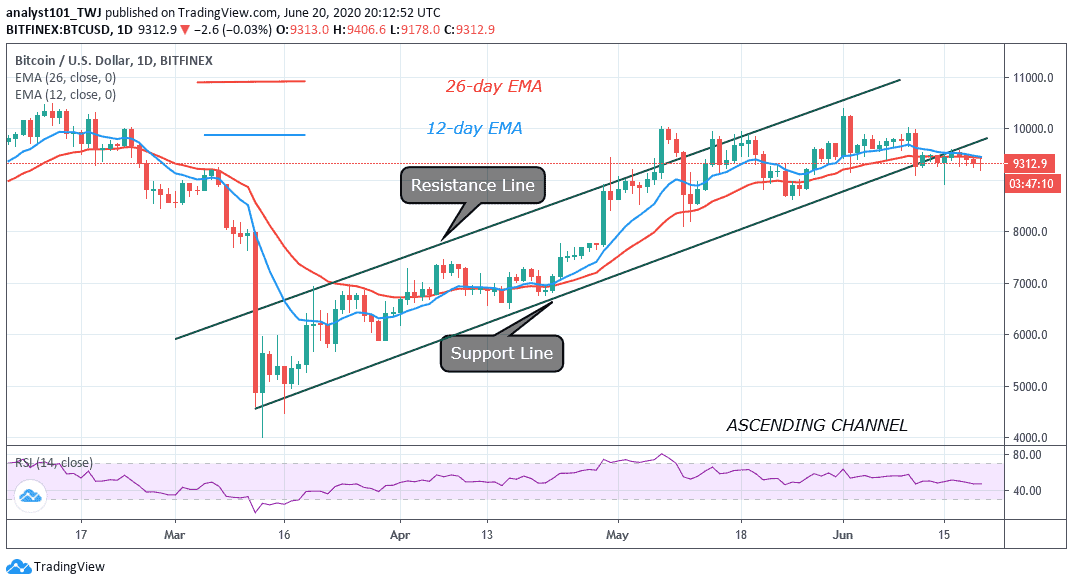

On a daily chart, price broke the support line in the last bearish impulse. However, the selling pressure was exhausted as price resumed a sideways trend. In the sideways trend, the market is consolidating with small body candlesticks. These candlesticks represent the Doji and the Spinning tops which describe that buyers and sellers are undecided about the direction of Bitcoin. Meanwhile, the price bars have broken the support line of the ascending channel. Technically, when price breaks the trend line and closes below it, the downtrend is likely to continue.

In this case, the market is in a sideways trend, instead of a downtrend. A few hours ago, the bears have earlier pushed BTC to $9,200 but the market went up above $9,300. The upward move will resume once the price remains above $9,300. Meanwhile, the market is still consolidating above $9,300. The Relative Strength Index period 14 is at level 47. The King coin is still trading in the downtrend zone and below the centerline 50.

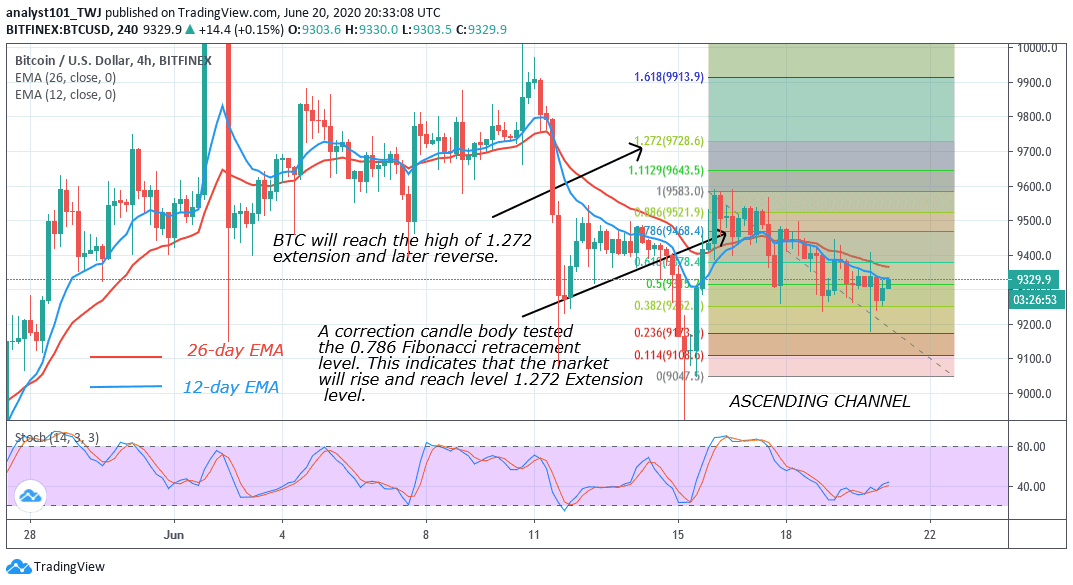

BTC/USD Medium-term Trend: Bullish (4-Hour Chart)

On the 4 hour chart, BTC is still consolidating above $9,300 support level. The coin is likely to rise in a couple of days. A correction candle body tested the 0.786 Fibonacci retracement level. This indicates that the market will rise and reach a level of 1.272 extension level. In other words, Bitcoin will rise and reach a high of $9,738 but will reverse. However, the reversal will not be immediate. Bitcoin is above 25% range of the daily stochastic. Presently, it is in a bullish momentum. This is contrary to the recent price action which indicates a bearish signal.

Join Our Telegram channel to stay up to date on breaking news coverage