Join Our Telegram channel to stay up to date on breaking news coverage

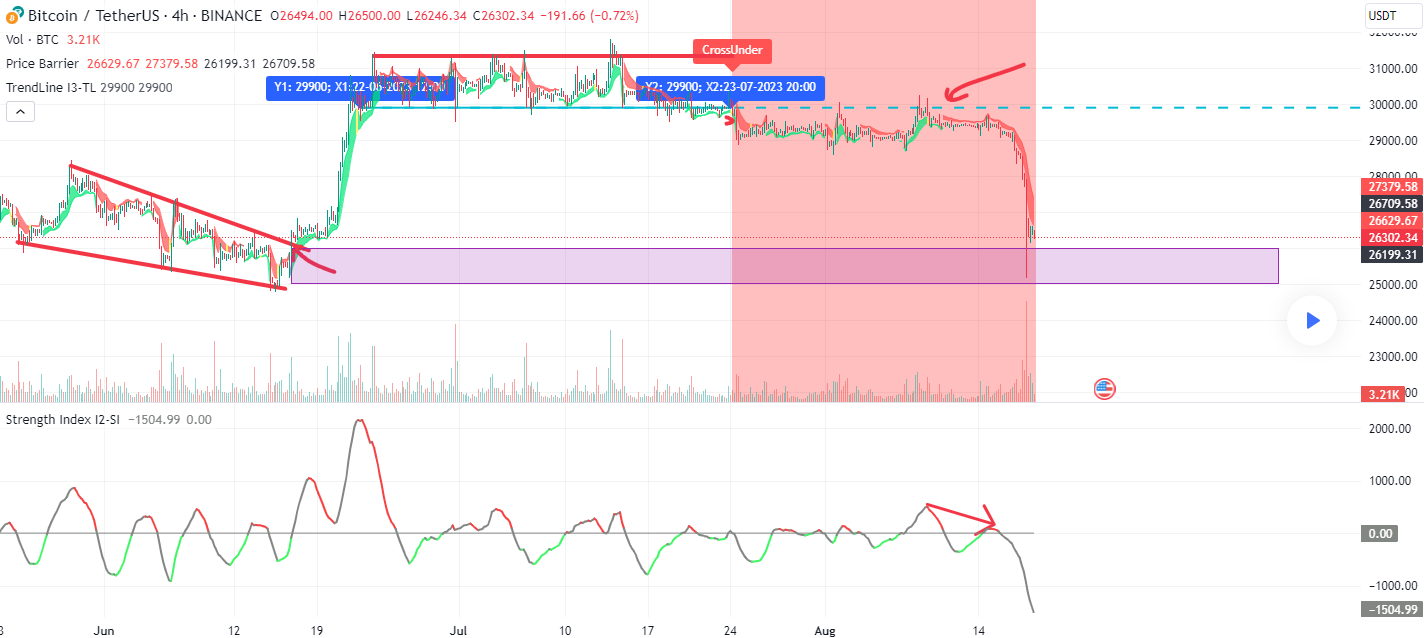

The Bitcoin price crashed past its support at $29k in the last 24 hours, sinking to $26k — even more profound than some predictions expected in the past few days. Along the way, Dow Jones dropped 150 points earlier today, August 18.

Many believe that the reason behind Bitcoin’s crash is SpaceX, which sold the entirety of its stake in Bitcoin. The sale occurred yesterday, August 17, and Elon Musk’s space company made $55 million in profit on $1.5 billion in revenue during the first quarter of this year.

Just woke up.

WHO SOLD pic.twitter.com/iusl2dAC20

— Reetika (@ReetikaTrades) August 18, 2023

Reports say that SpaceX wrote down Bitcoin’s value by $373 million last year. Musk-led companies have had a similar impact on Bitcoin in the past. For example, in 2021, BTC crashed during its bull run after Musk announced that Tesla would stop accepting Bitcoin payments for its cars. At the time, he said that Bitcoin is not eco-friendly and that Tesla, which produces electric vehicles, cannot continue to support it.

Now, SpaceX sold off the entirety of its stake, and Bitcoin dropped by over 7% in response.

Is SpaceX not responsible?

Bitcoin’s price crash came quickly after SpaceX moved, but some reports claim that SpaceX is not responsible for the “Bitcoin bloodbath.”

According to some professional traders, the market structure and recent liquidations caused the price to crash rather than a fundamental catalyst. The market has been illiquid and flat for too long, which created conditions for sudden movements. Unfortunately, the move happened to be down.

Some also suggested that the crash came in response to China Evergrande’s bankruptcy filing. However, this theory also encountered a lot of skepticism.

Evergrande filed for bankruptcy and we care? What is this? September 2021?

Elon allegedly sold, no confirmed reports yet though?

Hearing some big Vol seller blew up too

— Reetika (@ReetikaTrades) August 18, 2023

How did Bitcoin react?

Bitcoin price dipped from $29k to $28.6k on Thursday, August 17. However, this drop was dwarfed by the price dip that followed later in the day. Seemingly without warning, Bitcoin’s price dropped to $28.3k, from where it sank to $28k.

At first, it looked like it would stabilize here, but then the new support broke, only for BTC to sink to $26,289. The coin reached these levels for the first time since mid-June when it skyrocketed after the announcement of Bitcoin ETF filings spread worldwide.

After hitting $26,289, Bitcoin briefly bounced back up to $26,867, only to be rejected to the new bottom again. In the last several hours, the coin went up to $26.6k several times, each time facing a slight rejection.

These minor spikes are believed to be moves by some holders to buy the dip, as many are already predicting a strong price recovery in days to come. However, at the time of writing, Bitcoin is back to $26,241, and it seems to be stabilizing once again.

Wall Street Memes expected to sell even faster now after Bitcoin crash

While Bitcoin is suffering intense volatility, many are turning to the only safe cryptos, not stablecoins — those still in their presale phases. The most significant option on the market right now is Wall Street Memes (WSM). The presale has raised over $25.1 million by selling the WSM token, which is still ongoing.

The token’s price is $0.0334; it will jump to $0.0337 in less than a day. However, there are still two more phases before the presale ends in late August, so there is still time for buyers to get their hands on some of these tokens. The tokens can be bought with a credit or debit card or in exchange for ETH, BNB, and USDT.

The project itself was inspired by a subreddit called WallStreetBets. It consists of amateur investors who engaged in massive stock purchases in early 2021 to counter institutional investors who were shorting those stocks for profit while threatening to destroy multiple companies. By boosting the demand, WallStreetBets investors saved the companies, and institutions were forced to withdraw.

Related

- Best Crypto Exchanges – Top 10 List

- How to Buy Bitcoin Online Safely

- Bitcoin Price Prediction: Amidst Volatility, Could Wall Street’s Favorite Meme Coin Be a Wise Bet?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage