Join Our Telegram channel to stay up to date on breaking news coverage

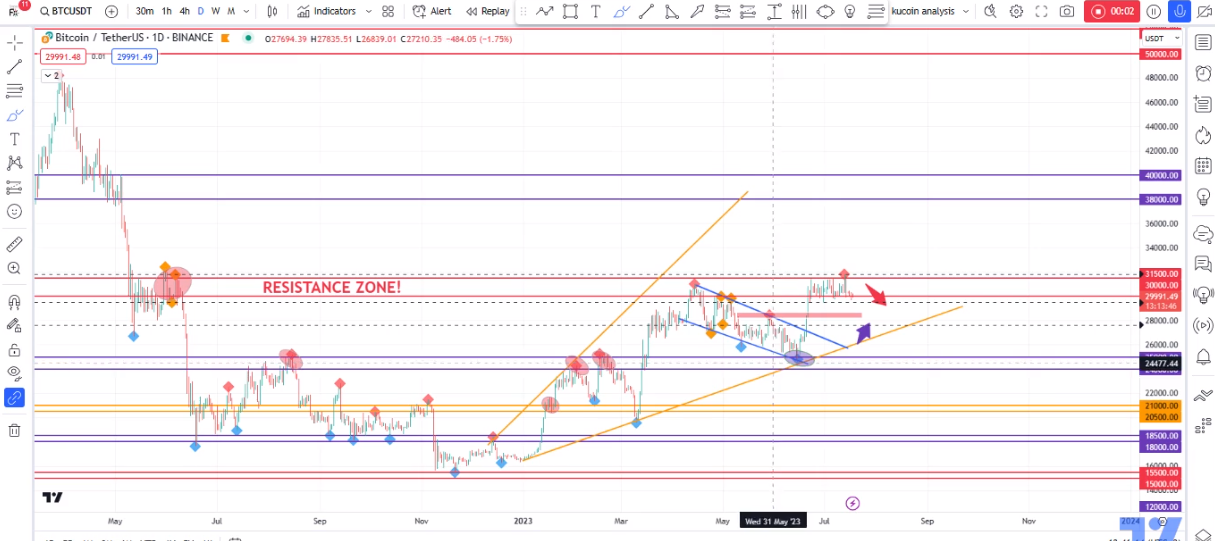

Bitcoin’s price spent nearly a month stuck between a support at $30k and a resistance at $31k. For weeks, analysts were speculating when the coin might break out and which way it was going to go. The coin finally made its move, breaking the support that held it from sinking since June 21st.

The support broke yesterday, July 17th, as to coin crashed down to $29,685. However, the price immediately recovered back to $30,251.

The sudden recovery to a new resistance caused the coin’s price to be rejected, and Bitcoin fell back down, once again dropping below $30k earlier today, July 18th.

However, this time, Bitcoin managed to remain close to its new resistance, only dropping to $39,916 before trying to breach it again.

Bitcoin sits at $29,999 at the time of writing, just under the resistance. Unfortunately, it appears that it currently lacks the buy pressure to breach the level again.

Even so, it is clear that the coin is trying everything in its power to grow back up and return above the $30k level.

Analysts say that BTC is consolidating right now and going into a ranging pattern.

Breaking the support, now a resistance could open doors to a new low, especially if the price experiences another strong rejection. The short-term prediction is that the coin will likely see a major correction in the next few days.

The SEC is preventing US banks from holding crypto

Investors have become hesitant to buy BTC because of the recent revelation regarding the US securities regulator, the SEC.

According to Matt Walsh, a Castle Island Ventures partner, the regulator is preventing US banks from holding any crypto through an obscure accounting rule.

The rule was apparently inserted quietly, and until not, it managed to pass undetected. The rule is known as Staff Accounting Bulletin No. 121, and it was introduced in March 2022.

Welsh explained it on Twitter, pointing out that Gary Gensler, the SEC Chair, likely introduced it as part of Elizabeth Warren’s anti-crypto campaign.

SAB 121 and how Gary Gensler, the lead henchman of Elizabeth Warren’s anti-crypto army, is turning the SEC into a merit regulator and using an obscure accounting rule to prevent major banks from touching crypto in the United States… pic.twitter.com/SsXLBZddBn

— Matt Walsh (@MattWalshInBos) July 17, 2023

He explained that the rule applies to entities that file financial information with the SEC under the US Generally Accepted Accounting Principles or International Financial Reporting Standards.

Essentially, its core requirement is for such entities to recognize a liability on their balance sheets, meaning that the banks are forced to treat Bitcoin as if it was not the bank’s own asset. As a result, the banks are forced to hold more USD as a capital charge against the asset.

So, you basically have a new directive from the SEC that stipulates that some of the most trusted US financial institutions cannot offer digital asset custody services.

How does that protect consumers or promote capital formation?

Whose agenda does this serve?

— Matt Walsh (@MattWalshInBos) July 17, 2023

SEC Acknowledged Valkyrie’s Bitcoin ETF Proposal

Not all recent news were bad for Bitcoin, however. The US SEC recently acknowledged another proposal in a new twist on the Bitcoin ETF field.

This time, the proposal filed by Valkyrie is the only applicant to include a ticker symbol for the ETF: BRRR.

Valkyrie altered its proposal last month, shifting the exchange to Nasdaq, which aligned it with BlackRock — one of the world’s largest asset managers.

BlackRock is also a company whose new, re-filed proposal was accepted by the regulator, even though the SEC did not approve either.

But, with Valkyrie’s Bitcoin ETF acknowledged, the chance of the regulator approving an ETF this time has become much greater.

SEC seeks public input regarding Bitcoin ETF

The SEC has fought the approval of a Bitcoin ETF for a full decade at this point, but it now appears that it has nowhere to go, and nothing to point out as a problem.

So, the regulator decided to request the members of the public to share their opinion on the Bitcoin ETF filings, and see where the people stand on the matter.

The regulator invited members of the public to share their views yesterday, July 17th.

The public is expected to provide input on filings made by WisdomTree Bitcoin Trust, Wise Origin Bitcoin Trust, Invesco Galaxy Bitcoin ETF, and VanEck Bitcoin Trust. Anyone can share their opinions using the Cboe BZX Exchange, Inc.

ChimpZee presale raised nearly $900k

While most eyes view Bitcoin and wait for the SEC to decide what to do with the ETFs, opportunity seekers have seemingly found a new meme coin to support. Known as ChimpZee (CHMPZ), the new meme coin has already attracted some serious money.

On July 18th, the project has raised around $874,000, closing in at $900k and its first million.

The project is focused on fighting climate change and saving endangered animals. It seeks to empower users to positively impact the environment and save wildlife along the way.

The project is currently in the 7th stage of its presale, which will last for another three and a half days. During this time, users can buy CHMPZ using BNB, ETH, USDT, or credit cards at the price of $0.0007 per token.

However, after the current stage ends, the price will increase to $0.0000775, and it will continue to grow until it reaches $0.00185, which is to be its listing rice. So far, the project has sold 1.5 billion tokens, and investors continue to buy more.

Related

- Bitcoin Still Bound At $30k Level While Wall Street Memes Surges to $15 Million in Presale

- How to Buy Bitcoin Online Safely

- Best Bitcoin Trading Platform UK

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage