Join Our Telegram channel to stay up to date on breaking news coverage

BCH Price Prediction – March 25

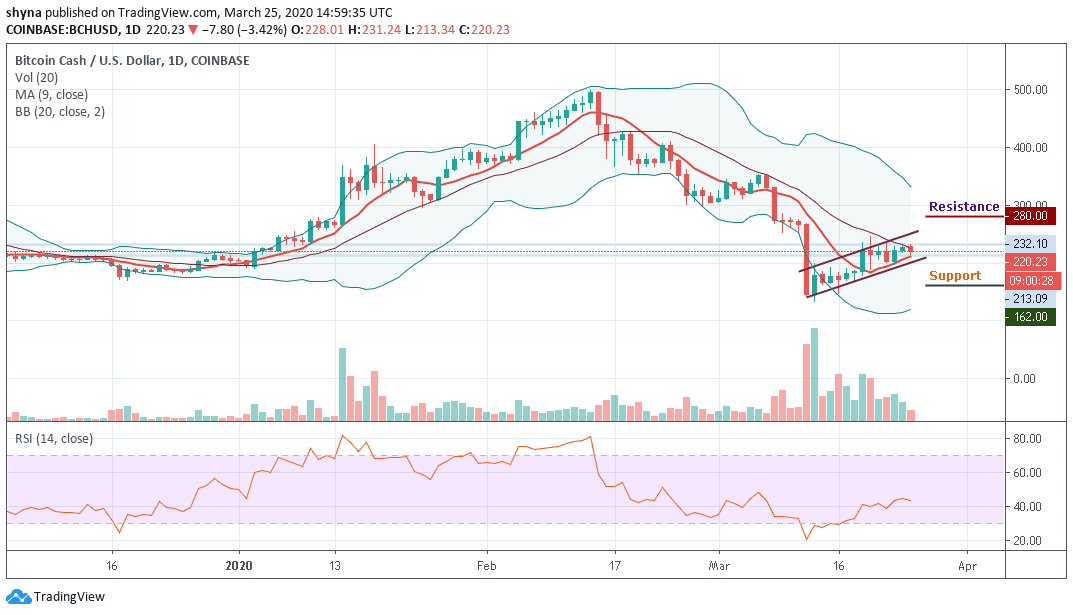

The bears are looking to negate the gains made by the bulls yesterday as the price moves down from $232 to $213.

BCH/USD Market

Key Levels:

Resistance levels: $280, $290, $300

Support levels: $162, $152, $142

BCH/USD is still positive but it looks like it lacks enough momentum to hit 250. Following the recent price, Bitcoin Cash faces a potential resistance at $232 level above the middle limit of the Bollinger bands. A break above this is likely to produce a huge green candle to the upside, marking resistances at $280, $290, $300 levels and above. By then, the BCH market would have been in a bullish run.

As we can see in the daily chart, a bearish step back is dragging the price towards the 9-day moving average which may likely roll the market back to $180 support, if the bulls fail to hold this support, a possible break down to $162, $152 and $142 supports may be visited, and this may establish another low for the market.

Looking at the chart, we can see that the trading volume is rising, giving a sign of an upcoming big move. More so, the technical indicator, RSI (14) signal line is moving around 43-level due to the price increase where a precise bullish cross might reveal more buy signals for the market.

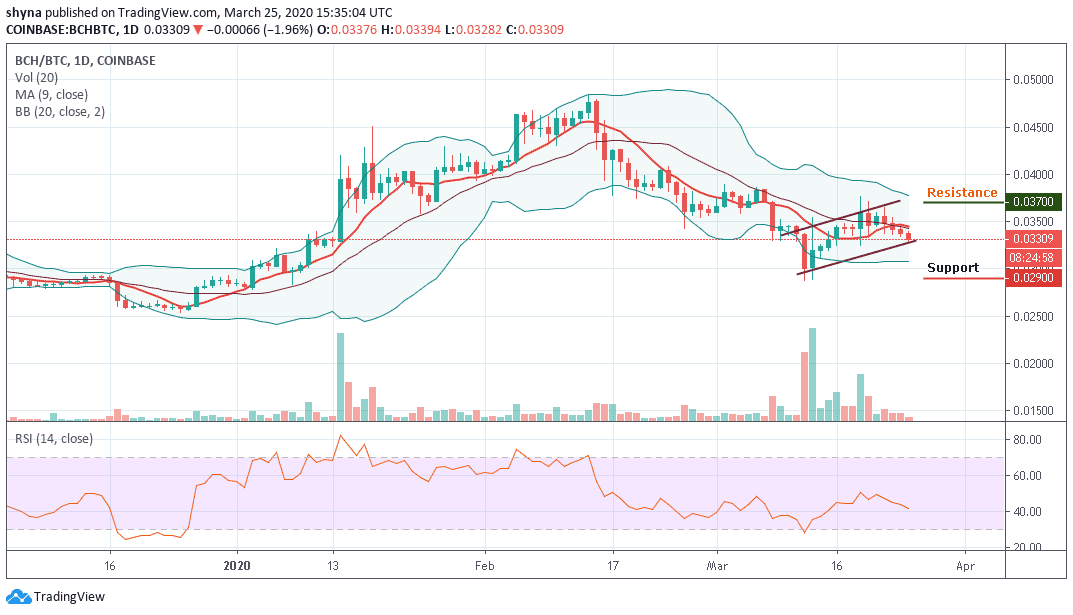

When compared with Bitcoin, the daily chart reveals that the bears have started showing some commitment to the Bitcoin Cash trading. However, following the recent negative signs, the trend may continue to go down if the sellers continue to pump more pressure into the market.

More so, as the RSI (14) signal line nosedives to 43-level, if the buyers can hold the support of 0.030 BTC, the market price may likely follow an upward movement, pushing further can take it to the resistance level of 0.037 BTC and 0.038 BTC but a retest could lower the price to 0.029 BTC and 0.028 BTC support levels.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage