Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – November 7, 2020

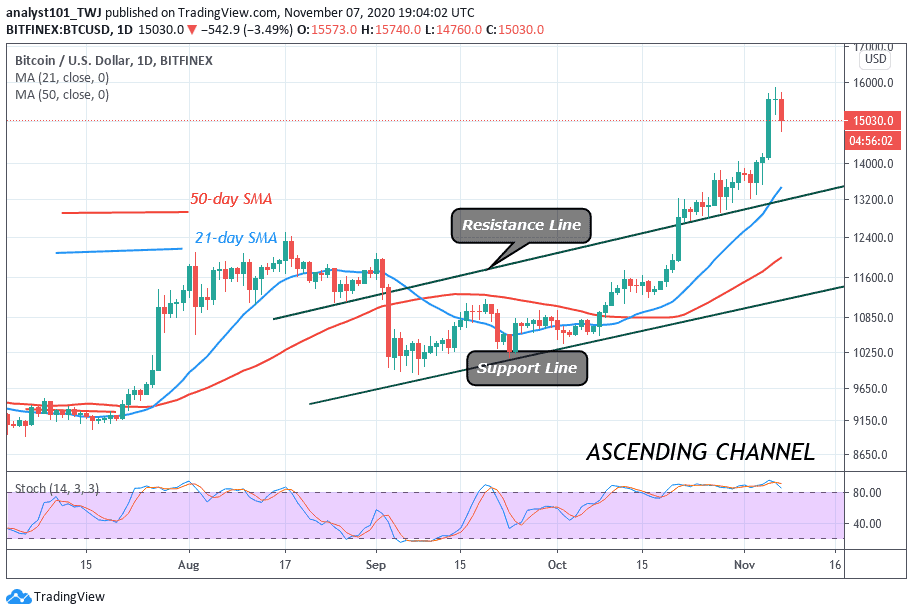

Yesterday, BTC/USD rallied to a high of $15,888 but was resisted.The king coin now consolidates between $15,400 and $15,888. Possibly, this present consolidation will result in a breakout at a high of $15,888. On the other hand, a breakdown below $15,400 will push the downward.

Resistance Levels: $13,000, $14,000, $15,000

Support Levels: $7,000, $6,000, $5,000

Since October 21, Bitcoin’s price has been in upside momentum after a successful breaching of the resistance levels. On November 5, Bitcoin traded and reached a high of $15,888. Nevertheless, for the past two days, BTC has been in a sideways trend. The coin now fluctuates between $15,400 and $15,888. The bulls have been finding penetration difficult at the recent high. Possibly, there is a likelihood of a further upward move if a breakout occurs at the $15,888 resistance.

A breakout will push BTC to a high of $16,500. Conversely, the bears have not been able to break below the $15,400 low. A breakdown will make BTC fall to the next support at $14,950. Meanwhile, Bitcoin has been trading in the overbought region since October 15. BTC has been trending higher despite the overbought condition of the market. Sellers may emerge if Bitcoin shows signs of weakness.

Chair Jerome Powell’s Latest Comment Is a “Code for Buy Bitcoin”

On November 5 Fed’s meeting on the state of the economy and a future measure, Powell was addressing a news conference. He said Congress should agree to a further fiscal stimulus as U.S. public debt reached $27.2 trillion. The United States Federal Reserve is inadvertently marketing Bitcoin, as Chair Jerome Powell suggests for more money printing. Tyler Winklevoss, in a tweet on Nov. 6, reacted that Powell’s latest speech this week was a “code for buy Bitcoin.”

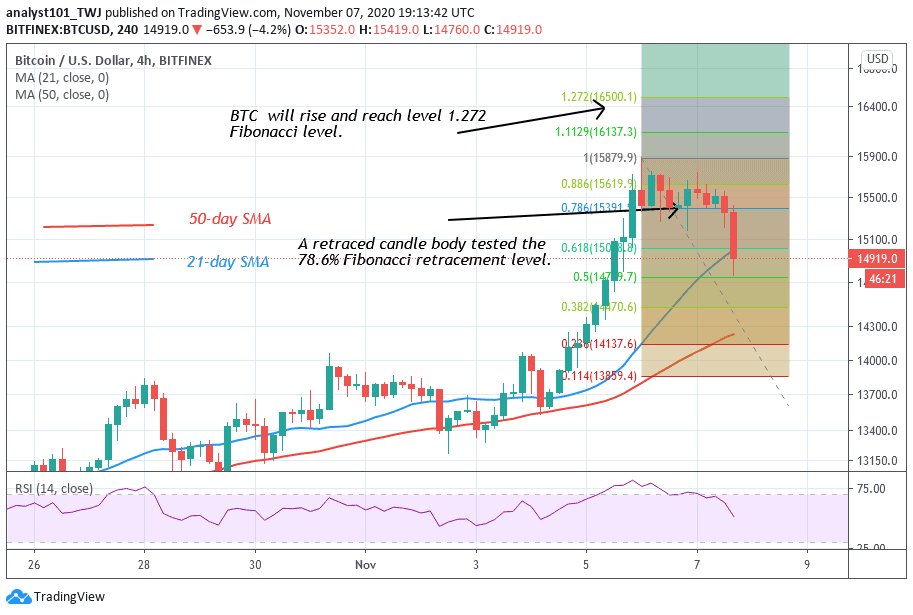

Nevertheless, on November 5 uptrend; BTC was resisted at $15,723 high. The retraced candle body tested the 78.6% Fibonacci retracement level. This retracement suggests that BTC will rise to a level of 1.272 Fibonacci extensions. This extension is the same as the high of $16,521.20. However, BTC is likely to reverse at the 1.272 Fibonacci extensions and returned to 78.6% retracement where it originated. Meanwhile, a breakdown below the $15,400 support has invalidated the above analysis.

Join Our Telegram channel to stay up to date on breaking news coverage