Join Our Telegram channel to stay up to date on breaking news coverage

London-based asset manager Ruffer recently put 2.5% of its Multi-Strategies Fund in the world’s largest cryptocurrency- Bitcoin. The company said that it works as a “potent insurance policy.”

Multi-billion-dollar fund

Ruffer Investment Company is based in London and manages over $20.3 billion in assets. The traditional finance company is the latest in the line of top asset managers riding the Bitcoin wave. The firm announced its investments in an update to shareholders. According to the company, 2.5% of its Multi-Strategies Fund has been allocated to Bitcoin. The firm believes that Bitcoin could provide a safety net at a time when major world currencies are suffering.

The company wrote, “We see this [Bitcoin investment] as a small but potent insurance policy against the continuing devaluation of the world’s major currencies.” It added that Bitcoin helps diversify its large pool of investments like inflation-linked bonds and golds. It could also become a hedge against the market and monetary risks.

Ruffer’s investment portfolio

Ruffer caters mainly to families and individuals, charities, and pension funds. Its Multi Strategies Fund handles over $620 million in assets of which it will invest $15.5 million in Bitcoin. Other tops of the line firms have been eyeing the Bitcoin market for hedging, especially as the price of the cryptocurrency is rising to new highs. In June, MicroStrategy, a business intelligence firm made headlines when it announced an investment in Bitcoin. It ended up investing over half a billion dollars in Bitcoin.

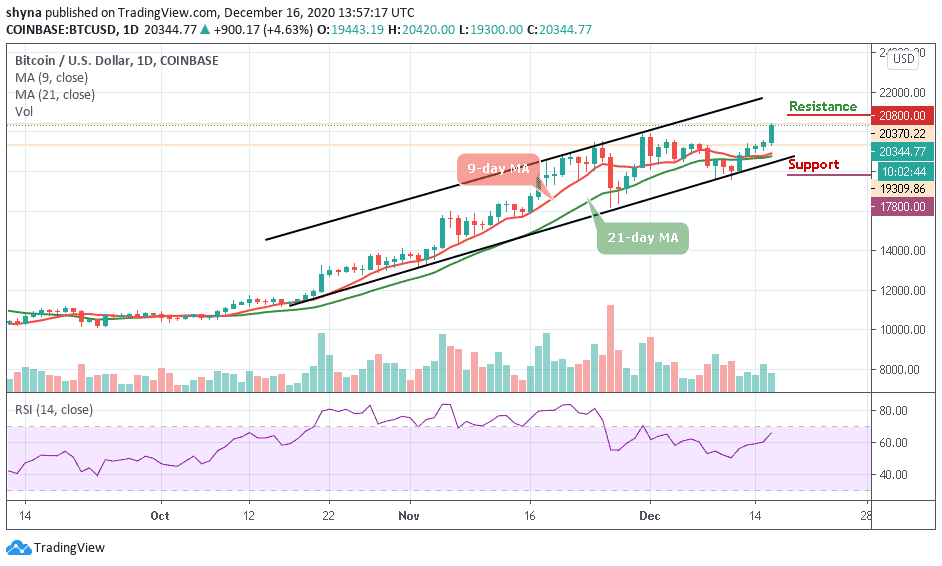

Square, a payments firm owned by Twitter’s Jack Dorsey also invested about $50 million in Bitcoin in October. Last week, MassMutual also announced a $100 million investment in Bitcoin, showing faith in the currency’s future. Both hedge funds and Wall Street giants are now turning to Bitcoin, looking at it as an alternative investment asset like gold. This year’s Bitcoin price rally is being fueled by institutional interest in the cryptocurrency.

Join Our Telegram channel to stay up to date on breaking news coverage