Join Our Telegram channel to stay up to date on breaking news coverage

BNB has captured significant crypto market attention, surging 11% in the past 24 hours and 21% over the past week. This impressive rally has fueled speculation that the token could surpass the $1,000 mark. Analysts point to strong technical indicators, particularly a key ascending trendline BNB has consistently maintained as support.

Historically, this trendline has been a launchpad for major price surges, and the latest bounce from this level suggests further upside potential. If this pattern holds, BNB could be on track to retest its all-time high and push beyond previous resistance levels. As some predict a continuation of the upward trend, the market is printing gains. Insidebitcoins has curated a list of the most viewed cryptos on GeckoTerminal to watch.

Most Viewed Cryptos on GeckoTerminal to Watch

PIPI is priced at $0.05448, marking a sharp 84.93% drop in the last 24 hours. In contrast, TOSHI has seen a strong upward trend, climbing 29.76% within the same period to trade at $0.0008285. Meanwhile, CZ’S DOG experienced an extraordinary surge of 42,098% in just six hours but is now undergoing a market correction.

Similarly, Fullsend has skyrocketed by 13,706% over the past day, positioning itself among the most explosive gainers in the crypto space. On the innovation front, Solaxy aims to improve Solana’s efficiency by integrating an additional processing layer. In traditional markets, Robinhood shares have surged following a remarkable 700% increase in crypto transaction revenue.

1. Duster (PIPI)

PIPI is trading at $0.05448, reflecting an 84.93% decline in the past 24 hours. The price has dropped 27.43% in the last hour, showing signs of extreme volatility. Over the past six hours, it has seen a sharp 84.93% decline, indicating a potential rug pull or major sell-off.

The token’s market cap is only $4.57K, equal to its fully diluted valuation (FDV). Liquidity is extremely low at just $6.64K, which poses a high risk for traders. The 24-hour trading volume reached $2.12 million, spread across 56,494 transactions. Despite being only five hours old, the token already has 108 holders.

PIPI initially experienced a rapid surge, reaching a high of $0.0723 SOL before crashing. The sharp drop suggests a pump-and-dump pattern, where early buyers took profits, leaving late investors with heavy losses. The price has stabilized near $0.000004243, but further drops remain likely.

2. Toshi (TOSHI)

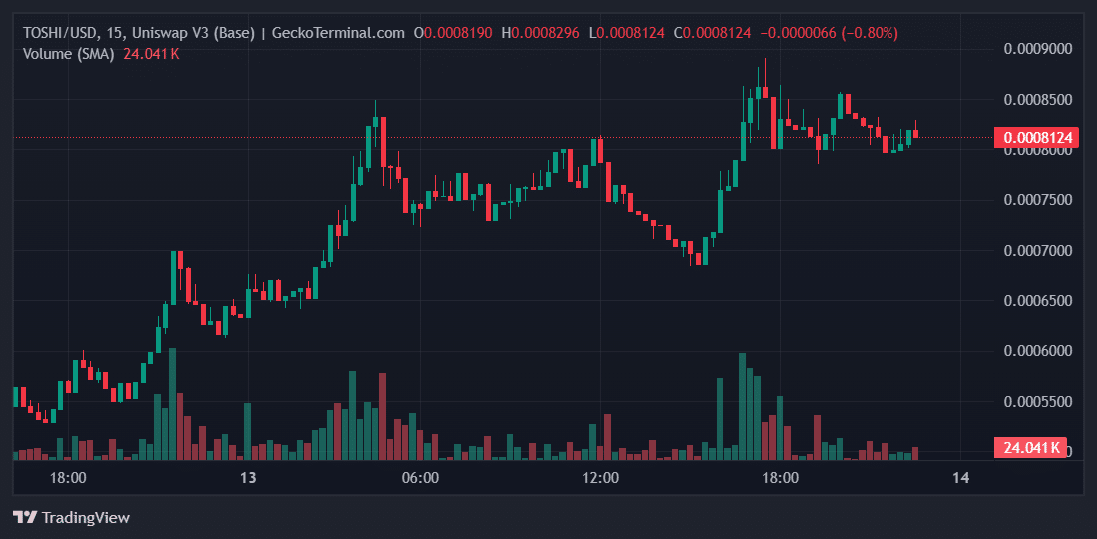

TOSHI is trading at $0.0008285, reflecting a 29.76% gain in the past 24 hours. Over the last six hours, the token has climbed 6.81%, showing consistent upward momentum. It increased by 2.42% in the past hour, indicating continued buying interest.

The token’s market cap is $348.7M, matching its fully diluted valuation (FDV). Liquidity is strong at $4.18M, providing a stable trading environment. The 24-hour trading volume is $4.3M, with 3,261 transactions recorded. Of these, 1,942 were buy orders, and 1,319 were sell orders, highlighting a positive buying trend.

TOSHI has been in the market for one year and currently has 540.92K holders, demonstrating a well-established community. The token’s liquidity is backed by 2.61 billion pooled TOSHI tokens valued at $2.16M and 757.7 WETH worth $2.02M.

We're thrilled to see the Toshi community expanding into new channels!

/r/toshicoin was started by a few dedicated community members and has now grown to over 4k members 😺

Join the conversation here: https://t.co/6xmINxGzSu pic.twitter.com/6VqeJvJuF4

— TOSHI (@Toshi_base) February 6, 2025

The price movement over the past 24 hours has been bullish, with gradual accumulation and periodic surges. The recent spike suggests increased investor confidence and demand. However, slight pullbacks indicate traders are taking profits. If the current trend continues, TOSHI could see further gains.

3. CZ’S DOG (Broccoli)

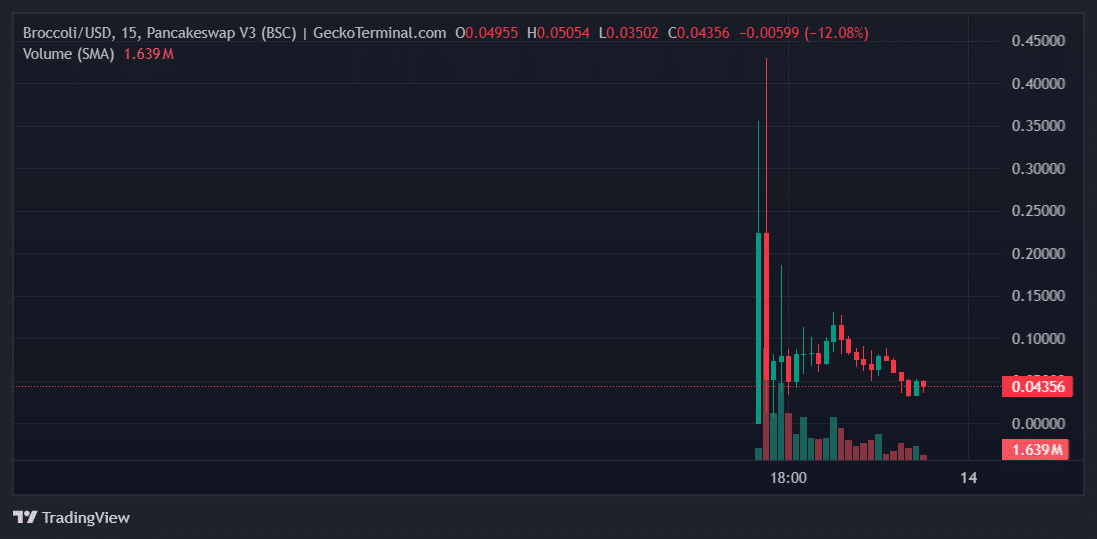

CZ’S DOG has experienced an explosive 42,098% increase in the past 6 hours but is now experiencing a correction. Currently priced at $0.03674, it has dropped 37.72% in the past hour and 4.77% in the last 5 minutes, signaling significant volatility.

The 24-hour trading volume is $247.77M, with 85,260 transactions, suggesting high interest. Buy orders outnumber sell orders (61,215 vs. 24,045), indicating strong demand despite the recent price dip.

The market cap and fully diluted valuation (FDV) are both at $39.08M, with liquidity standing at $3.31M, backed by 42.54M Broccoli tokens worth $1.82M and 2,398.36 WBNB valued at $1.62M.

This massive pump and subsequent pullback indicate potential whale activity or a hype-driven rally. If the token stabilizes, it could consolidate at current levels before making another move.

4. Fullsend Community Coin (Fullsend)

Fullsend has experienced an astronomical 13,706% increase in the past 24 hours, making it one of the most explosive gainers in the market. Currently priced at $0.04743, it has shown significant volatility. Over the last six hours, it has gained 208.77%, but in the past hour, it dipped -2.86%, only to rebound +8.56% in the last five minutes.

Trading activity has been intense, with a 24-hour volume of $141.4 million and 236,247 transactions recorded. Of these, 128,790 were buy orders, while 107,457 were sell orders, indicating strong but fluctuating interest. The token’s liquidity stands at $1.18 million, which is relatively low compared to the massive trading volume, potentially leading to sharp price swings. The market cap and fully diluted valuation (FDV) are $44.65 million, with 13,180 holders despite the token being just three days old.

This surge suggests strong speculative interest driven by hype and social media influence. However, the rapid price movements indicate that traders are actively taking profits, leading to noticeable pullbacks. The high trading volume and transaction count reflect active market participation. Still, the low liquidity relative to volume could cause extreme price fluctuations.

5. Solaxy ($SOLX)

Solana remains a major player in the blockchain industry and is known for its high transaction speeds. However, network congestion continues to pose challenges, especially during periods of increased activity. Solaxy (SOLX), a new Layer-2 protocol, aims to address this issue by optimizing transaction processing.

Solaxy seeks to enhance Solana’s efficiency by introducing an additional processing layer. Instead of all transactions competing for space on the main blockchain, Solaxy processes them off-chain. It then consolidates them and settles them back onto Solana. This method is expected to reduce congestion, lower fees, and improve transaction speeds.

The SOLX token serves as the core of this system. It facilitates transactions, staking, governance, and other network functions. Additionally, Solaxy plans to develop a multi-chain bridge connecting Ethereum and Solana. This feature would give users access to Ethereum’s liquidity while benefiting from Solana’s efficiency.

Since launching its presale in December, Solaxy has attracted considerable attention. In just two months, it has raised over $20 million. The presale price of SOLX currently stands at $0.001634, and it will increase within the next 48 hours. The steady inflow of investments indicates investor confidence in the project’s vision.

Growing online interest in Solaxy is also evident. Its Twitter following has surpassed 68,000. Influencers and analysts have started discussing its potential. Some predict significant price movements once the token is listed on decentralized exchanges (DEXs). Listings on centralized exchanges (CEXs) could also be a future step.

To bolster investor confidence, Solaxy has completed a security audit with Coinsult, a notable blockchain auditing entity. The project has also gained recognition on platforms like CoinSniper.net. These developments suggest that the team is actively working to establish credibility.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage