Join Our Telegram channel to stay up to date on breaking news coverage

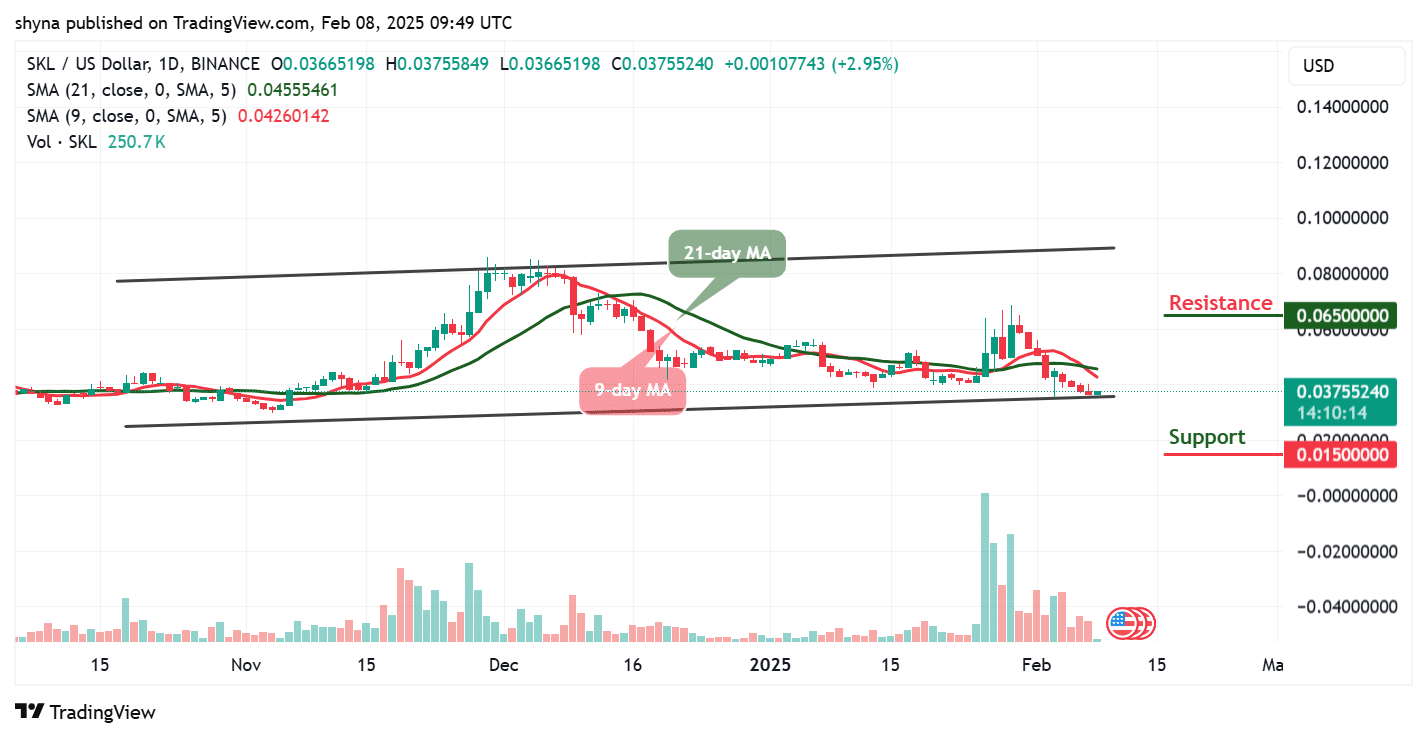

The Skale Network price prediction reveals that SKL is currently in a downtrend, trading near key support at $0.0150, with bearish momentum confirmed by the 9-day MA below the 21-day MA.

Skale Network Prediction Statistics Data:

- Skale Network price now – $0.037

- Skale Network market cap – $216.36 million

- Skale Network circulating supply – 5.77 billion

- Skale Network total supply – 6.07 billion

- Skale Network Coinmarketcap ranking – #193

Timing is crucial in crypto, and SKALE (SKL) proves it. Since hitting its all-time low of $0.01954 on October 19, 2023, SKL has surged 91.62%, now trading between $0.036 and $0.04006 in the past 24 hours. While still 96.94% below its all-time high of $1.22 (March 12, 2021), such corrections often present opportunities for future gains, making SKL a token worth watching.

SKL/USD Market

Key Levels:

Resistance levels: $0.065, $0.070, $0.075

Support levels: $0.015, $0.010, $0.005

The current price of SKL/USDT is around $0.0375, which is trading near a key support level of $0.0150. The price action suggests that the market is in a downtrend after peaking in December 2024. The 9-day MA (red line) is below the 21-day MA (green line), confirming a bearish sentiment. Moreover, this indicates that selling pressure remains dominant as the price is currently testing the lower boundary of a rising channel, which could act as dynamic support and potentially trigger a bounce.

Skale Network Price Prediction: Skale Network Faces the Downside

The Skale Network price is currently hovering near the lower boundary of the channel. If buyers step in at this level, traders could see a retracement toward the 9-day MA and 21-day MA, which are currently at $0.0426 and $0.0455, respectively. Meanwhile, a break above these MAs could signal a short-term recovery, with $0.060 acting as a significant resistance level. Therefore, any further bullish movement could hit the potential resistance levels at $0.065, $0.070, and $0.075 respectively.

Nevertheless, if the support at $0.020 fails to hold, a deeper correction could follow, possibly leading SKL toward lower levels at $0.015, $0.010, and $0.005. However, the declining moving averages indicate that sellers are in control, and without a strong bullish catalyst, the price might struggle to break above the resistance while the volume also appears to be declining, signaling weakening momentum. Meanwhile, if the current structure remains intact, the next move is likely to be sideways or bearish unless a strong reversal pattern emerges.

SKL/BTC Consolidates Below the Moving Averages

The SKL/BTC pair is trading at 39 SAT, near a critical support level of 20 SAT. However, the price action remains bearish, with the 9-day MA (43 SAT) positioned below the 21-day MA (45 SAT), signaling ongoing selling pressure. Additionally, the price tests the lower boundary of the ascending channel, which has historically acted as support. If this level holds, a potential short-term bounce could occur, pushing the price back toward the 9-day and 21-day MAs before encountering resistance at 60 SAT and above. Meanwhile, with the moving averages sloping downward, the likelihood of a sustained uptrend remains low unless there is a significant volume increase.

On the downside, if 30 SAT support fails to hold, the market could experience further selling pressure toward the 20 SAT, potentially leading to a deeper correction. Therefore, given the current bearish momentum, a break below this support could open the door for new lows, possibly targeting untested levels. Nonetheless, for a bullish reversal, the price must reclaim 50 SAT and break above the descending trend to shift sentiment. Until then, traders should watch for confirmation signals, as the overall structure suggests continued weakness unless buying volume increases significantly.

Similarly, @RJtradescrypto shared with his over 22K followers on X (formerly Twitter) that SKL appears to be forming a major double bottom after a 2.5-year sideways period. He noted that the price recently showed a strong reaction from the monthly OB but faced a setback as buyers were shaken out by a flash crash. Despite this, he highlighted that it’s still a significant level, with lows being taken out in the process.

SKL appears to be working on a major double bottom/2,5 year sideways period here. Price started a strong reaction from the monthly OB a few days ago but buyers got rinsed because of the flash crash. Still a nice level and lows got taken out.

As with every coin right now,… pic.twitter.com/MZ453ndpHh

— RJ (@RJtradescrypto) February 3, 2025

Alternatives to Skale Network

The Skale network fails to sustain higher levels due to strong selling pressure at the long-term downtrend line. However, this current pattern indicates that bears remain in control, and without a breakout above the moving averages, SKL may continue to face the downward pressure. Meanwhile, Wall Street Pepe’s presale is nearing its hard cap of $73 million, and with launch day approaching, volatility is expected.

Wall Street Pepe Launch Day Expectations

Comparing it to Pepe Unchained, a similar trajectory may unfold – initial panic selling followed by a potential surge. During Pepe Unchained’s rise, investors who secured a 7x return reinvested into Wall Street Pepe, fueling further momentum. The key to success is recognizing these patterns and following the money. If history repeats itself, Wall Street Pepe could experience another explosive move before investors rotate their profits into the next opportunity.

Related News

- Ethereum Price Surges On Hopes That Bitcoin’s ETF Breakthrough Opens The Door For ETH ETFs

- Investors Foresee Major Breakout for Wall Street Pepe as Presale Exceeds $70 Million

Newest Meme Coin ICO - Wall Street Pepe

- Audited By Coinsult

- Early Access Presale Round

- Private Trading Alpha For $WEPE Army

- Staking Pool - High Dynamic APY

Join Our Telegram channel to stay up to date on breaking news coverage