Join Our Telegram channel to stay up to date on breaking news coverage

The cryptocurrency market is gradually recovering, which suggests that an altcoin rally may be on the horizon. Several digital assets, such as Stacks, Sui, Polygon, MultiversX, VeChain, THORChain, and Toncoin, have already shown significant gains during this period of market improvement.

As the market stabilizes, many investors are turning their attention to altcoins with growth potential, seeking to maximize their returns. This article analyzes some of the best crypto to buy now.

Top Cryptocurrencies to Invest in Now

Recent data from IntoTheBlock underscores Arbitrum’s expansion, with the network exceeding 1 billion cumulative transactions. Meanwhile, the Crypto All Stars presale has garnered considerable interest, raising over $1.9 million, mainly due to its distinctive staking rewards system. Additionally, the RENDER token has recently captured market attention, driven in part by its relevance in decentralized GPU rendering.

1. THORChain (RUNE)

THORChain is a decentralized liquidity protocol that facilitates cross-chain cryptocurrency exchanges, allowing users to swap assets like Bitcoin and Ethereum without surrendering custody of their funds. This eliminates the need for intermediaries, creating a trustless environment for asset trading.

Recently, the THORChain ecosystem has seen notable growth, particularly with the merger of the decentralized finance (DeFi) network Kujira and other key projects into the “Rujira Alliance.” This alliance aims to establish a new application layer that supports THORChain’s cross-chain liquidity protocol, potentially enhancing the network’s utility and expanding its reach.

THORChain’s App Layer is the next major upgrade to the network

Lending, Orderbooks, Perps, and much, much more. All coming to the THORChain App Layer https://t.co/1g82GAozfR

— THORChain (@THORChain) October 2, 2024

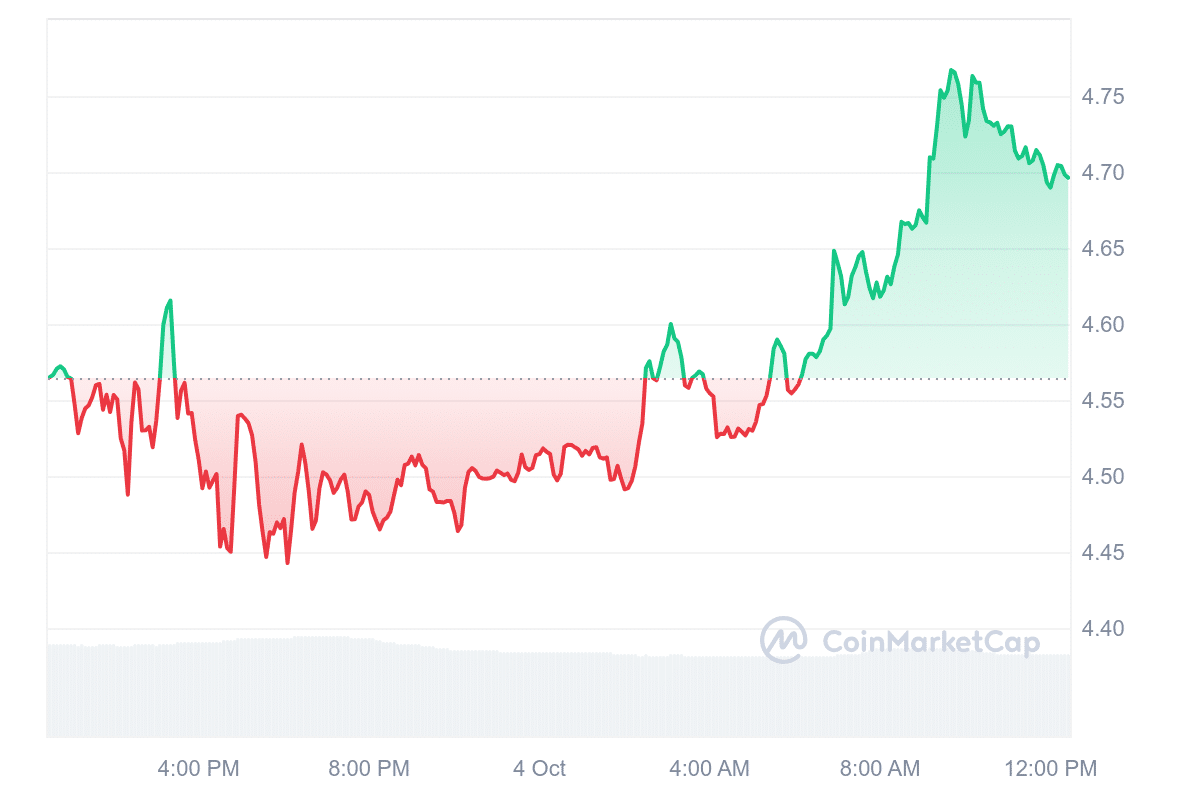

As of the latest data, RUNE has experienced a price increase, currently trading at approximately $4.70, reflecting a 2.84% rise over the day. Its recent performance remains positive, with the token trading above its 200-day simple moving average, which is often considered a bullish indicator in technical analysis.

The protocol has also demonstrated a relatively stable price trend, with 15 out of the last 30 days showing price gains. Furthermore, the token’s inflation rate sits at a low of 0.09%, which suggests that new token issuance is minimal, potentially limiting the risk of supply dilution.

2. Arbitrum (ARB)

Arbitrum plays a significant role in the decentralized finance (DeFi) space as an Ethereum layer-two (L2) scaling solution. Using optimistic rollups aims to improve the speed, scalability, and cost-efficiency of transactions on Ethereum while still relying on Ethereum’s security infrastructure.

This approach allows for quicker and more affordable transactions, addressing some of Ethereum’s primary limitations, such as high gas fees and slower transaction times during network congestion. Recent data from IntoTheBlock highlights Arbitrum’s growth, as the network surpassed 1 billion cumulative transactions.

Arbitrum Autumn is in full swing! 🍂

– 1 billion transactions on Arbitrum One

– 1 million Infinite Rainbows Stylus NFTs minted

– First L2 on @uniswap to hit 200 billion in swap volumeWhat's next? 👀

— Arbitrum (💙,🧡) (@arbitrum) October 4, 2024

Moreover, this milestone reflects its rapid adoption and its potential to reshape the DeFi ecosystem. Initially processing fewer than 100,000 transactions per day, Arbitrum now handles over 2 million daily, highlighting the scalability of its network and increasing demand.

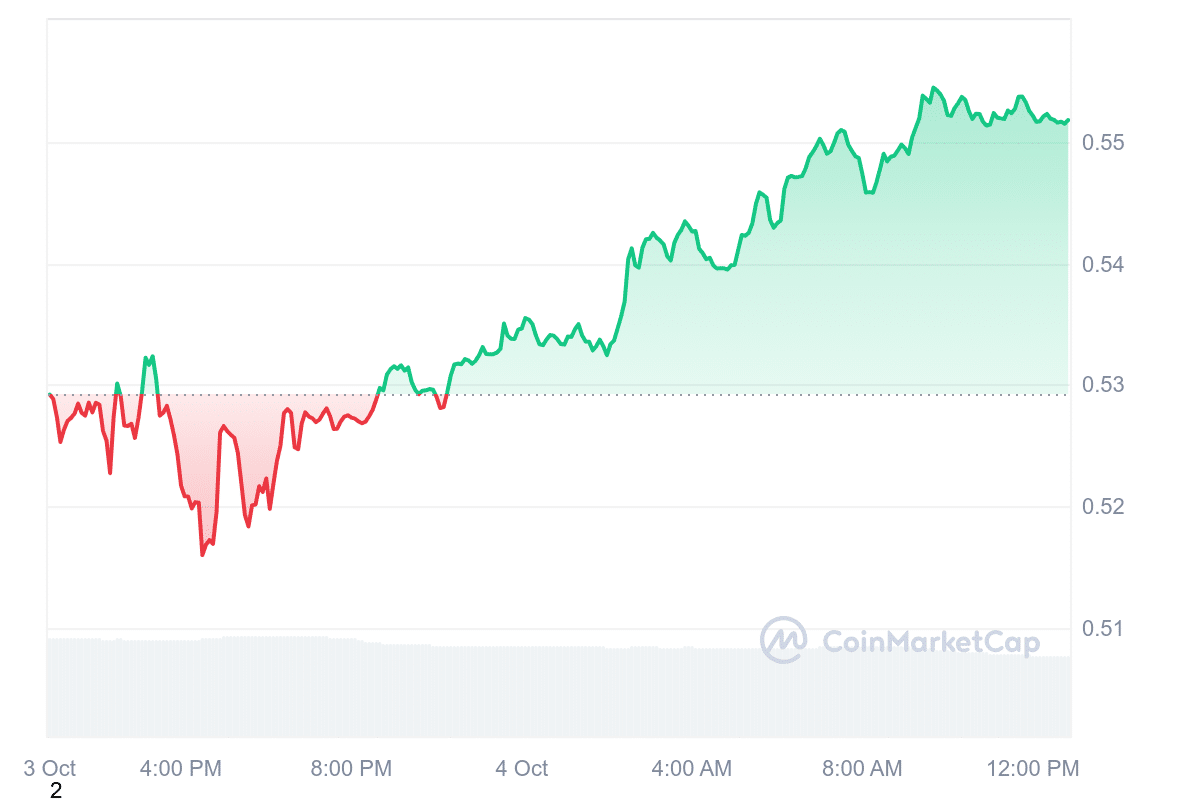

At present, the ARB token is priced at $0.5523, marking a 4.31% rise during the day. Over the past month, the token has experienced a 12.20% increase, partly driven by broader market recovery trends. This reflects a generally positive outlook from analysts, who expect continued growth in Arbitrum’s value as it expands within the DeFi sector.

3. Render (RENDER)

Render is a decentralized platform offering GPU-based rendering solutions aimed at transforming the digital content creation process. The network connects GPU node operators, who have unused computing power, with artists and developers needing scalable rendering solutions for 3D content.

The platform enables more efficient use of computing resources by decentralizing the rendering process. A key aspect of Render’s appeal lies in its ability to support the growing demand for GPU rendering, especially in the context of the Metaverse and other immersive technologies. Decentralizing this process allows creators to scale their projects more efficiently without the high costs associated with traditional centralized solutions.

Huge news! Render now supports @maxonvfx Redshift – bringing the two leading GPU rendering pipelines to @rendernetwork.

With native C4D file support and an easy to use scene checker, C4D users can get frictionless access to near unlimited GPU cloud rendering power on Render! pic.twitter.com/NrX3a9TWJh

— The Render Network (@rendernetwork) September 27, 2024

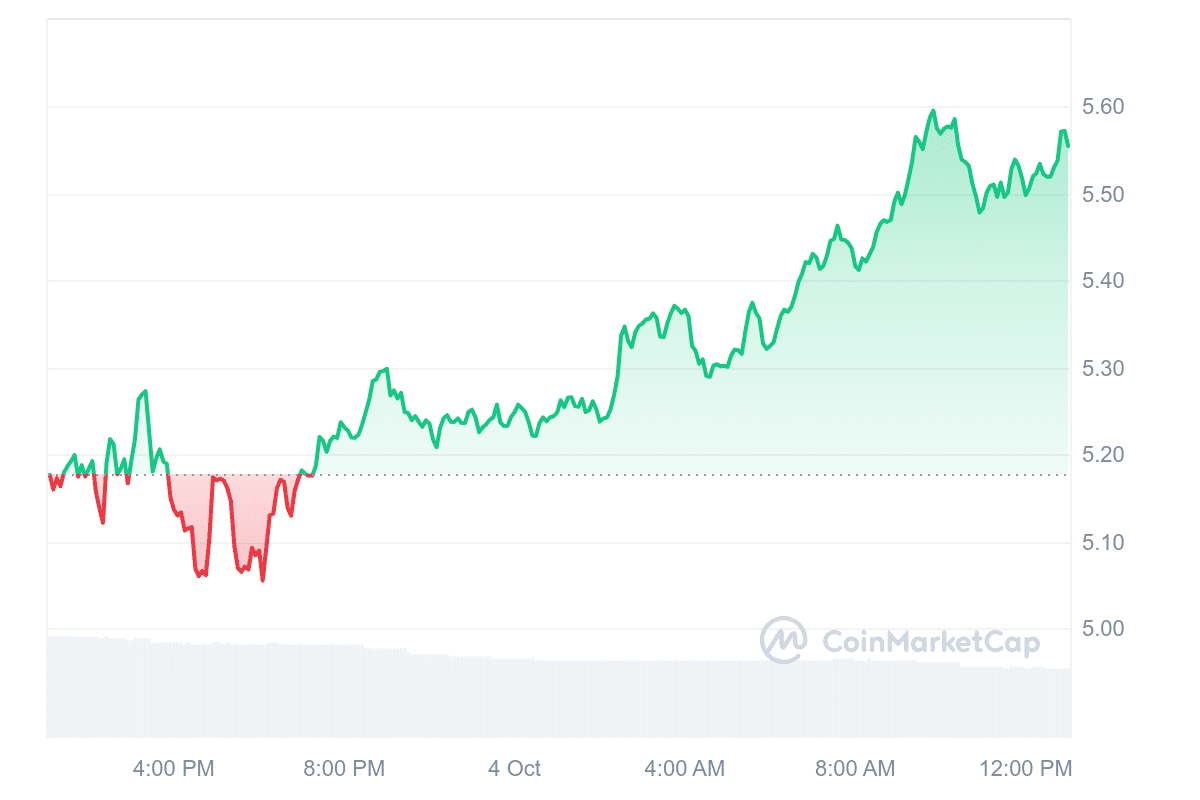

Moreover, the RENDER token has recently gained market attention, partly due to its relevance in decentralized GPU rendering. At press time, RENDER is trading at $5.55, reflecting a 7.40% intraday rise. Over the past month, the token has increased by 16.25%, with a notable 18 days of positive price movement out of the last 30 (60%).

Its high liquidity, driven by a strong market cap, also indicates a healthy level of trading activity. The increasing demand for decentralized infrastructure, coupled with Render’s growing role in the development of VR and AR applications, has boosted its momentum. Additionally, recent partnerships and ecosystem expansions have strengthened the project’s position within the crypto market.

4. Crypto All Stars (STARS)

Crypto All Stars has attracted significant attention by raising over $1.9 million in its initial coin offering (ICO), largely due to its unique staking rewards system. The project’s main focus lies in the meme coin niche. It aims to integrate a staking protocol specifically for well-known tokens in this category.

Given the popularity and optimism surrounding meme coins, this approach could appeal to a broad audience, especially those interested in finding additional utility for their meme-based assets. The platform features the MemeVault, a tool that allows users to stake their meme coin portfolios.

By doing so, holders of meme tokens like Dogecoin, Shiba Inu, and others can earn passive income. This adds a layer of functionality to meme coins, which are often viewed as speculative assets with limited use cases beyond trading.

The project targets investors within the meme coin community who are interested in maximizing the value of their holdings. During the presale, the native token, STARS, was priced at $0.0014828. There are expectations that this price will increase as further funding rounds unfold and the project gains momentum.

Visit Crypto All-Stars Presale

5. Uniswap (UNI)

Uniswap is a decentralized trading protocol widely recognized for its role in enabling automated trading of decentralized finance (DeFi) tokens. It operates without a central authority, allowing users to swap tokens directly on its platform and providing a key service within the DeFi ecosystem.

In recent months, Uniswap Labs, the organization behind the platform, introduced a 0.25% fee for token swaps performed through its interface. Over the past six months, this has generated over $51 million in revenue for the company. The fee increase builds on an earlier 0.15% fee, which was introduced in Q4 2023 and applied to select trading pairs.

With this lower fee structure, Uniswap’s projected annual revenue stood at around $13 million. However, the introduction of the higher fee reflects greater demand for the platform, as the market has absorbed this change without significantly impacting user activity.

Intents-based systems are fragmented, each with their own set of fillers and no unified cross-chain standard

That’s why we teamed up with @AcrossProtocol to propose ERC-7683, a standard designed to solve fragmentation through a universal filler network

⛺️✨ pic.twitter.com/MMDqnHTOl1

— Uniswap Labs 🦄 (@Uniswap) September 29, 2024

This increase in front-end fees has helped fund Uniswap’s ongoing research and development efforts, supporting future growth. Additionally, the platform’s ability to maintain user engagement during this period has contributed to the growth of the UNI token. The token has demonstrated resilience and continues to perform strongly in the market.

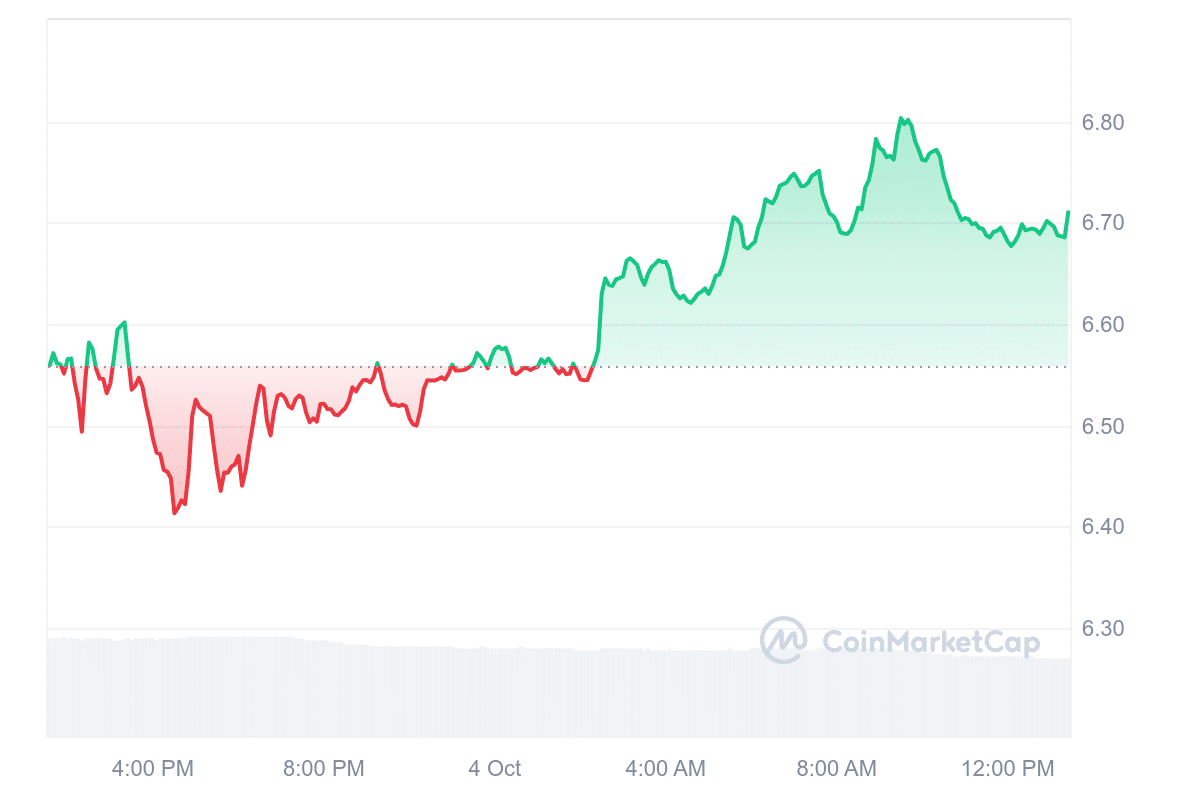

Currently, the UNI token trades at $6.71, reflecting an intraday price increase of 2.62%. It remains above the 200-day simple moving average, indicating a stable long-term trend. UNI’s high liquidity is supported by its large market capitalization, and it remains actively traded on major exchanges such as Binance.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage