Join Our Telegram channel to stay up to date on breaking news coverage

Keeping abreast of the latest trends in the market is critical to making wise investment decisions. Recently, Tron founder Justin Sun proposed purchasing the remaining $2.3 billion worth of Bitcoin seized by the German government. This offer comes in response to Germany’s significant Bitcoin transfers to exchanges, which have already impacted the market and caused a substantial selloff.

Earlier today, another $75 million worth of Bitcoin was moved to exchanges, contributing to a market plunge and a 5% drop in Bitcoin’s price to $56,892.53. Sun expressed his willingness to negotiate an off-market purchase to minimize market impact, highlighting the ongoing volatility in the cryptocurrency space.

Biggest Crypto Gainers Today – Top List

Amidst the volatility gripping the crypto market, today’s focus shifts to the top gainers: Enzyme, Cream Finance, SafePal, and Beldex. These cryptocurrencies have surged ahead, each offering unique strengths that appeal to investors. Enzyme leads the pack with substantial gains powered by a platform that reshapes asset management through decentralized strategies.

Meanwhile, Cream Finance showcases robust growth driven by its versatile DeFi lending protocols. SafePal, known for its secure wallet solutions, provides stability in uncertain times, while Beldex stands out with its privacy-focused ecosystem. In addition to these gainers, WienerAI’s recent success in surpassing $7 million in its ICO phase has garnered much attention. Explore further for deeper insights into these leading crypto assets.

1. Enzyme (MLN)

Enzyme is reshaping asset management through its decentralized platform that leverages blockchain technology. It allows users to create, manage, and scale various investment strategies, including discretionary, automated (robo), ETFs, and market-making. Powered by the MLN token, Enzyme simplifies access to digital assets and DeFi protocols, providing a user-friendly interface for both individual and institutional investors. The MLN token is crucial for governance, protocol fees, and incentivizing ecosystem growth.

A key feature of Enzyme is its strong commitment to security. The platform employs second-generation smart contracts that are rigorously tested and audited before deployment. Enzyme continuously updates its security measures and adheres to industry best practices to protect users from potential threats such as loss and data misuse. Thus, it is attractive to investors seeking innovative and secure digital asset solutions.

Last week, we announced Enzyme's new Modular Liquid Restaking As-a-Service for LRT projects.

Now, let's take a closer look at @AngleProtocol's stUSD Restaking Vault, powered by Enzyme and @nektarnetwork.

⬇️⬇️⬇️$MLN #DeFi #DeFiNews #Restaking #Web3 https://t.co/VftLMoOXOX

— Enzyme (@enzymefinance) July 2, 2024

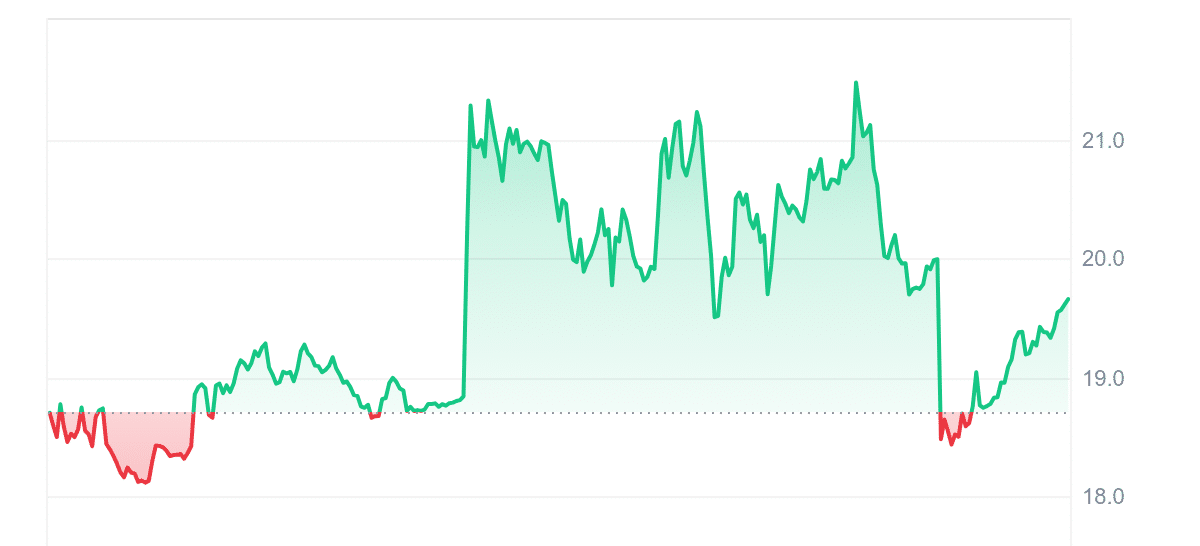

MLN tops the list with a remarkable 7.39% surge in the last 24 hours, positioning itself as the most dynamic among today’s top gainers. Boasting high liquidity with a 0.8820 volume-to-market cap ratio, Enzyme’s robust trading activity sets it apart from its peers. Its 14-day RSI of 69.80 suggests a neutral stance, indicating potential for further movement.

With 12 green days in the past month and a moderate 9% volatility, Enzyme strikes a balance between stability and growth. Although trading 24.18% above its 200-day SMA and showing a modest 9% annual increase, MLN’s high liquidity and recent performance make it a compelling choice compared to other cryptos on this list.

2. Cream Finance (CREAM)

Cream Finance is a decentralized DeFi lending protocol that enables individuals, institutions, and protocols to access financial services. It operates on Ethereum, Binance Smart Chain, Polygon, and Fantom, offering a permissionless, open-source, and blockchain-agnostic environment. Users can deposit assets like Ether or wBTC to earn yield, akin to a traditional savings account. The CREAM token facilitates lending, borrowing, staking, and governance, allowing users to vote on asset listings.

What makes Cream Finance unique is its ability to provide liquidity to essential DeFi assets through automated market making (AMM). Users can borrow and lend supported assets while earning liquidity mining rewards in CREAM tokens. The platform lists tokens crucial to the DeFi sector, including stablecoins, governance tokens, and leading cryptocurrencies.

As an ERC20 token, CREAM can execute Ethereum Virtual Machines via smart contracts, enhancing composability. This capability enables users to create decentralized autonomous organizations (DAOs). Although CREAM’s smart contracts are not officially audited, security is maintained through expert advisers and a multisig wallet system.

C.R.E.A.M. Markets are coming to @Blast_L2 to enable advanced native-yielding DeFi farming strategies on Blast.

Users can supply and borrow assets for their DeFi farming needs while choosing to hold major assets of their choice. pic.twitter.com/P8UlkpbaST

— Cream Finance 🍦 (@CreamdotFinance) June 7, 2024

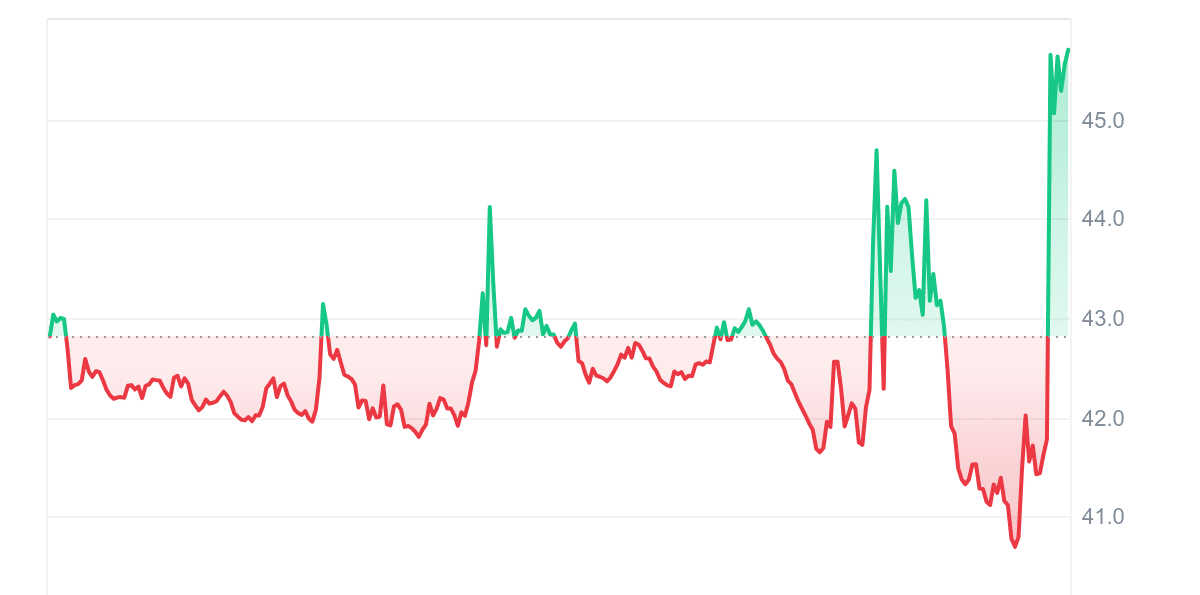

CREAM follows MLN closely, with a 6.65% increase over the last 24 hours. Its high liquidity, marked by a 0.0594 volume-to-market cap ratio, supports active trading. Despite an RSI of 39.37, indicating a neutral trend, it is trading an impressive 187.82% above its 200-day SMA. Additionally, it has achieved a substantial 183% annual growth, outperforming 78% of the top 100 crypto assets. While its 11 green days in the last month are fewer than MLN’s, Cream’s higher annual growth stands out.

3. WienerAI (WAI)

WienerAI has surpassed the $7 million mark in its Initial Coin Offering (ICO) phase, standing out amid the current struggles of many meme coins. This success is attributed to WienerAI’s innovative blend of memes and artificial intelligence (AI) technology to tackle real-world challenges. This unique combination has attracted significant investor interest, with analysts predicting substantial success due to its distinctive approach and strong community support.

We've hit the $7M milestone! 🌭🚀

A huge thank you to our amazing community! The journey is just beginning, and the future is bright! 💰🐾 pic.twitter.com/ZPmTgXb6Lu

— WienerAI (@WienerDogAI) July 3, 2024

The project’s whitepaper outlines plans to list $WAI on both decentralized exchanges (DEXs) and centralized exchanges (CEXs) post-presale. Of the 69 billion total tokens, 30% are allocated for the presale, giving early investors the chance to purchase at a low rate and earn staking rewards of up to 162% APY. Additionally, 20% of tokens are designated for staking rewards, another 20% for airdrops and community incentives, and the rest for liquidity and marketing.

WienerAI aims to simplify crypto trading through its AI-powered assistant on the Ethereum network. The platform offers a user-friendly interface for querying market trends, potential investments, and specific cryptocurrencies. It provides zero trading fees, seamless swaps across DEXs, and protection against MEV bots. WienerAI’s integration of analytical tools and execution capabilities is designed to simplify trading for users of all skill levels.

4. SafePal (SFP)

SafePal offers a comprehensive crypto wallet solution that includes both hardware and software wallets, ensuring secure management of digital assets. As the first hardware wallet backed by Binance, SafePal supports a wide range of crypto-assets across Ethereum, Binance Smart Chain, and TRON blockchains. Since its inception, SafePal has attracted over 3,000,000 users in 196 countries, underscoring its global reliability and appeal.

SafePal stands out due to its affordability and security. The SafePal S1 Hardware Wallet, a fully offline device, features advanced security elements and supports over 30 blockchains and 10,000+ cryptocurrencies. The Software Wallet offers a secure, decentralized way to manage assets on mobile devices. Additional features like the Wallet Holder Offering (WHO) and GiftBox enhance community engagement and reward users, ensuring SafePal provides top-notch security and usability. The native SFP token is used for discounts, user incentives, and governance, allowing holders to propose and vote on new features.

#SafePal now supports Telegram users with TON Connect🙌

Use our mobile & browser extension wallet to seamlessly access TG and @ton_blockchain Dapps📲

More collabs with the #TON ecosystem incoming🤝

📚: https://t.co/IqlEBDURUu

📱DL Mobile Wallet: https://t.co/fBj8jI9ied#SFP pic.twitter.com/TpczwSlIzX— SafePal – Crypto Wallet (@iSafePal) July 5, 2024

SFP recorded a modest 0.80% surge in the past 24 hours, showcasing its steady performance. It enjoys high liquidity with a 0.1164 volume-to-market cap ratio and a market cap of $355.99M. SafePal’s 14-day RSI of 56.59 indicates neutrality, suggesting stable trading ahead. With 13 green days and low volatility at 4%, SafePal presents a reliable investment option. Its 32.00% trading above the 200-day SMA and 69% annual increase underscore its consistent growth. While not as dynamic as Enzyme or Cream Finance, SafePal’s stability and lower volatility make it an attractive choice for risk-averse investors.

5. Beldex (BDX)

Beldex is a privacy-focused crypto ecosystem designed to ensure secure, anonymous transactions through a variety of decentralized applications (dApps). It includes privacy-first dApps like BChat, BelNet, Beldex Browser, and the Beldex bridge, which aim to enhance user confidentiality. Transitioning from Proof-of-Work (PoW) to Proof-of-Stake (PoS) has enhanced Beldex’s scalability, lowered costs, and sped up transactions.

Beldex’s unique approach addresses privacy and anonymity challenges in the crypto space through its Ring Confidential Transactions (RingCT) protocol, which hides transaction details. The network uses the CryptoNight hashing algorithm and ring signatures to prevent transaction tracing. Users can run masternodes with a minimum of 10,000 BDX to stake tokens and validate transactions, enhancing network security. The Beldex bridge supports cross-chain anonymity, and a coin burn mechanism manages inflation. Also, the BDX token functions as both a privacy coin and utility token, reinforcing Beldex’s commitment to private, secure data exchange.

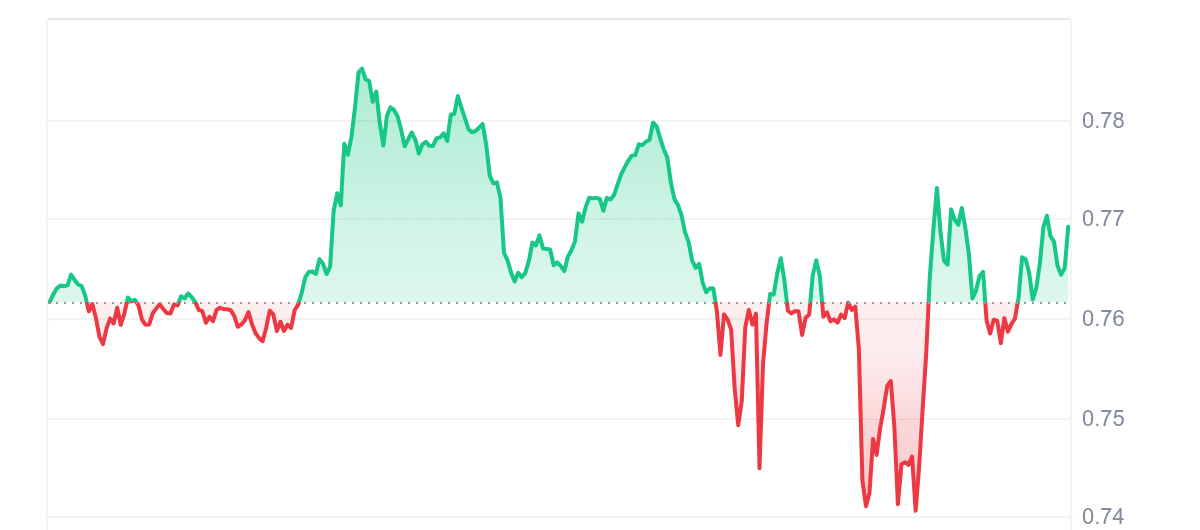

BDX experienced a 0.77% increase in the last 24 hours, reflecting modest short-term gains. Despite its lower liquidity, with a 0.0051 volume-to-market cap ratio, Beldex stands out with 17 green days in the past month—the highest among the listed cryptos. Its 14-day RSI of 65.59 signals neutrality and an 8% volatility indicates stable price movements. Trading 13.43% below its 200-day SMA and with a 28% annual decrease, Beldex appears less promising in long-term growth compared to others. However, its higher frequency of positive trading days and low volatility appeal to conservative investors seeking stability over aggressive growth.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage