Join Our Telegram channel to stay up to date on breaking news coverage

InsideBitcoins consistently reviews the top cryptocurrencies to invest in based on their recent price performance. This review considers market trends and overall performance to provide investors with informed recommendations.

The recent fluctuations in the crypto market have undoubtedly caused some unease, with Bitcoin experiencing a slight dip of 0.05% in the past 24 hours. This trend has also affected several altcoins and meme coins. However, amidst this uncertainty, a few altcoins have managed to shine. Wormhole (W) and Injective (INJ) have emerged as top gainers, hinting at potential profit opportunities.

In this context, analyzing select altcoins that have the potential to outperform established digital assets becomes essential. This analysis captures the interest of traders and investors, highlighting the promising prospects in the current market.

Top Crypto to Invest in Right Now

Recent market performance indicates strong confidence in CRO, presenting it as a fascinating investment opportunity in the volatile cryptocurrency market. Additionally, WienerAI has successfully raised over $5 million in its limited-time presale phase. Furthermore, the introduction of W staking for governance has significantly contributed to Wormhole’s price surge. Moreover, Injective has recently integrated gumi, a major gaming company, as a new validator.

1. Fantom (FTM)

Fantom is an open-source, decentralized smart contract platform and an alternative to Ethereum. It aims to address the limitations of earlier blockchains by focusing on scalability, security, and decentralization. The platform provides tools to simplify dApp integration and offers a detailed staking reward system alongside built-in DeFi instruments.

The platform can execute faster and cheaper transactions while maintaining high-security standards. It is compatible with the Ethereum Virtual Machine (EVM), which facilitates the creation and deployment of smart contracts.

Furthermore, Fantom boasts a transaction processing capacity of thousands per second, achieving transaction finality in about one second and ensuring completed transactions cannot be reversed. Additionally, it allows multiple blockchains to operate independently while communicating with each other, each with its own custom tokens and governance rules.

FTM serves as Fantom’s native utility token, vitally powering the ecosystem. It is utilized for payments, network fees, staking, and governance activities. It forms the backbone of transactions, enabling fee collection and facilitating staking, which rewards users for their participation.

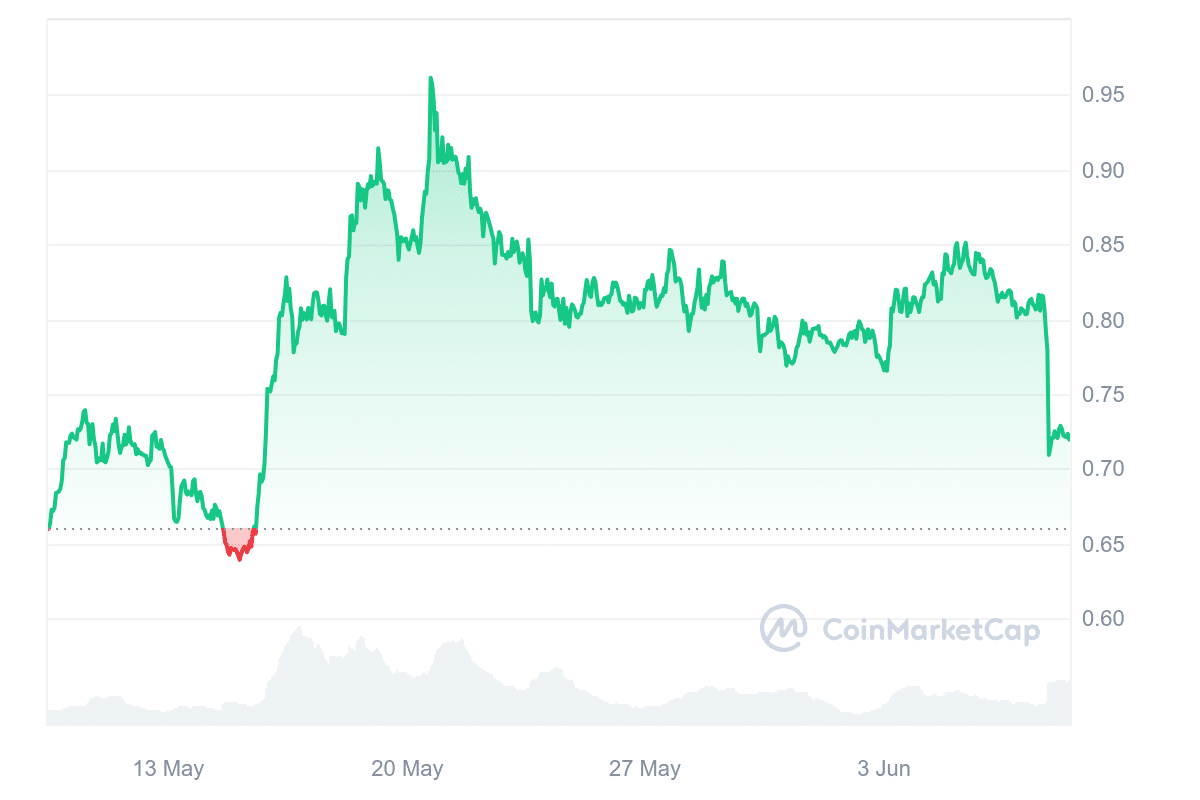

At press time, Fantom’s price is $0.7185, having decreased 10.87% in the last 24 hours. However, it has surged 8.92% over the past month. The current sentiment towards the token’s price prediction is neutral, while the Fear & Greed Index indicates a level of 72, indicating greed among investors.

Fantom is trading above its 200-day simple moving average and has shown positive performance compared to its token sale price. Moreover, it boasts high liquidity based on its market capitalization.

2. Cronos (CRO)

Cronos aims to support decentralized crypto assets and applications, enabling real-time, low-cost global transactions. The Cronos cross-bridge mainnet beta indicates a promising future for CRO by improving interoperability between blockchains.

This development could make CRO more appealing to developers and users. Recent market performance shows strong confidence in CRO, presenting it as a fascinating investment opportunity in the volatile cryptocurrency market. Notably, Cronos has secured high-profile partnerships, including endorsements by Eminem and actor Matt Damon and collaborations with major sports teams.

Great to see @PUUSHDABUTTON building and launching an innovative memecoin launchpad platform for the #crofam 🚀

Check them out! https://t.co/ttP8mIoZkl

— Cronos (@cronos_chain) June 7, 2024

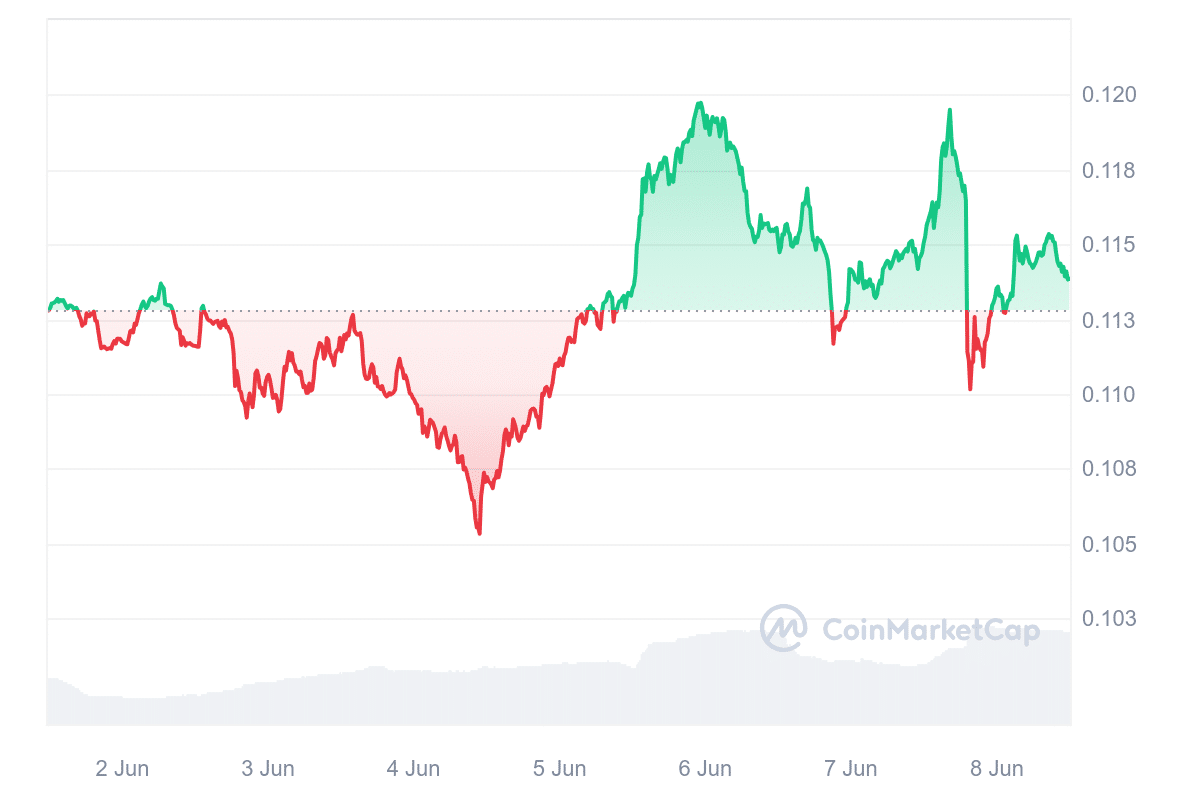

These partnerships, combined with technical advancements like the Cronos cross-bridge, are poised to influence CRO’s market positioning positively, further instilling confidence in its potential. At press time, CRO is trading at $0.1138, showing a 0.99% rise over the past seven days.

Nonetheless, the token saw an intraday decrease of 0.71%. The 14-day Relative Strength Index (RSI) is 48.53, indicating a neutral position and potential sideways trading. Importantly, CRO is trading 22.14% above its 200-day Simple Moving Average (SMA) of $0.093226, suggesting a stable performance in the long run.

3. WienerAI (WAI)

WienerAI has successfully raised over $5 million in its limited-time presale phase. Currently, the WAI token is priced at $0.000712, but this price will increase in less than 42 hours. The platform aims to innovate in the crypto market by offering advanced AI technology and high-yield staking opportunities.

Furthermore, the project recently announced its new trading bot, which is nearing completion. This bot leverages machine learning to identify trading opportunities. Users input basic criteria, such as risk tolerance or target gains, and the bot analyzes market data to find suitable trades.

WienerAI’s tokenomics are designed to support the project’s potential growth. With a total token supply of 69 billion WAI tokens, 30% have been allocated to presale investors.

An additional 40% of the tokens are reserved for staking rewards and community incentives when WienerAI enters the open market. This strategic allocation and the promise of rewards have sparked optimism among investors, fueling speculation about potential price increases.

In addition, WAI offers a utility-driven feature set, positioning itself as a valuable tool for cryptocurrency traders. The project focuses on making predictive market analysis accessible to everyday investors, aiming to simplify the trading process through its AI-driven approach.

4. Injective (INJ)

Injective is a platform designed for finance, enabling next-generation DeFi applications such as decentralized exchanges, prediction markets, and lending protocols. It offers a unique infrastructure with a decentralized, miner extractable value (MEV)-resistant on-chain order book.

This setup supports various financial markets and allows cross-chain bridging with Ethereum, IBC-enabled blockchains, and non-EVM chains like Solana. Moreover, the platform’s smart contract functionality, based on CosmWasm, facilitates advanced interchain capabilities.

Injective employs a Tendermint-based Proof-of-Stake consensus mechanism, which ensures quick transaction finality and supports over 10,000 transactions per second. Injective has recently made significant strides, permanently removing 12,266 INJ tokens, a clear sign of increased user activity.

The platform anticipates users will burn 6 million INJ tokens by next week. This ongoing cycle of use, revenue generation, and token burning is reducing the circulating supply, potentially boosting the token’s value.

Injective is onboarding one of the largest gaming giants gumi as the latest validator!

gumi’s addition to the Injective ecosystem will not only expand its role in the world of GameFi but also drive further adoption across Japan, Asia and beyond 🌐https://t.co/taZhN8qyfN

— Injective 🥷 (@injective) June 7, 2024

The transparent, decentralized token burn auctions further bolster user trust and confidence. Furthermore, Injective has recently integrated gumi, a major gaming company, as a new validator. This inclusion strengthens Injective’s network, historically making it one of the largest proof-of-stake networks.

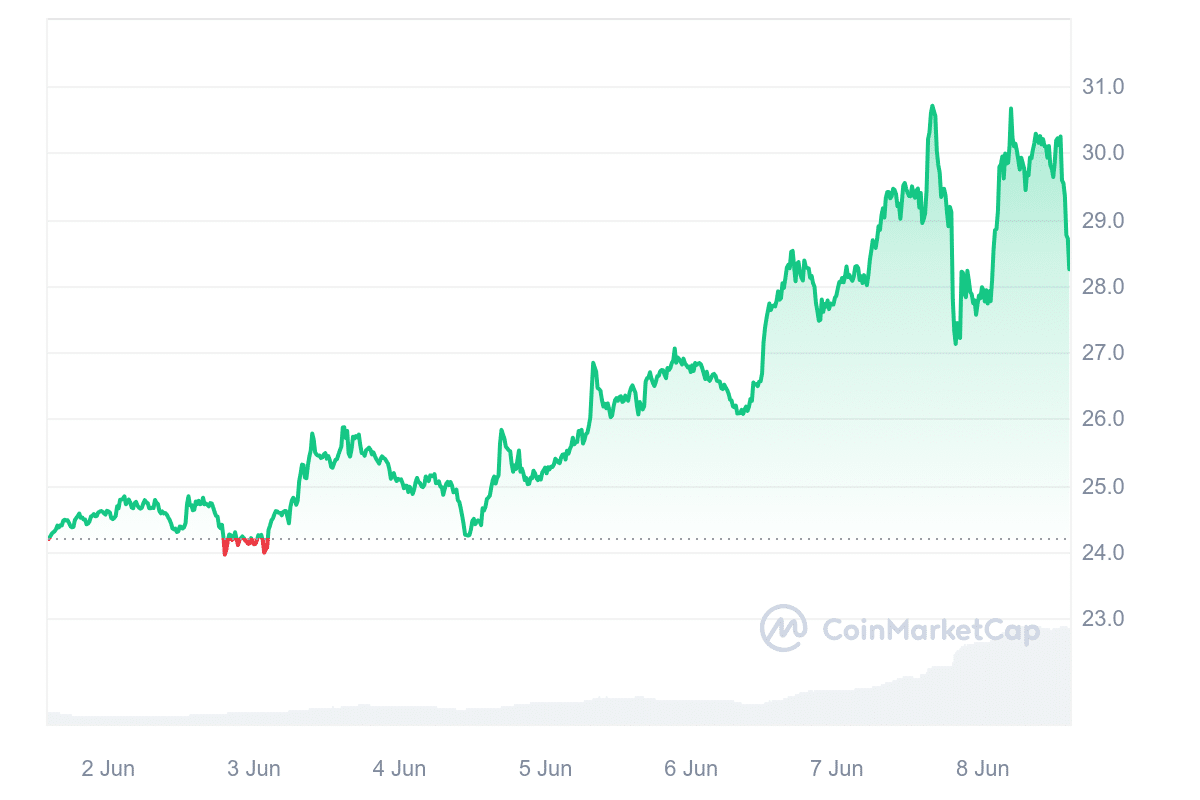

gumi, known for its popular mobile games and millions of active players, plans to explore GameFi with Injective. In the past week, Injective’s price increased by 16.79%. Current market sentiment for Injective is bullish, with a Fear & Greed Index score of 72, indicating greed.

5. Wormhole (W)

Wormhole has recently gained attention in the altcoin market due to its impressive performance. Known for its interoperability platform, Wormhole supports multichain applications and bridges, allowing access to liquidity and users across over 30 major blockchain networks.

This capability extends to various uses, including DeFi, NFTs, and governance, making it a vital component of decentralized ecosystems. In the past week, W’s price increased by 16.90%; however, it decreased by 3.17% in the past day.

Nonetheless, the token soared by 1,132.91% in the past six months. Currently, the price is near its resistance level at $0.74 and support level at $0.51. The introduction of W staking for governance has been a significant factor in this price surge.

💥 $osETH is now natively multichain and live on @Arbitrum, leveraging @Wormhole's Native Token Transfers (NTT) framework.@stakewise_io's $osETH is a liquid staking token that is now accessible across the multichain ecosystem.

Learn more about $osETH below. ⬇️ pic.twitter.com/tDDA1x09f5

— Wormhole (@wormhole) June 5, 2024

Staking has attracted investor interest by offering rewards and positioning token holders for potential future airdrops. The Relative Strength Index (RSI) for Wormhole shows a pattern of higher highs and lows, indicating a potential for continued price growth. This trend suggests the price could reach $1.

Moreover, the token shows positive performance compared to its token sale price and maintains high liquidity based on its market cap. In addition, Wormhole’s recent achievements highlight its role in enhancing interoperability within decentralized ecosystems. The introduction of staking and the observed RSI trends indicate potential continued growth, making it a project to watch in the coming months.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage