Join Our Telegram channel to stay up to date on breaking news coverage

Retail investors are not the only group that believes in the future value of cryptocurrencies. Even corporate organizations now see Bitcoin as a viable long-term strategy. While institutional investors are content with betting on Bitcoin’s potential, retail investors search for short-term financial rewards. The divided interest of the two groups is evident in the fluctuations in the price of BTC despite the ongoing bull run.

Moreover, Michael Saylor’s Monday interview may have shown institutional investors’ perspective regarding the prospect of Crypto coins. While appearing on CNBC on Monday, he implies through his comments that it’s only a matter of time before Bitcoin eats gold. The declaration credits the giant cryptocurrency as the viable successor of gold in terms of a store of value and wealth transfer.

Next Cryptocurrency To Explode

Hence, upcoming Bitcoin mining initiatives like Bitcoin Minetrix have a path to play in the future of Bitcoins. The project aims at providing mining services through cloud computing technology. Thus, it democratized Bitcoin mining, allowing anyone with the BTCMTX token access to mining opportunities. Further project details are provided below to help investors see how the industry’s future unfolds.

1. Vanar Chain (VANRY)

Vanar Chain is currently gaining traction in the crypto market, and many traders believe that its token, VANRY, might become the next cryptocurrency to explode. The token has seen an over 856% increase in trading volume compared to what it recorded yesterday. This growing volume indicates that there’s a growing interest in the asset.

Apart from VANRY’s increasing trading volume, it is also recording a price surge, with over 46% increase in the last 24 hours. At the time of writing, VANRY is valued at $0.2852. With the growing interest in the token, it might find more momentum to climb further.

Given the recent partnerships with AI platforms and other crypto networks, there is a higher chance that the Vanar Chain will record more use cases in the coming months. Consequently, the demand for the VANRY token will remain high, resulting in increased value.

The Vanar Chain project is an offshoot of the Virtua metaverse platform. Virtual initially focuses on providing web3 gaming and entertainment services. However, the project and its cryptocurrency, TVK, recently rebranded to VANRY. Since the migration, the new token has kicked off an impressive uptrend, bringing about over 350% value pump. Plus, the price action of VANRY suggests that it might continue its uptrend.

🚀 Exciting News! 🚀

Unveiling the latest building block in our ecosystem: Vanar AI

Merging the power of AI with blockchain's potential!

Working with top tier tech and #AI partners, we're setting new standards of innovation!

More about the Vanar AI Ecosystem:… pic.twitter.com/jX7c2z2lYe

— Vanar (@Vanarchain) March 11, 2024

Nevertheless, there are significant downsides to watch out for regarding the VANRY trend. The first one is that the token is approaching a critical resistance zone at the $3 range. The chance of a pullback or price consolidation is relatively high.

Also, the relative strength index reading tests the oversold zone during the daily timeframe, confirming that a pullback is imminent. Risk management precautions are best when interacting with the token.

2. Ethereum (ETH)

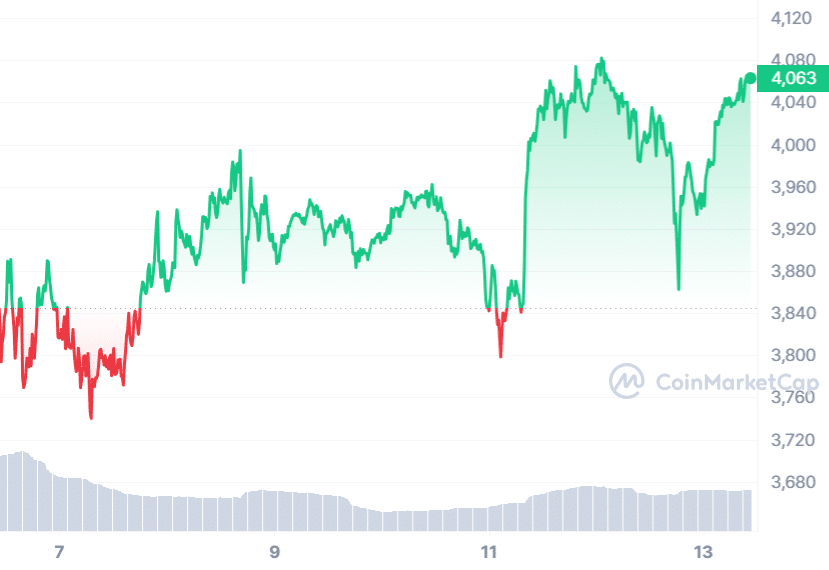

After a period of price consolidation, ETH is back on an uptrend, trading above $4k. Interestingly, the price point has been a significant milestone for traders since the start of the bull market. Even though ETH tested the region several times this quarter, it encountered intense resistance, causing it to trend sideways for most of the past weeks.

A recent post on the Ethereum blog has announced the arrival of the Dencun network upgrade on all testnets, and the mainnet launch is slated for March 13, 20,24 at 13:55 UTC. With that, the crypto community should expect more leg up in the coming weeks triggered by the growing visibility.

The main highlight of the Dencun upgrade is the protodanksharding, which would change some fundamental network operations. It aims to ensure that Layer 2 network users pay reduced transaction fees. The facts imply that there will soon be increased activity in the Ethereum network.

Latest Week in Ethereum Newshttps://t.co/1Jtp6EWZix

— Week in Ethereum News (@WeekInEthNews) March 2, 2024

Notwithstanding, there’s been a growing concern about the activities of node validators. Since the debut of the Dencun upgrade, on-chain data shows that over 78 thousand ETH have been withdrawn from the staking network. The volume of fund movement indicates that the market may get flooded with excess supply in the coming weeks.

Without a complementary deflationary strategy, the price of the ETH token might be forced into a sideway trend in the coming weeks. Also, rumors exist that the SEC may decline the ETH ETF proposals. If the rumors are true, it may affect the price of ETH negatively. Ultimately, traders and investors should factor these essentials into their strategies.

3. ORDI (ORDI)

Has ORDI reached its peak value? Many have claimed that the token reached its highest possible value in this bull run, but there are indications that the claims might be flawed. In the last 24 hours, ORDI printed over a 5% price increase and a trading volume increase of 48%.

While the sudden price action may not equal long-term prospects, it shows existing market interest in the token. Moreover, the concept of ordinals in the Bitcoin network is an emerging trend. As it gains ground, projects like ORDI would record more upside. However, the downside is that it might take a while before the growth is evident.

ORDI is moving close to its ATH value of $96, and it’s only 15% from crossing reaching it. If the macro crypto environment sustains its bullish trend, the likelihood of the ORDI printing an ATH is high. In addition.

Again, ORDI has bullish readings from most of its indicators. The RSI values are moving closer to the oversold levels, which indicates that the current uptrend might hold for a while. Also, the moving averages are significantly below its current price. It means there is more accumulation going on at the current price. For a reversal to ensue, ORDI might reach the $90 range. Being a new asset increases its volatility in the short run.

4. Bitcoin Minetrix (BTCMTX)

The mining sector is one of the crypto sectors most affected by the coming halving. The pressure to maximize their resources would increase due to reduced service rewards. Hence, the need to democratize the sector has never been more necessary.

Exploring the perks of #BitcoinMinetrix:

Easy access points. 🛰️

Cost efficiency.

Streamlined and noise-free installations.

Reliable assurance without worries of resale. 💰 pic.twitter.com/ZLVVhJPUgK

— Bitcoinminetrix (@bitcoinminetrix) March 12, 2024

Bitcoin Minetrix provides the technology needed to put the mining power into the hands of the public. It offers cloud computing technology to establish a decentralized mining system. This initiative not only ensures sustainable mining operations but also provides the opportunity for more people to participate in the sector.

Aspiring miners and crypto investors only have to invest in the Bitcoin Minetrix token, BTCMTX. The token is currently offered on presale at $0.014. It won’t be long before the price increases as the current presale stage is gradually ending.

It is quite thrilling to see investors commit over $12 million to the Bitcoin Minetrix project and a growing community of enthusiastic participants forming around the project. Hopefully, it will be the revolution that the mining sector has been waiting for. The details of the project are available on its presale page.

Visit the Bitcoin Minetrix Presale

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage