Join Our Telegram channel to stay up to date on breaking news coverage

TUSD’s $1 billion injection could transform the market landscape profoundly. A substantial infusion of capital is expected to affect market dynamics and reshape the competitive landscape. Market participants eagerly await TUSD’s substantial investment, which could drive significant changes and create new growth opportunities.

TrueUSD’s Market Cap Spikes by $1 Billion in Two-Day Frenzy

The market cap of TrueUSD (TUSD) increased by $1 billion in just two days, according to Santiment. TUSD’s surge contributed to the overall market capitalization of the top six stablecoins reaching $126 billion. As TUSD’s market cap grows, it shows its rising prominence and influence in the stablecoin space.

TUSD’s milestone shows how important it is in the market. The market cap of TUSD was slightly over $815 million in December 2022. Market participants are starting to recognize and trust TUSD more due to this significant increase in market cap.

Stablecoin supply is rising because investors are looking for stable assets and are willing to buy more volatile assets like Bitcoin (BTC) and altcoins. Investors are willing to explore and invest in assets with higher price fluctuations.

Market Cap Decline Raises Doubts and Uncertainty

The stablecoin market saw a downturn in market cap in the past year due to a range of unfavorable events that sparked widespread skepticism.

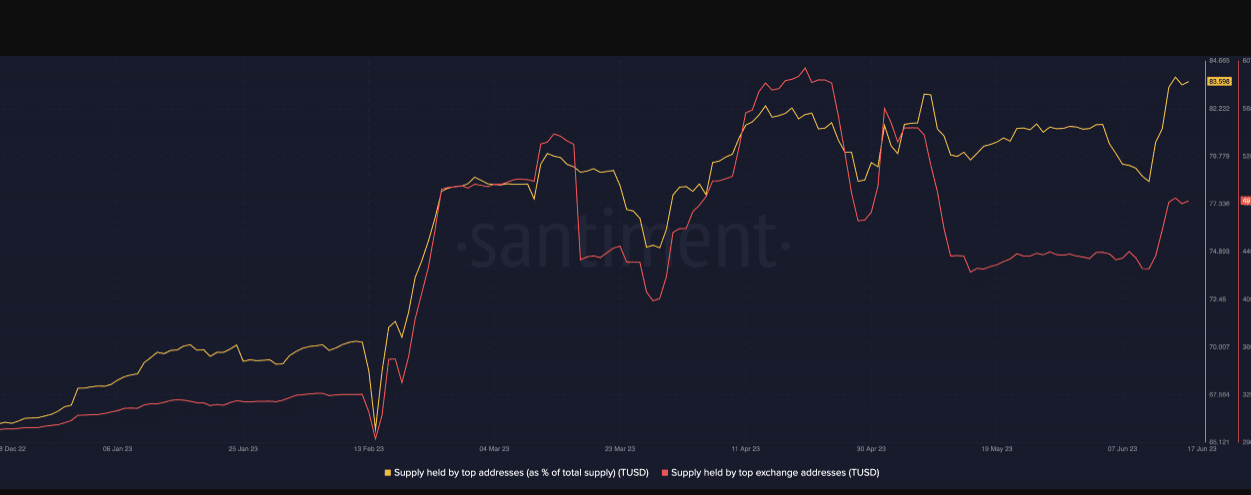

In addition, a segment of the market is getting ready to take advantage of the decline. Stablecoin availability outside cryptocurrency exchanges has decreased, which could explain this.

In this metric, you can see how many coins are in wallets that aren’t managed by third parties. An upward trend in stablecoins suggests that market participants are cautious and aren’t accumulating other cryptocurrencies.

In this case, the decrease indicates the opposite. Furthermore, the supply of addresses associated with big investors increased. Blockchain transactions showed an upward trend for this metric.

Additionally, according to a thorough analysis of exchange activity, Binance had the highest level of involvement from these significant investors.

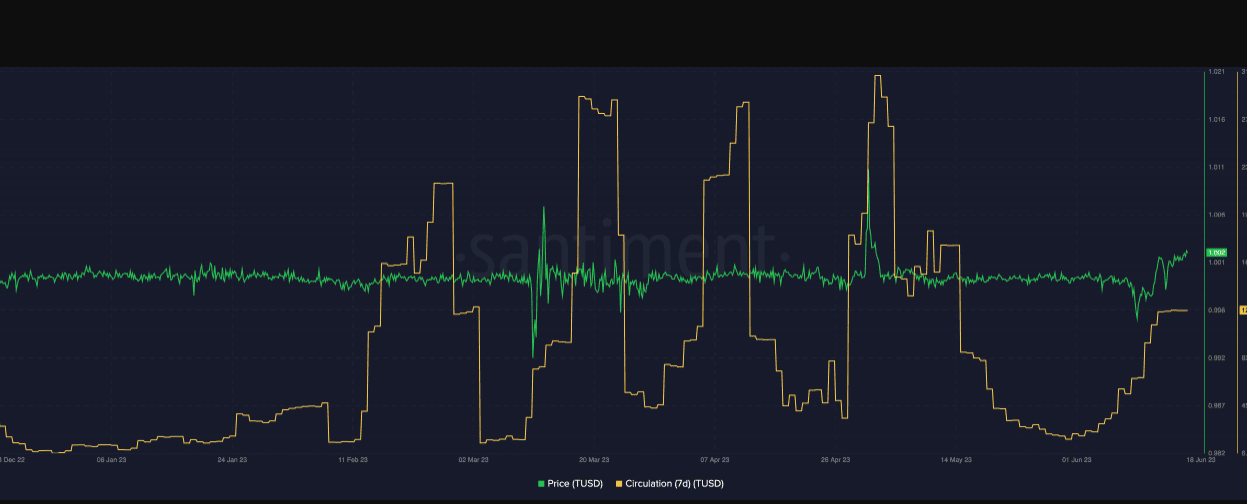

TUSD Circulation Spikes, Reflecting Market Activity

Over the past seven days, Binance received 59.1 million TUSD from Santiment. In the last 24 hours, 237,100 coins have been transferred into the exchange since the first transfer 1626 days ago.

Moreover, the surge in TUSD supply on exchanges suggests a possible strategy for accumulating altcoins. The renowned crypto trader Michael van de Poppe thinks the current depressed state presents a great investment opportunity.

On June 17, van de Poppe talked about the significance of BlackRock’s filing and how it could affect the market. In addition, he said altcoin prices may be boosted as Asia gets more involved in crypto.

We are in a comparable period like the end of 2019. So, this is the phase where you can conclude that this is the point of maximum financial opportunity.

Moreover, TUSD’s 7-day circulation shot up, indicating a lot of coin transactions in that timeframe. In recent days, TUSD coins have been active and moving.

An increase in demand for TUSD coins and a surge in trading and investing could explain the high activity. An upcoming price surge could be a good sign for investors.

Join Our Telegram channel to stay up to date on breaking news coverage