Join Our Telegram channel to stay up to date on breaking news coverage

Litecoin (LTC) Price Prediction – January 31

LTC/USD market presently tends to show a probability of forming a bullish flag as in the trading situation of flagship crypto paired with the US Dollar.

LT/USD Market

Key Levels:

Resistance Levels: $160, $180, $200

Support Levels: $100, $80, $60

LTC/USD – Daily Chart

The 14-day SMA trend-line has slantingly bent towards the southward with the formation of size-able bearish candlesticks. The 50-day SMA trend-line has placed a bit over the value of $120 below the smaller SMA trading indicator. The bearish candlesticks are most likely bottomed around the value mentioned earlier in consolidation settings of price movements. The Stochastic Oscillators, yet, slantingly point down towards range 20. That signifies that a downward-move of the current retracement has not fully faded-off.

What could be the next price-formation outlook for LTC/USD?

Indication has had it that the current downward correction is presently finding a sit around the key $120 market-level. The LTC/USD Bulls would have to brace up their energy at a reversal bid of price slightly touching past the $120 mark. The crypto-market may have to feature in a range-moving formation around $120 and $140 levels. A further downward move will most likely be to rebuild a stand-base for an upswing reason.

On the downside, bears seem losing significant forces as price has been slowing down in pressures towards the key $120 value. The highest-low market point that bears may achieve is put around the immediate support at the $100 line. As they intensely consolidate positions at that point for a long time of trading sessions.

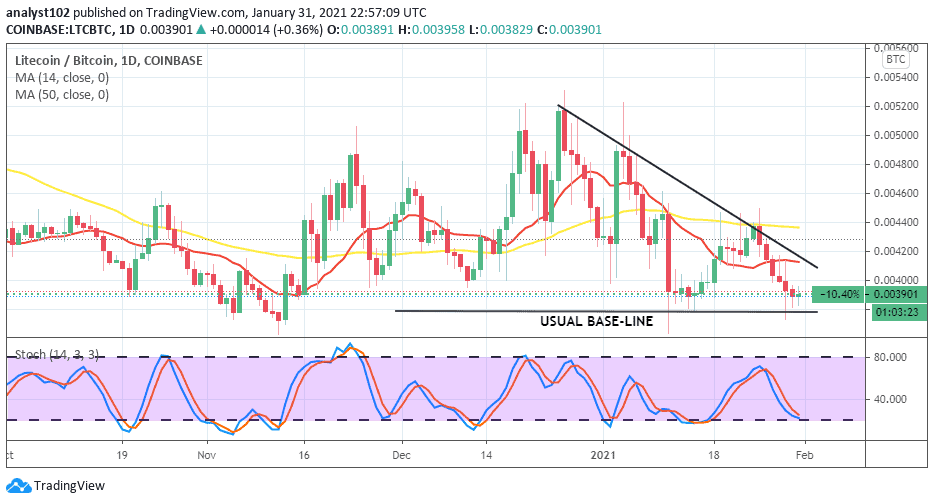

LTC/BTC Price Analysis

In the market-weights’ comparison of Litecoin with Bitcoin, the counter-crypto has dominated over the base-crypto’s value over some trading days/ sessions. The trading-chart shows that the BTC pressure is almost at its maximum utilization capacity as price approaches a usual base-line line where LTC technically tends to regain momentum in the near trading cycle.

Join Our Telegram channel to stay up to date on breaking news coverage