Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum Price Prediction – January 24

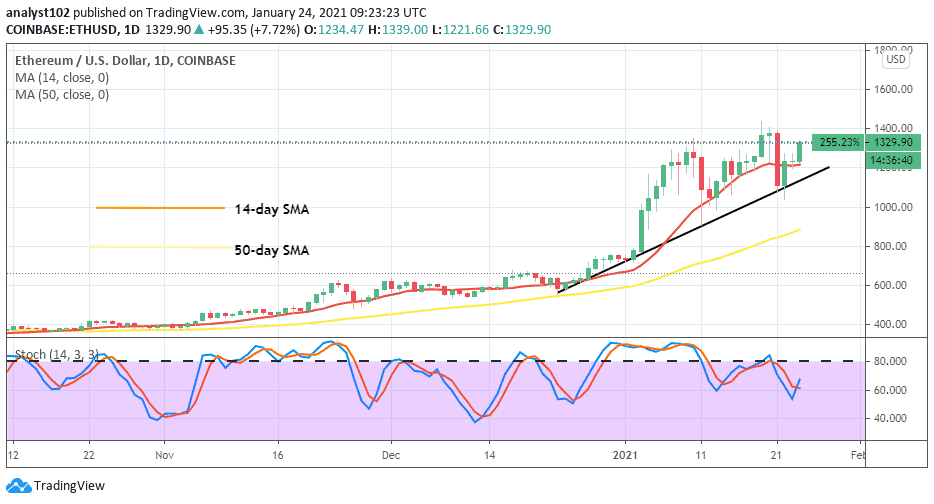

On January 21, a notable drop emerged in ETH/USD that briefly pushed southbound against the smaller SMA trend-line. In the following day’s trading sessions, the crypto strived to show a strong-promising recovery mood that can successfully breach past the recent recorded high point around $1,400 level.

ETH/USD Market

Key Levels:

Resistance levels: $1,600, $1,800, $2000

Support levels: $1000, $800, $600

ETHUSD – Daily Chart

Despite some bearish candlesticks formed in the ETH/USD market operations, the trading chart yet depicts that the trend is bullish. Expectably, A bullish candlestick is strongly in the making averaging a vital resistance at $1,400 level. Both the two SMA trading indicators point northward to attest that there is still buying spree ongoing in the crypto’s trade. The Stochastic Oscillators have slightly crossed hairs at range 60 to possibly signify a return of an upward move.

Will ETH/USD price continue to prolong its current bullish trend?

There is a high expectation as regards a prolong in the market-valuation of ETH/USD. The crypto’s price is now on the verge of possibly surging higher past the drop that occurred on January 21 as it did with a value-drop on January 11. In the meantime, A successful breakout of the $1,400 resistance level may potentially set the crypto-market witnessing a new-high value over $1,600 line in a near trading time.

On the downside, a rejection at $1,600 mar will allow bears to take a position of staging a comeback. While that assumption plays out, the market point at $1,200 may be a vital point where bears will have to intensify effort to break down past successfully to suggest a probable resumption of a downward-trend in the trade-economy of ETH/USD.

ETHBTC Price Analysis

Comparing the value of ETH’s with the BTC’s, the base instrument has a higher price-worth than the counter cryptocurrency. The 50-day SMA trend-line has been intercepted from the underneath by the 14-day SMA indicator. And, price is now pushing northward on the buy signal side of the smaller SMA. The Stochastic Oscillators have dipped into the oversold region. And, it could start a consolidation move within it. That suggests that the base cryptocurrency’s pressures are somewhat in a bit getting relax. Therefore, traders may have to exercise a degree of cautiousness while placing a position.

Join Our Telegram channel to stay up to date on breaking news coverage