Join Our Telegram channel to stay up to date on breaking news coverage

USDCAD Price Analysis – May 23

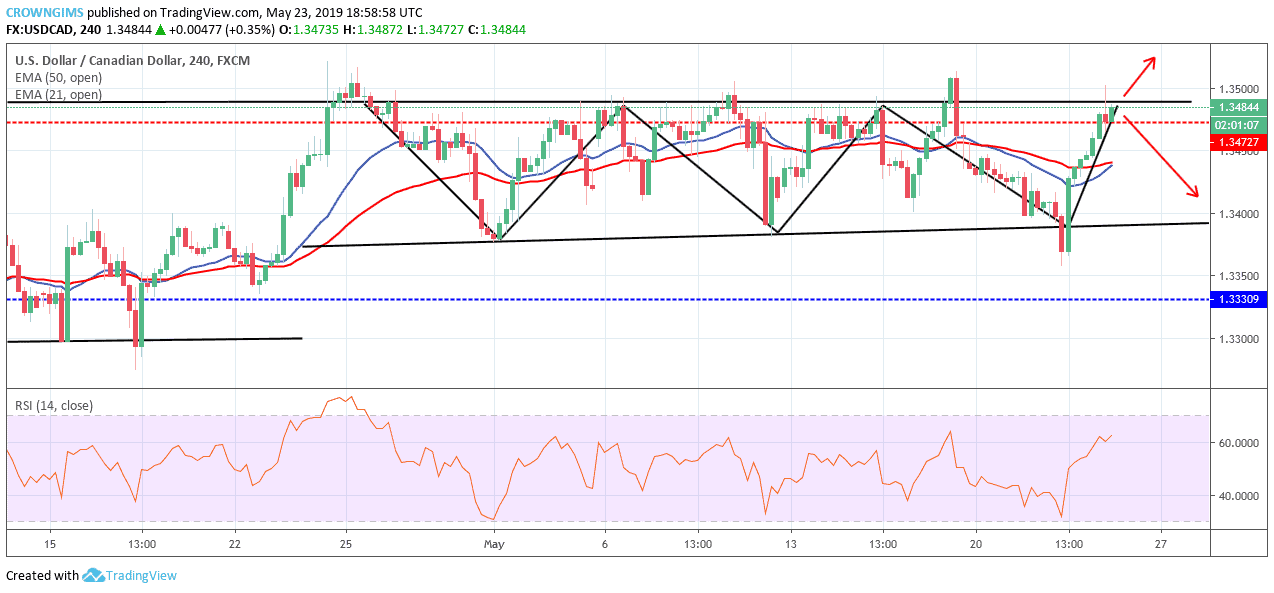

Sideways movement may continue should the Bears continue to defend the $1.3472 level and the Bulls defend $1.3330 level. In case the Bulls break up the $1.3472 level, the price will rally towards $1.3678 level. Likewise, Should the Bears break down the $1.3330 level, the price may target $1.3207 demand level.

USD/CAD Market

Key levels:

Supply levels: $1.3472, $1.3648, $1.3845

Demand levels: $1.3330, $1.3207, $1.3093

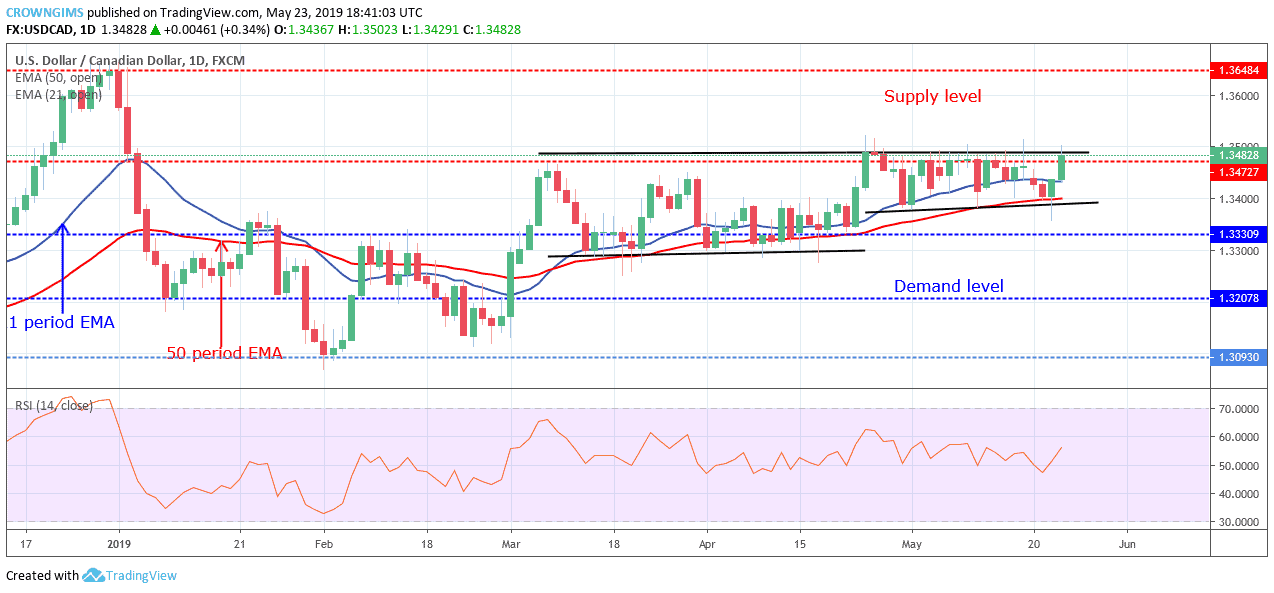

USDCAD Long-term trend: Ranging

On the long-term outlook, USDCAD continues on the sideways movement. USDCAD continues moving sideways like that of last week. No significant movement to the south or to the north. The price is ranging around $1.3472 supply level. All attempt made by the Bulls to break up the level was resisted by the Bears. The bullish daily candle formed today tried to penetrate the level but failed. Until the Bulls break up the $1.3472 supply level or the Bears break down the $1.3330 demand level, sideways movement may continue in the USD market.

The 21 periods EMA and 50 period EMA are flat horizontally showing no specific direction of the market and the currency pair is trading over and around the two EMAs. Nevertheless, the Relative Strength Index period 14 is below 60 levels with the signal line pointing up to indicate a buy signal. Sideways movement may continue should the Bears continue to defend the $1.3472 level and the Bulls defend $1.3330 level. In case the Bulls break up the $1.3472 level, the price will rally towards $1.3678 level. Likewise, Should the Bears break down the $1.3330 level, the price may target $1.3207 demand level.

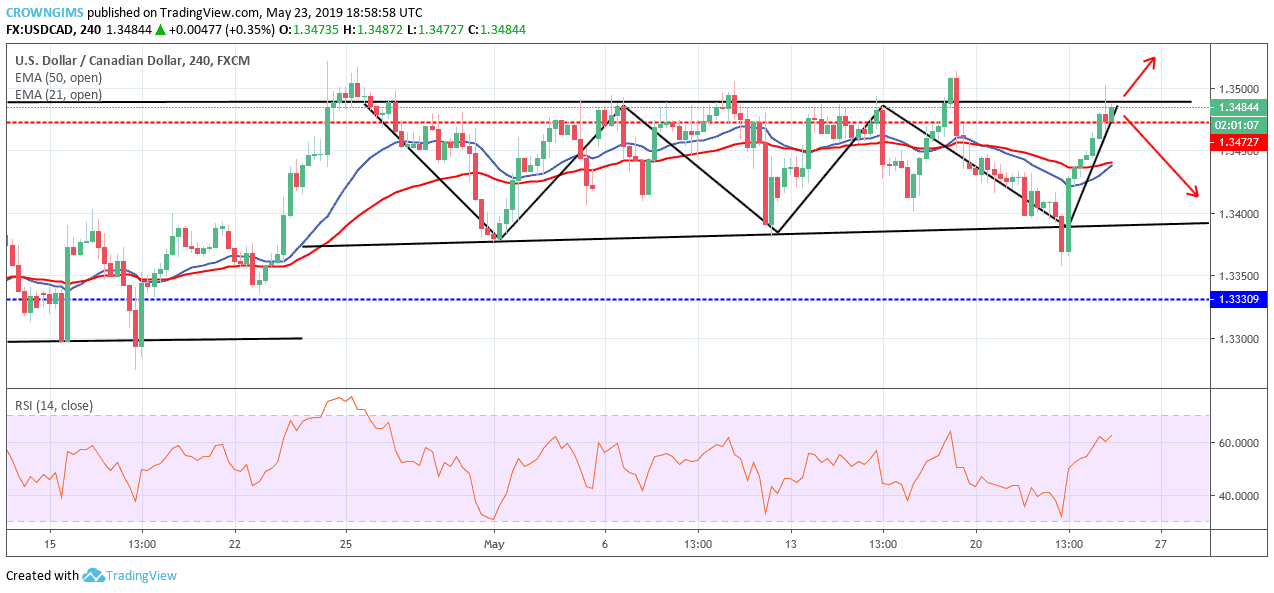

USDCAD medium-term Trend: Ranging

USDCAD is still on the sideways movement in the medium-term outlook. The price of the currency pair has formed a rectangular channel in which the pair is trading in a sideways pattern. On May 17, the Bulls pushed the pair to break up at the upper trend line of the channel but could not continue the uptrend movement when the Bear interrupted it with the formation of a bearish engulfing candle.

The Relative Strength Index period 14 is at 60 levels with the signal line pointing to the north to connote buy signal.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage