When you are ready to dive into the crypto world, selecting a broker to trade or invest in cryptocurrency is one of the most crucial steps. With so many crypto brokers currently active in the crypto market, deciding which platform to start your investment can be challenging for you.

As crypto brokers have different features, you must research which type of broker is best suited for your investment needs. In this guide we’ll go over the crypto investing process with reviews of the best crypto brokers in the UK.

[table_of_content]Best Crypto Brokers in the UK – Top 5 List

UK Crypto Broker Reviews

eToro – Overall Best UK Crypto Broker

eToro is the leading crypto broker which provides traders and investors with access to over 2000 different financial assets, including currencies, ETFs, stocks, indices, crypto assets, and commodities, most of which could be leveraged, thereby providing access to short-term, mid-term, and long-term investment avenues.

Further, this leading crypto broker offers competitive trading fees. Various asset classes are competitively priced at eToro, with spreads as little as 1 pip for popular Forex pairings.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

This crypto broker started as a stock broker and a forex broker and then added crypto to its portfolio. However, it does not offer leverage services for cryptocurrencies. For the benefit of its clients, eToro has bought insurance coverage from Lloyd’s of London. The insurance covers claims made by Eligible Clients who have suffered damages as a result of eToro’s insolvency or a misconduct event.

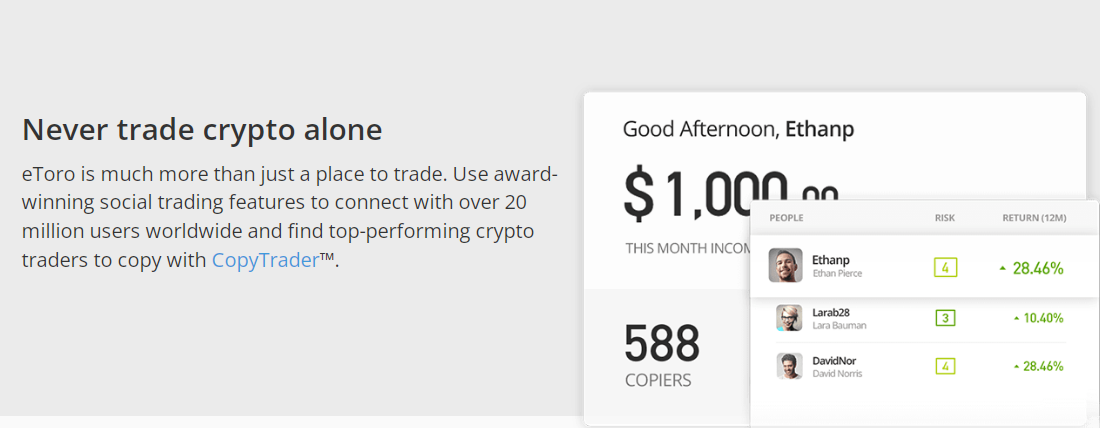

eToro is the world’s largest trading and investing community, with more than 20 million members from different parts of the globe.

Moreover, it has premium features like Smart Portfolios, and Copy trader functionality to enhance the user’s trading experience. eToro Investment Portfolios (Smart Portfolios) are collections of assets or people that are strategically grouped based on a theme.

Similarly, the Copy trader function on the eToro platform allows users to copy the trades other investors. For all these reasons, the eToro crypto broker is an excellent choice for trading and investing in crypto.

- Buy any cryptocurrency outright or trade it for CFDs

- Have features like Smart Portfolio, Copy Trader function

- Accepts multiple payment options

- Limited technical analysis tools

- Not well-suited for the more advanced investor

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest. Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

OKX – Advanced Trading Tools for Seasoned Investors

OKX is a prominent UK crypto broker that offers a range of features for traders and investors in the cryptocurrency market. With OKX, users have access to a wide selection of cryptocurrencies, allowing them to diversify their portfolios and explore various investment opportunities.

One notable advantage of OKX is its competitive fee structure. The platform offers trading services with low fees and transparent pricing, ensuring that users can trade without worrying about hidden costs. Additionally, OKX provides a user-friendly interface and advanced trading tools, empowering traders to execute their strategies effectively.

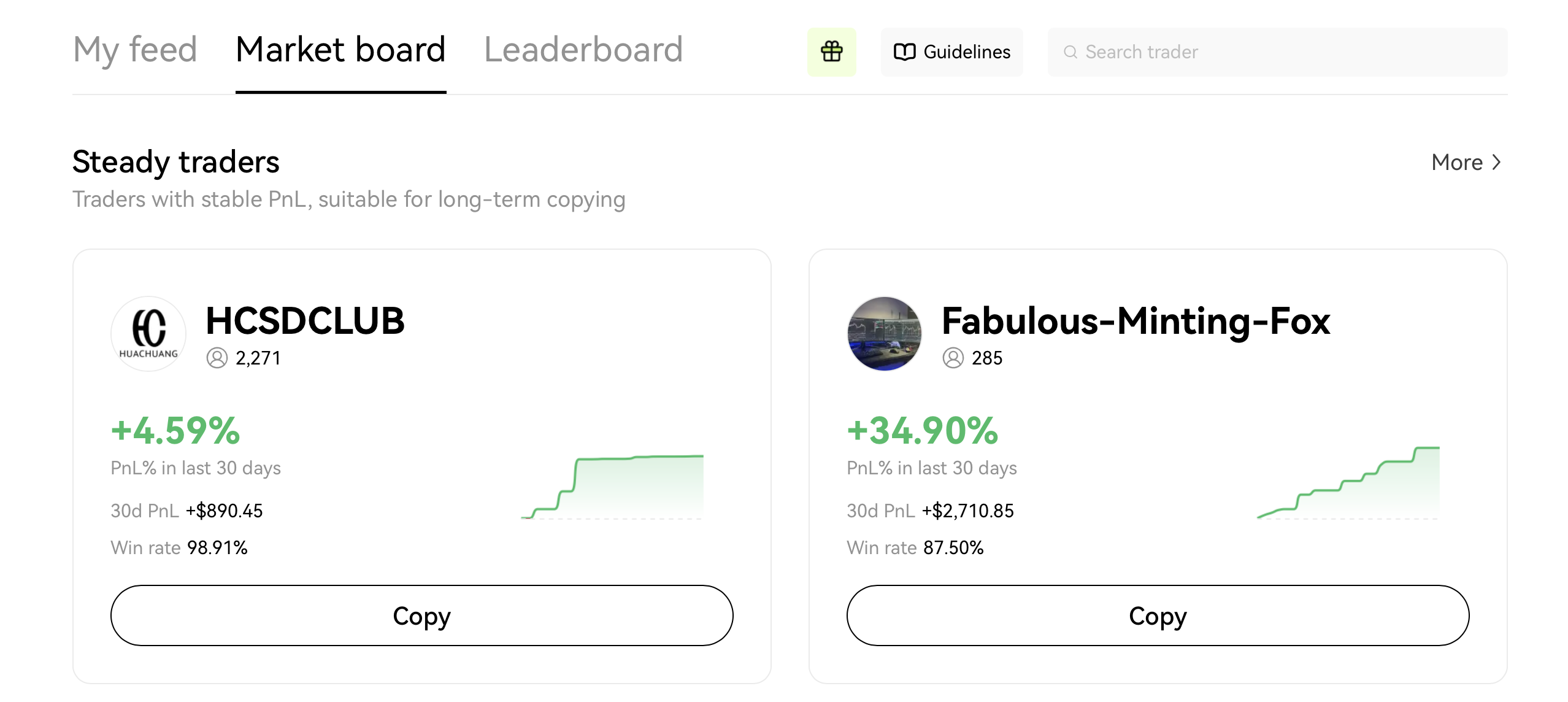

CopyTrading Feature on eToro

The platform also employs stringent security measures to safeguard user funds and personal information. OKX also follows industry best practices and compliance standards, providing users with a secure and reliable trading environment.

As a regulated crypto broker, OKX adheres to regulatory guidelines and prioritizes the protection of its users and therefore, emerges as one of the best choices for individuals looking to engage in cryptocurrency trading within the UK market.

- Fully regulated platform for user safety

- Advanced trading tools for enhanced analysis

- Fast and efficient order execution

- Limited availability in certain regions and countries

- Customer support occasionally unresponsive

Your capital is at risk. Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Bybit

Bybit is another reputable crypto broker which has a massive subscriber base of over 1.6 million users across the globe. It maintains a customer-centric approach and strives to give the best possible user experience.

This leading platform does use a buy-sell spread like eToro, rather it employs the maker/taker fees model in its services. It charges fees of about 0.1% in spot trading while giving you a rebate of about 0.025% in margin trading for limit orders.

Unlike Binance, Bybit is considered to be the ‘lowest spread’, where you get a maker rebate. Another advantage of using Bybit is the absence of the KYC (know-your-customer) process. Here, you are not required to submit your license copy, or passport for the purpose of identity verification unless you want to withdraw more than 2 BTC per day which is more than most traders need.

Bybit platform

Further, this broker is freely accessible to all crypto enthusiasts in form of mobile applications and desktop-based programs. Bybit offers high leverage, low trading fees, and a market maker rebate.

It supports multiple orders on its platform, including limit orders, conditional orders, market orders, and partial orders. Having an insurance policy for mitigating the loss of its users, this reputable crypto broker is considered the favorite platform for trading in crypto derivates.

- Advanced tools backed up by cutting-edge technology

- Supports multiple orders on its platform

- One can get up to 100x leverage on cryptocurrencies

- Not suitable for spot trading

- Your data may be shared with third parties for marketing purposes

Your capital is at risk. Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Binance

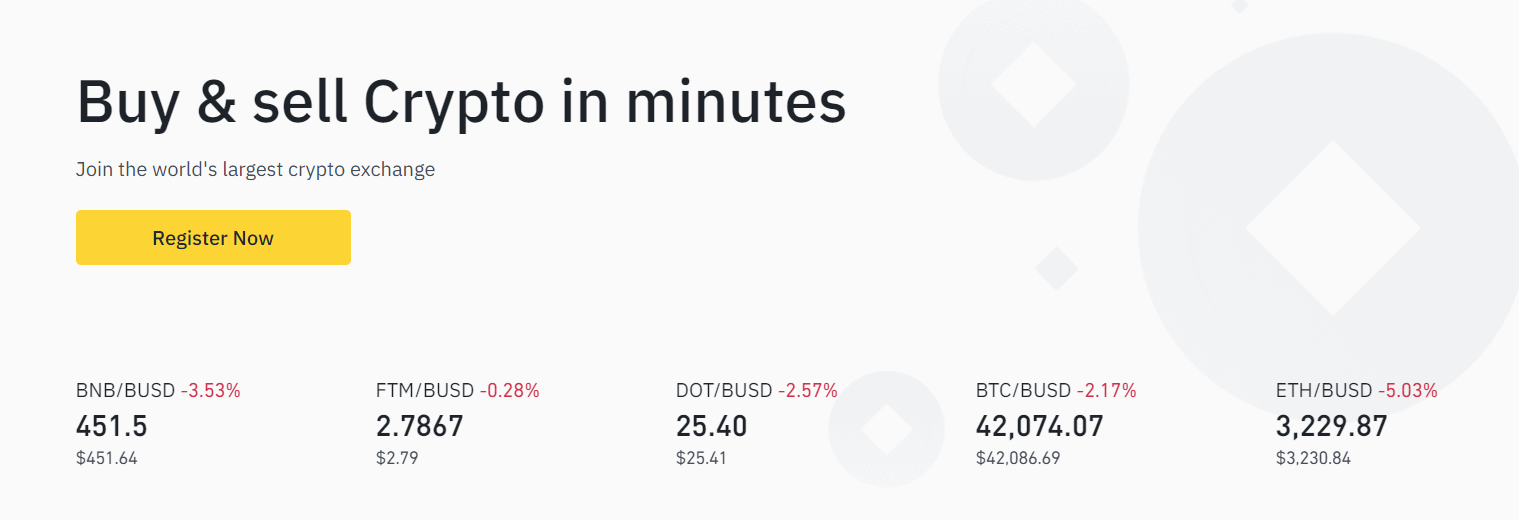

Next, we have the Binance crypto broker which offers the best way to invest in cryptocurrencies at a very low price. Binance stands apart when it comes to providing a decent trading experience to all its users.

The crypto broker does not charge any transaction fees from its users, thereby allowing users to freely use the platform for understanding the nuances of this volatile market without incurring any additional costs.

Binance employs a volume-based pricing strategy and even offers further savings if you buy and sell with its own coin. Further, in case you are searching for a crypto broker that supports MT4 (Metatrader 4 software), then your hunt ends here as Binance has all of the features MT4, which users would expect.

Binance online crypto broker

Using this feature, you are allowed to know all trends, trades, and signals on a real-time basis. The popularity of the MT4 Binance trading platform can be attributed to the fact that it is one of the simplest and most dependable ways to conduct business on the Forex market.

Using this trading platform has a number of advantages, one of which it could assist you in learning how to trade and help you in obtaining a better grasp of how the entire process of trading works. Binance customers can use the “Expert advisors” feature for receiving a variety of investment tips from expert traders in order to boost productivity.

Binance is the most popular exchange in terms of trading volume, and it offers leveraged spot and margin trading. Lastly, the fact that it has the greatest number of altcoins on its platform itself displays its dominance among the crypto brokers.

- Highly reputable broker

- User-friendly platform

- Factor Authentication (2FA) Login

- No formal address or head office

- Not licensed in some regions

Your capital is at risk. Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

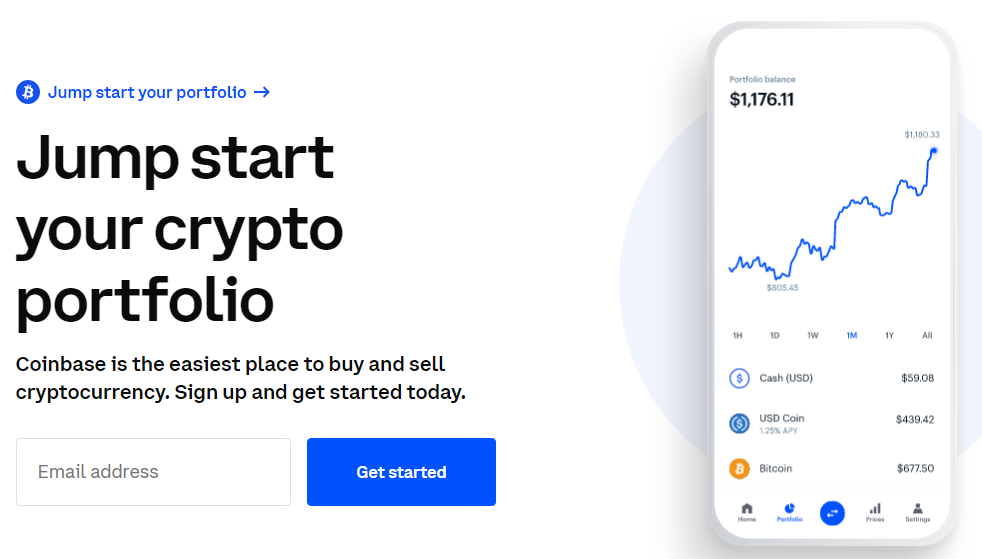

Coinbase

Having a huge customer base of more than 10 million users, Coinbase is one of the top crypto brokers where you can purchase and sell a variety of cryptocurrencies, including Bitcoin, Ethereum, Dogecoin, etc.

One of the advantages of using Coinbase for purchasing cryptocurrencies is that it allows you to buy cryptocurrency with a wide variety of payment options, including debit cards and bank transfers.

Coinbase has a specific cap on its fees for different transactions. You’ll be charged whenever you deposit or withdraw money, as well as when you buy or sell a cryptocurrency. The total transaction cost on Coinbase comes at around 1.49 percent of the transaction value. Therefore, if you want to buy $100 worth of Bitcoin with your debit card, you’ll have to spend $1.49.

Coinbase platform for buying crypto

Further, Coinbase is only having spot trading on its platform, it doesn’t have margin trading. Coinbase Pro is a premium feature of this crypto broker which allows you to trade yourself by setting the limit order on the chart. Coinbase has advanced security measures on its platform for ensuring the complete safety of your transaction.

For instance, it users two-factor authentication (2FA) check whenever you log in and has multi-signature logins for your investment protection. Overall, Coinbase comes out as a decent option as a crypto broker for all investors.

- Supports many cryptocurrencies

- Highly user-friendly

- Offers several platforms for different users

- Multiple payment options

- Huge customer base

- Charges high fees

- Doesn’t support credit card transactions

Your capital is at risk. Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

KuCoin

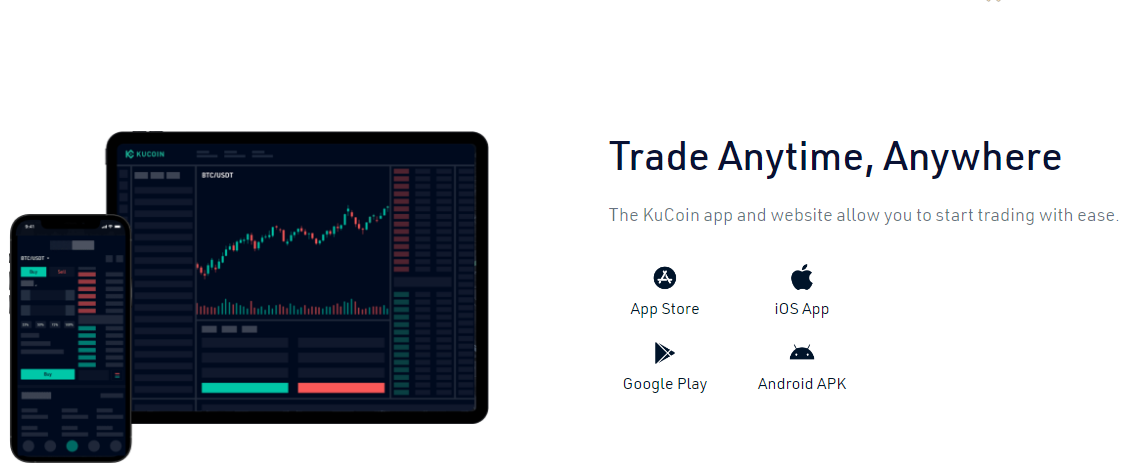

Launched in 2017, KuCoin has established itself as a one-stop solution for all crypto operations, making it a well-known broker in the crypto sector. This trading platform is offering more than 200 cryptocurrencies to all its users.

KuCoin is known for providing a user-friendly experience to all its users. It offers a wide variety of crypto services, including a fiat onramp, margin trading exchange, crypto staking, and lending, future trading exchange, peer-to-peer (P2P) marketplace, non-custodial trading, and a lot more.

KuCoin platform

Apart from all these features, this crypto broker offers an amazing crypto trading experience at low trading and withdrawal fees. Further, it supports a plethora of altcoins on its platform, which allows traders to diversify their portfolios.

For resolving all trade-related concerns or queries of its customers, KuCoin is having excellent 24/7 customer support for its users. Unlike many other crypto brokers, KuCoin is not having the requirement of a mandatory KYC (know-your-customer) process.

Further, in case you are looking to make generate some passive income, then this platform gives you an opportunity to do so with the feature of crypto staking. To ensure the complete safety of your crypto assets, KuCoin has deployed advanced security measures in its system, like dynamic multifactor authentication, multi-level encryption, etc.

KuCoin offers a high level of liquidity, a large number of users, a diverse range of supported assets and services, and minimal trading costs. As a result it comes highly recommended by other traders.

- Less trading and withdrawal fees

- User-friendly platform

- No mandatory KYC (know-your-customer) checks

- Allows crypto staking

- Limited payment options

- Limited collection of educational resources

Your capital is at risk. Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

How do we rank the best UK crypto brokers?

Knowing which platform to start with can be difficult with so many crypto brokers now active in this space. Since no two brokers are the same, it is important to consider your priorities while making your choice.

Given below we have listed out some qualities which we consider while making our recommendations for the best crypto brokers in the UK:

Supported Cryptocurrencies

Nowadays, many investors are looking forward to diversifying their investment portfolios, which is why they seek to divide their money into different cryptocurrencies. If you are also planning to go for this option in the future, then it would make more sense to choose those crypto brokers which support many cryptocurrencies on their platform.

Payment Methods

Always look for those crypto brokers that allow their users to make a crypto investment with the help of different payment options. For instance, eToro allows you to purchase any crypto with a wide variety of payment methods, including bank transfer and debit cards.

Trading Fees and Commissions

As crypto brokers are in the business of making money, you’ll have to pay a charge to buy and sell cryptocurrency on their platform. This is done usually in form of a trading commission. It is advisable to choose those crypto brokers that charge less trading fees on your transaction.

Leverage and Short-Selling

You’ll need to use a CFD broker if you want to employ leverage in your crypto trades. You’ll also be able to short-sell any cryptocurrency if you do so.

Minimum Deposit and Withdrawal Fees

Many crypto brokers are having a minimum deposit requirement. You should double-check this before signing up with a new broker to make sure this requirement fits within your budget. Further, you should also check to see if there is a fee charged for withdrawals.

Trading Volumes

One must always go for a crypto broker that offers high levels of liquidity to all its users. Trading at high levels of liquidity allows you to trade at competitive market pricing. Therefore, in case you decide to trade with a crypto broker that doesn’t have sufficient trading volumes, you might face difficulty in selling your cryptocurrencies.

Customer Support

Reputable crypto brokers have another feature in common. They provide excellent customer support services to ensure that every query of their user is resolved.

How to trade crypto in the UK?

In case you are planning to trade crypto in the UK, and unsure about the choice of your broker, then we would recommend you to buy your favorite crypto from the eToro platform because it offers robust security mechanisms, a competitive fees structure, social trading features, and a lot more.

Given below are the steps you must take before trading crypto from the eToro platform:

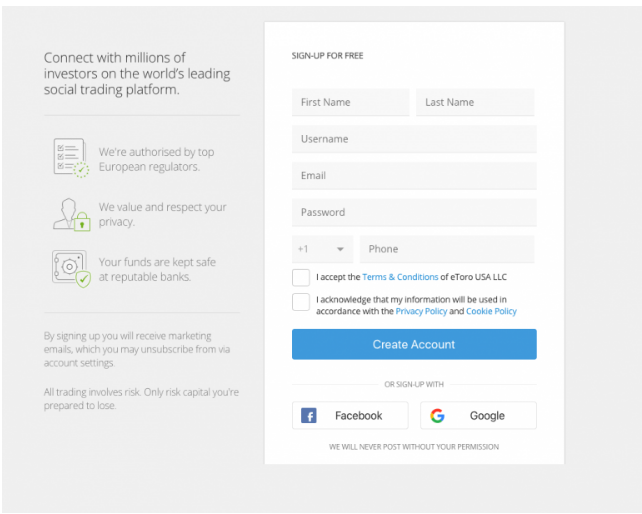

Step 1: Open a Crypto Trading Account

Go to the eToro platform’s official website and click the “Join Now” option. After that, fill in the required information, such as your name, address, user name, phone number, and email address, and generate your login credentials. Alternatively, you can register with your Google or Facebook account.

After you have created your account on the eToro platform, complete the KYC (know-your-customer) process by having your identity verified. You can share a copy of your passport or driving license for getting your identity verified. Also, as proof of address, include a utility bill or bank statement. After you’ve uploaded all of the relevant documents, your account will be validated.

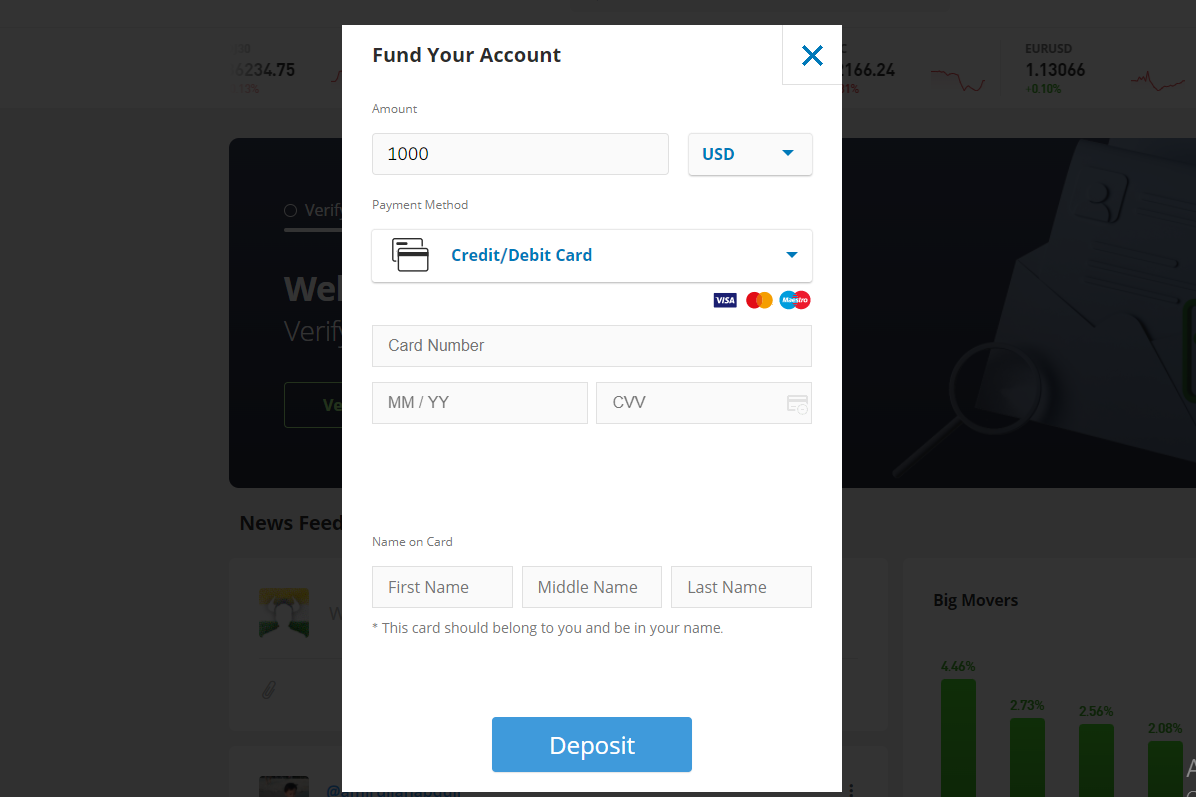

Step 2: Deposit funds in your account

Once you have created your account on the eToro platform, the next step is to deposit funds in your account. You can fund your account with eToro using a number of different methods. Debit cards, a bank account, and other means can all be used to fund your account.

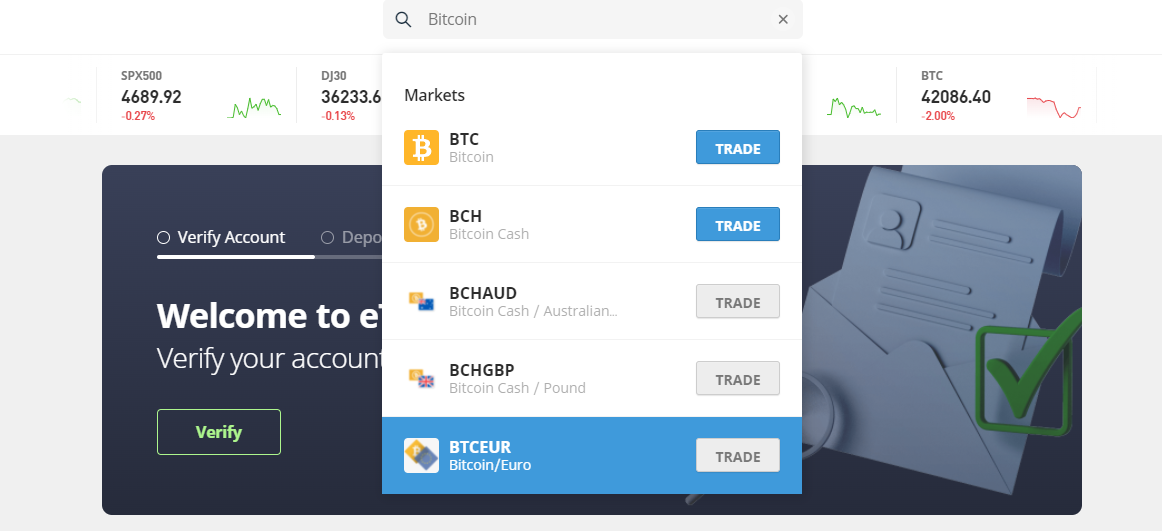

Step 3: Search for “Bitcoin” or “Ethereum” or any other cryptocurrency

After depositing funds in your account, go to the search bar, and mention the name of the cryptocurrency which you want to buy.

Step 4: Place Trades

Once you have entered the name of the crypto in which you want to invest, click on the “Trade” option. Enter the amount you want to invest in that crypto, and then click on the “Open Trade” button for completing the transaction.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest. Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

What is the difference between Crypto Brokers and Exchanges?

Some people are often confused with the terms: crypto brokers and exchanges. These terms are often used interchangeably due to this confusion. In essence, an exchange is a company that works as a trusted third party for people who want to trade their assets with others. Users who have placed orders are often listed in an order book, and the exchange protocol’s job is to match the orders and settle the deal.

Unlike crypto exchanges, a broker acts as a middleman between a trader or investor and a market (or exchange). Contrary to an exchange, users do not own the asset they are trading, and they do not exchange any digital assets they own.

Basically, a broker keeps a specified amount of money on the user’s account as collateral, grants him trading power (known as leverage or margin), and executes an order on the trader’s behalf. In other words, when someone says broker, they’re referring to the fact that you don’t own the cryptocurrency; instead, you’re trading contracts for it (CFDs), long or short, with leverage.

Since brokers perform the trade for you in form of an intermediary, they charge decent fees from you. Further, a broker in stocks/forex requires a big amount of capital to even trade, such as $25k, to make it worthwhile for them to provide you with their services.

In contrast, anyone may readily trade themselves on a crypto exchange in quantities as small as a few dollars. Considering all these differences, you have to be careful whenever you use the terms: broker or exchange as they function differently when it comes to crypto trading.

Conclusion

Finding the right crypto broker for starting your trading is a very important step towards ensuring a long run in your investment career. Since there are hundreds of brokers operating in the crypto industry, it is difficult to choose the right crypto broker for yourself.

We would suggest you to choose eToro as your crypto broker as it allows you to purchase different cryptos, with a variety of deposit options, and offers social trading features such as a news feed, copytrading, and more.

FAQs

What is a cryptocurrency broker?

A cryptocurrency broker is a company or individual that operates as a middleman between cryptocurrency markets, facilitating the purchase and sale of cryptocurrencies.

How do you validate the legitimacy of a cryptocurrency broker?

One can validate the legitimacy of a cryptocurrency broker by verifying how many regulatory authorities have approved the license of that broker.

How to choose a cryptocurrency broker?

The features of a good crypto broker include well-regulated, supported cryptocurrencies, different payment options, low trading fees, and commissions, high trading volumes, etc. You can choose a cryptocurrency broker based on the services offered by it along with your preferences.

Do popular crypto brokers offer MT4 and MT5?

With the increase in the popularity of crypto trading, many popular crypto brokers have started offering to trade on MT4 and MT5 platforms.

What is the best broker for cryptocurrency?

Though you can choose your broker depending upon your preferences, however, we recommend you to choose eToro as your broker as it allows you to purchase different cryptos with a variety of payment options.

How does a cryptocurrency broker make money?

The spreads — the difference between the buying and selling prices of cryptocurrency — are a crypto brokers primary source of income. Nonetheless, you will still find some brokers charging trading fees and commissions to make some money.