Join Our Telegram channel to stay up to date on breaking news coverage

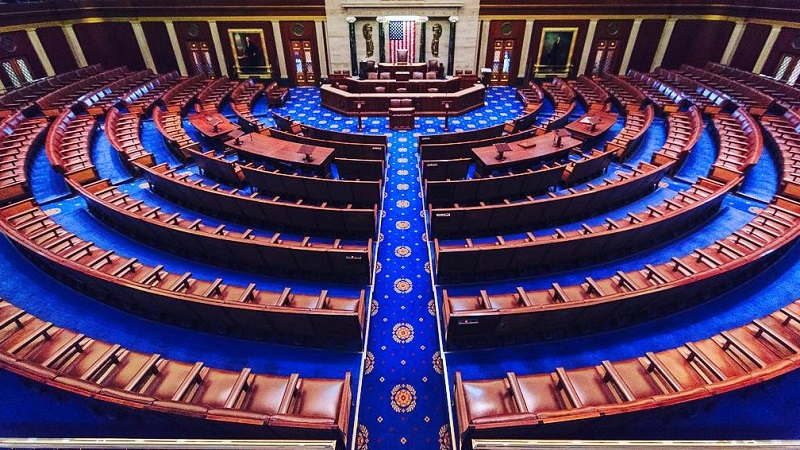

Yesterday, April 27th, The US House of Representatives saw two committees — Financial Services and Agriculture Committee — hold crypto hearings. The hearings had very similar titles and covered the same ground, coming to similar conclusions.

Do the standing securities laws apply to crypto?

The Financial Services Committee held a hearing under the title of “The Future of Digital Assets: Identifying the Regulatory Gaps in Digital Asset Market Structure.” The leading speaker was Zachary Zweihorn, the Davis Polk partner. Zweihorn argued that the standing laws for the securities markets do not align with digital asset securities. “We’ve all heard the siren’s call to ‘come in and register.’ It sounds enticingly attractive. But this is an oversimplification that conflates registration, which may theoretically be possible, with compliance, which is not,” he said.

Looking forward to testifying in the House Financial Services Committee today at 2 ET! Livestream: https://t.co/fWH7etJQH6

— Marta Belcher (@MartaBelcher) April 27, 2023

However, Hilary Allen, a law professor from the American University, disagreed. Allen has been known to be an opponent of the crypto industry, calling Zweihorn’s statement “a misdirection.” According to her, it is entirely possible to use the standing security laws to regulate blockchain-based technologies.

Ranking Member @RepMaxineWaters' opening statement at today's Subcommittee hearing on #DigitalAssets, market structure: “We do not need to create an entirely new & special framework for #crypto—we already have one.” | https://t.co/3vSmywEvPI pic.twitter.com/v7XAmfo7Oh

— U.S. House Committee on Financial Services (@FSCDems) April 27, 2023

Meanwhile, the founder and CEO of Gattaca Horizons, Daniel Gorfine, stated that some of the problems observed in the crypto industry are a result of focusing too much on novel digital assets instead of real-world applications that can yield productive gains and potentially improve lives.

The same topics were discussed in a different hearing

Meanwhile, the Agriculture Committee held its own hearing titled “The Future of Digital SAssets: Identifying the Regulatory Gaps on Spot Market Regulation.” The hearing was marked by a very similar sentiment.

Katten Muchin Rosenman partner Daniel Davis spoke on the spot market in the crypto industry, saying that it is outside the jurisdiction of both the CFTC and the SEC. According to him, digital assets are not securities but are also not leveraged retail commodities products. Cryptocurrencies are not regulated even though the CFTC has what Davis called “backward-looking authority” to prosecute those suspected of committing fraud.

Two of the top 15 digital assets traded have been named securities by the US SEC. Meanwhile, CFTC has marked seven of them as commodities. All this did was cause more confusion among market participants, even when it came to the most traded assets.

The current SEC regulatory framework has plenty of shortcomings, as several witnesses have pointed out during the hearing. Deputy general counsel at FalconX, Purvi Maniar, stated that the mandatory SEC disclosures would mean that P2P transactions are basically impossible. Regulatory gaps like that are what made the collapse of FTX and associated businesses possible, according to CFTC’s former chairman, Timothy Massad.

His idea was for the CFTC to join up with the SEC and for the two to create a new set of principles for BTC and ETH users. He also referred the audience to the op-ed he wrote with the former SEC Chair, Jay Clayton.

Related

- The US Congress is beginning to doubt the crypto sector

- Congressman Warns People That the Digital Dollar May Increase “Financial Control”

- Senator Ted Cruz Says Something Is Missing In The US Senate

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage