Join Our Telegram channel to stay up to date on breaking news coverage

For all the promise that blockchain technology has shown to improve our lives and provide better ways of conducting services, some still doubt its efficacy.

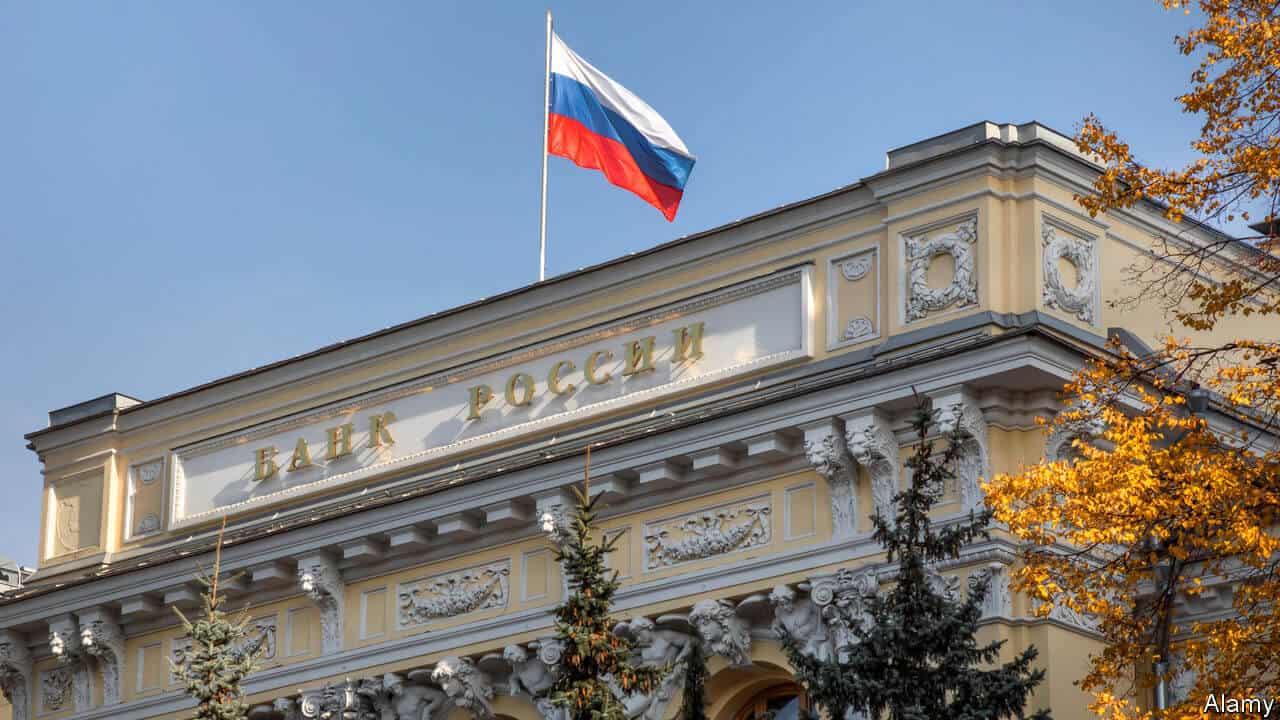

The latest in detractors is Olga Skorobogatova, the First Deputy Governor of the Russian Central Bank. In a recent interview with Euromoney, the finance chief explained that she hasn’t seen blockchain provide as much a benefit as many claimed.

Blockchain is Mostly Hype, While Crypto Can’t be Trusted

The interview was more of an exposition into some of the regulatory sandboxes and initiatives that the central banking institution was involved in.

The bank has notably been working for three years on Masterchain, a local blockchain-based platform that will help optimize the transfer of valuable financial data. However, Skorobogatova explained that while blockchain’s trust-based technology was great for things like letters of credit and guarantees, it isn’t the financial solution that it was touted to be.

“I remember being told by some tech companies back then: ‘Olga, in five years everything will be powered by blockchain, there will be no other technologies.’ I responded that this technology would work in cases when it would create additional value but not as a substitution for everything. Time has proven me right,” she said.

She also touched on cryptocurrencies and their potential for helping to improve payments, explaining that she believes the risks posed by these assets far outweigh the benefits. For instance, she pointed out that digital assets are highly volatile and lack the guarantee of savings since their prices fluctuate significantly.

These, compounded with the assets’ propensity to be used in money laundering and other illegal activities, present a major problem of trust.

As for stablecoins and central bank digital currencies, she had a few questions as well. Most especially, she questioned whether any of these assets would provide any additional benefits for the people and the Russian economy at large. While she conceded that people would like to make payments faster, she also questioned the benefits that CBDCs can bring to the table.

As far as she’s concerned, all of these benefits can be provided with a government-controlled “national fast payments platform.”

Russia Has Been Dragging Its Heels for a Long Time

Russia’s approach to cryptocurrency regulation and adoption has been pretty confusing, to say the least. While there are usually several developments that point to progress being made on the adoption front, the country has admittedly not taken any concrete steps to make this happen.

Late last month, reports surfaced that the Ministry of Economic Development of the Russian Federation had prepared a draft law that would allow it to test blockchain and crypto projects in a regulatory sandbox. The draft law was reportedly introduced into the State Duma on March 17, and the experimental law would pertain to the implementation of digital technologies in eight industries – including financial markets, healthcare, construction, and transportation.

Then, on March 31, Anatoly Aksakov, chairman of the Russian State Duma Committee on Financial Markets, said that “On Digital Financial Assets” – the country’s crypto law bill – won’t be finalized until at least spring 2020.

Aksakov explained at the time that previous delays in the bill’s adoption were caused by disagreements on crypto regulation itself. However, now that things seem to be in the clear, the bill will be pushed back as the government is now focusing its attention on the coronavirus pandemic.

Join Our Telegram channel to stay up to date on breaking news coverage