Join Our Telegram channel to stay up to date on breaking news coverage

Many have lauded PayPal’s entry into the crypto space, with most noting its implication for adoption and the price surge that followed. However, investment firm Pantera Capital is raising some alarm concerning the development and what it could be doing to the Bitcoin supply.

No Bitcoins For Anyone Else

In a report from this week, the investment firm explained that PayPal had been scooping up most of the newly-mined Bitcoin tokens, causing a supply glut that seems to be driving up the asset’s price. Citing data from iBit, Pantera explained that the payment processor has taken up almost 7- percent of the Bitcoin in circulation since its announcement last month.

“When PayPal went live, volume started exploding. The increase in itBit volume implies that within four weeks of going live, PayPal is already buying almost 70% of the new supply of bitcoins,” the report highlighted.

Additionally, the investment firm believes that PayPal and Square’s CashApp now hold all the newly-mined Bitcoin.

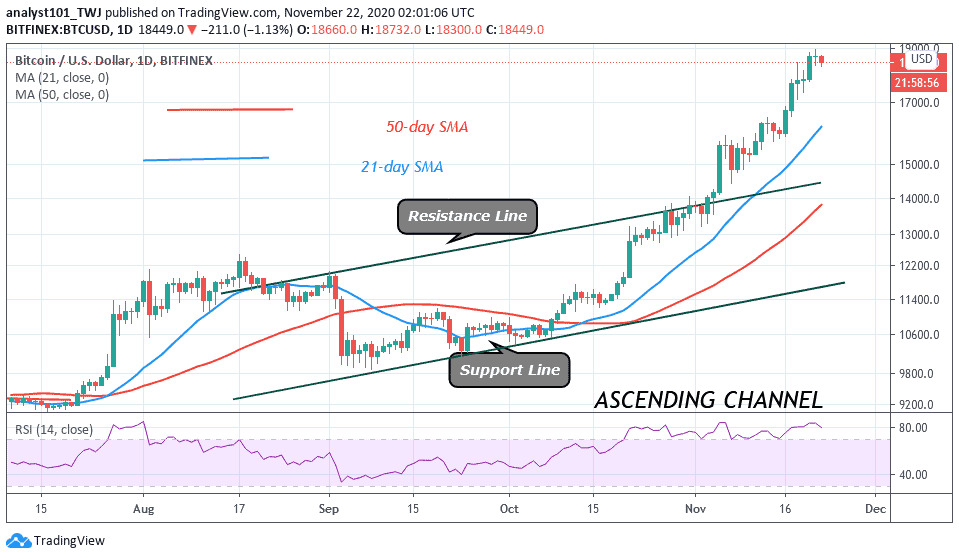

Can Bitcoin hold the Rally?

As expected, this supply glut will invariably help Bitcoin to maintain its current market rally over time. Pantera adds that this situation, along with the increased ease of spending and accessing Bitcoin, makes the current rally different from 2017.

Ever since it became apparent that we’re in a Bitcoin rally, many have sought correlations between this season and the 2017 bull run. Pantera isn’t the only entity to draw comparisons. Earlier this week, Nic Carter, the co-founder of analytics platform CoinMetrics, noted in a blog post that the current bull run already has significant differences from the last one.

Carter’s post highlighted up to nine factors. These include the number of crypto wallets with balances over $10, Bitcoin spot prices in several fiat currencies, and the number of institutional holdings. Most of the metrics showed Bitcoin performing in historic territory, suggesting that the market has matured and should be able to maintain the rally.

“In these nine charts, I covered a variety of factors where clear improvements are manifestly present when we compare today’s market environment with the bull run of yesteryear,” the post summarized.

While these are positive, it’s worth noting that some metrics also suggest a possible pullback. Yesterday, Rafael Schultz-Kraft, the Chief Technical Officer at Glassnode, noted that Bitcoin’s adjusted Spent Output Profit Ratio (SOPR) indicator had reached a one-year high suggesting a pullback.

The SOPR is a measure of asset holders’ profitability at a specific time. When it gets too high, the asset becomes vulnerable to a profit-taking pullback, since traders would most likely begin a selloff. The trend can become particularly alarming if Bitcoin’s momentum slows. If the asset gets stagnant or consolidates below $19,000, investors could get antsy and begin selling – leading to a price drop.

Join Our Telegram channel to stay up to date on breaking news coverage