Join Our Telegram channel to stay up to date on breaking news coverage

Finblox, a crypto investment platform, now allows investors to earn a yield from tokenized U.S. Treasury bills (T-bills) using their stablecoin holdings.

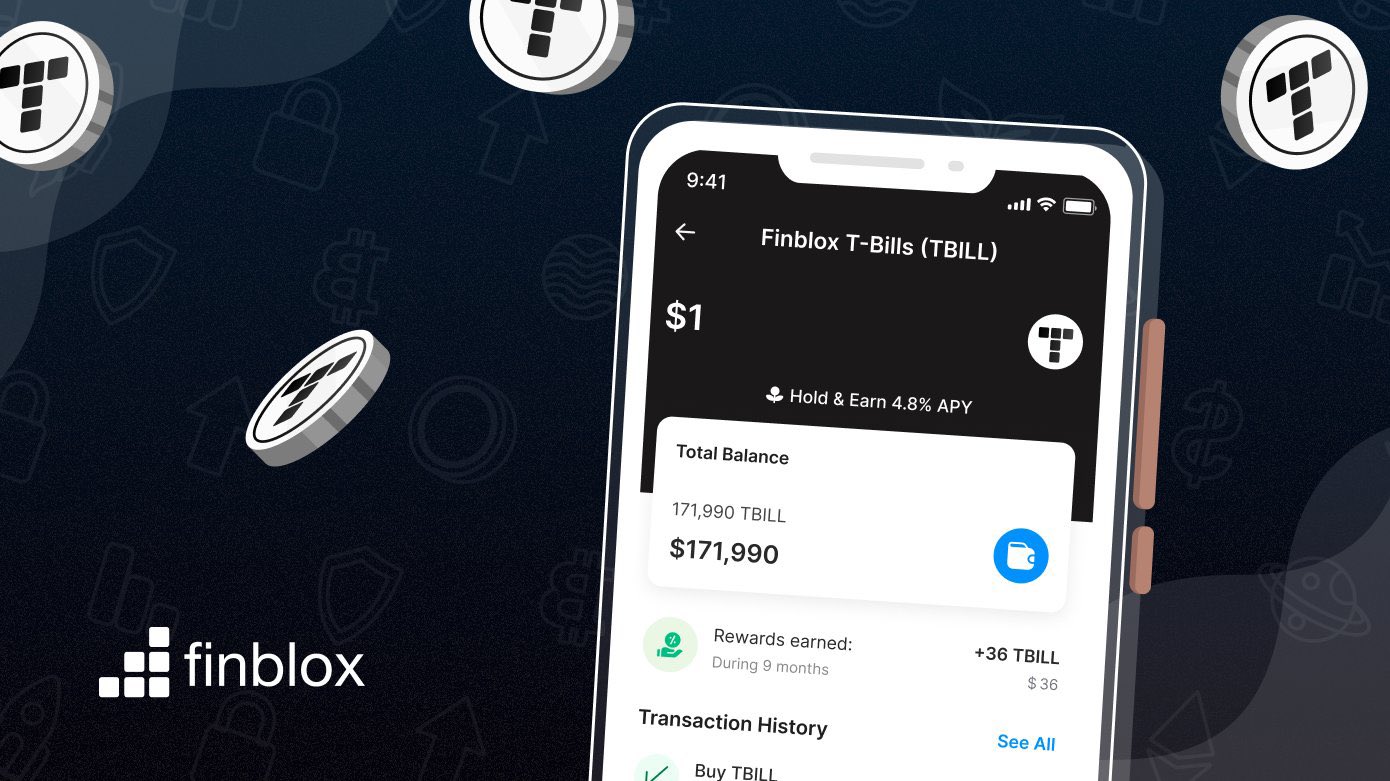

Finblox Introduces Yield Opportunities with Tokenized T-Bills

Finblox has opened up new avenues for investors by offering yield opportunities with tokenized U.S. Treasury bills (T-bills). On the platform, investors can now utilize Circle’s USDC stablecoin to invest in OpenEden’s decentralized finance (DeFi) protocol. This investment opportunity involves yield-generating TBILL token rights supported by short-term U.S. government bonds.

EXCITING NEWS (a thread) 🚀

Finblox is working on unleashing a Trillion Dollar Market with the launch of Tokenized Rights to US T-Bills in Partnership with OpenEden🧾🧵 (1/6) pic.twitter.com/WrO0X1ugjE

— Finblox (@finblox) June 13, 2023

Tokenized T-bills have emerged as a $500 million asset class, bridging the gap between digital assets and traditional financial products. These tokenized real-world assets (RWA) function similarly to a blockchain-based high-yield savings account. Investors can now securely store their surplus stablecoins in short-term U.S. government bonds, which are considered a highly secure investment. In return, they generate profit.

With lending-based yield offerings failing last year, digital investors have turned to T-bill yields, which have steadily increased over time. As a result, significant investment banking firms like Franklin Templeton and DeFi platforms such as Ondo Finance, Maple Finance, and OpenEden have responded to meet the demand.

Finblox Plans to Expand Access to Retail Investors for Tokenized Investment Opportunities

By allowing users to utilize their stablecoin holdings, Finblox is expanding its financial services to cater to cryptocurrency users looking to generate returns securely and reliably. Currently, tokenized products are predominantly accessible to professional investors, but Finblox intends to provide a way for retail users to invest as well. Acting as an intermediary, the company invests in OpenEden’s TBILL tokens, which are limited to accredited investors and institutions due to regulations.

According to Peter Hoang, CEO of OpenEden, the yield from these tokens will be passed on to users through Finblox’s own “T-Bill Toke.” Finblox will charge a fee of up to 1% of OpenEden’s estimated annual yield, which is currently around 5.2%. Initially, the platform opened access to professional investors for feedback, but it will soon expand to users who have completed know-your-customer (KYC) checks and provided proof of address for compliance purposes.

Qin En, a principal at Saison Capital, a venture capital firm that invested in Finblox and OpenEden, stated that,

“This collaboration provides access to a trillion-dollar market and ensures transparency and trust for users. It offers portfolio diversification and the potential for more reliable and safer yields.’’

Rising Demand for Tokenized U.S. Treasury Bonds Attracts Crypto Investors

The demand for tokenized U.S. Treasury bonds has continued to rise as higher yields in traditional financial markets attract new investments from cryptocurrency investors. The market capitalization of tokenized money market funds has grown significantly, reaching nearly $500 million and quadrupling in size this year alone.

Investors are turning to money market funds for their perceived safety compared to bank deposits and the 4-5% interest rates they offer. Money market funds are traditional investment products that hold short-term government securities and provide a relatively secure means of earning a yield.

Additionally, crypto asset investors, disappointed by low lending rates and previous bankruptcies, have also been attracted to the high yields of government bonds.

Consequently, several platforms have emerged to provide blockchain-based access to these bonds in tokenized form. The leading offering is Franklin Templeton’s Franklin OnChain U.S. Government Money Fund (FOBXX), which issues BENJI tokens on the Stellar blockchain to represent one share. According to blockchain data, the fund’s assets grew to $276 million by the end of April, nearly tripling the deposits the BENJI token supply represented in early January.

Tokenized Government Bonds Fueling the Crypto Industry

The tokenization of real-world assets like government bonds has become one of the most significant trends in the crypto industry this year. Central banks like JPMorgan have labeled it the killer app for blockchain, while Bank of America sees it as a crucial factor driving the adoption of digital assets.

There is an exceptionally high demand for tokenized money market funds. According to Eugene Ng, co-founder of OpenEden, this includes digital asset investment funds, crypto companies, and DAO treasuries.

Related News

- Jack Dorsey Says that He Hopes Twitter Would Adopt Bitcoin Technology

- Nassim Taleb’s Evolving Critique of Bitcoin: From Cult-like Nature to Ineffectiveness in Payments

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage