Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – February 23

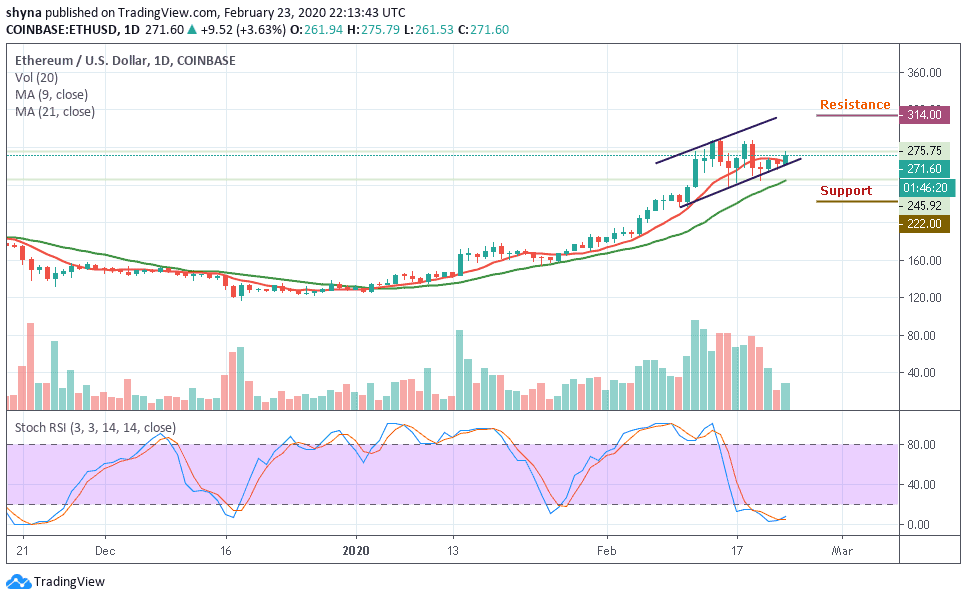

ETH/USD has been making an effort to recover by moving in sync within the channel. A sustainable move above $275 will improve the technical picture.

ETH/USD Market

Key Levels:

Resistance levels: $314, $316, $318

Support levels: $222, $220, $218

Yesterday, ETH/USD tested $258 during early Asian hours but managed to recover above $270 at the time of writing. The price of Ethereum (ETH) with the current market value of $271.60 has stayed unchanged on a day-to-day basis and gained nearly 3.63% since the beginning of today amid the recovery across the cryptocurrency markets.

However, the ETH/USD has continued to rise further higher until it finds resistance at the expected level of $280. Looking at the daily chart, we can see that ETH/USD even spiked higher into the resistance level at $275.75. Therefore, if the buyers continue to push the market higher, the immediate resistance above $300 level will be located. Above this, further resistance levels lie at $314, $316 and $318.

Alternatively, if the bears try to bring down the price below the 9-day and 21-day moving averages, also to the support level of $240, the bears can expect immediate support to be located at $230 which is below the trend line of the channel. Below $225, further support is found at $222, $220 and $218. Meanwhile, the stochastic RSI is moving within the oversold zone, which shows more bearish signals may still come to play.

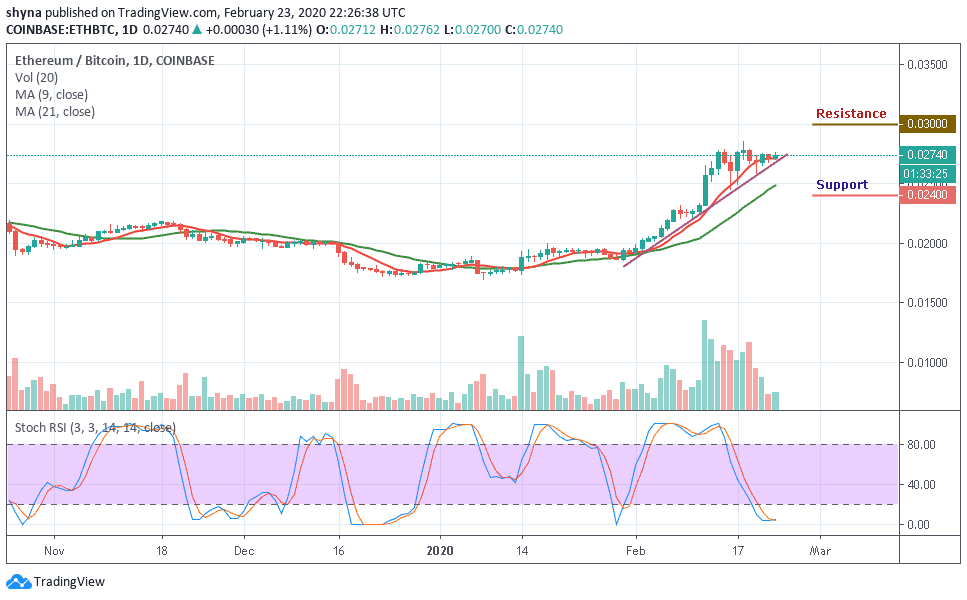

Against BTC, Ethereum is still trading above the moving averages of 9-day and 21-day and the price is now hovering at 2740 SAT as the stochastic RSI moves within the oversold zone. Although the bulls seem to be the dominant of the market, the pair is moving towards the trend line.

At the upside, the resistance levels to be reached are 3000 SAT and 3200 SAT. Conversely, a lower sustainable move may likely cancel the bullish pattern and this could attract new sellers to the market with the next focus on 2400 SAT and 2200 SAT support levels.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage