Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – March 18

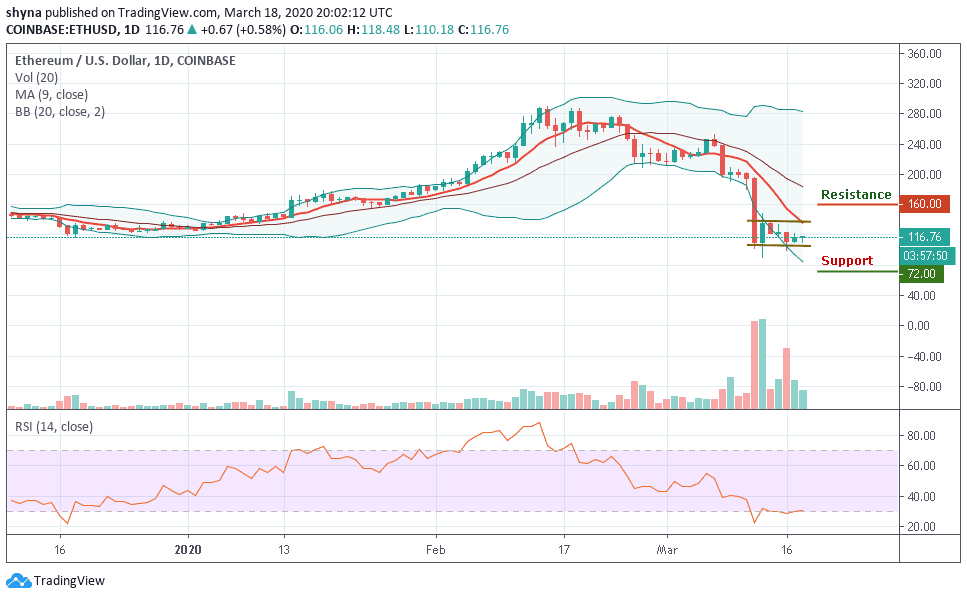

ETH/USD is expected to suffer further potential damage as the price consolidates within a narrow range.

ETH/USD Market

Key Levels:

Resistance levels: $160, $165, $170

Support levels: $72, $70, $68

The Ethereum (ETH) price is seen consolidating within the channel and has been range-bound recently. ETH/USD faced stiff resistance on approach to psychological $130 and it is trading at $116.76 at the time of writing. Since the beginning of today’s trading, ETH/USD has gained about 0.58% on a day-on-day basis after touching $110 support level.

At the moment, the price of Ethereum is likely to start following the sideways movement as the coin is experiencing a price drop in the market. Nevertheless, after touching the $110 level today, ETH/USD has been waiting for a break out of the channel to the upside, but with the appearance of the chart, it might not come into play as revealed by the technical indicator.

However, Ethereum price is moving within the channel and around the Bollinger bands lower level. More so, should in case the bulls push the price upward, it may likely reach the resistance at $160, $165 and $170 resistance levels, otherwise, there is a possibility of it getting to the support levels at $72, $70 and $68 respectively while the RSI (14) is moving in the same direction at the top of the oversold territory.

Comparing it with Bitcoin, it was discovered that the Ethereum price broke down significantly to touch the lower level of the Bollinger bands. Today, the price started falling to touch 2150 SAT and the signal line of RSI (14) is found moving around 36-level, which might be considered as a sideways movement.

Furthermore, the market may continue to decline if the sellers put more effort to bring it down to the support levels of 0.019 BTC, 0.018 BTC, and 0.017 BTC. Therefore, with the look of things, the price of Ethereum is likely to go up as high as 0.024 BTC, 0.025 BTC, and 0.026 BTC resistances as soon as the technical indicator turns upward to introduce new trend for the coin.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage