Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – February 6

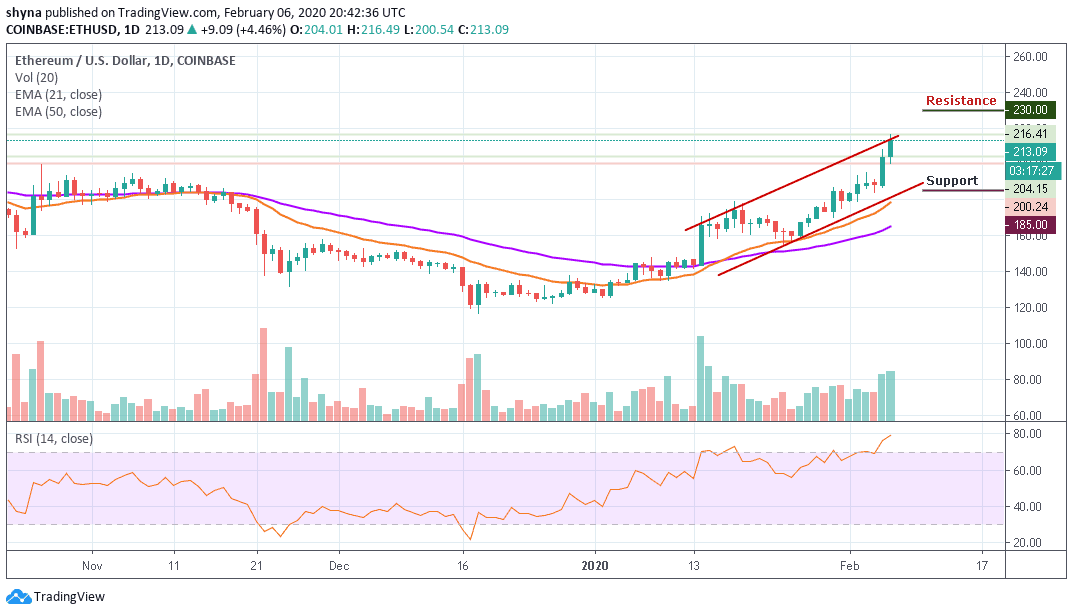

Ethereum (ETH) climbed higher and settled above the main $210 barrier against the US Dollar.

ETH/USD Market

Key Levels:

Resistance levels: $230, $240, $250

Support levels: $185, $175, $165

Yesterday, the ETH/USD had a significant boost that allowed the coin to exceed the $200 level, this momentum extending considerably as crypto continues to climb higher today. The current performance of the coin indicates the addition of an upward movement since some weeks ago. It’s just a matter of time for this coin to reach $250 level in the nearest term.

In the last two days, Ethereum has moved from $187 to $213 and at the same time moving towards the upper boundary of the channel at the time of writing. The on-going trend may move a little bit higher before the week runs out, and the coin may likely reach the nearest resistance at $230, but if the bulls put more effort, it could hit additional resistance levels at $240 and $250 respectively.

However, a bearish drop may roll the market back to the initial support level of $188. Meanwhile, the support levels to watch for are $185, $175 and $165. As the trading volume increases, the RSI (14) is extremely at the overbought zone and this could supply more bullish signals into the market.

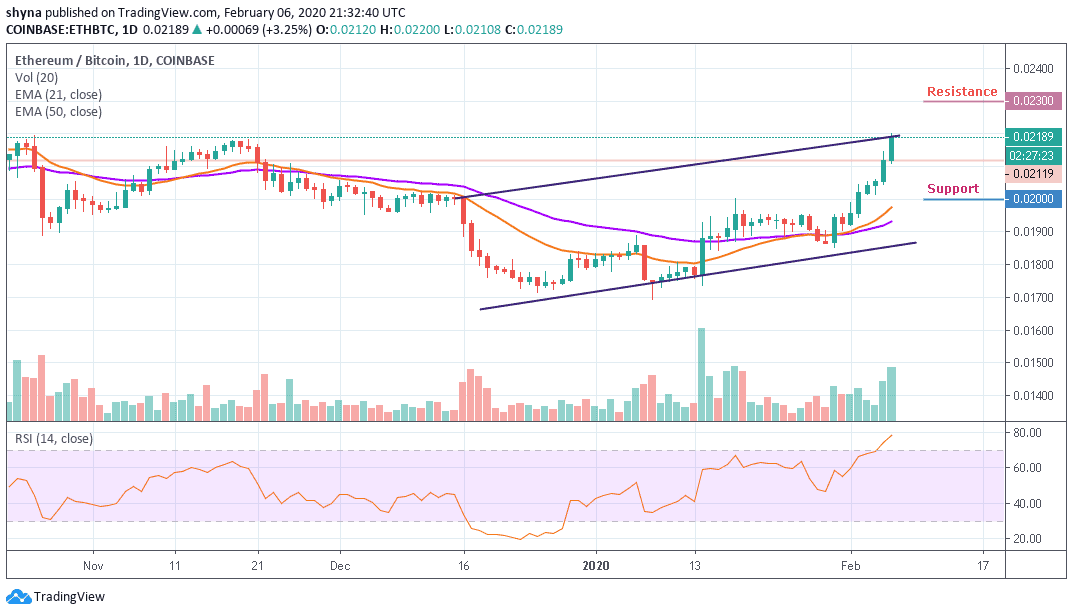

When compared with Bitcoin, Ethereum is still trading above the 21 periods and 50 periods EMA within the ascending channel and the price is changing hands at 2189 SAT as the RSI (14) stays within the overbought zone. However, the daily chart reveals that the buyers continue to dominate the market as the pair seems to break above the channel.

Positively, the resistance levels to be reached are 2300 SAT and 2350 SAT. Conversely, a lower sustainable move may likely cancel the bullish pattern and it could attract new sellers to the market with the next focus on 2000 SAT and 1950 SAT support levels.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage