Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum (ETH) Price Prediction – August 31

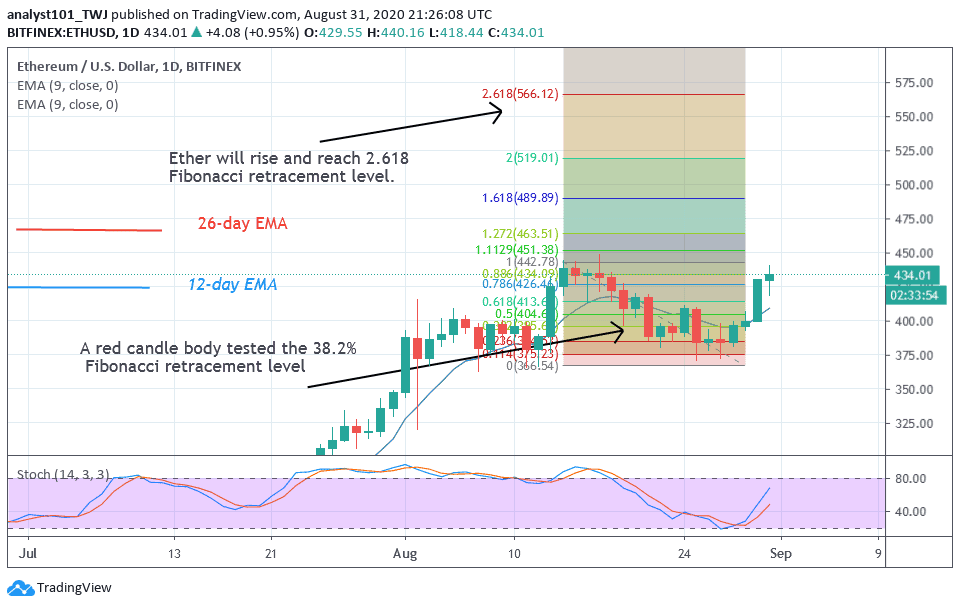

Ethereum bulls are battling to break the $440 overhead resistance. Yesterday, buyers made the first move but were resisted at the $430 price level. Today, the price pulled back to $420 low and resumed a fresh uptrend. The reason for the current upward move is that the bulls are attempting to break $440 overhead resistance.

ETH/USD Market

Key Levels:

Resistance Levels: $200, $220, $240

Support Levels: $160, $140, $120

The bulls are nearing the breaking of $440 overhead resistance. ETH/USD has traded up to $436 high. The current upward move will persist as long as price is sustained above $410 and $420 price levels. Once the overhead resistance is breached, price will rally above $500 . On August 14 uptrend; Ether was resisted at $440. The retraced candle body tested the 38.2% Fibonacci retracement level. This suggests that Ethereum will rise and reach the 2.618 Fibonacci extension level. In other words, Ether will reach a high of $566. This bullish view depends upon the breaking of the $440 overhead resistance.

Ethereum at Risk to Frontrunners: Researcher

Dan Robinson is a research partner with the crypto-asset investment firm Paradigm. He indicated that Ethereum is at risk to frontrunners. He added that Ethereum’s set of unconfirmed transactions is where the vulnerability lies. He noted that arbitrage bots examine pending transactions in the Ethereum and attempts are made to exploit the profitable opportunity created by them.

The arbitrage bots specifically look for certain transactions for the frontrunners. Frontrunners copy such transactions and replace such addresses with their own. Dan Robinson explained that he has devised a plan to extract the money in cooperation with a team of Ethereum engineers. The plan is to confuse the transaction so that the bots can not detect the connection to the Uniswap spouse. However, despite the efforts made the rescue plan failed.

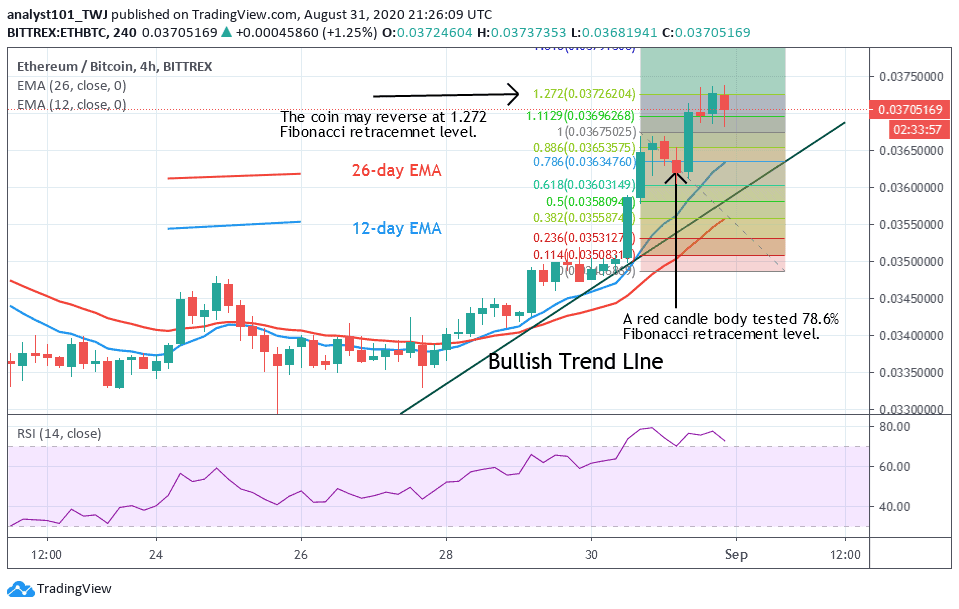

Nonetheless, in the ETH/BTC, the price is making a series of higher highs and higher lows. On the August 30 uptrend, the coin was resisted at Ƀ0.0365000. The retraced candle body tested the 78.6% Fibonacci retracement level. The implication is that the coin will reach 1.272 Fibonacci extension level and reverse. It will reverse to 78.6% extension where it originated. Meanwhile, the crypto is at level 77 of the Relative Strength Index period 14. The coin has reached the overbought region of the market. Sellers may emerge to push prices down.

Join Our Telegram channel to stay up to date on breaking news coverage