Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin Price Prediction – November 19

A notable change has been in the BTC/USD trade as the crypto market prices lower pace between the $18,000 and $16,000 lines. Price is trading around $16,623.48 at a minute negative percentage rate of 0.39 as of the time of writing.

BTC/USD Market

Key Levels:

Resistance levels: $18,000, $19,000, $20,000

Support levels: $16,000, $15,000, $14,000

BTC/USD – Daily Chart

The BTC/USD daily chart showcases the crypto-economic prices lower in the points of $18,000 and $16,000 levels. Three horizontal lines drew to mark the points the market movers may tend to push in terms of an upward direction from those value lines to the most-ever psychological zone at the $20,000 resistance level. The 14-day SMA indicator is at $18,224.11, underneath the $20,177.56 value line of the 50-day SMA indicator. The Stochastic Oscillators have conjoined their lines in a consolidating manner at 28.87 and 29.67 levels.

Can there be additional downs in the BTC/USD market as the price consolidates at low points?

There can be reductions in the BTC/USD trade as the prices lower in a consolidation-moving mode at low points. In the event of that playing out, long-position placers would have to exercise a great deal of cautiousness to look out for testing and retesting of a particular lower-trading spot that can eventually spring up with active moves to the upside before launching a buying order afterward. Investors may now key in or add to the existing size of their portfolios and leave it to run for a long-term basis.

On the downside of the technical analysis, the current lower-trading pace may prolong for some purposely suit the presence of the BTC/USD market bears around the $16,000 support level. A sudden emergence of a bullish candlestick against the 14-day SMA indicator around the $18,000 resistance level will signify an invalidation of getting to see the price continuing to surrender to a falling force.

BTC/USD 4-hour Chart1

The BTC/USD medium-term chart reveals the crypto market prices lower between $18,000 and $16,000. More variant lower lows than lower highs have occurred below and closely around the sell signal side of the 14-day SMA indicator at $16.717.17, underneath the $17,777.83 value line of the 50-day SMA indicator. The Stochastic Oscillators have slantingly swerved southbound from around the 80 range to 35.99 and 26.72 levels. At this time, the trading situation tends to run in an indecisive mode. However, a rebound is likely from around the first recently mentioned mark.

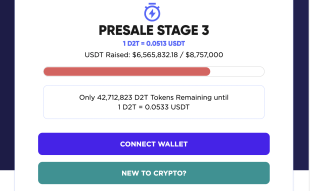

In the meantime, the collapse of FTX brings about a need for a cutting-edge trading intelligence platform, and that exactly is what Dash 2 Trade offers. It is a platform that can adequately detect impending adverse issues similar to what happened to FTX, and thus enabling investors and traders to pinpoint safe opportunities for good profits. The D2T token presale is ongoing and it has raised $6.5 million so far.

Related

Join Our Telegram channel to stay up to date on breaking news coverage