Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – March 29

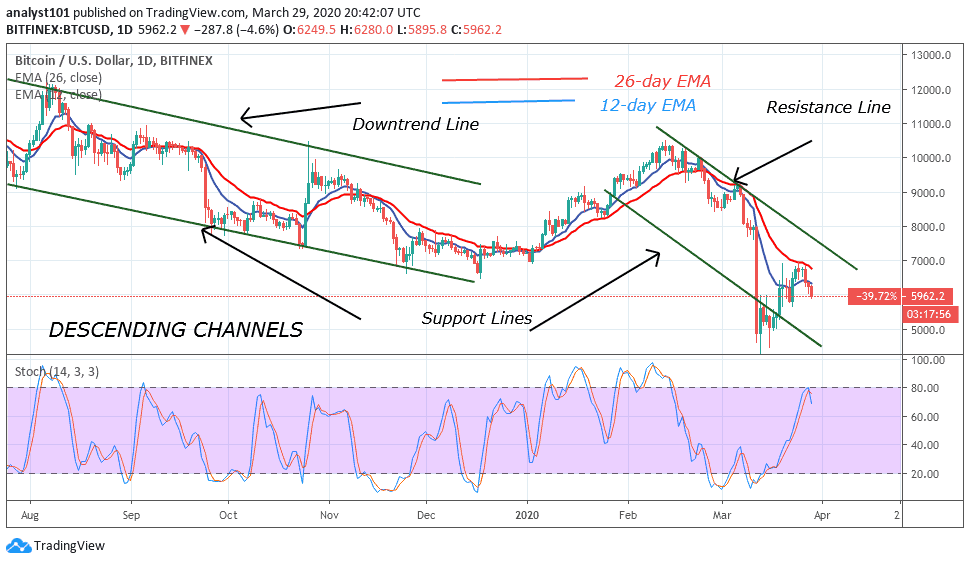

After BTC/USD pair slumps to $6,200, the market went into a period of consolidation above $6,200. At the end of a sideways move, the downtrend resumed. Bitcoin now trades below $6,000.

Key Levels:

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

It has already been established that if the bulls fail to regain their $6,800 level, there is a likelihood of Bitcoin retesting the previous low of $5,500 and $5,300. Today, Bitcoin has dropped to a low of $5,960; a further downward movement is expected. Undoubtedly, the predicted lows are likely to be achieved. On the downside, if the downward moves continues and the bears break below $5,500, the momentum will extend to the low of $4,400. Incidentally, it was at a low of $4,400, Bitcoin rebounded to reach a high of $7,000. Nonetheless, a repeat of March 16 rebound cannot be ruled out. Meanwhile, Bitcoin is below 80% range of the daily stochastic. This indicates that Bitcoin is in a bearish momentum. The market is likely to undergo a downward movement.

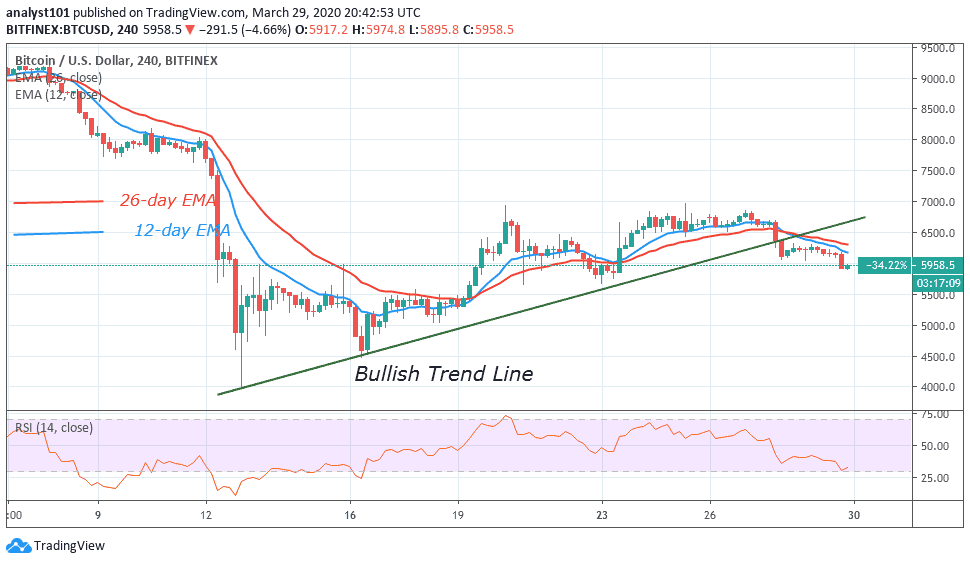

BTC/USD Medium-term Trend: Ranging (4-Hour Chart)

On the 4-hour chart, the uptrend has been terminated as the bears broke and closed below the bullish trend line. The bears are likely to sink Bitcoin to the low of $5,500. The downward movement is expected to reach a low of $4,500. BTC is presently at level 31 of the Relative Strength Index. The coin is approaching the oversold region of the market. Nevertheless, if BTC falls to a low of $4,500, the market is likely to reach the oversold region. Consequently, buyers are likely to emerge.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage