Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – February 27

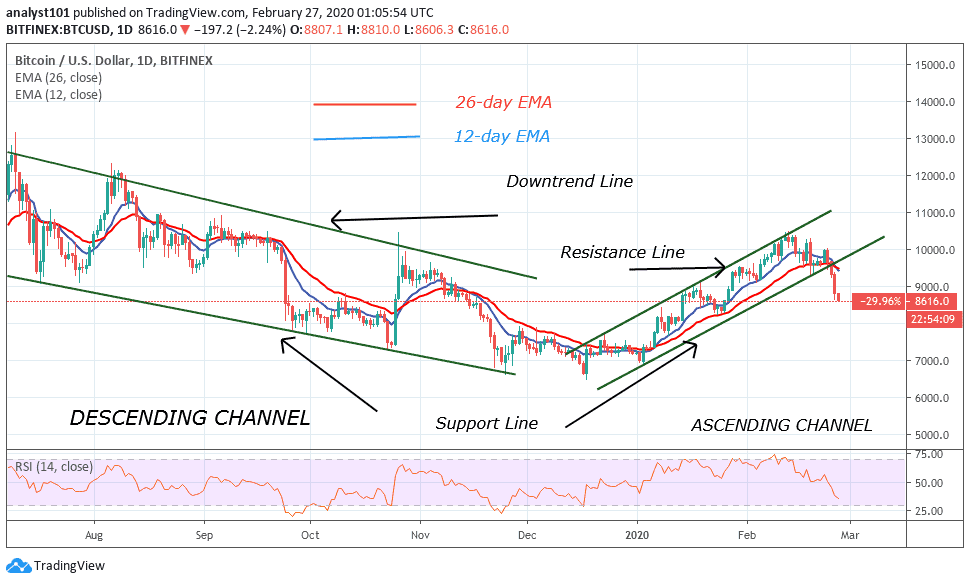

On February 23, the bulls made a final push at the resistance of $10,000 but were resisted. After a retest at $9,800, the bulls were sent packing. The bear’s successful resistances at $10,000 and $9,800 have made them take control of price.

BTC/USD Long-term Trend: Bearish (Daily Chart)

Key Levels:

Resistance Levels: $10,000, $11,000, $12000

Support Levels: $7000, $6000, $5000

On February 24, the bulls made their final upward move to retest the $9,800 resistance but were repelled. The resistance caused BTC/USD to fall to $9,400 low but pulled back to $9,600 and resumed a sideways move. Buyers finally lost control when a large bearish candlestick broke the supports of $9,600 and $9,400. Sellers have continued their downward move as the critical support of $9000 was broken and the price dropped again to the low of $8834.

The bears have more supports to breach as the next support is either $8,200 or $8,400. Meanwhile, as BTC drops to the low of $8,800, the Relative Strength index period 14 also falls to level 38. This implies that BTC is in the downtrend zone and it is below the centerline 50. BTC is likely to continue its fall.

BTC/USD Medium-term Trend: Ranging (4-Hour Chart)

On the 4-hour chart, BTC is in a descending channel showing the resistance levels where the bulls’ upward moves were repelled. In the last resistance at $10,000, BTC has a price breakdown where the support line of the descending channel was broken.

With this breakdown at the support line, it indicates that further selling pressure will follow soon. Nonetheless, Bitcoin has fallen into the overbought region of the market below 20% range. This means that the coin is in a strong bearish momentum. The coin will remain in the oversold condition until buyers emerge to push it upward.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage