Join Our Telegram channel to stay up to date on breaking news coverage

The cryptocurrency market rebounded overnight following a sharp decline over the weekend, with a $220 million inflow revitalizing the ecosystem. Bitcoin, the leading digital asset, spearheaded the recovery by surpassing the $100,000 mark, restoring optimism among investors anticipating further price increases.

The weekend downturn was linked to policy announcements made by President Donald Trump last week, which contributed to Bitcoin’s drop to $91,530 by early Monday. However, the market quickly regained momentum, pushing Bitcoin past $100,000. The cryptocurrency reached a daily peak of $102,569 before settling at $101,457. This rebound signals renewed investor confidence in the market. This positive outlook prompts investors to search for affordable tokens, particularly the best cheap crypto to buy now under 1 dollar.

6 Best Cheap Cryptos to Buy Now Under 1 Dollar

RequestFinance has integrated with the Tezos ecosystem to enhance crypto accounting for Web3 companies. TRON has introduced USDD 2.0, bringing key improvements to its decentralized finance platform. Over the past year, Amp (AMP) has seen an 82% price increase.

GMT token powers a move-to-earn platform operating on the Solana blockchain. Solaxy ($SOLX) has surpassed $18 million in its presale. Orderly Network has seen significant adoption, with more than 500,000 unique users and wallets interacting with decentralized exchanges (DEXs). Meanwhile, U.S. Crypto Czar David Sacks has described Bitcoin as a strong store of value.

1. Tezos (XTZ)

RequestFinance has recently integrated with the Tezos ecosystem to streamline crypto accounting for Web3 businesses. This integration allows for transaction management, financial report generation, and compliance assurance through automated processes, simplifying the financial operations of entities operating within this blockchain environment.

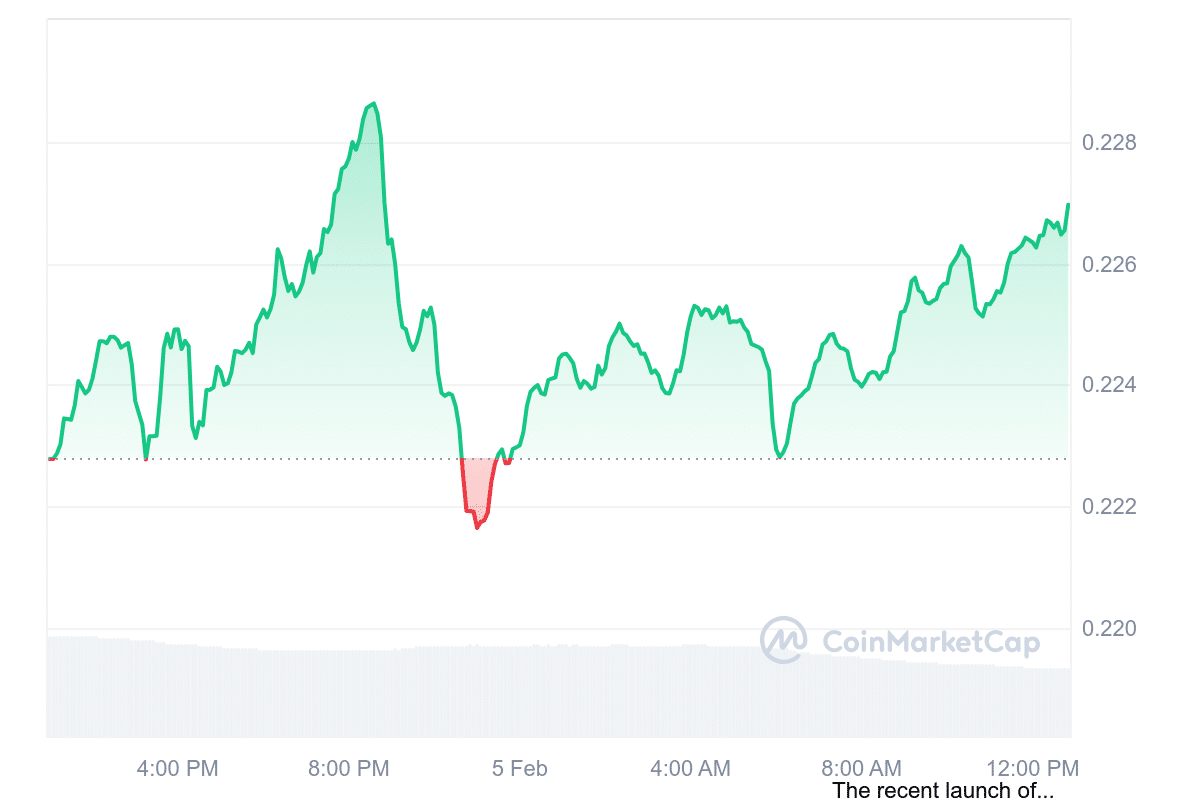

Tezos (XTZ) is trading at $0.9044, a 3.79% increase over the last 24 hours. It boasts a market capitalization of $933.13 million and a trading volume of $52.59 million in the same period. Despite this recent uptick, the sentiment around Tezos’s price prediction is currently bearish, with the Fear & Greed Index at 54, suggesting a neutral market mood. However, Tezos demonstrates high liquidity, as evidenced by its 24-hour volume-to-market cap ratio of 0.1041.

Market forecasts for February 2025 suggest that Tezos may experience up to 11.82% growth. Analysts predict an average price of $1.019675, with price fluctuations expected between $0.905689 and $1.167046. This trend could yield a return of 27.98% compared to its current value, presenting an optimistic outlook for investors despite the bearish sentiment.

2. TRON (TRX)

TRON’s recent launch of USDD 2.0 introduces key enhancements to its decentralized finance ecosystem. This update focuses on sustainability and offers an annual percentage yield (APY) of 20%, making it an appealing option for users. The upgrade also strengthens stability through governance under TRON DAO.

Additionally, TRON has integrated with Bubblemaps, a platform that provides insights into token distribution. With tools like SunPump, the network is seeing increased activity, particularly in the memecoin sector.

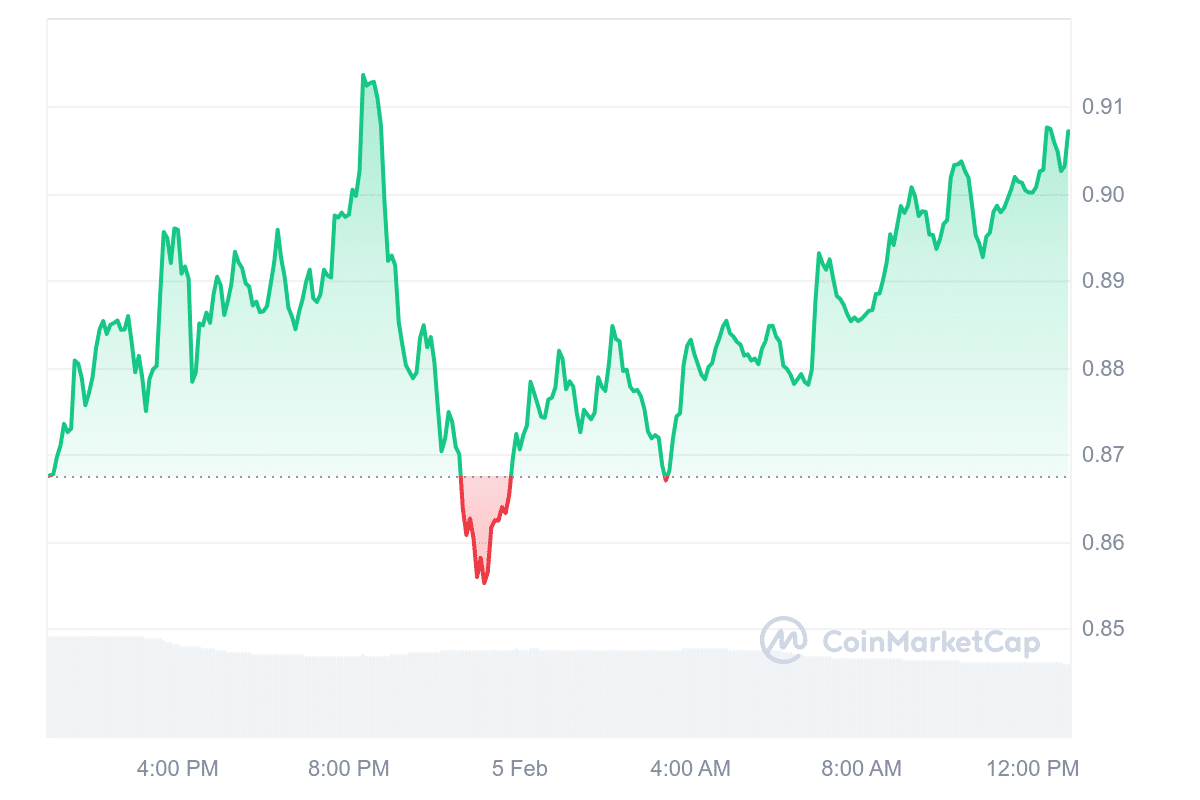

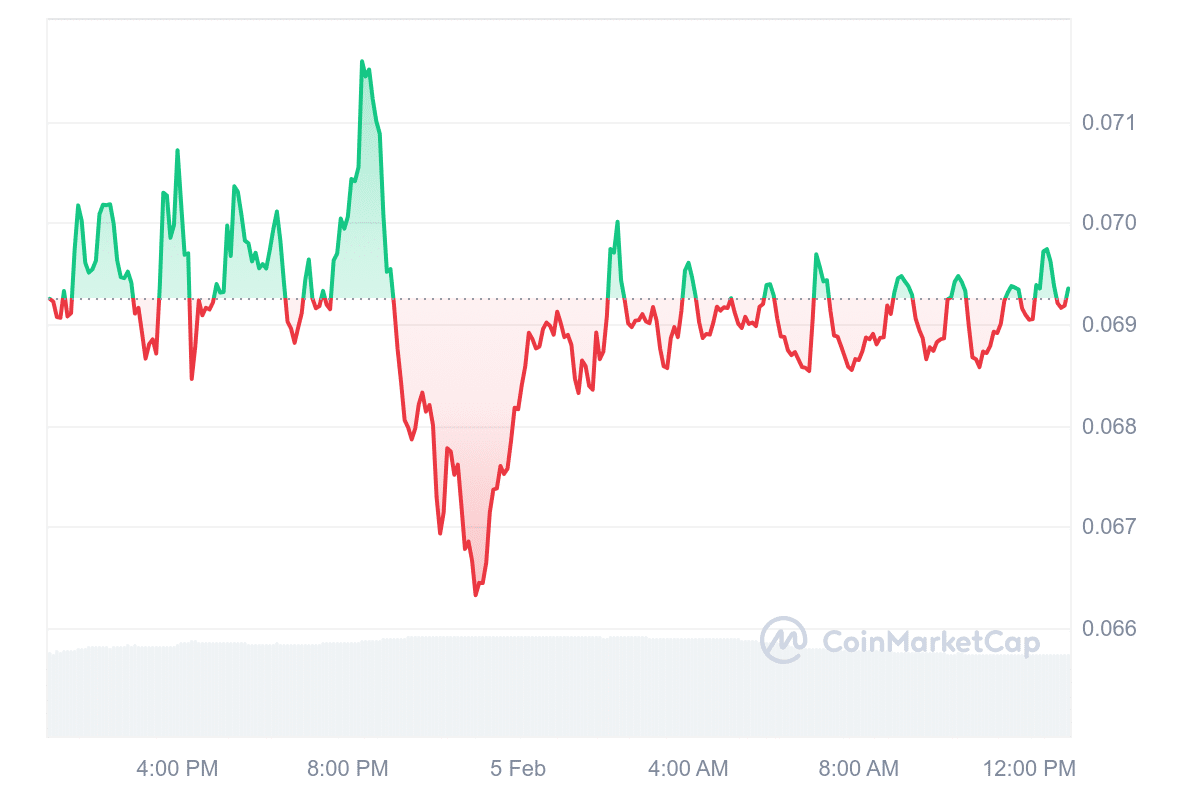

In terms of market performance, TRON (TRX) has seen a 4.12% price increase in the last 24 hours, reaching $0.22, while trading volume has declined by 25.21% to $1.03 billion. Over the past year, the token has surged by 86%, outperforming a significant portion of the top 100 cryptocurrencies. Currently, it is trading 12.5% above its 200-day simple moving average (SMA) of $0.2018, signaling positive momentum.

#TRON is ready to support the expansion of crypto adoption in the U.S. as @POTUS's administration provides clearer guidance.With a strong global foundation, we remain committed to making blockchain accessible to all. #MakeCryptoGreatAgain 🇺🇸 https://t.co/dwQ73EEiIi

— TRON DAO (@trondao) February 4, 2025

TRON’s recent developments highlight its commitment to growth and stability within the DeFi space. At the same time, its market trend suggests continued investor interest. However, potential investors should consider market fluctuations and long-term sustainability before making decisions.

3. Amp (AMP)

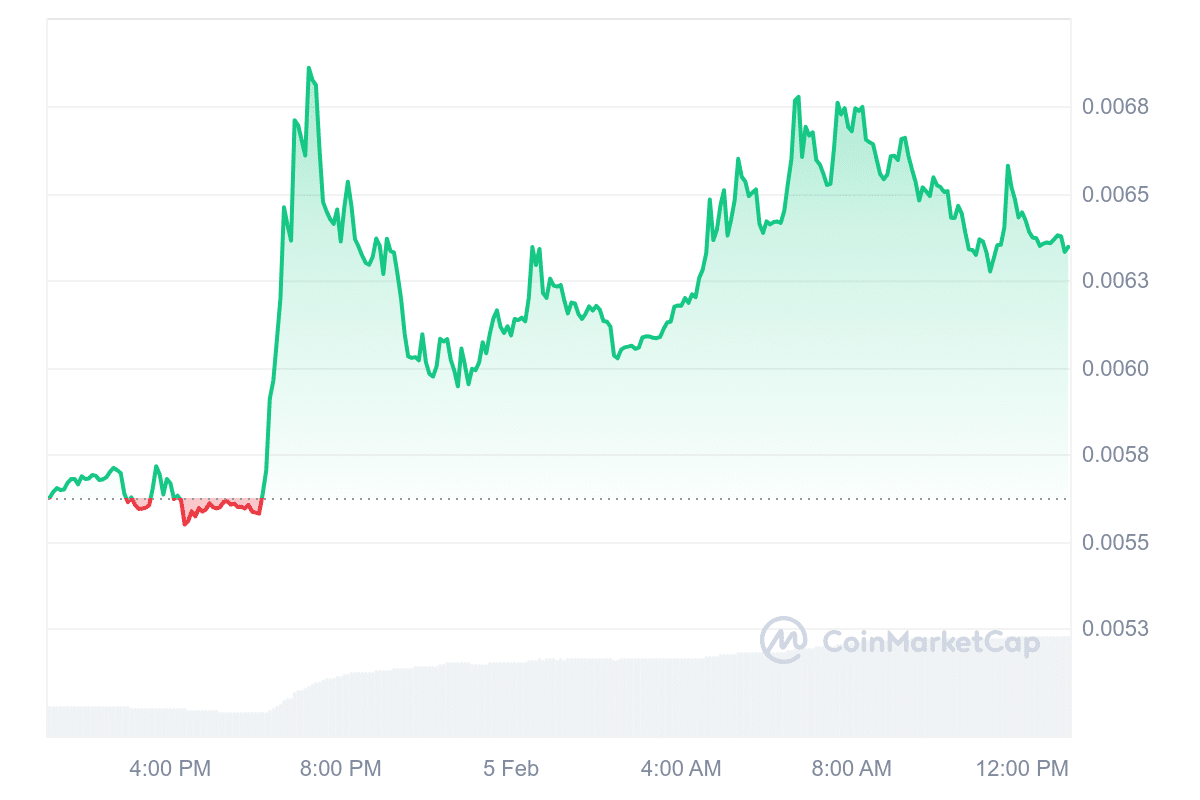

Amp (AMP) has performed well in the past year, with its price increasing by 82%. It trades at $0.006312, reflecting a 10.98% increase in the last 24 hours. The asset’s market capitalization is $531.65 million, while its 24-hour trading volume has surged 232.51%, reaching $124.74 million.

From a technical perspective, AMP is trading 3.68% above its 200-day simple moving average (SMA) of $0.00612. This suggests the asset is maintaining some stability above a key technical level. Additionally, it has outperformed 65% of the top 100 cryptocurrencies over the past year.

.@FlexaHQ is coming to @NighthawkWallet!

Seamless digital payments meet privacy, all #PoweredByAMP. 🔥 https://t.co/ZsvMyQVIxy

— Ampera (@ampera_xyz) December 18, 2024

Liquidity remains strong given its market capitalization, making it easier for traders to enter or exit positions. However, the current sentiment appears bearish, while the Fear & Greed Index is 54, indicating a neutral market outlook.

4. GMT (GMT)

GMT token is a digital asset designed for the move-to-earn platform built on the Solana blockchain. It facilitates various functions within the ecosystem, mainly encouraging physical activity through financial incentives.

One of its primary roles is governance, allowing token holders to participate in platform-related decisions. Additionally, it is used to upgrade NFT sneakers, which are essential for earning rewards in the app. Users can also unlock premium features and exclusive activities using GMT. Moreover, the token serves as a reward mechanism for achieving specific milestones. It is also tradable, making it accessible for exchange with other digital or fiat currencies.

.@FlexaHQ is coming to @NighthawkWallet!

Seamless digital payments meet privacy, all #PoweredByAMP. 🔥 https://t.co/ZsvMyQVIxy

— Ampera (@ampera_xyz) December 18, 2024

The total supply of GMT is capped at 6 billion, with a halving event every three years to maintain scarcity. This structure aims to create long-term value while ensuring a controlled supply.

5. Solaxy ($SOLX)

Solaxy ($SOLX) has raised over $18 million in its presale. This strong investor interest suggests confidence in its ability to improve Solana’s performance. Solana faces increasing congestion as trading activity grows, causing delays and transaction failures. These issues highlight the need for better scalability.

Solana attracts traders with its low fees and fast transactions. However, the rise of meme coin trading and high on-chain activity have pushed the network to its limits. As a result, users experience slower transactions and occasional failures. Even centralized platforms like Coinbase have struggled to process Solana transfers on time.

Solaxy offers a potential solution. It processes transactions off-chain while securing final settlements on Solana’s Layer-1. This approach reduces congestion and allows users to trade without interruptions, even during peak demand. As Solana’s ecosystem expands, the need for such scalability solutions will likely increase.

Unlike short-term fixes, Solaxy aims to enhance long-term network efficiency. It processes transactions separately before finalizing them on Solana’s main chain. This method preserves speed and security while increasing transaction capacity. Traders, NFT marketplaces, and DeFi platforms benefit from smoother operations.

Developers also find value in Solaxy. It provides tools that simplify application development while preventing network slowdowns. Reducing technical barriers encourages more innovation in Solana.

Investor interest in Solaxy extends beyond speculation. The $SOLX token has multiple functions, including lowering transaction fees, enabling governance participation, and securing the network. These features support long-term demand.

Staking rewards add another layer of appeal. Solaxy offers up to 228% APY, attracting early participants with higher returns. Their involvement helps maintain network liquidity. Demand could grow further as $SOLX moves toward exchange listings, especially as Layer-2 adoption gains momentum.

6. Orderly Network (ORDER)

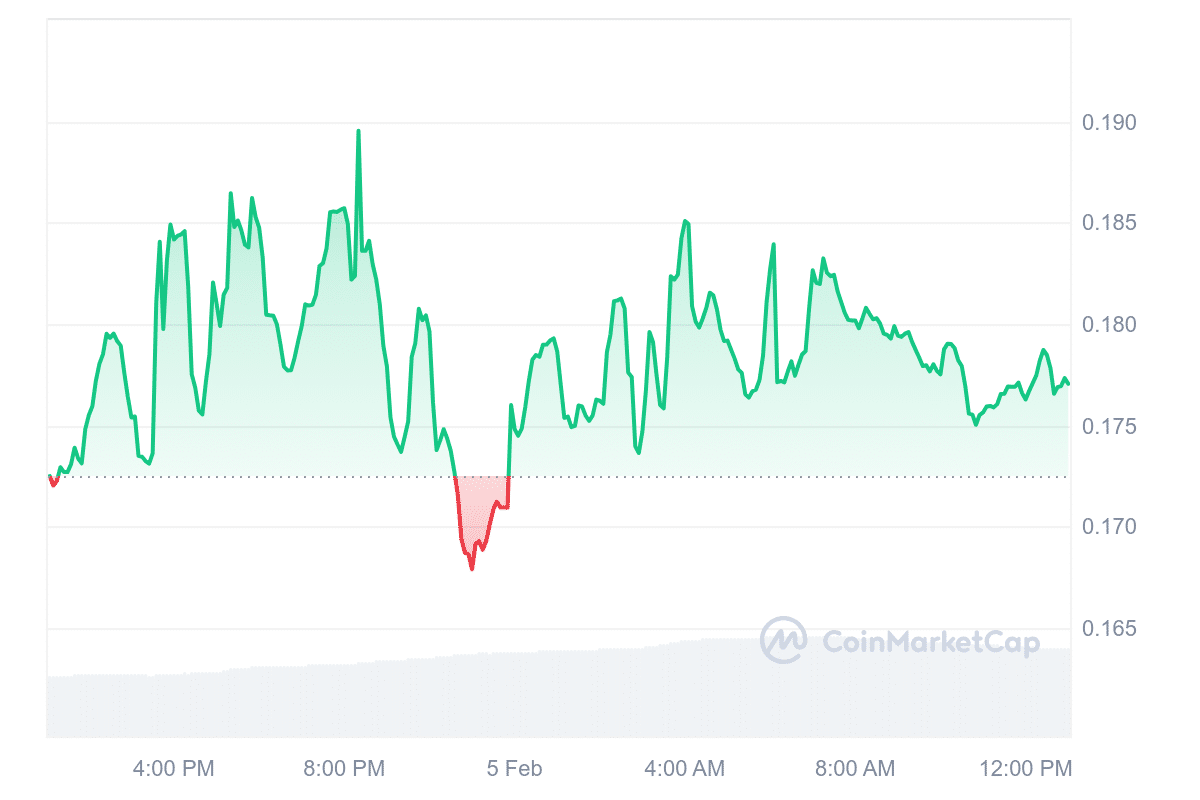

Orderly Network has gained traction, with over 500,000 unique users and wallets engaging with its decentralized exchanges (DEXs). Despite this growth, the current market sentiment for ORDER remains bearish, while the Fear & Greed Index indicates a neutral position at 54. The asset demonstrates strong liquidity, reflected in its 24-hour volume-to-market cap ratio of 1.4853.

Market forecasts for February 2025 suggest a notable increase in ORDER’s value, with an expected growth of 92.04%. The average price projection is $0.337621, fluctuating between $0.179321 and $0.608686. If these predictions hold, investors could see a return of approximately 246.23%.

New Futures Listing Incoming 💜

📈 $OM | @MANTRA_Chain

📈 $PLUME | @plumenetworkTrade long or short with up to 10x leverage 🤯

Trading Opens: February 5, 2025 10:00 UTC pic.twitter.com/D83EDgkPWf

— Orderly (@OrderlyNetwork) February 4, 2025

Looking ahead to March 2025, analysts anticipate continued upward momentum, with a projected increase of 301.39% from current levels. The expected price range extends from $0.55403 to a peak of $0.84643, averaging around $0.705664. This projection suggests a potential return on investment (ROI) of 381.46%, which may appeal to long-term traders.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage