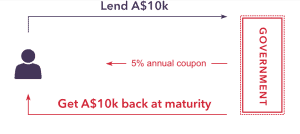

Bonds have, since the early days and inception of the financial markets we know today, been deemed one of the safest and standard investments to preserve and keep capital on standby for long-term growth. Now, mix in the concept of Bitcoin and cryptocurrency, which are digital storages of value, and you have an interesting topic that many are unfamiliar with, yet are *trying* to understand; what is a Bitcoin bond? And how do you get a Bitcoin bond?

[no_toc]We’ve created this guide to help new users get accustomed to the new world of cryptocurrency as it moves towards a more regulated and overseen compliant financial environment. Bitcoin bonds are complex topics: They combine the old, traditional world of finance with the new, digital methods of cryptocurrency and digitized markets. In this guide, we’ll overview what Bitcoin bonds are, their closest alternative, how close financial institutions are to issuing them, and how to go about the current industry.

How to Buy Bitcoin Bonds in Your Country

At the moment there seem to be relatively limited amounts of information about pending Bitcoin or cryptocurrency bonds in the United Kingdom. As bonds are in general one of the staple forms of investment vehicles in financial markets within the U.K. markets, we wouldn’t be surprised if they began developments with crypto/Bitcoin bonds fairly soon.

Those looking to buy Bitcoin bonds in Canada and the U.S. will, unfortunately, be stopped immediately in their tracks, as neither residence offers cryptocurrency/Bitcoin bonds. Both jurisdictions have stated they are looking into the developments and technicalities surrounding this possibility, and the United States houses the IMF, where multiple jurisdictions from around the world stated their interest in issuing Bitcoin bonds. However, at this time, Bitcoin bonds are not available for buying and selling, unless you make your way into bloomberg.

Australia is one of the only jurisdictions in the world that has offered Bitcoin/cryptocurrency bonds; well, sort-of. Australia issued over $1B worth of government bonds via the Ethereum blockchain, making all investments and processes for the bonds available on the blockchain. For retail users, however, you won’t be able to find Bitcoin/Cryptocurrency bonds at the moment.

Conclusion

While at this time, Bitcoin bonds are not currently available to retail users and the like, governments and jurisdictions are seeing their potential within the markets.

If you’re still confused on buying Bitcoin and other cryptocurrencies, check out our main Bitcoin Buying guide which goes into more depth on the topic; if you have any further questions, don’t hesitate to ask!

FAQs

Where's the best place to get a Bitcoin bond? Where's the best place to get a Bitcoin bond?

You cannot get a Bitcoin bond at the moment.

When will Bitcoin bonds be available?

There is no confirmed date for when Bitcoin bonds will be available.

How do I know my Bitcoin is safe?

If you buy your Bitcoin from registered, legally acknowledged platform, your Bitcoin is safe and secured on an insured, and compliant broker.

Can Bitcoin bonds make me rich?

Bitcoin bonds do not exist currently, however, if they are deployed in the future, they can potentially yield large amounts of profit.

Which countries use Bitcoin/cryptocurrency bonds?

Australia is among one of the only countries that have issued cryptocurrency bonds, and this was only for institutional clients.

Can I buy informal Bitcoin bonds?

There may be informal Bitcoin bonds available online, but we advise against them as they are traditionally subjects of fraud and misconduct.