Join Our Telegram channel to stay up to date on breaking news coverage

DeFi is transforming the financial world, with over $100 billion in total value locked (TVL) and a growing ecosystem of decentralized platforms offering innovative financial services. By leveraging blockchain technology, DeFi empowers users to take control of their assets, offering greater transparency, security, and accessibility while eliminating the need for traditional intermediaries. This rapidly expanding space continues to gain momentum as more users seek decentralized alternatives to conventional financial systems.

This article examines some of the leading DeFi tokens by market activity today, including Yearn.finance, Raydium, Kadena, and DeXe. These projects are making significant strides, driven by vigorous market activity, innovative updates, and growing investor interest. Their continued success reflects the increasing adoption of decentralized finance, offering new opportunities for users to maximise returns, enhance scalability, and engage in governance within the DeFi space.

Biggest DeFi Token By Market Activity Today – Top List

Yearn.finance is a DeFi aggregator that automates yield farming to maximize user returns. Raydium is an AMM and liquidity provider on the Solana blockchain, integrated with Serum DEX. Kadena combines Bitcoin’s PoW consensus with DAG principles to create a scalable version of Bitcoin. DeXe is a DAO focused on developing effective and equitable DAOs in the DeFi space. Let’s explore why these tokens are among the leading DeFi tokens by market activity today.

1. Yearn.finance (YFI)

Yearn.finance is a decentralized finance (DeFi) aggregator that automates yield farming to help users maximize their returns. The platform simplifies DeFi investment by utilizing protocols such as Curve, Compound, and Aave to offer high yields without requiring technical expertise. It targets investors who want to optimize their returns in a more straightforward and more accessible manner.

The YFI token is central to the platform’s governance, allowing holders to vote on protocol changes. Yearn.finance earns revenue through withdrawal and gas subsidization fees, which can be adjusted by community consensus. The YFI token empowers users to actively contribute to shaping the platform’s future while reaping the benefits of its automated yield farming tools.

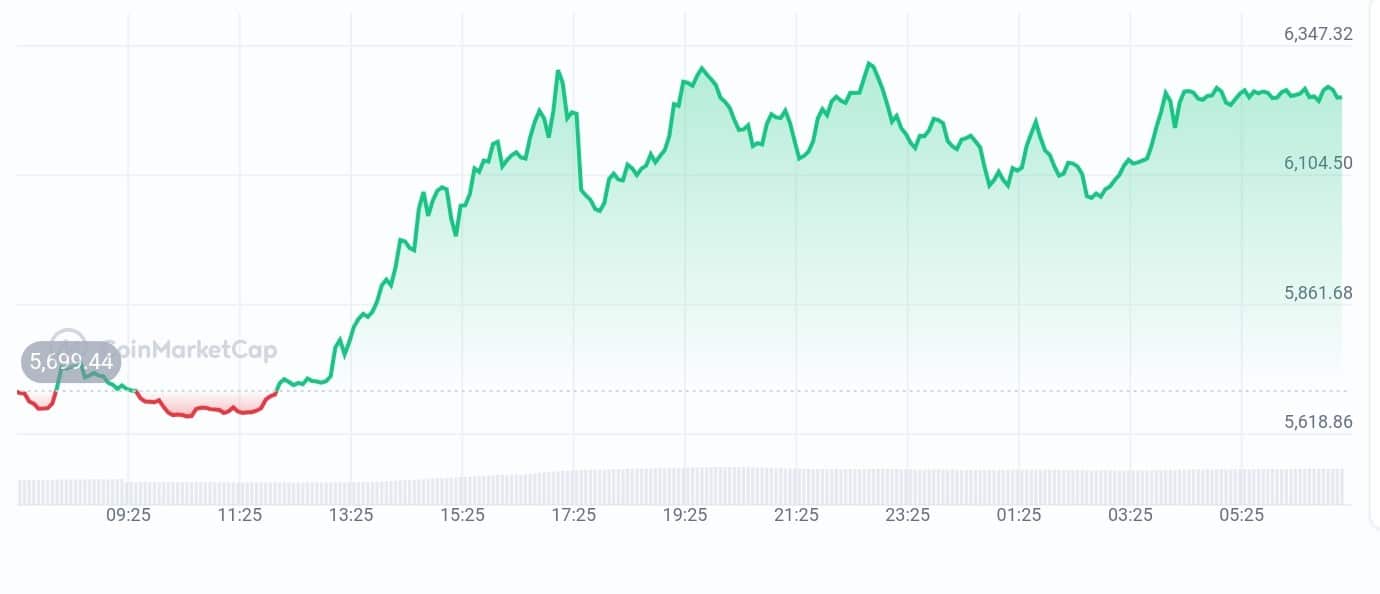

Yearn.finance (YFI) is exhibiting strong bullish momentum. It is currently priced at $6,185.85, following an 8.32% increase in the past 24 hours and a 29.28% rise over the last week. Trading between $5,651.80 and $6,316.57, the token continues to capture investor interest with its strong price performance, positioning itself as a leader in the DeFi space.

Yearn recently posted on X announcing its collaboration with MoonwellDeFi on Base and inviting users to explore the “frontier of yield.” The post emphasizes that APY (Annual Percentage Yield) isn’t just annual but “interstellar,” highlighting the expansive potential of their joint DeFi efforts.

This partnership has the potential to generate excitement within the DeFi community by offering innovative yield opportunities. By collaborating with MoonwellDeFi and integrating with Base, Yearn is positioning itself to tap into new, scalable opportunities, which could attract new users and investors seeking higher yield possibilities.

2. Raydium (RAY)

Raydium is an automated market maker (AMM) and liquidity provider on the Solana blockchain, integrated with the Serum decentralized exchange (DEX). Unlike other AMMs, Raydium converts deposited funds into limit orders on Serum’s order book, providing liquidity providers (LPs) access to Serum’s liquidity and order flow.

The RAY token is used to stake to earn protocol fees, secure initial DEX offering (IDO) allocations, and participate in governance. A portion of the token supply is allocated for liquidity mining and ecosystem growth. Raydium’s unique model and the utility of the RAY token make it a vital part of the Solana-based DeFi landscape.

Raydium (RAY) is experiencing strong growth. It is currently priced at $3.02, following a 2.38% increase in the past 24 hours and a 34.88% rise over the last week. Trading between $2.77 and $3.13, the token maintains a bullish market sentiment and has outperformed 83% of the top 100 crypto assets over the past year, reflecting growing investor confidence and solid momentum. This has positioned it as one of the leading DeFi tokens by market activity today.

LaunchLab Rewards have landed 🪂

Be part of the action, there will be plenty of ways to earn

First prize pool? How about a share of 50k $RAY to kick things off

The trenches are heating up 🔥 pic.twitter.com/MBAlJps6pX

— Raydium (@RaydiumProtocol) April 25, 2025

LaunchLab recently posted on X, announcing the arrival of LaunchLab Rewards, which offer numerous opportunities to earn. The post highlights a first-prize pool of $50,000 in $RAY, inviting the community to get involved as the competition intensifies.

This announcement is expected to attract existing and new users to participate in the rewards program, thereby boosting engagement within the community. By offering a substantial prize pool and creating a competitive atmosphere, LaunchLab is likely to generate excitement and drive interest in its ecosystem.

3. SUBBD Token (SUBBD)

SUBBD is an AI-powered platform revolutionising content monetisation in the creator-subscriber economy. Combining AI tools and Web3 enables creators to manage and monetise content, efficiently cutting out middlemen. With features like AI live streams, voice generators, and a 24/7 personal assistant, SUBBD offers a decentralised alternative to platforms like OnlyFans.

The $SUBBD token powers the platform, enabling access to content, offering tips, and facilitating creator requests. Currently in presale at $0.055275, with over $282,000 raised, the token provides exclusive perks, VIP access, and a 20% annual return through staking. Ten per cent of the total supply is allocated for airdrops and rewards.

It has also been featured on major cryptocurrency platforms, including Cryptonomist, Coinspeaker, Bitcoinist, 99Bitcoins, and TradingView via NewsBTC, highlighting its growing presence in the AI and Web3 space. With its increasing influence, $SUBBD is gaining rapid traction. The launch of the AI Personal Assistant further strengthens its position, offering creators continuous fan engagement. As AI and Web3 redefine digital content, $SUBBD shapes the future of creator income.

4. Kadena (KDA)

Kadena is a proof-of-work blockchain that integrates Bitcoin’s PoW consensus with directed acyclic graph (DAG) principles, creating a scalable version of Bitcoin. This hybrid infrastructure combines the security of Bitcoin with increased throughput, making the blockchain suitable for enterprise adoption. Kadena’s multi-chain approach is decentralized, built for mass adoption, and capable of supporting a wide range of global applications.

The KDA token plays a key role in the Kadena ecosystem, serving as the medium for transaction fees, staking, and governance. It incentivizes miners to secure the network, ensuring Kadena’s scalability and efficiency. Additionally, businesses can leverage KDA tokens for “crypto gas stations,” enabling them to pay transaction fees on behalf of their users, thereby simplifying the adoption of enterprise applications. The KDA token is crucial for maintaining the network’s operations and enabling its future growth.

Kadena (KDA) is exhibiting strong bullish momentum, currently priced at $0.6293, following a 12.15% increase in the past 24 hours and a 31.46% rise over the last week. Trading between $0.5512 and $0.6333, the token is gaining traction, reflecting growing investor confidence in its scalability and innovative approach to blockchain

🚨 Wallet Adapter Beta Release 🚨

dApps can now easily integrate whitelisted $KDA wallets!

✅ dApp builders can integrate wallets easier

✅ more wallet options for users on dApps

✅ improved user experience for ecosystemCheckout the 🧵 for more info ⤵️ pic.twitter.com/xrSRGySNGU

— Kadena (@kadena_io) April 23, 2025

Kadena recently posted on X, announcing the beta release of the Wallet Adapter, which enables dApps to integrate with allowed $KDA wallets easily. The release provides developers with access to foundational tools, including WalletAdapterClient, the Provider interface, and various JSON-RPC method handling capabilities, making it easier to integrate multiple wallet options and enhance the user experience within the ecosystem.

This update will enhance the app development process by simplifying wallet integration. By offering a smoother experience for developers and users, this beta release could drive the adoption of Kadena’s ecosystem, particularly as more wallet providers are added.

5. DeXe (DEXE)

DeXe is a decentralized autonomous organization (DAO) focused on developing equitable and effective DAOs in decentralized finance (DeFi). The platform offers a protocol for creating and governing DAOs, fostering sustainable growth, meaningful participation, and a meritocracy.

The DEXE token functions as the governance token, allowing holders to participate in decision-making and earn rewards for their contributions. Through partnerships like SwissBorg and support from the DeXe Association, the protocol is expanding its reach, driving adoption, and fostering a more inclusive DeFi ecosystem.

DeXe (DEXE) is holding steady at $13.22, with a 2.21% increase in the past 24 hours, despite a 13.69% decrease over the last week. Trading between $12.94 and $13.33, the token is showing resilience amid short-term fluctuations, maintaining investor interest and confidence in its decentralized social trading platform.

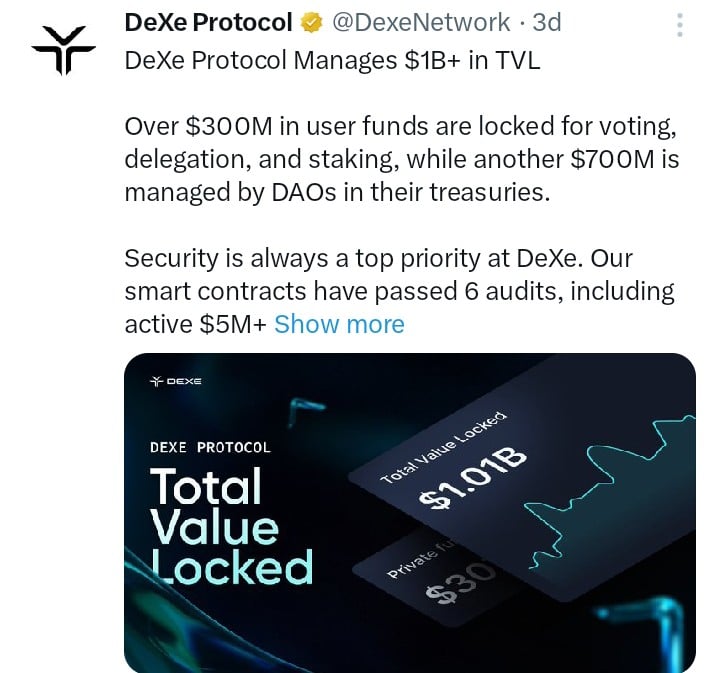

DeXe Protocol recently posted on X, announcing that it manages over $1 billion in Total Value Locked (TVL). The post highlights that over $300 million in user funds are locked for voting, delegation, and staking, with an additional $700 million managed by DAOs in their treasuries. The platform emphasizes security, noting that its smart contracts have passed six audits and are protected by active $5M+ bounty campaigns on Immunefi and HackenProof.

This announcement will likely instill confidence in current and potential users by showcasing DeXe’s robust security measures and large-scale adoption. With significant TVL and a strong focus on security, DeXe is positioning itself as a trusted platform for DAOs and DeFi enthusiasts looking to build and manage decentralized organizations.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage