Join Our Telegram channel to stay up to date on breaking news coverage

The global crypto market cap has risen to $2.51 trillion, marking a 4.46% increase in the past 24 hours. In contrast, trading volume dropped by 2.47%, totaling $157.03 billion over the same period. This market rise suggests growing confidence in digital assets, even as overall conditions remain uncertain. The shift has sparked renewed interest in several altcoins, especially those showing strong performance and potential.

Some altcoins are gaining attention as some of the best crypto to buy right now. Their recent activity reflects a broader trend of investors exploring diverse strategies amid rapid market changes.

Best Crypto to Buy Right Now

Telos is trading at $0.084, representing a 6.70% rise over the past 24 hours. Meanwhile, the AIOZ token is currently valued at $0.1989, showing a 10.78% gain in the same period. Furthermore, SUBBD successfully raised $112,000 during its presale, achieving this milestone within just a few hours of launch.

On a broader scale, global cryptocurrency ETPs encountered significant outflows totaling $240 million last week. These outflows came amid increasing market uncertainty driven by U.S. tariffs, with Bitcoin-related ETPs experiencing the largest declines.

1. Osmosis (OSMO)

Osmosis is a decentralized exchange (DEX) built as an appchain, meaning it operates on its blockchain tailored specifically for DeFi applications. This design gives Osmosis more control over its technology compared to DEXs that depend on larger, shared networks. That flexibility has allowed the platform to develop features such as Smart Accounts, one-click trading, and advanced on-chain orderbooks.

The project is central to the Cosmos ecosystem, serving as both a trading hub and a foundation for decentralized finance tools. It is now moving to integrate the Babylon Bitcoin staking protocol.

This system, known as Babylon Genesis, allows users to stake Bitcoin to support Proof-of-Stake networks. Unlike traditional methods, this approach does not involve bridges, token wrapping, or third-party custody. As a result, users retain control of their Bitcoin while contributing to network security.

Osmosis is cementing its place as the best liquidity and trading venue for assets on chains without a native DEX, like @MANTRA_Chain, @celestia, and the biggest appchain of all — Bitcoin.

Bitmosis 🧪 https://t.co/O5mz1nxCwC

— Osmosis 🧪 (@osmosiszone) April 7, 2025

By adopting Babylon, Osmosis becomes part of the Bitcoin Secured Network (BSN), combining Bitcoin’s security strength with the flexibility of Cosmos-based infrastructure. This integration opens new options for Bitcoin holders who want to earn rewards without giving up their assets.

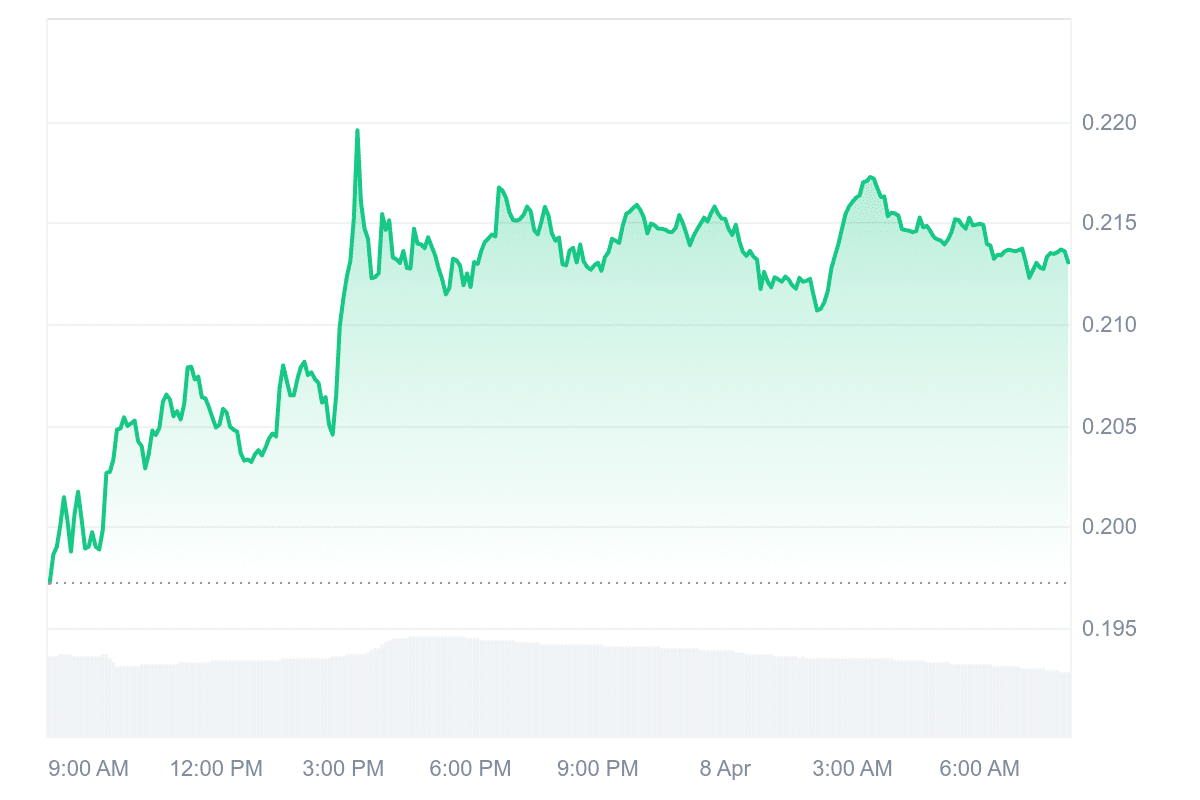

In March, Osmosis reached over $224 million in Bitcoin trading volume, setting a new high for the platform. Its token, priced at $0.21, has risen 8.03% in the last 24 hours. A volume-to-market cap ratio of 0.0939 suggests strong liquidity. With these developments, Osmosis continues exploring ways to connect existing blockchain systems while offering users more efficient decentralized trading and staking tools.

2. Telos (TLOS)

Telos (TLOS) is a blockchain platform designed for high performance and scalability. It focuses on enabling decentralized applications (dApps) and offers features like fast transactions, low fees, and environmental efficiency. Telos uses a version of the EOSIO software and targets industries such as gaming, DeFi, and digital identity management.

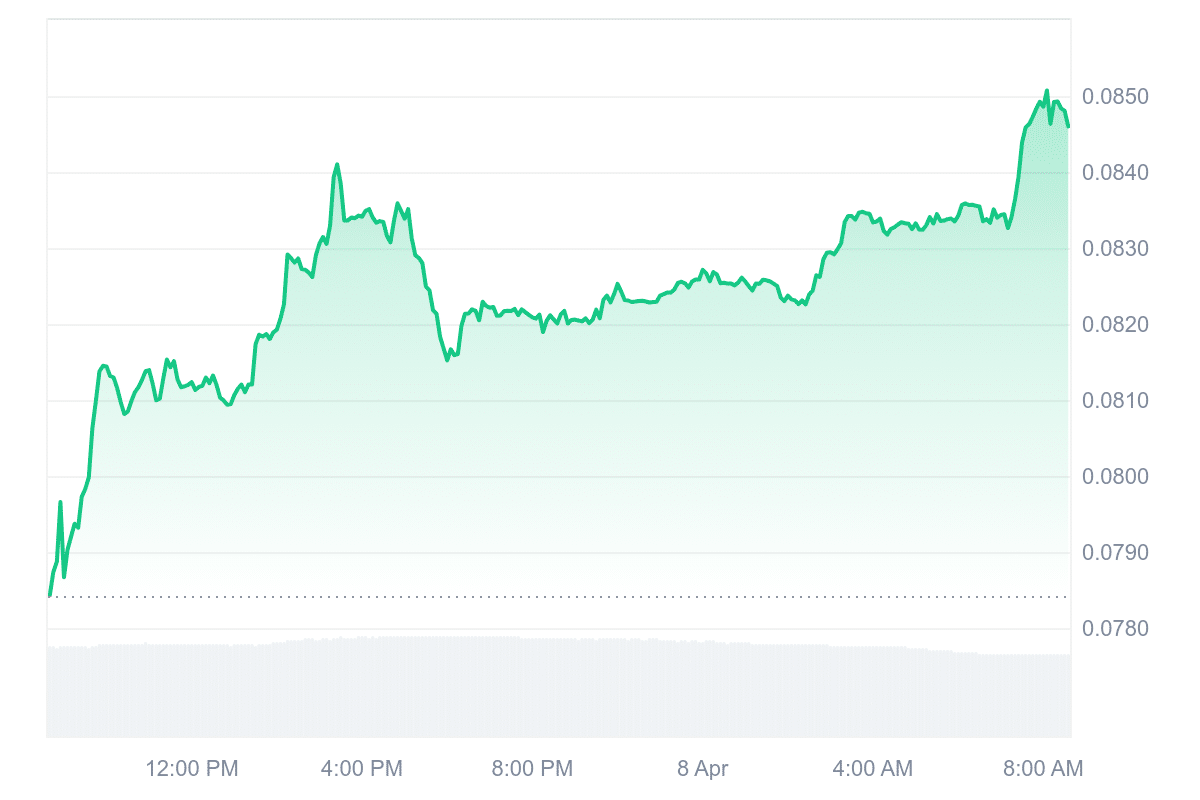

At the time of writing, TLOS trades at $0.084, marking a 6.70% price increase in the last 24 hours. Its 24-hour trading volume exceeds $5 million, while the market cap is $37.32 million, up by 6.76%. The token has seen relatively steady activity, recording 18 positive trading days out of the last 30, indicating moderate market confidence.

The token shows a high liquidity level, with a 24-hour volume to market cap ratio of 0.1552. This means the token is actively traded relative to its size, which can support smoother buying and selling. Over the past 30 days, volatility remains low at 7%, suggesting stable price behavior in the short term.

However, the current price is 23.42% below its 200-day simple moving average of $0.110234, indicating a longer-term downtrend. Telos also remains significantly below its all-time high, down 94% from that peak. On a technical level, the 14-day Relative Strength Index (RSI) is at 69.03, which reflects a neutral stance and suggests the token might continue to trade sideways in the near term.

3. AIOZ Network (AIOZ)

AIOZ Network is a blockchain-based platform aiming to change how digital content is distributed. Instead of relying on centralized servers, it uses a decentralized system known as DePINs—decentralized physical infrastructure networks. These networks support services like AI computation, data storage, and video streaming. The platform integrates with Ethereum and Cosmos, offering developers flexibility and low-cost transactions.

AIOZ supports decentralized applications and smart contracts, allowing many use cases. Users can easily move assets across different blockchain networks with its mainnet live and compatible with MetaMask.

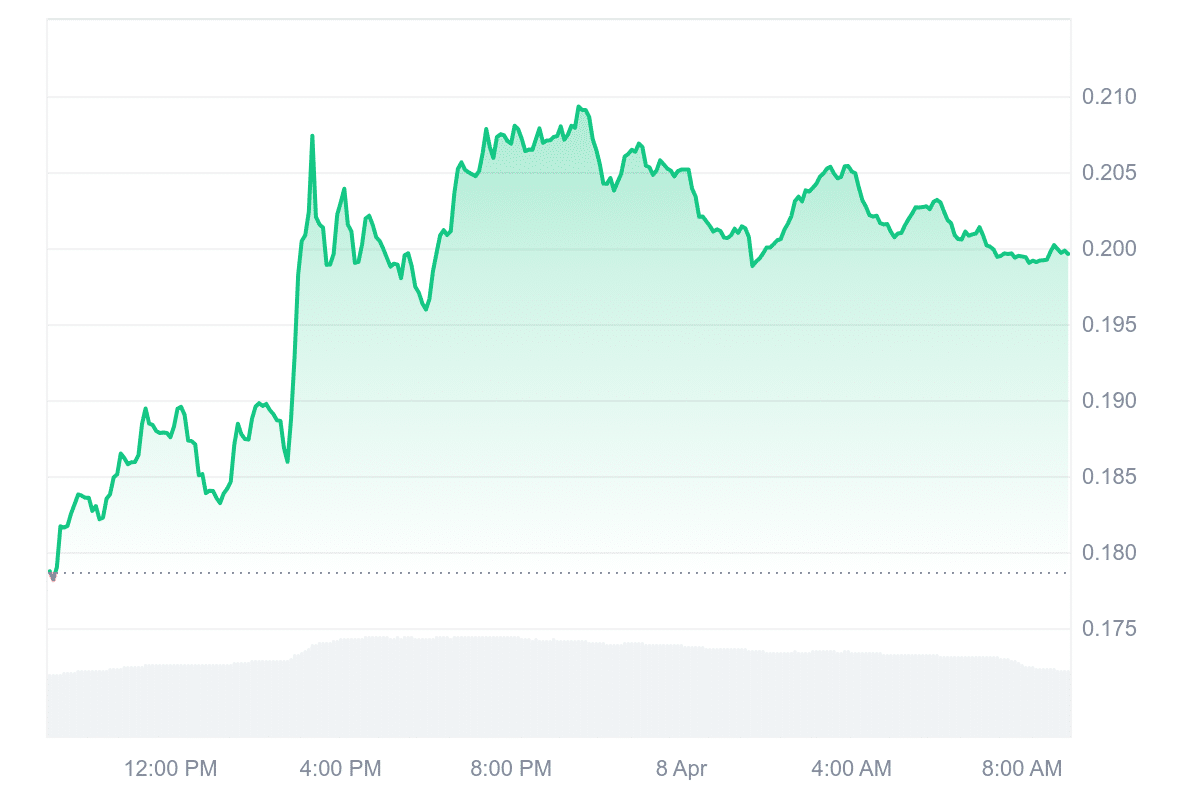

The AIOZ token is currently priced at $0.1989, reflecting a 10.78% increase in the last 24 hours. During this period, the token traded between $0.1821 and $0.2093. It shows strong performance compared to its earlier token sale price and is trading well above its 200-day simple moving average of $0.041955 by 373.96%. This suggests long-term growth, although short-term sentiment remains cautious.

AIOZ Stream, a DePIN Media Infrastructure, is redefining the creation, distribution, and monetization of video & audio content powered by 270,000+ AIOZ DePINs.

Use Case Spotlight: E-Commerce Live Streaming

Unlock interactive shopping experiences with live product demos and… pic.twitter.com/jXYzbIQFKR

— AIOZ Network (@AIOZNetwork) April 2, 2025

The 14-day Relative Strength Index is 48.22, indicating a neutral zone where price could move sideways. Despite recent gains, market sentiment appears bearish, and the Fear & Greed Index reads 24, signaling extreme fear. This suggests traders remain uncertain, even with the token’s recent rally and liquidity levels.

4. SUBBD (SUBBD)

SUBBD is an AI-driven content creation and subscription platform aiming to address common challenges faced by digital creators. By automating tasks like research, editing, and content optimization, the platform allows creators to focus more on producing original material. It integrates AI tools with blockchain features, introducing a native cryptocurrency, SUBBD, to enable direct monetization without intermediaries.

The platform has raised $112,000 in its presale, reaching this milestone within a few hours of launch. Each SUBBD token is priced at $0.0551, with an upcoming price increase scheduled as the presale continues. The project claims to support a network of over 250 million followers across creators, offering tools that enable creators to connect more efficiently with their audiences.

$SUBBD isn’t just another coin with a cute ticker.

It’s your VIP pass to staking benefits.Utility, but make it fashionable.

This is just 1 of 6 utilities. Each will be revealed soon – and yes, they’re worth the hype.

You’re welcome. 🫶https://t.co/8yAMjVQD5E pic.twitter.com/DGw24F47P9

— SUBBD (@SUBBDofficial) April 7, 2025

Through the use of blockchain, SUBBD allows both creators and fans to engage in a decentralized ecosystem. Creators can earn directly through content sales and token-based incentives. Fans can stake SUBBD tokens, access exclusive content, and receive rewards.

SUBBD also positions its token as a utility asset within the platform. Users gain access to premium features and community-based rewards. While the idea of combining AI and crypto in content creation is still developing, SUBBD offers an early example of this integration.

5. Render (RENDER)

Render Network offers decentralized GPU-based rendering services by linking those with unused GPU power to digital creators who need significant computing resources. This setup helps artists and developers handle demanding 3D rendering tasks more efficiently by shifting the workload to a distributed network.

The platform supports rendering jobs and provides a foundation for building creative tools and applications. This focus aligns with the growing demand in digital content industries, where scalable and flexible computing power is essential.

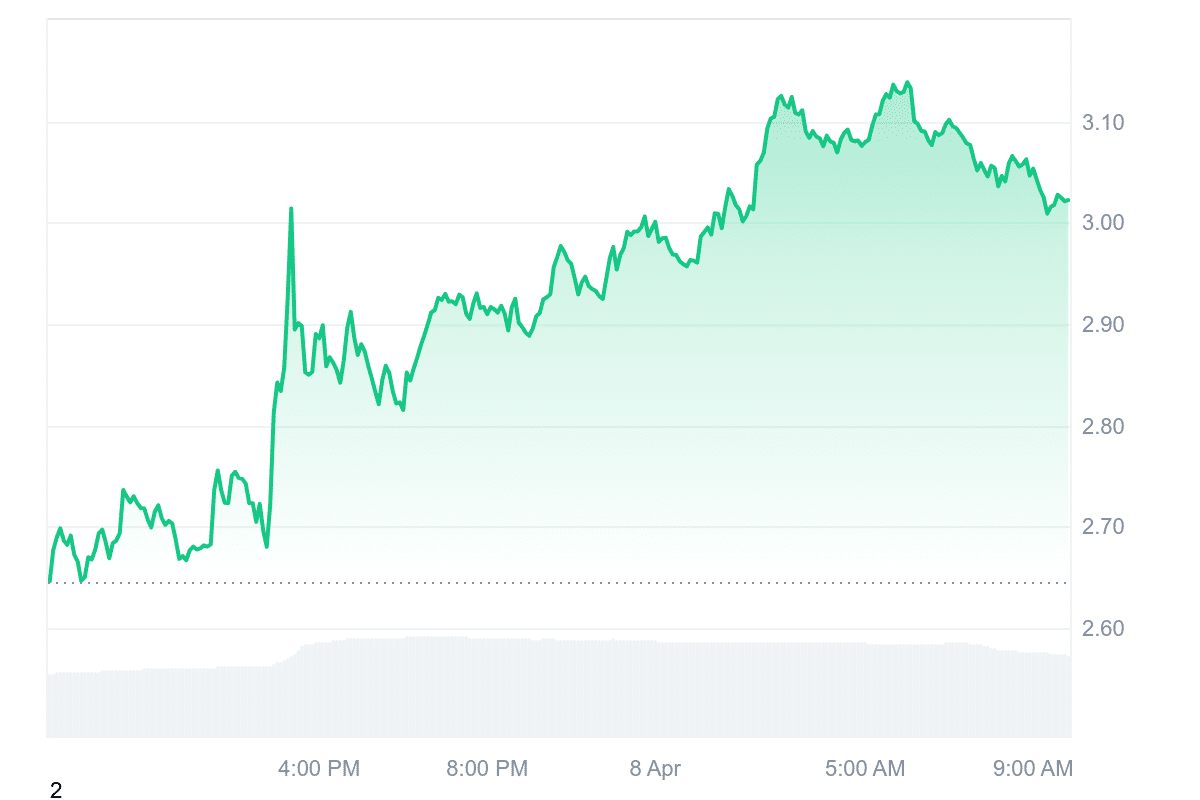

Render’s native token currently trades at $3.03, with a 24-hour volume of $359.20 million and a total market cap of $1.19 billion. The token has gained 15% in the past day and is trading close to its recent cycle high. Its 24-hour volume-to-market cap ratio stands at 0.3019, reflecting high liquidity relative to its size.

RNP-019 aims to support @rendernetwork’s expansion to support AI / ML services, providing a framework for emissions to AI + general compute nodes.

The initial Community Vote is live – here’s a blog breaking it all down: https://t.co/v96bZaBYoZ

— The Render Network (@rendernetwork) April 3, 2025

Over the last 30 days, the token experienced 15 days of positive price movement. However, its 14-day Relative Strength Index (RSI) is at 44.62, indicating neutral market conditions, meaning price action could remain steady in the short term.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage