Join Our Telegram channel to stay up to date on breaking news coverage

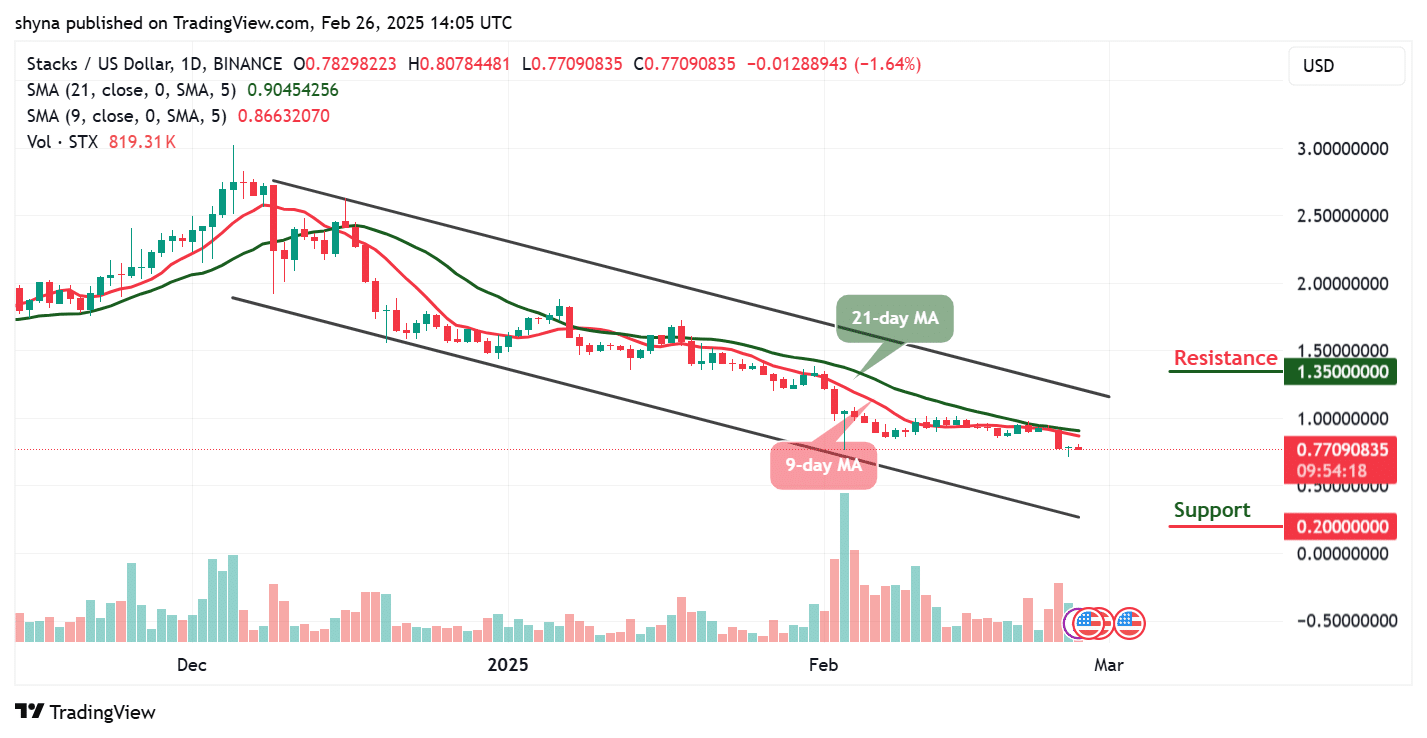

The Stacks price prediction reveals that STX continues to trade within a descending channel, with price action fluctuating between key resistance and support levels.

Stacks Prediction Data:

- Stacks price now – $0.77

- Stacks market cap – $1.16 billion

- Stacks circulating supply – 1.51 billion

- Stacks total supply – 1.51 billion

- Stacks Coinmarketcap ranking – #67

Getting in early on crypto projects can often lead to significant gains, and STX is a prime example of this potential. Since hitting its all-time low of $0.04501 on March 13, 2020, STX has surged by an impressive 1,645.42%, showcasing the power of long-term holding in the crypto space. While it reached an all-time high of $3.84 in April 2024, the current price movement between $0.7299 and $0.8064 highlights the ongoing volatility and opportunities in the market. Investors tracking STX from its early days have witnessed remarkable growth, proving the value of strategic entry points in crypto investments.

STX/USD Market

Key Levels:

Resistance levels: $1.35, $1.40, $1.50

Support levels: $0.20, $0.15, $0.10

STX/USDT is hovering within the midpoint of the channel while holding above the long-term support at $0.75. This level has historically acted as both resistance and support, making it a critical price zone. However, a failure to maintain this support could result in further downside movement. On the other hand, a sustained bounce from this level may lead to another retest of the upper boundary of the descending channel.

Stacks Price Prediction: STX Could Slide Toward the Downside

The STX/USD daily chart indicates that the market is in a clear downtrend, as evidenced by the descending parallel channel formed by two black trendlines. The price action has consistently respected this channel, making lower highs and lower lows. The 9-day MA (red line) remains below the 21-day MA (green line), reinforcing the bearish momentum. Additionally, the price is trading below both MAs, signaling continued weakness. However, a key area of resistance is observed at $1.20, while support lies at $0.50. Given the current price of $0.77, the market is struggling to gain bullish traction, and further downside movement is likely unless a breakout above the channel occurs.

Stacks (STX) Coin Crash or Surge?

Meanwhile, if the price fails to break above the 9-day and 21-day MAs, the selling pressure may intensify, leading to a potential test of the lower boundary of the channel. A breakdown below this support could drive the price toward the major supports at $0.20, $0.15, and $0.10. However, if bulls manage to push the price above the MAs and sustain it, a reversal toward the resistance levels of $1.35, $1.40, and $1.50 could be possible. In other words, the volume also suggests decreasing bullish interest, indicating that sellers currently have more control over the market. Traders should watch for confirmation of a breakout or further bearish continuation within the descending channel.

STX/BTC Consolidates Below the Moving Averages

The STX/BTC daily chart reveals a persistent downtrend within a descending parallel channel, where the price has consistently made lower highs and lower lows. Currently, the market price stands at 889 SAT, with the 9-day MA (red line) trading below the 21-day MA (green line), signaling sustained bearish momentum. However, the price remains below both MAs, indicating weak bullish pressure. The nearest resistance is at 1200 SAT, while the major support is found at 350 SAT. If the price continues to face rejection at the 9-day and 21-day MAs, it may retest the lower boundary of the descending channel, potentially bringing it closer to the 500 SAT psychological level before further declines.

However, if buyers step in and the price manages to break above the MAs, an upward push toward the 1400 SAT resistance zone could be possible. A confirmed breakout above this level might indicate a potential trend reversal, attracting more bullish momentum. Nevertheless, the overall structure still favors the bears, and without a strong buying volume, the price is likely to continue its downward trajectory. Traders should monitor whether the price sustains within the channel or breaks out in either direction, as that will determine the next significant move in the STX/BTC pair.

Crypto analyst @ali_charts informed his 128K+ followers on X (formerly Twitter) that #Stacks ($STX) is currently consolidating within a descending triangle, positioning itself for a potential 18.52% price move.

#Stacks $STX is consolidating within a descending triangle, setting up for an 18.52% move! pic.twitter.com/iWRYdmeTrj

— Ali (@ali_charts) February 24, 2025

Alternatives to Stacks

For STX to regain bullish momentum, it must break above the descending channel’s resistance, with a confirmed breakout setting a technical target of around $2.50—aligning with a key historical resistance level. However, reaching this target will require strong buying volume and positive market sentiment. Meanwhile, the Best Wallet token is gearing up for its highly anticipated launch, having already raised over $10.5 million and gaining traction among investors. With a robust ecosystem and a strong focus on security, Best Wallet aims to transform digital asset management. Notably, Stacks (STX) can be conveniently purchased on the Best Wallet platform, making it easier for investors to access and trade the token.

The Best Wallet Token Is Launching Soon

With Best Wallet set to disrupt the crypto space, now is the perfect time to invest in its native token before it takes off. Holders of the Best Wallet token enjoy exclusive benefits like early access to presales, reduced transaction fees, high staking rewards, and community governance. Plus, with a roadmap packed with exciting developments—including a decentralized exchange, advanced trading tools, and a spending card offering 8% cashback—this is more than just another crypto project; it’s a game-changer. Don’t miss out on this opportunity to be part of the next big thing in digital assets—secure your Best Wallet tokens today.

Related News

- Stacks Price Prediction: STX Surges 25%, But Experts Eye This New Solana Meme Coin

- Is Best Wallet The Top App For Trading Bitcoin After Multi-Chain Upgrade Launch?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage