Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin is approaching its all-time high as investors anticipate a market shift following the upcoming U.S. presidential election. On Tuesday, Bitcoin’s price rose to $73,577, approaching its previous high of $73,750, last recorded on March 13, based on Yahoo Finance data. As of now, it trades below $72,000.

According to a digital asset strategist, the key drivers behind this recent price surge include seasonal factors—October’s second half is historically favorable for Bitcoin—and anticipation surrounding the U.S. election.

This positive momentum in Bitcoin could influence the broader cryptocurrency market, potentially leading altcoins to see similar gains. With this outlook, many market participants are closely watching altcoins as potential opportunities for strong returns. InsideBitcoins has identified some of the best cryptocurrencies to invest in right now.

Best Cryptocurrencies to Invest in Right Now

Conflux recently partnered with Footprint Analytics, which aims to strengthen data-driven growth within Conflux’s ecosystem. Meanwhile, Lido DAO made strides in decentralized staking by introducing a Community Staking Module (CSM) following a community-approved vote. At the same time, Optimism’s price stands at $1.75, showing a 2.25% increase over the last day and a 2.88% rise over the past week.

1. Helium (HNT)

Helium is designed to support Internet of Things (IoT) devices by enabling low-power, long-range connectivity. Its goal is to attract device owners and IoT enthusiasts, encouraging them to expand network coverage by operating Helium-compatible hotspots in exchange for HNT tokens. This incentive structure supports Helium’s efforts to build a large, distributed IoT network.

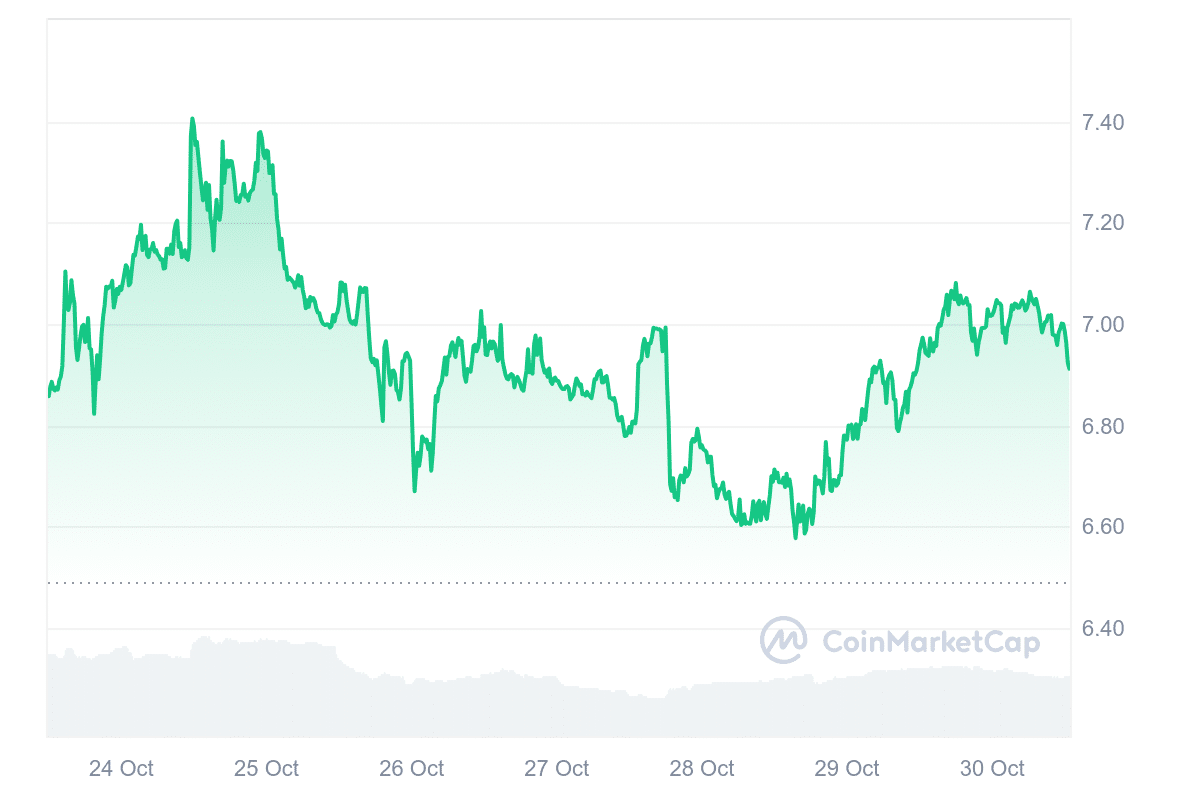

Currently, Helium is priced at $6.82, with a 24-hour trading volume of $11.08 million and a market cap of $1.16 billion, accounting for 0.05% of the total cryptocurrency market. Recent market sentiment appears optimistic, with a Fear & Greed Index score of 69, suggesting a greed phase where interest in the token is high.

Moreover, technical indicators show that Helium’s price sits significantly above its 200-day simple moving average (SMA), which is $2.25, by about 203.63%. Over the last month, the token saw 15 positive trading days, representing a steady trend, with 50% of recent days showing price gains. Over the past year, Helium’s price has grown by approximately 345%, placing it among the larger projects by market cap.

Price projections for Helium suggest a potential increase of 25.17% in the coming month, with a target of $8.65 by November. Analysts suggest a near-term price range between $6.79 and $8.65, largely influenced by recent performance and current market trends.

2. Conflux (CFX)

Conflux recently partnered with Footprint Analytics, a blockchain data platform designed to simplify analytics and help manage communities in the Web3 space. This collaboration aims to strengthen data-driven growth within Conflux’s ecosystem, supporting its efforts to expand in the Asian market.

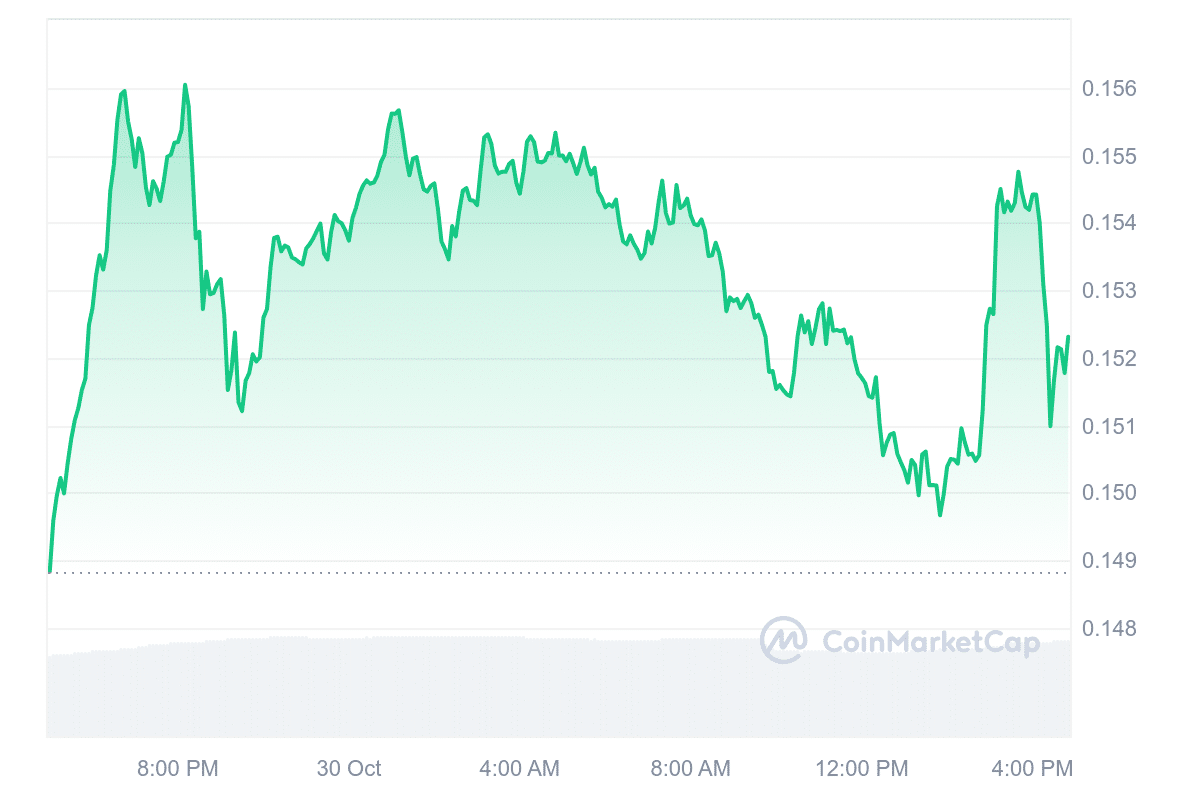

At the time of analysis, CFX trades at $0.152, marking a 1.81% increase within the past 24 hours. The trading volume has also risen by 16.97% over the same period, signaling increased investor activity. With a 24-hour volume-to-market cap ratio of 0.2635, CFX demonstrates substantial liquidity for its market size.

We're excited to collaborate with @Footprint_Data, a comprehensive blockchain data analytics platform that simplifies analysis and community management for sustainable growth in Web3 projects.

Together, we’ll empower data-driven growth in our ecosystem and unlock new… https://t.co/0jUsaBPs6t

— Conflux Network Official (@Conflux_Network) October 24, 2024

However, the market sentiment surrounding Conflux remains cautiously bearish. Nevertheless, the Fear & Greed Index is 69, which falls in the “Greed” zone. This sentiment indicates high market interest but suggests potential caution from investors. The 14-day Relative Strength Index (RSI) is at 53.41, placing CFX in a neutral zone, likely resulting in sideways trading for now.

Furthermore, Conflux’s 30-day volatility is low, at 8%, suggesting a period of relative price stability. Current price predictions from CoinCodex show that CFX may increase by approximately 226.75%, potentially reaching $0.49144 by November, though this depends on market conditions and investor response. Conflux’s recent developments reflect its goals of leveraging data insights for growth, particularly in expanding markets.

3. Pepe Unchained (PEPU)

Pepe Unchained is a Layer-2 blockchain project designed to address Ethereum’s well-known limitations with scalability, specifically targeting the persistent issues of high gas fees and slow transaction times. As a new entry in the market of meme-driven blockchain solutions, Pepe Chain aims to streamline the user experience by providing faster and more cost-effective transactions.

Recently, Pepe Unchained has shown considerable growth, nearing a $24 million mark in market activity, which has generated significant interest. With upcoming exchange listings, market watchers anticipate potential price movement upon availability, especially as it appeals to traders experienced in high-risk, high-volatility assets.

We are FLOORED by the support for Pepe Unchained!

$23M is a huge achievement. We're building the future of meme coins, and can't do it without our incredible community. pic.twitter.com/Gvr01DV3TS

— Pepe Unchained (@pepe_unchained) October 28, 2024

The project initially gained attention for an exceptionally high annual percentage yield (APY) of 16,000% during its Initial Coin Offering (ICO), a rarity in the meme coin sector. Although the APY has now adjusted to around 99%, staking participation remains robust, with over 1.6 billion PEPU tokens already staked ahead of the official launch. Following the presale, the team plans to launch on decentralized exchanges (DEXs), although additional specifics are still pending release.

4. Lido DAO (LDO)

Lido DAO recently advanced its approach to decentralized staking by introducing a new Community Staking Module (CSM) through a community-approved vote. The CSM aims to make Ethereum staking accessible to a broader audience by reducing the technical and financial barriers often linked to solo staking.

By enabling more users to run Ethereum validators, Lido moves closer to operating as a fully permissionless protocol, where anyone can contribute to Ethereum’s security without restrictive conditions. This initiative aligns with Lido’s goal to democratize access to staking, allowing more stakeholders to participate.

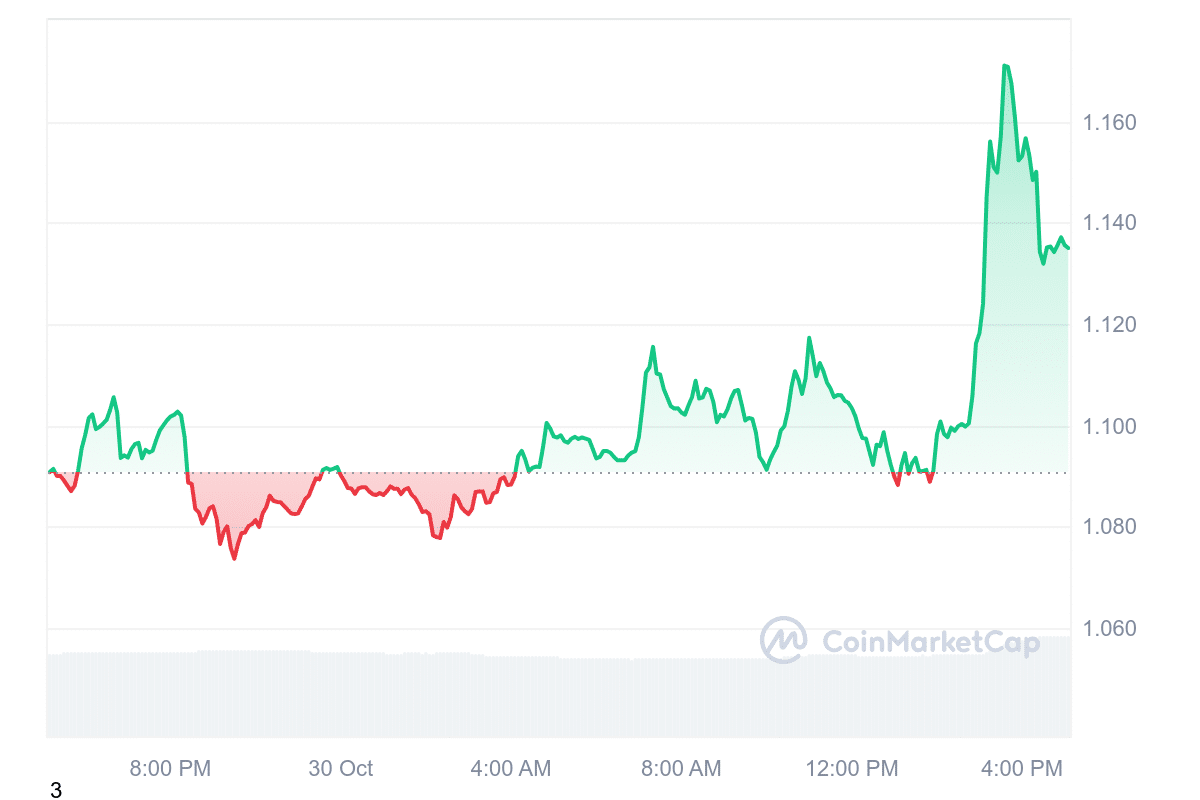

Meanwhile, the Lido DAO token is currently trading at $1.14, with an intraday gain of 4.06%. This price reflects a neutral sentiment, suggesting the market is balanced between buying and selling pressures. The Fear & Greed Index rating stands at 69 (Greed), indicating an optimistic outlook among investors.

Community Staking Module (CSM) is live on mainnet!

A new era begins for solo stakers on Ethereum.

Start your validation journey with CSM 👉 https://t.co/tXyyUSCqAR pic.twitter.com/jaJaZmNWYB

— Lido (@LidoFinance) October 25, 2024

The token also exhibits a 24-hour volume-to-market cap ratio of 0.1546, highlighting a relatively high level of liquidity based on its market capitalization. LDO trades actively on Binance, benefiting from this high-liquidity platform. The yearly inflation rate for LDO is 0.24%, a low rate that suggests limited new token issuance, which can help maintain token scarcity over time.

The 14-day Relative Strength Index (RSI) for LDO sits at 51.64, positioning the token in a neutral zone. This index value implies that the token is neither oversold nor overbought, which often suggests a potential for sideways trading.

5. Optimism (OP)

Optimism is a layer-two solution built on Ethereum, designed to improve transaction speed and reduce costs on the network. The platform processes transactions separately, recording them within its framework before securing them on Ethereum. This setup allows transactions to be faster and cheaper while still benefiting from Ethereum’s security features.

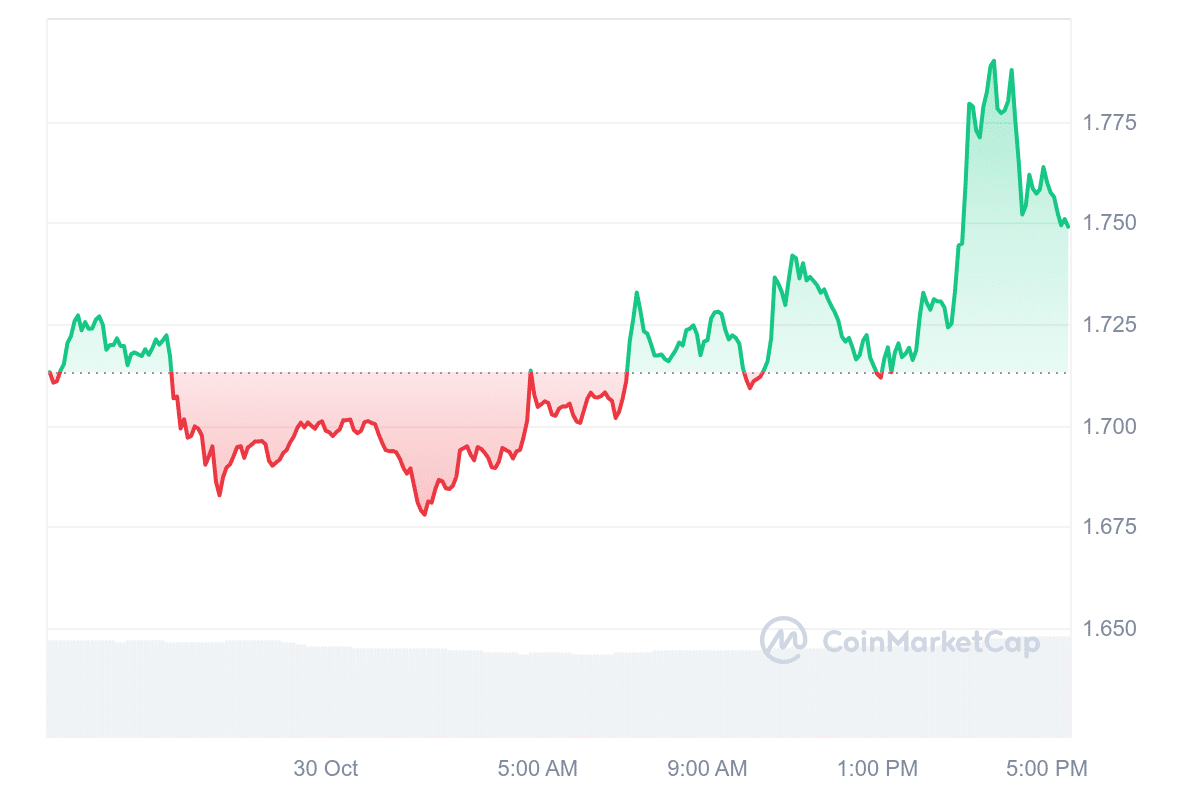

At the time of writing, OP’s price is $1.75, surging by 2.25% in the past day and gaining 2.88% over the past week. Over the past year, Optimism’s price has grown by around 28%. Market sentiment remains generally optimistic, as shown by the Fear & Greed Index, which sits at 69, indicating “Greed.” The token is also trading above its 200-day simple moving average, often seen as a positive indicator of longer-term performance.

Proud to partner with Base to continue bringing the OP Stack’s Fault Proof System to the Superchain. https://t.co/H0odQ8xZAu

— Optimism (@Optimism) October 23, 2024

Due to its substantial market cap, OP also has high liquidity, allowing for relatively smooth trading. Optimism’s approach seeks to help Ethereum scale while maintaining security, which may explain the continued interest in the token. With stable liquidity and technical trends favoring potential growth, it remains a notable part of the Ethereum ecosystem.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage