Join Our Telegram channel to stay up to date on breaking news coverage

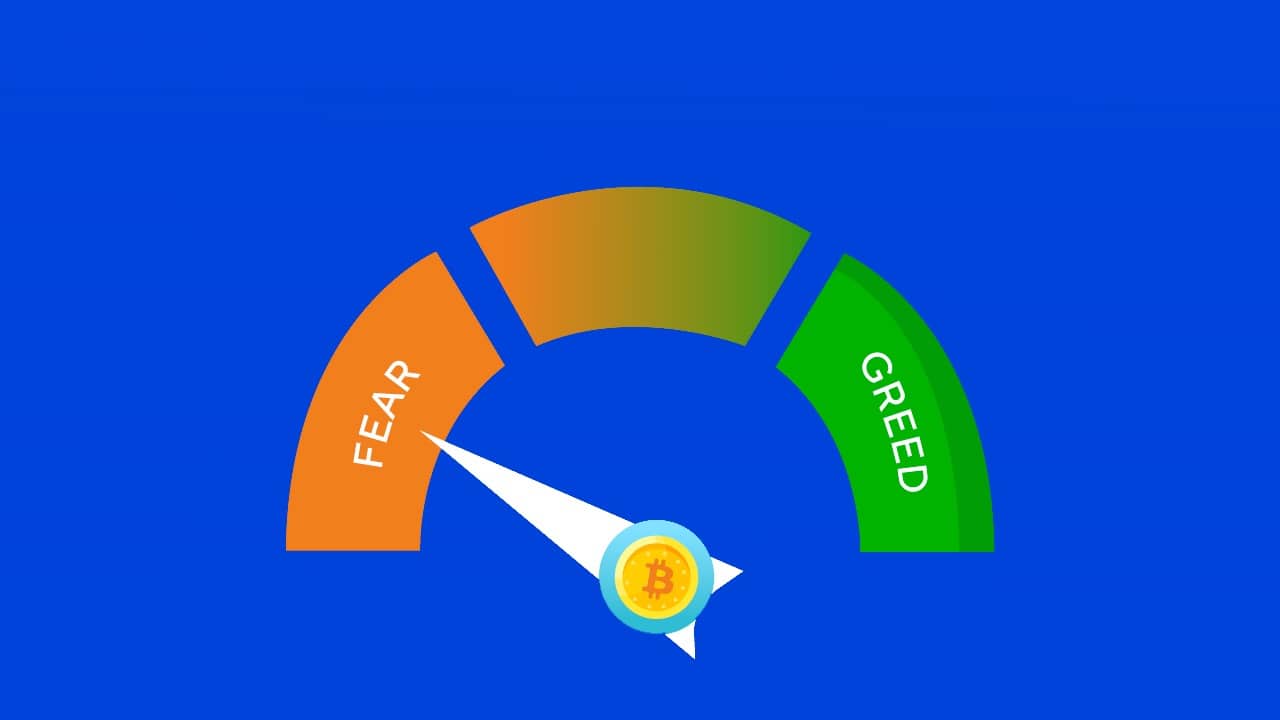

The Crypto Fear and Greed Index plunged to its lowest point since January 2023 as market sentiment soured and Bitcoin struggled to keep the $55k support.

Spot Bitcoin ETF Investors Unfazed As Crypto Fear And Greed Index Plunges To 28

BTC reached an all-time high of $73,750.07 in March, which led to the Fear and Greed Index presenting a sell signal. This signal has since been validated, with the Bitcoin price down more than 24% from its new peak.

Based on trading activity it looks like #BitcoinETF buyers are still HODLing. So far there's no sign of panic. It will likely take a much larger drop in #Bitcoin before they finally capitulate. That may come as soon as next week, especially after another big selloff this weekend.

— Peter Schiff (@PeterSchiff) July 5, 2024

The drop in BTC’s price seems to have been identified as a buying opportunity by spot Bitcoin ETF (exchange-traded fund) investors. Peter Schiff, the Chief Economist and Global Strategist at Euro Pacific Asset Management, said in a July 5 post on X that trading activity suggests “Bitcoin ETF buyers are still HODLing.”

Bloomberg ETF analyst James Seyffart also commented on recent ETF trading activity in a July 6 X post. “Bitcoin ETFs doing the exact opposite of “dumping” in the first ~20% drawdown since launch,” Seyffart said while quoting a post by Bitwise CEO Hunter Horsley.

Bitcoin ETFs doing the exact opposite of “dumping” in the first ~20% drawdown since launch https://t.co/bh4dyKzOft

— James Seyffart (@JSeyff) July 6, 2024

Mt. Gox Repayments Could Lead To BTC Dropping To $50K

One key factor behind the extreme fear in the crypto market might be the anticipated unloading of seized BTC by German and U.S. Governments. Additionally, investors are pre-emptively selling their holdings to avoid getting caught in the potential sell off by Mt. Gox investors, SynFutures CEO Rachel Lin said in a market update.

10x Research founder Markus Thielen believes the Mt. Gox repayments could lead to a lot of selling pressure being exerted on BTC. He went on to predict that the leading crypto could drop to $50K as a result.

Related Articles:

- Best Altcoins to Invest In: Unveiling Top Picks for Maximum Returns!

- Bitcoin Plunges Below $58K As Investors Brace For Mt. Gox Payouts This Month

- NFT Sales Surged 7% Past Week – Here’s This Week’s NFT Market Prediction

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage