Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum price fell 0.2% in the last 24 hours to trade at 2051 as of 6:28 a.m. EST.

Ethereum has experienced an uptick of 8.6% in its price over the past week. According to Raoul Pal, a former Goldman Sachs executive with a following of over 1 million on X (Twitter), Ethereum is poised to outperform Bitcoin based on the Tom Demark Sequential Indicator.

That is the weekly DeMark 9 count for the ETH/BTC cross. ETH most likely outperforms from here as per usual at this stage in late Crypto Spring. pic.twitter.com/yBCrLRzFXn

— Raoul Pal (@RaoulGMI) November 9, 2023

Pal asserts that exchange-traded funds (ETFs) based on Ethereum will be a coveted opportunity for asset managers. This is because they can benefit from yield capture while only providing price performance to the ETF holders. This presents a highly lucrative business model until potential competition arises and alters the landscape.

“An ETH ETF is the holy grail for asset managers as they can capture the yield and only give price performance to the ETF holders,” he said. “It is a super profitable business until it gets competed away eventually.”

Ethereum Price Has Broken Over the Falling Channel

The movement in ETH’s price suggests the potential for an upward trajectory following a decline, as evidenced by a series of red daily candlesticks within a descending channel originating from the $2150 supply zone.

Bulls have found a robust foundation at the $1535 support level, enabling them to take charge of the price and displaying a general upward resilience.

ETH’s price has surpassed the 50-day and 200-day moving averages, currently at $1,779, higher than the $1,729 mark. The 50-day SMA acts as immediate support, affirming the imminent bullish rally.

Although showing a slight decline from 84, the Relative Strength Index (RSI) supports the bullish sentiment with the current reading at 72, above the overbought region of 70, indicating intense buying pressure on ETH’s price.

Breaking out of the descending channel, ETH has set the stage for potential new highs in the coming weeks.

This bullish sentiment is further strengthened by the RSI and the 50 and 200 SMAs. If the positive momentum persists, the bulls may aim for $2,350 by the end of Q4 in 2023.

Ethereum Price Faces Resistance

Nevertheless, ETH faces resistance at $2136, prompting a minor correction by the bears. Capitalizing on this resistance could drive the price to the $1,950 support level.

As Ethereum faces a curial resistance ahead, there’s another upcoming altcoin that is leveraged to spot BTC ETFs and housed on the Ethereum network that promises greater returns.

Bitcoin ETF Token Crosses $500K, Price Rise in 2 Days

Amidst the growing excitement around Bitcoin ETFs approval, the Bitcoin ETF Token ($BTCETF) project represents more than just a typical cryptocurrency. It marks a forward-thinking strategy that lays the groundwork for future spot Bitcoin ETFs.

Developed on the Ethereum platform, $BTCETF is designed to capitalize on this emerging trend, providing unique advantages to its members. It presents a new way for people to acquire Bitcoin.

Identifying the Future! 🔍#BitcoinETF isn't just another #Cryptocurrency; it signifies a proactive approach that paves the way for #Bitcoin ETFs.

Built on #Ethereum, $BTCETF anticipates and harnesses this forthcoming development, offering exclusive benefits to its community. pic.twitter.com/UX7eWXgpBq

— BTCETF_Token (@BTCETF_Token) November 11, 2023

Recently launched, the project has already garnered over $500,000, approaching its initial target of $856,800. This presale phase is concluding in two days, after which the price of $BTCETF will increase from the current $0.0052 to $0.0054 per token.

This is the best opportunity for serious investors who understand the power that lies underneath the approval of Bitcoin’s ETF’s to jump into this project. If speculations are to go by, the price of BTC will shoot up once the SEC approves Bitcoin ETFs, which will also push the price of $BTCETF to unprecedented highs.

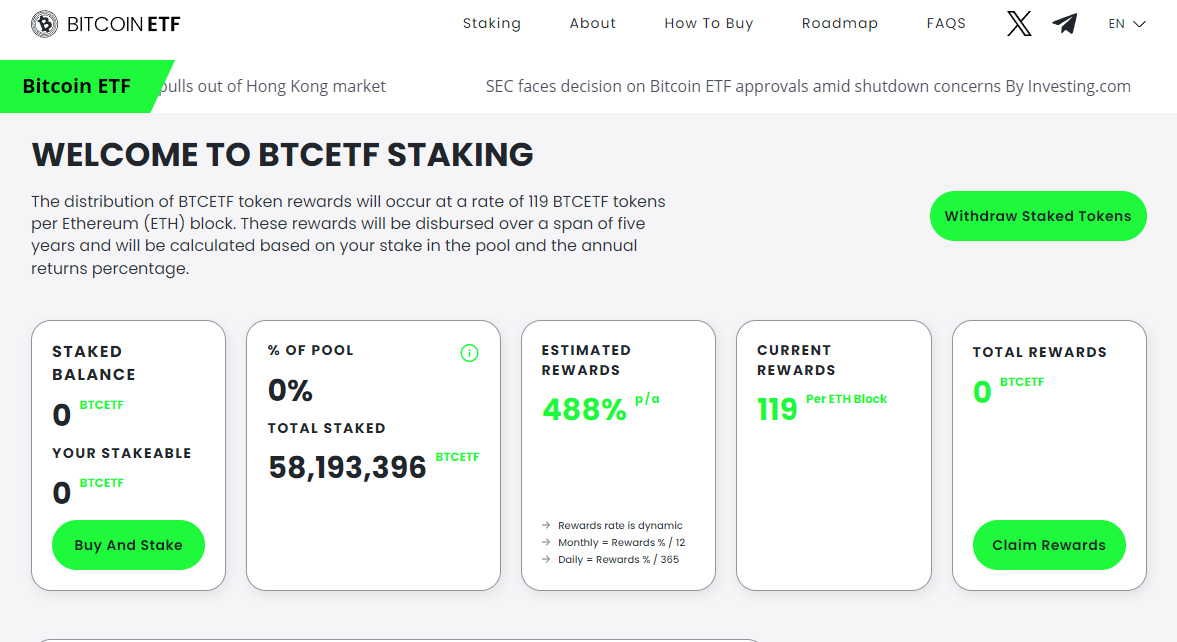

Earn Passive Income by Staking, 488% APY

Investors also have the opportunity to earn passive income from staking their already-purchased BTCEFT tokens.

As of this writing, 58,043,552 BTCEFT tokens have been staked, with the current annual percentage yield (APY) at an impressive 491%.

However, note that the APY rate is set to reduce when more investors stake their tokens, and with a limited supply of 840 million tokens available for presale, those who invest early stand to gain the most from the current high interest rates.

Alessandro De Crypto, a prominent crypto Youtuber and analyst with over 11.6K subscribers, thinks that the Bitcoin ETF token is the next big thing and explains how you can buy some tokens this early for great rewards.

https://www.youtube.com/watch?v=hsO9HNneaDg

To purchase $BTCEFT tokens, visit the Bitcoin ETF token website and connect your wallet. Once successful, you can exchange your ETH or USDT for $BTCEFT, or purchase using your bank card.

Related News

- Bitcoin Price Prediction: All Eyes On Possible BTC ETF Approvals This Week As This Bitcoin Cloud Mining Platform Rockets Toward $4 Million In Presale

- Pepe Price Prediction: PEPE Plunges 6%, But This Would-Be Meme Coin King’s Presale Keeps On Pumping

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage