Join Our Telegram channel to stay up to date on breaking news coverage

Investors are in a quest for assurance in the face of the continuous creation of new cryptocurrencies at an almost hourly rate. They strive to differentiate between beneficial and detrimental investment options. In the wake of previous disappointments, some of these fresh digital assets offer solace to those who have incurred losses. Others fail to live up to expectations.

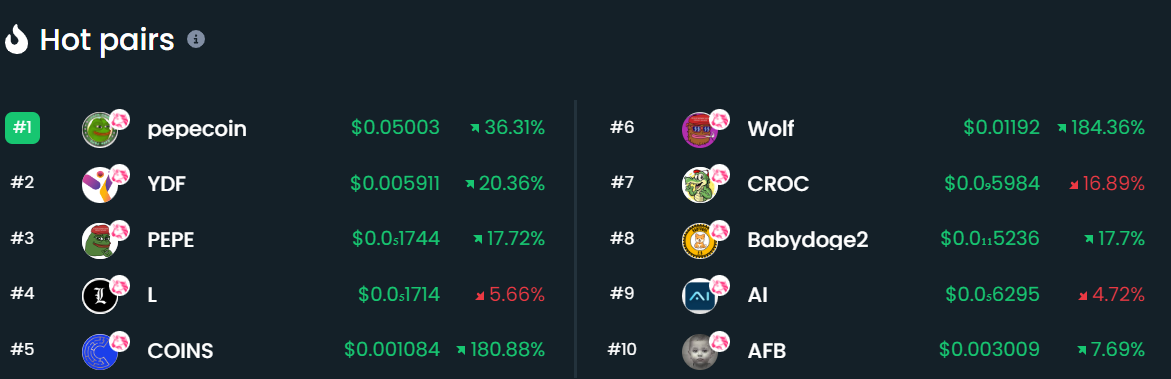

DEXTools takes an active role in tracking and analyzing the performance of various assets. It provides users with invaluable insights into the crypto market. Using cutting-edge technology and real-time data, DEXTools identifies the trending cryptocurrencies. These trending cryptos on DEXTools empower investors and traders, enabling them to up their game in the market.

1. Yieldification (YDF)

The first coin on today’s list of top trending cryptos is YDF. Yieldification is a cutting-edge NFT utility DeFi protocol that provides real yield opportunities with an impressive annual percentage rate (APR) of up to 50%. Its developers have implemented a groundbreaking integration between ERC-20 fungible tokens and NFTs. They serve as valuable certificates of deposit or stake receipts. Its team aims to ensure the sustainability of the protocol by incorporating unique features. These features include an innovative perpetual futures trading mechanism that supports various tokens as collateral.

Additionally, they are enhancing the utility of NFTs. The team employs carefully selected concepts and tokenomics from prominent projects like HEX, OHM, GMX, and REFI. Focusing on long-term viability and sustainability, the team plans to establish a thriving ecosystem fueled by utility fees and usage.

Yieldification builds a strong foundation for the concept of NFTs by encompassing robust utility and features. The protocol harmoniously integrates each component, ensuring an optimal balance to sustain the underlying infrastructure. This move will enable the project’s perpetual existence and growth.

The Yieldification protocol utilizes YDF as its primary ERC-20 token, serving as the gateway into the system. Since its inception, YDF has been available on the Ethereum network and traded on Uniswap. However, there are plans to expand its availability to various centralized exchanges and potentially even across different networks.

The initial supply of YDF is set at 696,900,000 tokens. It should be noted that YDF operates under a dynamic protocol structure. The token is continually burned and minted to facilitate revenue generation. This process is achieved by consuming YDF burn and stake/unstake activities by protocol products and user interactions. When users stake their assets, the yield is used to mint additional YDF tokens. These newly minted tokens are then vested in the contract, ensuring a gradual distribution to users upon unstaking.

2. CBSwap (COINS)

CBSwap builds upon Coinbase’s recently announced Base Chain. Therefore, this trending crypto is the pioneering decentralized exchange (DEX) on this Ethereum Layer 2 (L2) chain. It endeavors to facilitate onboarding the subsequent 100 million users into DeFi. The Coinbase Base Chain, constructed using Optimism’s OP Stack, presents a developer-friendly and cost-effective solution for on-chain development.

To facilitate various advantages such as farming and governance rights, CBSwap introduces $COINS as its native utility token. As the governance token of the CBSwap platform, $COINS empowers users with a secure and convenient means to trade cryptocurrencies. The token will be listed on prominent decentralized exchanges, including CBSwap on Base Chain and Uniswap on the Ethereum mainnet.

CBSwap offers lightning-fast transactions, minimal fees, yield farming, liquidity-locking functionality, state-of-the-art security, and advanced key management. It ensures multi-signature stewardship of wallets.

Uniswap and PancakeSwap boast a combined trading volume of over $1 billion and $162 million, respectively. The overall daily trading volume of decentralized exchanges (DEXs) is about $2.2 billion. With these metrics, CBSwap is poised to capture substantial revenue by introducing a new Layer-2 chain to the DeFi ecosystem.

CBSwap provides traders a swift and efficient platform to trade various cryptocurrencies, including native tokens to Coinbase’s Base Chain. The exchange operates fully decentralized, enabling users to trade without intermediaries, thereby minimizing the risks associated with fraud and hacking.

Hot Pairs on DEXTools

3. Conic Finance Token (CONIC)

Conic Finance builds an accessible platform that allows liquidity providers to broaden their exposure to various Curve pools effortlessly. Users can supply liquidity into a Conic Omnipool. It efficiently distributes funds across Curve based on predetermined pool weights controlled by the protocol.

The Conic DAO utilizes the CNC token as its governance token. It enables participants to engage in governance activities by locking their tokens. CNC tokens are minted proportionally to the amount of liquidity supplied by Conic LPs. These liquidity providers receive a share of CNC tokens.

When adjustments are made to the liquidity allocation weights within an Omnipool, deposits and withdrawals that rebalance the Curve pools towards their target weights are rewarded with CNC tokens, providing incentives for participants. Also, 10% of the total CNC supply is allocated to stakers of the Curve factory pool’s CNC/ETH LP token. This allocation ensures sufficient liquidity for swaps, and stakers receive CNC tokens as an incentive.

CNC holders can lock their tokens for vlCNC. This procedure resembles the locking mechanism in vote-locked tokens like vlCVX or veCRV. Interested investors should note that vlCNC cannot be transferred between users. The locking duration for CNC tokens ranges from a minimum of 4 months to a maximum of 8 months. Users can relock all or one of their existing locks at any time.

Conic depends on Omnipools, liquidity pools for a single asset that distribute liquidity among multiple Curve pools. Curve LP tokens are deposited on Convex and staked in the corresponding Convex pool rewards contracts. LPs can access multiple Curve pools through a single LP token and earn CRV and CVX. Additionally, Conic Omnipools assign a liquidity allocation weight to each Curve pool.

Curve and Convex offer mechanisms for CRV and CVX holders to vote on gauge inflation weights and adjust CRV emissions across Curve pools. However, Conic provides a means to adjust weights that shift the liquidity of one or more assets among Curve pools.

4. Ecoterra (ECOTERRA)

Investors from all over the globe have flocked to support one of the top trending coins. This interest has established Ecoterra’s position as a potential frontrunner in the environmentally conscious crypto industry.

The ecosystem aims to offer a carbon offset marketplace and a recycled materials marketplace, catering to businesses of various sizes. Ecoterra strives to create a comprehensive solution to environmental challenges by integrating these features on a single platform. It harnesses the Ethereum blockchain’s potential to accomplish this goal.

Investors have shown great interest in Ecoterra due to its Recycle2Earn app. Through Reverse Vending Machines (RVMs), this app allows users to recycle various materials and earn $ECOTERRA tokens.

Investors anticipate launching the Alpha version of the Recycle2Earn app by the end of 2023. The app, designed for desktop and mobile platforms, assures an intuitive user experience, ensuring that individuals of all age groups can utilize it effectively.

The project’s fuel is the $ECOTERRA tokens, providing holders various benefits. Holders can enjoy exclusive access to real-world events, educational programs, and other offerings.

Notably, the developers will introduce a staking protocol in the future. This protocol will enable $ECOTERRA holders to generate passive income through their holdings. Ecoterra’s team presents an enticing opportunity for eco-conscious investors searching for financial returns. ECOTERRA has a limited supply of two billion tokens.

What Might Be The Next Top Trending Crypto?

The Web3 landscape presents itself as intricate and fragmented, causing complexity and confusion. Navigating the third generation of the internet can overwhelm newcomers and exhaust seasoned users due to the multitude of platforms and resources available. Addressing this challenge, a new platform called Launchpad XYZ endeavors to create a unified environment for Web3.

Launchpad XYZ strives to become the ultimate destination for the Web3 arena, where it provides top-tier blockchain projects. It will achieve this goal via thoroughly evaluated presale tokens, NFT rankings, metaverses, and Play-to-Earn games. Furthermore, Launchpad XYZ will feature a user-friendly crypto wallet, DEX, analytics, news, educational resources, and a trading terminal.

The project has additionally created the Launchpad Quotient. This cutting-edge AI-driven ranking system examines 400 real-time data points to condense projects into a solitary value. Besides, it indicates the risk-reward potential in any Web3 asset – be it a cryptocurrency token or an NFT.

Launchpad XYZ will furnish comprehensive analytics on hundreds of coins and identify arbitrage opportunities. It will present trading insights from renowned professional traders and deliver customized indicators for assets with technical analysis.

The platform possesses a built-in decentralized exchange (DEX) that enables users to purchase, sell, and trade numerous asset pairs. Subsequent iterations will introduce restricted perpetual contracts for specific pairs, and staking LPX will grant users a fee reduction.

Moreover, Launchpad XYZ boasts Apollo, a proprietary AI language model. It will aid users in identifying promising prospects within the domain and deliver comprehensive search outcomes based on straightforward instructions.

Launchpad’s team has made 25% of the 1 billion maximum supply of LPX available for the presale. Also, they are allocating 40% towards the platform’s development. Additionally, they are dedicating 15% to user acquisition, 12.5% to themselves, and 10% to market making.

The presale of the platform’s native LPX token, scheduled to end in the third quarter of 2023, is underway. As of the second quarter’s conclusion, the creators of Launchpad XYZ have managed to secure $1.15 million in funding. Once listed, they will set the token’s price at $0.0565.

Join Launchpad XYZ before it is too late.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage