Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – December 2, 2020

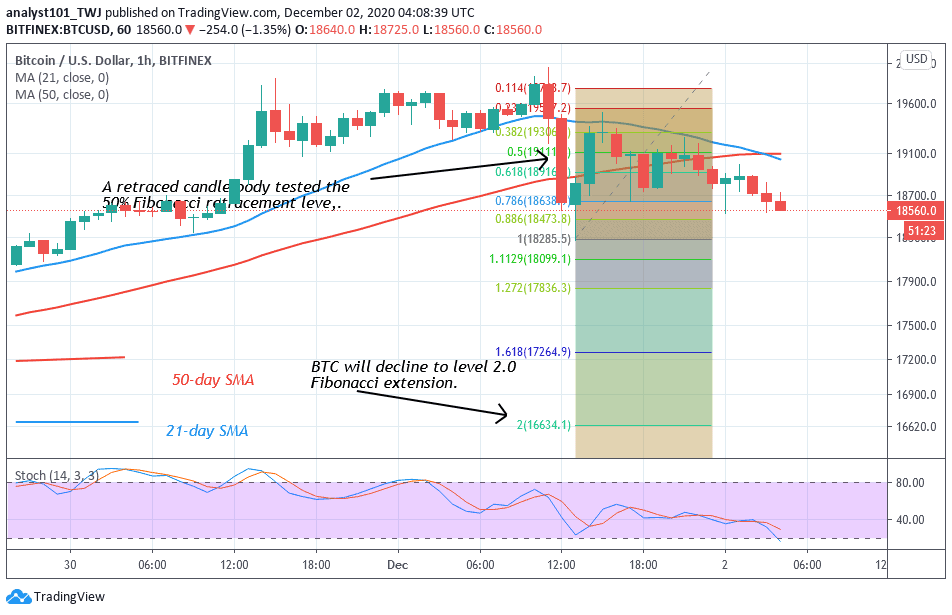

On November 30 uptrend, Bitcoin rallied to $19,740 but faced another rejection at the recent high. In the first uptrend of November 24, BTC reached a high of $19400 and was resisted which led to the coin falling to $16,600 low.

Resistance Levels: $13,000, $14,000, $15,000

Support Levels: $7,000, $6,000, $5,000

Bitcoin bulls have made attempts to push BTC above the $20,000 overhead resistance. In the first attempt on November 24, buyers were able to push the price to reach $19,400 high but were subsequently repelled. This resulted in the coin reaching a low of $16,600. In the second attempt on November 30, buyers pushed BTC to $19,740 but were also resisted.

The downward move has begun and the king coin is likely to revisit the previous low of $16,600. Nonetheless, the crypto is likely to be range-bound between $16,600 and $20,000 if the bulls fail to push above the $20,000 price level. On the upside, if buyers were able to push the coin above $20,000, BTC will rally above $22,000. Meanwhile, the coin is trading at $18,557 as at the time of writing. BTC price is expected to reach a low of $16,600 before resuming upward.

Microstrategy’s $425 Bitcoin Purchase Executed by Coinbase in September 2020

Coinbase is the United States’ largest cryptocurrency exchange that facilitated the execution of Microstrategy’s $425 Bitcoin Purchase. According to reports, Coinbase was selected as the primary execution partner for the exercise in September 2020.

The BTC purchase took more than five days to complete. Meanwhile, the head of institutional sales at Coinbase, Brett Tejpaul explains further: “Using our advanced execution capabilities, leading crypto prime brokerage platform, and OTC desk, we were able to buy a significant amount of Bitcoin on behalf of MicroStrategy and did so without moving the market. According to the post, MicroStrategy chose Coinbase because the platform provides several market tools like smart order routing and algorithmic trading tools.”

Nevertheless, Bitcoin is falling as a result of the rejection at the $19740 high. According to the Fibonacci tool indicator, the market is expected to fall to the previous low. On December 1 downtrend; a retraced candle body tested the 50% Fibonacci retracement level. The retracement indicates that BTC is likely to fall to level 2.0 Fibonacci extension or the low of $16,634.10.

Join Our Telegram channel to stay up to date on breaking news coverage