Join Our Telegram channel to stay up to date on breaking news coverage

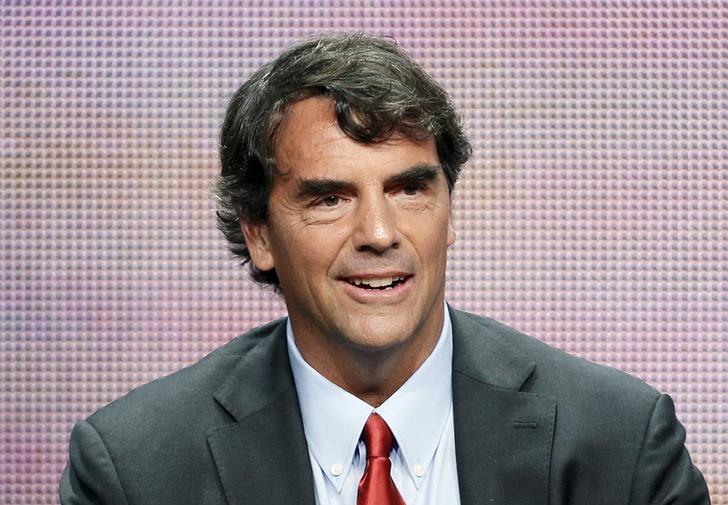

Billionaire businessman and investor Tim Draper has built a reputation for himself over his bullish views on Bitcoin. However, he also appears to be diversifying his portfolio to include other digital assets, following the time-tested rule of investing.

The Right Way to Invest

Recently, Draper appeared in an interview with British investor and businessman Rob Moore. In the interview, the pair spoke about the financial market, and how the coronavirus pandemic had forced investors to amend their portfolios.

Draper explained that he was losing faith in the dollar. In part, he said that the Federal Reserve is printing $9 trillion in currency – a move driving all knowledgeable investors out of cash and into alternative assets.

Draper explained that this presents the most significant advantage for Bitcoin, an asset whose supply has a fixed peg. In part, he explained:

“There are only 21 million of them and they are going to be more and more valuable as you see governments have less and less,” he said in part.

On the flip side, Draper also pointed out that he isn’t committed to the top cryptocurrency alone. He expressed praise for its fork, Bitcoin Cash. The investor also pointed out that Ether was performing somewhat well, although he had concerns over the top altcoin’s issuance rate.

Draper added to Moore that he now holds a portfolio of several cryptocurrencies. He also credited the fact that his portfolio is up during the pandemic to his ability to find the right mix of digital assets.

Neck-Deep in Crypto

The angel investor has continued his aggressive push for cryptocurrencies, as he appears to be getting deeper into the market. Apart from his prediction that Bitcoin will reach a price peg of $250,000, he has also gained notoriety for taking his Wall Street-style aggressiveness to crypto investing.

Earlier this week, Draper joined the Unitize panel, where he promoted Initial Coin Offerings (ICOs) as a much better means of making money than the traditional Initial Public Offering (IPO) – especially for blockchain firms.

During the panel, Draper explained that existing regulations have made it challenging for blockchain firms to go public. He pointed out that the IPO process in the past made it easier for companies worth $150 million, and with $20 million in revenues, could go public. Now, he won’t recommend an IPO for a company worth less than $10 billion.

However, alternative fundraising methods – including smaller investments and tokenization – can help blockchain firms to survive. “The regulators made it so expensive to go public that it’s really not worth it […] The largest investments are coming from those large funds, and that tends to be an easier way to get your money than trying to go public.”

He also pointed out that diversity is vital in terms of funding for early-stage startups. With an ICO or another alternative funding means, factors like history, origin, race, and sex become irrelevant when it comes to what company to fund. Eventually, the most vital factors are the company and the solutions that it hopes to bring.

Join Our Telegram channel to stay up to date on breaking news coverage