Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – May 12, 2020

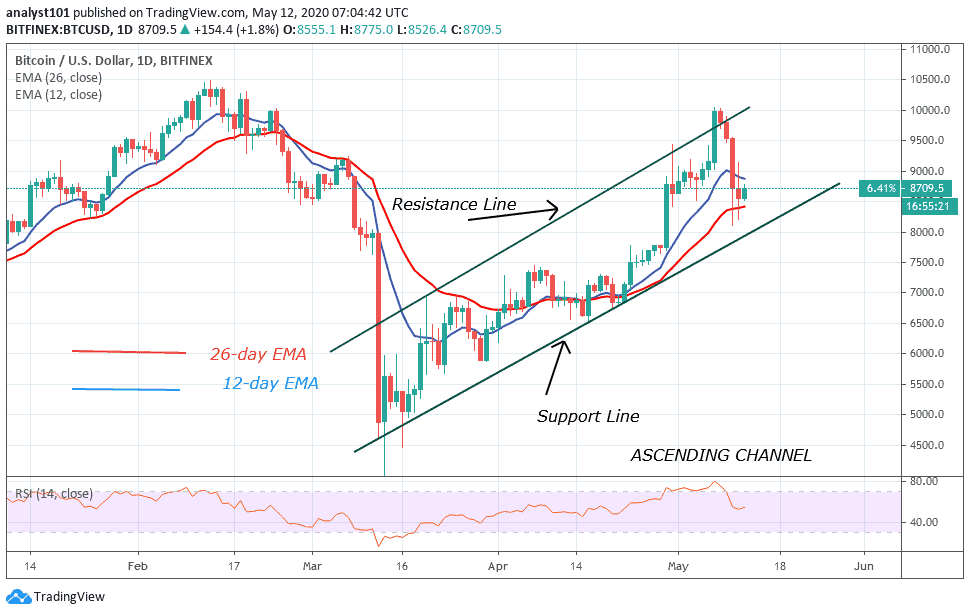

Surprisingly, in the last 24 hours, BTC/USD pair was making an impressive move as it reached a high of $9.142. The bulls penetrated the resistance at $8,800, and $9,000 but were stopped at $9,100. Analysts believe that a break above $9,100 and subsequent sustenance of price will propel BTC to rally.

Key Levels:

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

Interesting ly, after the price surge, the bulls were resisted and BTC dropped to $8,200 yesterday. Immediately, a downward correction was made as price returned above $8,500. BTC is stable as it continues to fluctuate above $8,500. On the upside, BTC can possibly retest the $10,000 resistance, if price is sustained and the $9,100 resistance is breached. Above the $9,100 support, the momentum can extend to $9,500. Nonetheless, if the bulls fail to push price above $9,100 resistance, the bears may catapult price to a previous low of $8,200.

On the downside, the bears have been testing $8,200 for a possible downward move. If the bears succeed in breaking the $8,200 support, the next support will be $8,000. Bitcoin will continue its uptrend as long as the $8,000 support holds. On the contrary, if the bears break below the $8,000 support, there is likely to be a change in trend. The king coin will drop to $7,500. Presently, the coin has fallen to level 55 of the Relative Strength Index period 14. This implies that Bitcoin is in the uptrend zone.

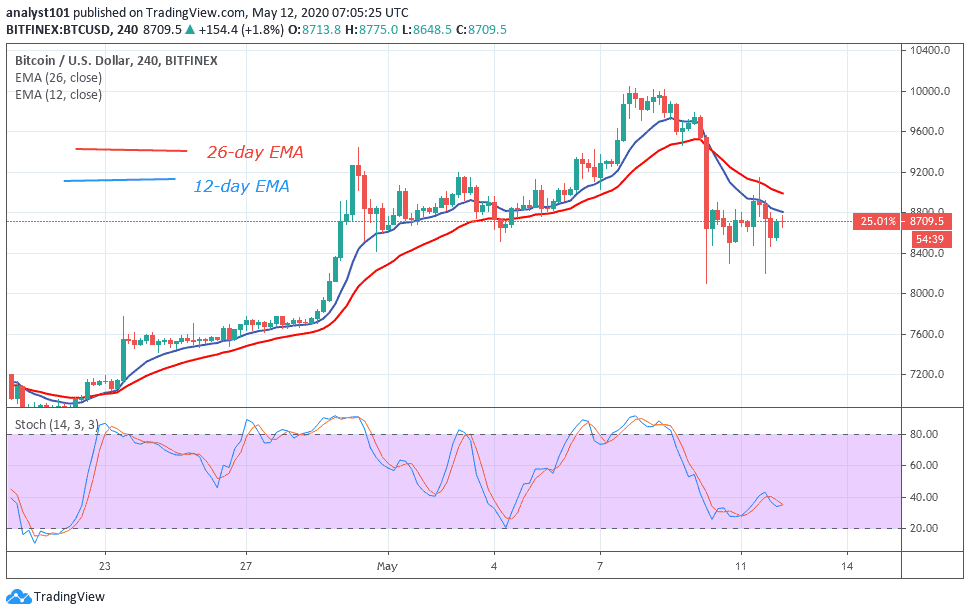

BTC/USD Medium-term Trend: Bullish (4-Hour Chart)

On the 4 hour chart, the price surge of yesterday was resisted at $9,100 and as the market dropped immediately. The coin is still consolidating above $8,500 support after failing to breach the $9,100 resistance. On the downside, if the bears break below $8,400 support, the price will revisit the previous lows of $8,200 and $8,000. The market is above 20 % range of the daily stochastic. This indicates that the king coin is in a bullish momentum.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage