Join Our Telegram channel to stay up to date on breaking news coverage

XPTUSD Price Analysis – June 20

In case the Bulls maintain or increase their pressure, the price of platinum may reach the supply level of $898.

XPT/USD Market

Key levels:

Supply levels: $898, $962, $1,030

Demand levels: $833, $776, $714

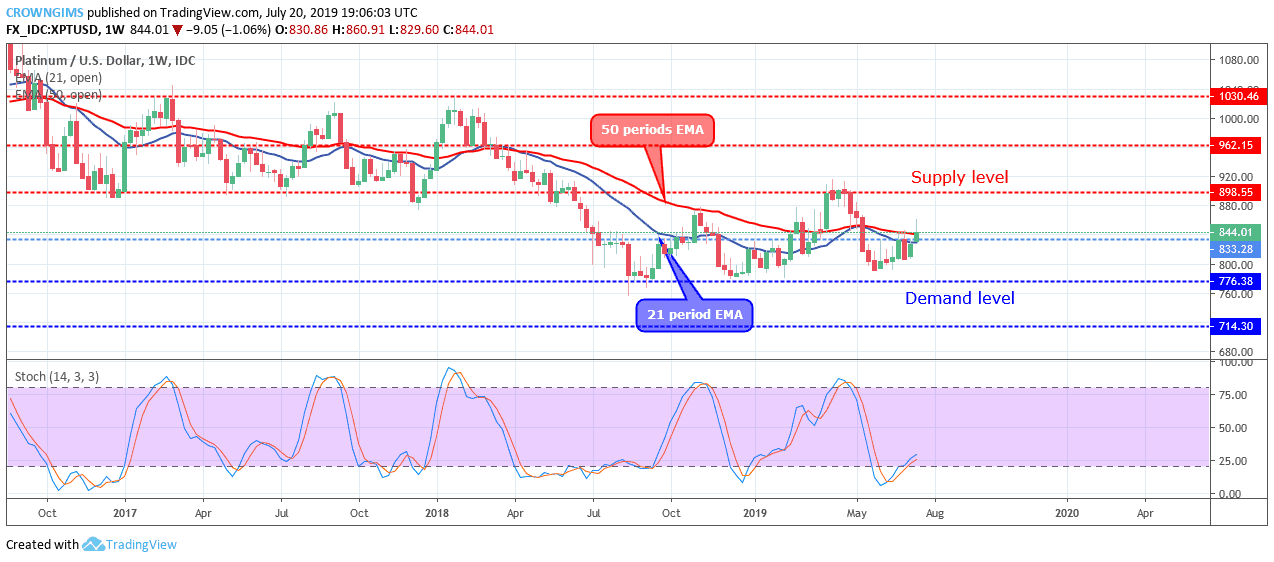

XPTUSD Long-term trend: Bullish

On the weekly chart, XPTUSD is bullish. The Platinum consolidated at the former supply level of $833 for three weeks. At just concluded week, the Bulls gained enough pressure that pushed up the price and it broke up the $833 level and also penetrated the dynamic resistance level (21 periods EMA and 50 periods EMA level). The price moved towards the supply level of $898. The price eventually pulled back before the closing of the market last week.

XPT price has moved above the 21 periods EMA and 50 periods EMA and the former is trying to cross the later upside to establishing a bullish trend. The stochastic Oscillator period 14 is above 25 levels with the signal line pointing up to indicate a buy signal. In case the Bulls maintain or increase their pressure, the price of platinum may reach the supply level of $898.

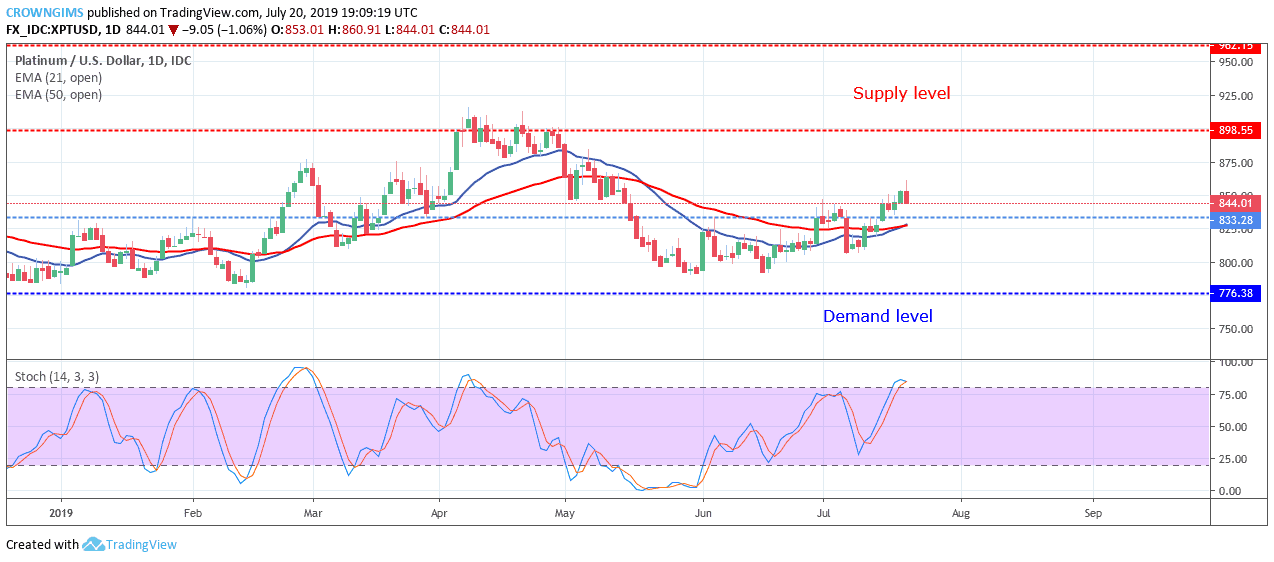

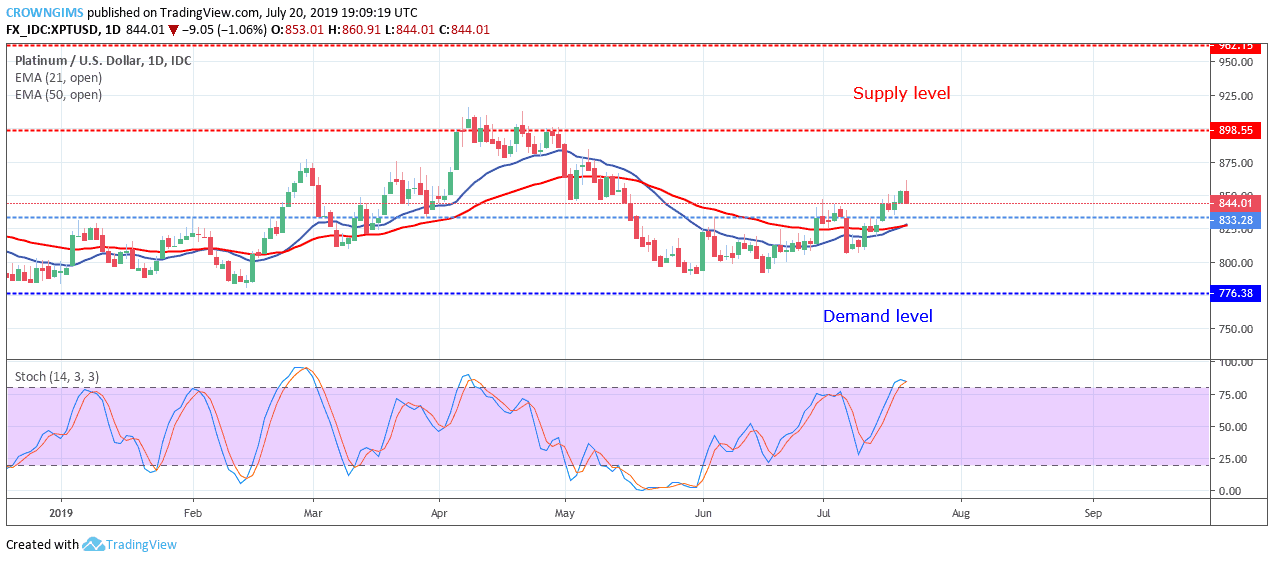

XPTUSD medium-term Trend: Bullish

XPTUSD is bullish in the medium-term outlook. The strong bearish candle that emerged on July 05 served as a price retracement to the Platinum market before the continuation of a bullish trend. On July 15, the bullish momentum broke the barrier at $833 level and the price is advancing towards $898 level.

The 21 periods EMA is crossing the 50 periods EMA upside as a sign of an uptrend. The price is trading above the two EMAs. The Stochastic Oscillator period 14 is at 80 levels and the signal lines crossing each other downside to indicate sell signal which may be a pullback.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage