The trading of foreign currencies, or simply ‘Forex’ or ‘FX’, is arguably one the largest investment markets in the world. To illustrate just how big the forex scene has become, it is estimated that the industry is responsible for more than $5 trillion in trading volumes – each and everyday.

With so many platforms to choose from, how do you go about finding the best forex brokers? What should you look for when choosing a FX brokerage service? Read our guide to find out the best forex brokers for 2025.

It is important to note that forex trading is not just reserved for institutional investors. On the contrary, the forex investment space is utilized by traders of all sizes. Whether you’re looking to trade forex full-time, or for a couple of hours a day, there are now heaps of established trading platforms available to choose from.

Keep in mind that the platforms we are referring to in this guide are not bitcoin robots such as Bitcoin Revolution and Bitcoin Trader, but actual brokers.

Best UK Forex Brokers for 2025

If you’re interested in trading forex and you’re based in the UK, you’ll be

Best Forex brokers for U.S customers

Although U.S. citizens are somewhat restricted when it comes to trading

Just remember, if you are based in the U.S., you’ll be required to submit additional information during the application process with respect to your tax obligations. Furthermore, all of the following forex brokers are registered with the Commodity Futures Trading Commission (CFTC), meaning they are fully authorized to accept U.S. citizens.

Best Forex CFD Brokers for Australia & New Zealand

For those looking for a CFD broker that allows you to trade forex and are located in either Australia or New Zealand, we would recommend taking a closer look at Plus500. Although the broker has a very strong presence in the UK space, they hold all of the required licenses to accept traders from both Australia and New Zealand.

As a company listed on the stock exchange, Plus500 discloses all its financials and is considered one of the most reputable forex trading platforms in the industry. The minimum deposit for forex trading on Plus500 is $100 and the leverage offered on their forex trading accounts is a maximum of 1:30.

Best Forex brokers for advanced traders

If you are looking for a highly advanced platform and you are a more experienced trader, then FP Markets is probably your best bet. Launched in 2005 and based in Australia, the broker offers huge leverage levels of up to 500:1. On top of this, and perhaps most importantly, FP Markets are an ECN broker, meaning that among other benefits, you’ll have access to ultra-low spreads.

Cheap Forex brokers

Trading fees are an important factor to consider when searching for a new forex broker. This is especially true if you trade smaller amounts, as low-level traders are often penalized for small trade sizes. As such, Plus500 is potentially one of the most competitively priced CFD brokers operating in the market. Their commission-free pricing system is further amplified by tight forex spreads, especially in the major pairings.

Forex Brokers Ranked By Category

The main types of forex brokers are Dealing Desks (DD ) and No Dealing Desk (NDD).

Forex brokers that operate through Dealing Desks (DD) make money through spreads and providing liquidity to their clients. They are also called “market makers”. On the other hand, NDD brokers simply link two parties together and do not execute their clients’ orderes through a Dealing Desk.

Now that we understand the division of forex brokers, it is also important to know that there are many different types of forex brokers out there. The different options available nowadays means that you are more likely to find a forex broker suited to your needs – whether it be high leverage, low spreads, or a large forex bonus. Below are the different types of forex brokers explained.

High leverage forex brokers provide the chance to use borrowed capital as a funding source. With leverage trading, traders can open FX positions with a small balance, and employ risky tactics such as opening a large number of trades at the same time.

Leverage in FX trading can go as far as 1:1000, meaning that for every $100 in your trading account, you could be trading up to $100,000 in value. Some of the most popular forex brokers with high leverage include XM Global currently offering leverage up to 1:888 and FXGlory with 1:3000 max leverage.

It is crucial to note that higher leverage in a forex trading account is perceived as riskier due to the possibility of losing all capital. Therefore, we recommend that you take precautions when opening trades with leverage, especially for beginners who tend to be unfamiliar with forex money management techniques.

STP forex brokers are platforms offering STP trading accounts (“Straight Through Processing”). STP brokers are similar to ECN brokers in that the broker’s trading commission is included into the spread, which makes it highly affordable.

STP trading accounts also begin at a low minimum deposit of $10 and offer very small transaction sizes. The trades are executed in the real market (the interbank market), where the big banks play the role of liquidity providers.

Trading with STP forex brokers is typically more cost-effective since STP brokers do not profit from the loss of traders (unlike Dealing Desk brokers) and they typically only charge on the spread. STP forex brokers also accommodate traders with different strategies (scalping, hedging, etc) , and offer the possibility of using high leverage. These USPs make STP brokers one of the best choices for forex trading. Some of the best STP forex brokers for 2019 are IC markets and Vantage FX.

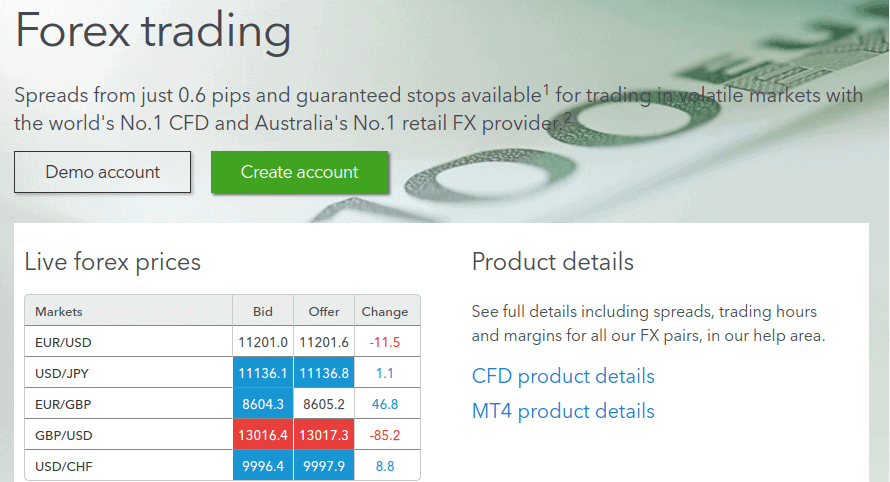

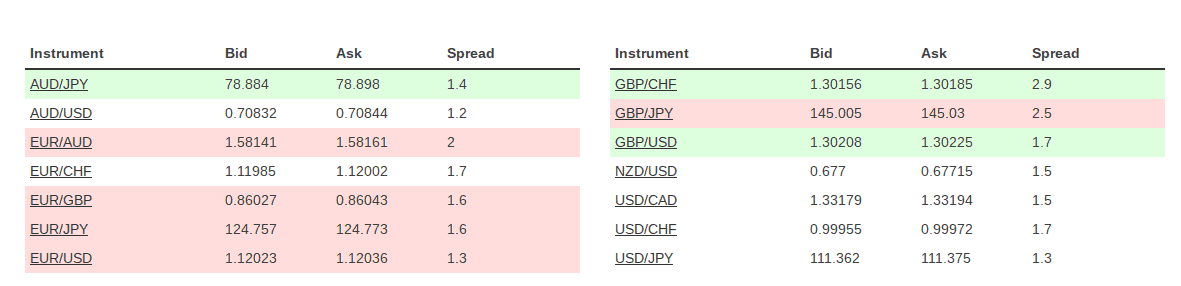

Low spread forex brokers charge small trading fees, which is particularly interesting for traders using scalping strategies who open various trades within one day and want to keep their commissions as low as possible. In order to cut their losses, those traders benefit from cheap forex brokers with tight spreads.

Since the main goal of trading is to secure personal funds and limit losses, using a low spread fx broker makes up a large part of any profitable forex trading stategy. Different brokers offer different spreads, but some of the cheapest options in the market today include Pepperstone with spreads starting at zero, and IC Markets, with an average spread of 0.1 pips.

According to Islamic law, Muslims are prohibited from trading for profit and their finance must be driven by ethics and justice. Islamic clients are also prohibited from executing risky trading strategies, and must not use brokers with high interest fees which according to Islamic law is exploitative and unlawful. Islamic forex brokers, also known as ‘no swap brokers” have therefore emerged in order to allow Muslim clients to trade forex in compliance with the Shariah law. These accounts do not charge rollover interest on positions held overnight but do charge a trading fee on open positions. The best Islamic trading account is IC Markets.

A good Forex broker bonus is a key characteristic for choosing a forex trading account. A forex bonus is a promotion offered to new or existing customers by a forex broker which can be accessed by signing up on a website or by depositing funds into your forex trading account.

There are 2 different types of forex bonuses. The first type is a forex deposit bonus which is trigger when a client makes a deposit. These are usually measured in %. An example of this is a 50% forex deposit bonus, which means that if you deposit $1000 you will receive $500 on top and have $1500 to trade with.

A forex no deposit bonus is a promotion which does not require the client to deposit funds. The only thing the client must do is sign up to the website, and their free forex bonus will be immediately available to trade with. This is a great option for beginners or those with limited funds as it allows you to trade the forex markets without risking your own funds, and to potentially make profits. Some of the best forex broker bonuses available are offered by Xtream Forex (100% initial deposit bonus), and RoboFX with a classic bonus of up to 115% on deposit.

What is Forex trading?

Forex, or simply FX, refers to the trading of foreign currencies. As domestic currency valuations fluctuate on a second-by-second basis, this makes it a highly active investment segment. The forex trading industry is now so fundamental that more than $5 trillion is traded on a daily basis.

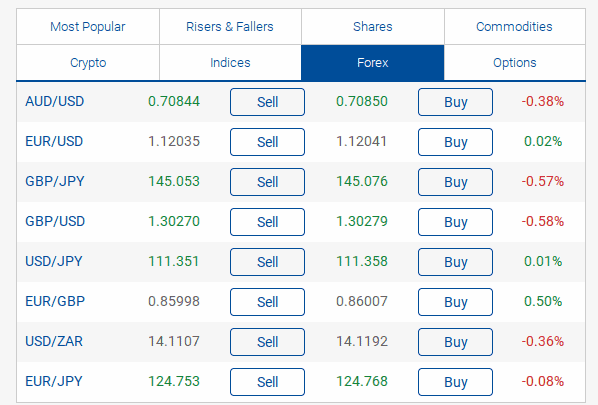

When trading two currencies against one another, this is known as a ‘pairing’. For example, GBP/USD would be one pairing, while USD/JPY would be another.

Generally speaking, forex pairings can be broken down into three key categories.

Major pairings

Firstly, and as the name suggests, major pairings must include the world’s most dominant currency – the USD. As such, each pairing must contain the USD on one side. These pairings must also include an additional major currency, such as GBP, EUR or JPY.

Here’s a full list of the major pairings.

- EUR/USD: Euro/US dollar

- USD/CAD: US dollar/Canadian dollar

- USD/JPY: US dollar/Japanese yen

- USD/CHF: US dollar/Swiss franc

- GBP/USD: British pound/US dollar

- AUD/USD: Australian dollar/US dollar

- NZD/USD: New Zealand dollar/US dollar

Minor pairings

Minor pairings refers to currencies that are still ultra-strong, however they do not need to include the USD. Example pairings includes the likes of EUR/GBP, GBP/JPY and AUD/JPY.

Here’s a list of some of the most widely traded minor pairings.

- CHF/JPY: Swiss franc/Japanese yen

- EUR/GBP: Euro/British pound

- GBP/CAD: British pound/Canadian dollar

- NZD/JPY: New Zealand dollar/Japanese yen

- EUR/AUD: Euro/Australian dollar

- GBP/JPY: British pound/Japanese yen

Exotic pairings

Finally, exotic pairings will include one major currency alongside a currency from a less dominant economy. These trading pairs often struggle to attract as much liquidity as major and minor pairings and thus, operate in a more volatile nature.

Here are some examples of some widely traded exotic pairs.

EUR/TRY: Euro/Turkish lira

NZD/SGD: New Zealand dollar/Singapore dollar

USD/HKD: US dollar/Hong Kong dollar

How does a Forex broker work?

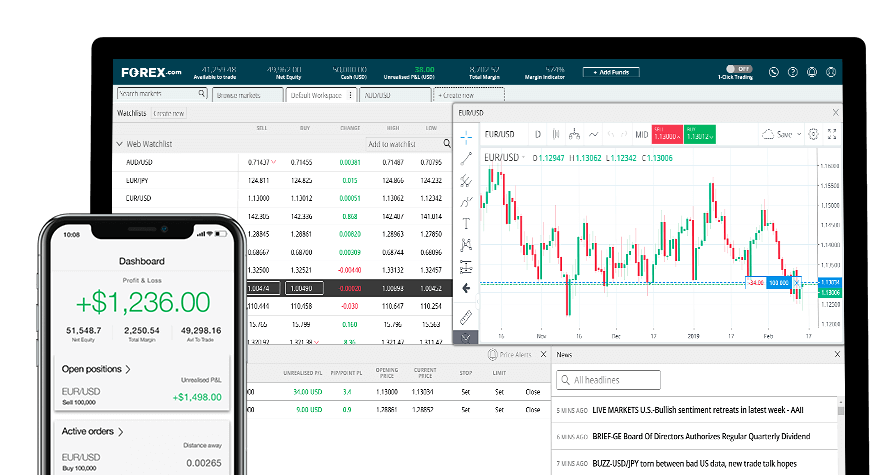

Essentially, the role of an online forex broker like ATFX is to facilitate currency trading for investors. The platform will be responsible for matching buyers and sellers, subsequently allowing investors to trade in the open marketplace.

On top of providing the required tools for online investors, forex brokers will facilitate deposits and withdrawals, and in most cases, will provide an array of educational tools, as well as fundamental and technical analysis.

Due to the sheer size of the forex broker marketplace, each platform will have its own advantages and disadvantages. However, one of the most important factors that you need to consider is whether or not the broker holds the required regulatory licenses, and that they have acquired an established reputation.

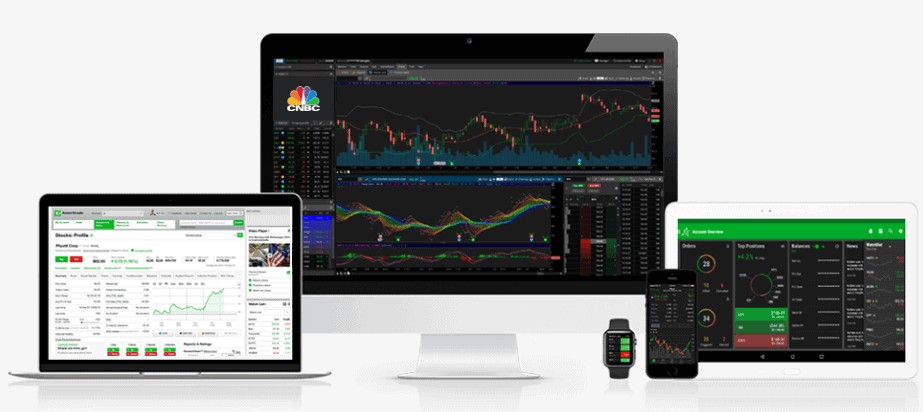

What kind of Forex trading platforms are there?

1. MetaTrader 4 (MT4)

The underlying trading platform used by the vast majority of online forex brokers is that of MetaTrading 4, or simply MT4. First launched in 2005, MT4 is an electronic trading platform that facilitates ultra-fast forex trades in a safe and secure eco-system.

Prior to MT4, forex brokers were forced to design and host their own trading technologies. However, due to the sheer popularity of MT4, alongside the ease at which online brokers can install it in to their platforms, the protocol is now commonly used by most forex brokers.

2. MetaTrader 5 (MT5)

Alternatively, some brokers now use the more recent MetaTrader platform, which is that of MT5. MT5 has the capacity to facilitate trades across stocks, futures and of course CFDs that represent forex pairs.

3. cTrader

Competing with both MT4 and MT5 is that of cTrader. The platform also offers highly advanced capabilities in the trading of forex, subsequently providing up to 70 charting indicators across 54 time-frames.

What type of Forex trading accounts are there?

Although forex trading is accessible by investors of all shapes and sizes, most brokers will allocate a specific trading account based on your individual circumstances. In most cases, this will either be in the form of a retail/individual account, or for more experienced traders, an institutional account.

➡️Retail/Individual client account

Regarding the former, this will be an account best suited for casual traders, or for those with very little experience. By having a retail/individual client account, you’ll ability to obtain leverage is likely to be limited. If leverage is offered, this will be for ratios significantly lower in comparison to institutional accounts.

Depending on where you are based, retail/individual traders are sometimes accustomed to regulatory compensation schemes and financial protections, should the broker in question not have your best interests at heart.

➡️Institutional client account

When it comes to an institutional account, you’ll need to go through a much more stringent client onboarding process, and be able to prove that you have the required knowledge and experience to trade significant volumes. Once you are set up, you’ll likely be offered substantial levels of liquidity, with brokers facilitating ratios of up to 500:1.

How do I choose a Forex broker?

Due to the sheer size of the forex brokerage industry, it can be a difficult task trying to find the best platform for your individual needs. Here are 10 tips to consider to help you along your way.

Conclusion

In conclusion, the online forex space is facilitated by a huge number of brokers. While listing them all would be beyond the remit of this guide, we have discussed the most notable. As you have probably now ascertained, you need to consider a full range of factors before joining a new broker. Take some time to understand what is most important for your needs.

In an ideal world, you want to choose a CFD broker such as Plus500 that is heavily regulated, has a full range of currency pairings and offers low fees and spreads.

How We Rated These Forex Brokers

In order to provide you with the most up-to-date, accurate and unbiased reviews, we have tried and tested each and every one of the brokers that makes our list. To give you an idea to what we look for when judging whether an online forex broker is worth choosing, we’ve listed the most important factors below.

- Trading fees, commissions, and other fees

- Spreads and leverage

- Basic risk management tools (stop losses, guaranteed stop losses)

- Risk management instruments (futures, options, swaps)

- Technical indicators

- Research and news

- Education and training resources

- Trading interface usability and customizability

- Trading platform (MetaTrader, cTrade, proprietary)

- Range of securities traded (CFDs vs direct trading)

Read more:

FAQs

In its most basic form, the vast bulk of ‘real-life’ forex trading is performed by financial institutions of phenomenal size. Known as inter-bank trading, these institutions trade currencies on a direct basis. For lower level trading, such as that found via online forex brokers, the broker will purchase currencies on behalf of its clients. As such, this is why you must pay brokerage fees.

All of the forex brokers we have recommended in our comprehensive guide also allow you to trade forex. This will either be in the traditional sense (where you actually own the equity), or via a CFD (Contract-for-Difference).

You can. Trading forex online is super easy, and much more efficient in comparison to the days where you would need to make a purchase via the telephone.

Each broker will have their own fee structure and thus, you should also check this before making a purchase. In most cases, this will be in the form of commission, and is usually charged when you both buy and sell the asset.

In order to trade forex without a broker, you would need to be recognized as an institutional investor. This would require a significant amount of financial clout, not least because you would be dealing directly with the exchange that lists the assets. This is why the services of a broker are crucial for every day investors.

Forex brokers usually offer a full range of tradable pairings, which is usually determined by majors, minors and exotics. Majors are strong currency pairings that always contain the USD on one side. Minors are also strong currency pairings, but they don’t need to contain the USD. Exotic currencies contain emerging currencies from weaker economies.

If you believe the currency listed on the left-hand side of pairing will rise in value, then you’ll want to ‘buy’ the pairing. Alternatively, if you think the currency of the right-hand side of the pairing will rise in value, then you’ll need to ‘sell’ it.

The position size is the amount of money you want to risk per ‘point’. For example, if you risk $10 per point, and the pairing rises in your favor by 20 points, then you would make a profit of $200.

Forex stands for ‘Foreign Exchange’. It is also commonly referred to as ‘FX’.

This is entirely dependant on how you set up your trade. Keeping position sizes low and free from liquidity will reduce your exposure, as will installing sensible stop-losses. On the other hand, utilizing high levels of liquidity and failing to install stop-losses is an ultra-high risk strategy.

The amount of leverage available is dependant on the broker that you use, and the type of investor status you hold. Institutional investors will be afforded much higher liquidity levels than retail/individual investors.

Each broker will have their own minimum deposit amounts, as well as the minimum position size you can implement per trade. Some brokers allow you trade really small amounts, which is perfect for newbies. Always check this before you register an account. What is the difference between online forex brokers and real-life forex brokers?

Which online trading company is best for trading forex?

Can I trade forex online?

What fees do forex brokers charge?

Can I trade forex without a broker?

What currencies can I trade with a forex broker?

How do I know whether to buy or sell a forex pairing?

What is a position size in forex trading?

What does forex stand for?

Is forex trading high-risk?

What leverage levels can I trade forex at?

What is the minimum amount I can invest in to a forex pairing?

Comments are closed.