Decentralized finance (DeFi) has witnessed exponential growth in the last two years. Of all the activities performed in the sector, staking has remained one of the foremost.

As the crypto markets are recovering in 2024, investors in cryptocurrency are looking to diversify into new ways to increase their holdings and earn crypto passive income, as an alternative to trading.

Crypto staking is the process of locking your coins on a platform and earning interest on it over time. Staking is the central premise of the fledgling proof of stake (PoS) technology, which many blockchains are now adopting. With PoS, participants lock (or “stake”) their coins on a protocol. Stakers are regarded as validators on the blockchain. Your annual percentage yield (APY) will be proportional to the amount of money you have in the staking pool – the more coins you stake, the more you earn. Staking crypto has grown in popularity, with many projects seeing high returns and online guides on how to stake crypto appearing in mainstream financial publications. The Ethereum 2.0 staking contract is currently the single largest holder of ETH tokens, with over 7.16M Ether tokens valued at $21.7 billion, at press time. In this crypto staking guide we’ll review some of the best crypto staking platforms to earn crypto passive income on. Binance is the world’s leading cryptocurrency exchange, with billions in assets being traded daily. Binance offers exposure to some of the largest crypto assets like Bitcoin, Ethereum, and several others. It also provides crypto staking services. Using its ‘Binance Earn’ crypto staking service, Binance allows you to earn interest on the staking coins you have in your wallet. The service has three staking options, namely locked staking, DeFi staking, and ETH 2.0 staking. Binance’s DeFi staking is focused on DeFi projects. Although they are considered the best coins to stake in terms of generating higher yields than locked staking, they are inherently riskier. ETH 2.0 Staking is the third option. ETH 2.0 allows you to earn staking rewards by supporting the Ethereum 2.0 network from your Binance wallet. Binance doesn’t charge staking fees when you use Binance Earn. But that might change soon. You can stake 69 assets on the exchange, as well as five flexible DeFi staking assets. These include Filecoin (FIL), Shiba Inu (SHIB), AOL, Kusama (KSM), and the Binance Coin (BNB). Your staking reward will vary on Binance, based on the asset staked, staking coins amount, and lock-up period. Coinbase is a US-based and leading exchange that emerged in 2021. The crypto platform provides crypto trading services and staking services across different PoS pools. To enjoy the staking service on Coinbase, users have to verify their identity with a valid TIN and reside in a location where staking is allowed. Unlike Binance, the pools available for staking on Coinbase are limited. Coinbase charges a commission for staking tokens on behalf of its users. Additionally, because Coinbase is US-based, US users are taxed on staking rewards as long as they are above $600, as provided by the 1099-MISC tax policy. Currently, there are thousands of staking pools distributed across various platforms. DeFi enthusiasts look out for pools with either high annual percentage returns (APR) or annual percentage yields (APY). Additionally, they try to stake assets with good fundamentals and room to grow in market valuation. Below is a list of some of the best coins to stake and the crypto staking rewards they can yield. Ethereum (ETH) has remained the second-biggest cryptocurrency behind Bitcoin and the largest altcoin in the history of digital currencies. Since Ethereum is switching to Proof-of-Stake consensus- also known as Ethereum 2.0- from the PoW model come 2022, Ether the native token has become a stakeable asset. This is currently one of the highest-ranking assets to stake in decentralized finance. Beyond this, it will be beneficial to be one of the early validators for ETH 2.0. The Ether staking pool which can be found on Eth2 LaunchPad is offering an annual yield rate of 6.8% to users. Those who participate can make crypto passive income before the transition to the PoS model is complete. Ethereum’s rival, Bitcoin cannot be staked because its blockchain still runs on the proof-of-work consensus which takes into account only physical input from miners before transactions are validated. As such, Bitcoin is only available for mining. Alternatively, users can stake the wrapped (ERC20) version of Bitcoin on other pools accessible through DeFi protocols such as Aave, Compound. The native token of the largest proof-of-stake blockchain, Cardano (ADA) has a staking utility. Cardano has the highest staking rate among other cryptocurrencies with staking functionality, with 71.7% of the tokens locked in various staking pools. ADA has an average yield rate of 4.6%. Cardano recently attained smart contract status, which provides more utility for its native token since many smart contracts will be launched with ADA being used to offset transaction fees. This will give the price of the token more value such that rewards earned for staking ADA will be more valuable. With the promise of being a blockchain designed to address the challenges of scalability and speed on other blockchains, Polkadot (DOT) has grown to become a favorite among investors. Its native token $DOT is now capable of being locked up in staking pools. $DOT has an average yield rate of 14%. Users can stake their tokens for as long as they prefer while they partake in the transaction validation process and earn valuable rewards for doing so. The price of $DOT has also been making new all time highs in 2021 in anticipation of its launch of parachains. Solana (SOL) is regarded as an Ethereum rival and the proof-of-stake blockchain has not failed to live up to the expectation, being one the best performing altcoins of 2021. $SOL, Solana’s native token is another great asset to look out for. With an average yield rate of 7.4%, users are sure to enjoy lots of rewards. SOL can be staked on Phantom wallet.. Tron (TRX) was a popular altcoin during the 2017 crypto bull run, developed and promoted by Justin Sun. It still has a loyal community of investors and has stood the test of time, having a large marketcap in 2024. Stablecoins are considering by more conservative investors to be the best coins to stake as they are less volatile, meaning they are not subject to sudden market fluctuations, unlike other crypto assets. One reason for this is that they are pegged to fiat currencies which give them adequate backing provided there is a reserve. Your principal is more guaranteed and the returns more predictable. Below are some stablecoins you could stake as well as platforms that enable stablecoins staking and yield rates: The disadvantage of staking stablecoins is of course that they don’t rise in value, they remain stable – whereas when you buy Ethereum and stake it you can earn income in two ways, both from the rise in the price of ETH, and from the crypto passive income. There are several ways how to stake crypto assets – DeFi staking, using staking-as-a-service platforms, staking on an exchange, and even on Hardware wallets. Decentralized finance advocates for users being in control of their funds, eliminating the role of a third party or an intermediary. This is the concept behind DeFi staking such that users act as validators and help secure the network just like miners do on PoW-enabled blockchains. More often than not, to run a node as a validator often comes with steep requirements. For instance, the minimum stake of 32 ETH required to run a node on ETH 2.0 is relatively high. Alternatively, you can opt for pools on decentralized exchanges such as Pancakeswap or Uniswap. In most cases, there is no minimum stake stipulated in these pools. This creates an opportunity for free entry and exit such that users can stake and stake at any time. In DeFi staking, you can earn passive income on your tokens via two means, namely liquidity mining and yield farming. With liquidity mining, stakers provide liquidity on a pool and are rewarded with transaction fees spent by other users of the pool. Tokens are often paired on liquidity pools (LPs). For example, you could have a pool with Binance Coin (BNB) and Axie Infinity Shards (AXS) paired together. Users who prefer to stake in this pool have to use equal amounts of BNB and AXS tokens. Staking-as-a-Service platforms are focused on providing crypto staking. Using these platforms, you are delegating your assets while they maintain a node as a validator on your behalf. Delegating your assets to them is not handing over custody – you are still in control of your assets and allowed to ‘undelegate’ them whenever you wish. While they run the nodes and handle other technicalities involved, they charge commissions on your rewards. This is like their rewards for the service rendered. Staking with SaaS platforms is also known as soft staking. Several platforms offer staking services and they do so across different pools. Only a few have been able to resonate with staking enthusiasts. Staking through this means is known as cold Staking. Investors who prefer this medium have to keep their PoS tokens staked in one address. Otherwise, moving them out of that address will cause them to lose their staking rewards. Hardware wallets are recognized for their security since they are not connected to the internet. Still, to access them, you would need a private key known to only the owners of such wallets. Many hardware wallets support staking. This is a leading wallet in the crypto industry in terms of security. It usually comes in two versions: the Ledger Nano S and X. Staking is supported on the Ledger wallet and users are in total control of their funds. Ledger supports the staking of up to seven coins including Tron (TRX) and ALGO. This is the oldest wallet and it supports the staking of assets like Tezos (XTZ) through third-party software. This is a Bluetooth-powered wallet and allows users to stake stablecoin USDT via its in-app X-Savings feature. Many leading crypto exchanges make things simple for their customers and offer automatic staking rewards on their platforms. There’s no need to set up your a node or purchase any special equipment. Rewards are automatically paid out to users monthly, with the platform reserving a small percentage of yields as the fee for operational costs and other incurred costs. Users should note that staking is not available in all countries via an exchange. The first step to staking crypto is to find a preferred crypto exchange. There are different platforms and each has its own strengths and weaknesses, unique features, and fees – find one that you’re comfortable with holding your funds. Most are available as free mobile apps on iOS or Android, or via their websites. Create an account with basic information and then verify that account. This will involve confirming an email address and phone number, and providing a photo ID such as a passport or driver’s license. Some platforms also require proof of address and may ask customers to complete a questionnaire. As mentioned above, staking services are not available on major crypto exchanges in some countries. Once an account has been created, search for the particular cryptocurrency you wish to stake. Find it via the search bar available on most platforms and then purchase the token. Different exchanges have different minimum purchase amounts and fees, but most will allow users to buy major cryptos such as ETH, ADA, and SOL, with fiat currency. Follow the instructions on-screen to complete the transaction. Next, navigate to the staking section of the app – on Binance, for example, this is called ‘Earn’. Find the token you wish to stake and the select the relevant product. Binance, for example, allows users to stake tokens for a set period of 30, 60, 90, or 120 days, with the rewards percentage increasing the longer a token is locked. Select the locking period and the amount to stake. Note that you can redeem tokens early if you decide to sell a token, but all potential rewards will be lost. Crypto exchanges will automatically distribute staking rewards, although the timescale for rewards varies. The rewards will not automatically be added to the staking pool, but there is nothing to stop users manually adding rewards to create compounding interest. Read more about how to buy cryptocurrency in 2024 here. While crypto staking may hold many benefits for those who engage in it, some risks must be considered as well. They include: This is what has driven some investors to use hardware wallets for their staking activities. Over the last few years, there have been several reports of hacks and exploits on both centralized exchanges and decentralized protocols. Huobi, for example, saw more than $100 million stolen in November 2023, This is what is considered an impermanent loss. When the asset is locked up, its value may decline, forcing the investor to sell off. However, if he doesn’t sell off, he may recover from the loss when the price of the asset rebounds. Where an investor uses a SaaS platform to stake his assets, he is likely to incur losses if the validator is not efficient in processing transactions. Many regulatory bodies are yet to assume a stance on crypto staking because it is a relatively new concept. Yet, earlier this year, UK regulators updated tax guidelines to include crypto staking classifying it into a similar vein as crypto mining. In the US, there are still debates as to the position of crypto staking in terms of taxes- whether it is in the same category as crypto mining. The United States IRS issued guidelines on crypto mining in 2014, declaring that mining is a business and would result in taxable gross income. Staking has become a lucrative venture for investors wanting to earn crypto passive income as an alternative to daytrading, or choosing to sell cryptocurrency and realise profits – it provides a way to hedge against downside risk, and compound gains. The growth of the industry will be spearheaded by Eth 2.0 staking as the complete integration of the PoS model draws near. While the benefits outweigh risks, investors still have to exercise due diligence if attempting to stake coins on small exchanges and lesser-known platforms. Several other of the best coins to stake are supported by reputable exchanges and crypto staking platforms Binance and Coinbase. The environmental benefits of crypto staking is also another plus point. The PoW consensus has been faulted by some for its implications on the climate. This is another area in which crypto staking bests crypto mining. Also read our guide to the top crypto saving accounts, another way to earn crypto passive income. Read more:

Crypto staking involves locking up your cryptocurrency assets for an extended period of time to unlock rewards or earn interest on your coins. Crypto staking rewards come in the form of more coins, making staking one of the simplest ways to earn crypto passive income.

We recommend Binance or Coinbase as two globally popular and secure crypto exchanges that offer staking services.

There can be risk attached to staking coins that are relatively new to the cryptocurrency markets and may end up as failed projects - earning crypto staking rewards on a token that crashes and doesn't recover won't be profitable long term. This is unlikely to happen with crypto majors such as ETH and ADA, although the price can vary wildly during a locked staking period.

The cryptocurrency markets have outperformed all other financial assets over the last decade, including Gold, and bank savings accounts. The crypto marketcap still has room to grow, currently at around a quarter of the size of Gold. Staking coins in order to earn more of that coin is safer than attempting to daytrade the volatile swings in the market. On this Page:

How to Stake Crypto – Quick Guide

What is Crypto Staking?

Compare Crypto Staking Platforms

1. Binance

Locked staking allows you to hold your coins for a pre-fixed period, between a week to three months. Funds are stored in your wallet, and you can withdraw whenever you want – although at a cost.

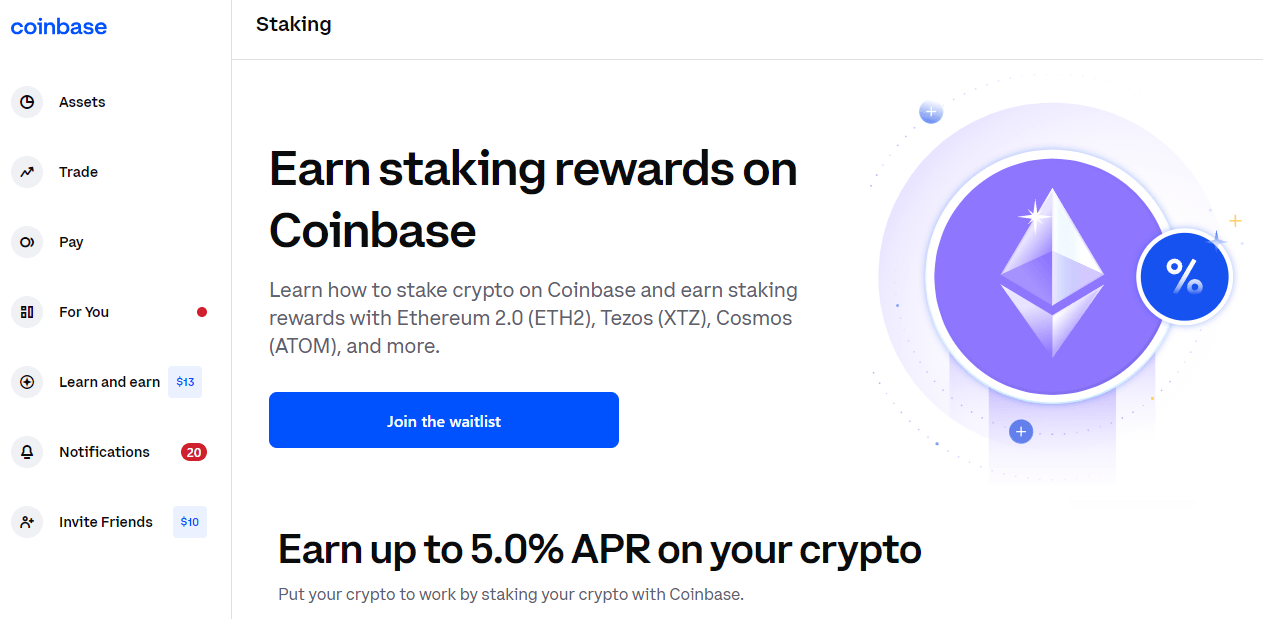

2. Coinbase

Coinbase allows users to stake on the following assets: DAI, USDC, Cosmos (ATOM), Tezos (XTZ), Algorand (ALGO) and largest altcoin Ethereum with an APR of 5%. Coinbase launched the pool for Eth2.0 staking in April 2021.

Best Coins to Stake

Ethereum

Cardano

Polkadot

Solana

Tron

Staking Stablecoins

How to Stake Crypto – Best Methods

DeFi Staking

Staking-as-a-Service Platforms

Staking on Hardware Wallets

Staking on Exchanges

How to Stake Crypto – Step-by-Step

Step 1 – Create an Account

Step 2 – Buy and Stake Coins

Step 4 – Receive Crypto Staking Rewards

Is Staking Crypto Safe?

Taxes Related to Staking

What is the Future of Crypto Staking?

FAQs

What does staking mean in crypto?

What is the best crypto staking platform?

Any risks in crypto staking?

Is crypto passive income a safe investment?