Join Our Telegram channel to stay up to date on breaking news coverage

GMX (GMX) price has been gaining bullish momentum over the past few months and continued its recovery in December. The price of the coin reached a high of $60 recently, which is its highest point since October 5 of this year. GMX has jumped by over 147% from its lowest level this year.

#catnews #crypto #tech Is DeFi back? GMX rallies toward all-time high and LOOKS price gains 30% – https://t.co/QaeytmSFT6 pic.twitter.com/mgEejePxO7

— DTM (@DerekTMcKinney) December 13, 2022

However, the reason for its massive upward rally could be attributed to multiple factors. Everything has been strengthening GMX’s value, whether it be encouraging remarks from well-known figures in the cryptocurrency industries or the overwhelming public interest in decentralized financing (DeFi).

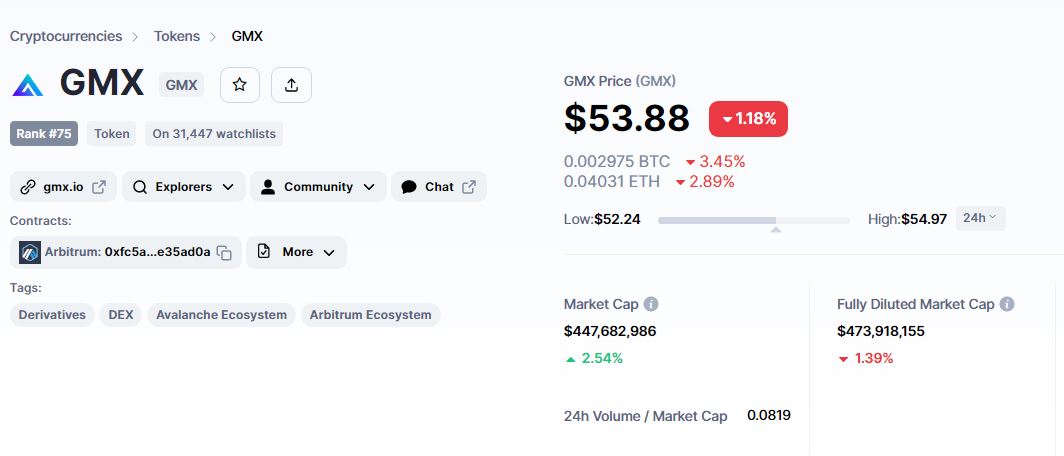

Although the upticks in the GMX coin appear to be fading on the day despite the recovering crypto market sentiment, The reason is yet unknown, though. The current GMX price is $53.90, and the 24-hour trading volume is $50,460,837.

In the last 24 hours, GMX is down over 1% and now ranks #77 on the market, with a live market cap of $430,738,017. The circulating supply is 7,990,696 GMX coins, and the maximum supply is not known.

BitMEX CEO Arthur Hayes Discussed Investment Thesis

As we previously stated, the GMX coin has experienced double-digit gains in the past week as former BitMEX CEO Arthur Hayes announced his investing thesis for this project. Former CEO of BitMEX and cryptocurrency icon Arthur Hayes admitted holding large bags of GMX tokens in a recent blog post.

👉 Former BitMEX CEO Arthur Hayes mentioned he holds sizable bags of GMX and LOOKS tokens in a recent blog post. On Nov. 28, GMX earned about $1.15 million in daily trading fees, which surpassed #Uniswap in protocol fees.

— Krypton AI (@KryptonAi) December 14, 2022

Hayes claimed that his prime reason for purchasing this token was the platform revenue and its potential to outperform traditional Treasury notes. Therefore, this statement has played a huge role in underpinning the GMX coin prices.

FTX Collapse Boost GMX

The collapse of FTX, the world’s second-largest cryptocurrency exchange, has gotten the most attention in the cryptosphere this year. Thus, the collapse of FTX prompted investors to shift their funds to decentralized exchanges like GMX.

It’s important to remember that Satoshi Nakamoto created Bitcoin in 2009, and he was most worried about the difficulties of centralization. He was concerned about the financial sector’s emphasis on a limited number of people at central banks.

3: Look for assets that perform well.

Decentralized perpetual exchanges have been the darlings of the bear market. Where can I short? Many chose protocols like $GMX and $ApeX, which have increased by around 70% and 50%, respectively, this year.— kitten Kash (@KittenKash) December 12, 2022

In contrast to this, GMX is a decentralized platform that is not governed by one person. It is also an open-source platform that accepts contributions from any user. Its transactions are also incredibly quick and economical because it is developed on top of Arbitrum and Avalanche.

According to data gathered by DeFi Llama, the total value locked (TVL) in GMX has reached an all-time high of close to $1 billion. In that way, decentralized exchanges like GMX gained a lot of popularity after the collapse of FTX, a leading centralized cryptocurrency exchange.

https://twitter.com/giorgionchain/status/1602730140856815616?s=20&t=Ks8XVI__S8K_zRPjPzUm_A

Cryptocurrency Market

The global crypto market has been flashing green on the day, buoyed by the probability that the Fed will raise interest rates by 50 basis points. Bitcoin (BTC) and Ethereum (ETH), two of the most valuable cryptocurrencies, surpassed $17,500 and $1,300, respectively.

Other cryptocurrencies, including Dogecoin (DOGE), Solana (SOL), Ripple (XRP), and Litecoin (LTC), also rose in value. Thus, the rebounding cryptocurrency market was viewed as another important factor that aided the GMX coin.

At 2 PM ET this afternoon the Fed will conclude its December monetary policy meeting, after which it is widely expected to boost the Fed Funds rate by 50-basis points, easing off the throttle on the pace of its efforts to tame inflation. #DailyMarketshttps://t.co/Ko781uJLtw

— Nasdaq (@Nasdaq) December 14, 2022

Another key factor that has supported the GMX coin is the bearish US dollar. The broad-based US dollar remained at its lowest levels since June against the euro and the pound on Wednesday, as traders awaited the Federal Reserve’s interest rate decision in the aftermath of mild US consumer inflation data that looked to give the Fed permission to stop its tightening pace.

The US stock market jumped on Tuesday as the Consumer Price Index data came in lower than expected, boosting expectations that #Inflation might soon ease. https://t.co/KKAZEZmXvJ

— The Epoch Times (@EpochTimes) December 14, 2022

Meanwhile, the November Consumer Price Index showed a smaller-than-expected gain for the second month in a row, while underlying consumer prices climbed by the least in 15 months. As a result, the dollar index was nearly flat after plunging to its lowest level since June 16 on Tuesday.

The Consumer Price Index show a slowdown in inflation with goods lowering across the board. #MarketWatch pic.twitter.com/pPao9u3f6t

— Jadid Herrera (@jadid) December 13, 2022

Moving on, the Fed is widely expected to raise interest rates by 50 basis points after raising them by 75 basis points in four consecutive meetings.

Top Coins Highlighted in the Highlights

With so many cryptocurrencies to choose from, it may be difficult to decide which one to invest in. Many investors consider supporting low-cost cryptocurrency startups at some point.

The majority of portfolios could benefit significantly from the addition of these digital currencies, which have token values of $5 or less.

Even though the market is slowing, the coins on the following list are excellent additions to our portfolio.

Dash 2 Trade (D2T)

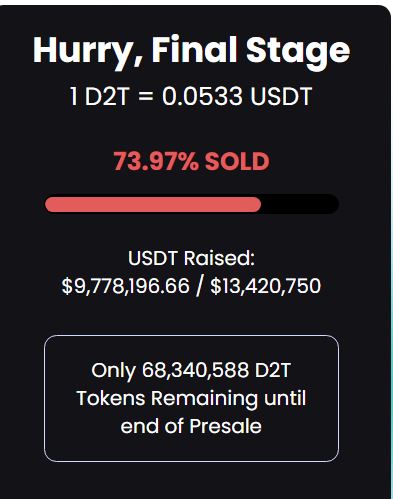

Dash 2 Trade is a cryptocurrency that operates on the Ethereum blockchain. It is intended to help you improve your cryptocurrency trading. It also helps you stay competitive in the industry by providing access to technical indicators and signals, as well as excellent on-chain data and trading approaches. You’ll get access to the most recent social data and on-chain analytics, as well as the most recent presale market data, via their unique grading system.

Dash 2 Trade debuted on October 19th for $0.0467 and raised $400,000 in less than 24 hours. Dash 2 Trade is nearing the end of its presale, having raised $9.7 million and trading at $0.0533. It has a total token supply of $1 billion, with the bulk of those tokens going on sale.

Investors rushed to the coin since it swiftly delivers useful crypto trading signals. Top-tier exchanges are prepared to list the D2T token following the presale due to the strong demand, and they anticipate a sizable amount of daily trading activity once the token becomes live.

LBank was the first to announce its D2T listing. LBank is a significant exchange with a daily trading volume of more than $1.4 billion. Following that, BitMart declared in a statement that they would start selling the D2T token when the presale was over.

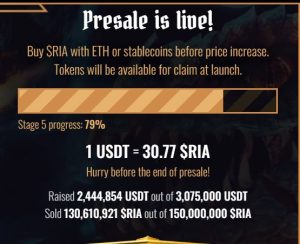

Calvaria (RIA)

RIA is a card game with an atheistic viewpoint that allows players to collect, trade, and battle with NFT-based cards. Calvaria will also provide a free-to-play version that will let gamers join without holding any bitcoin, making it more accessible to novices.

Calvaria has the potential to be more popular than other blockchain games since it does not exclude those who are unfamiliar with cryptocurrency. The RIA token, on the other hand, may be used in-game and staked for passive revenue, giving gamers a reason to keep the token.

The presale is currently 79% of the way through Stage 5, the final stage before it shuts, and has raised $2.4 million USDT in sales so far.

RobotEra (TARO)

RobotEra intends to give players higher-quality graphics than Decentraland and The Sandbox, as well as more engaging gaming mechanisms and income possibilities. In addition to player-versus-player games, RobotEra gives players many ways to win prizes as they explore the broken planet of Taro and try to fix it.

However, this approach will increase the game’s popularity and may even position it well for the upcoming bull run in a down market where investors are seeking assets with better yields. The first stage of RobotEra’s TARO token presale has collected over $540k. The cost per token will rise from $0.020 to $0.025 in stage 2 of the presale.

CCHG

C-Charge The ultimate goal is to transform the world via blockchain technology. By granting EV drivers access to benefits that were previously only available to major organizations and institutions, C+Charge seeks to democratize the carbon credit market.

C+Charge is the first on-chain or off-chain platform that allows EV drivers to earn carbon credits simply by running and charging their vehicles. By combining blockchain technology and decentralized finance, carbon credits will soon be the standard way to pay at EV charging stations.

Related:

- Best Crypto to Buy Now – Top 13 List

- 9 Best Future Cryptocurrency Tokens to Buy

- Whales are Predicting This Cryptocurrency to Explode 100x by 2023

Join Our Telegram channel to stay up to date on breaking news coverage