The popular internet meme ‘Hodl’ refers to not trying to trade the volatile swings of the markets (believing it’s time in the market, not timing the market) and just holding, not selling – confident that in the long run cryptocurrencies and decentralized finance (DeFi) will be the future of money, and continue to set new all time highs in the long term.

Crypto interest accounts target that market and reward them with a return on their investment (ROI) even when the markets are flat, or bearish – so that while you ‘hodl’ you are still generating income, which you can either withdraw to spend or keep to compound your position and profit more in the long-run when the markets turn around.

Youhodler is one such platform, and popularly known for being secured by Ledger, having a $150m insurance policy and an excellent TrustPilot rating.

Your capital is at risk.

YouHodler Review

When it comes to the blue chip cryptocurrency assets like Bitcoin and Ethereum, the ‘hodlers’ have always been correct – despite market crashes of 85 – 95%, both BTC and ETH have always historically recovered to set new highs.

As long as you avoid picking the wrong altcoins – as some do get abandoned by developers – cryptos are a good investment. The 50 crypto coins (and 8 stablecoins) Youhodler supports are verified projects that have a wide following, such as Chainlink, Uniswap, Cardano and some newer projects like ApeCoin.

If you’re interested in earning interest on crypto, we’ve reviewed several crypto savings accounts on this site – in this guide we review Youhodler.

What is Youhodler?

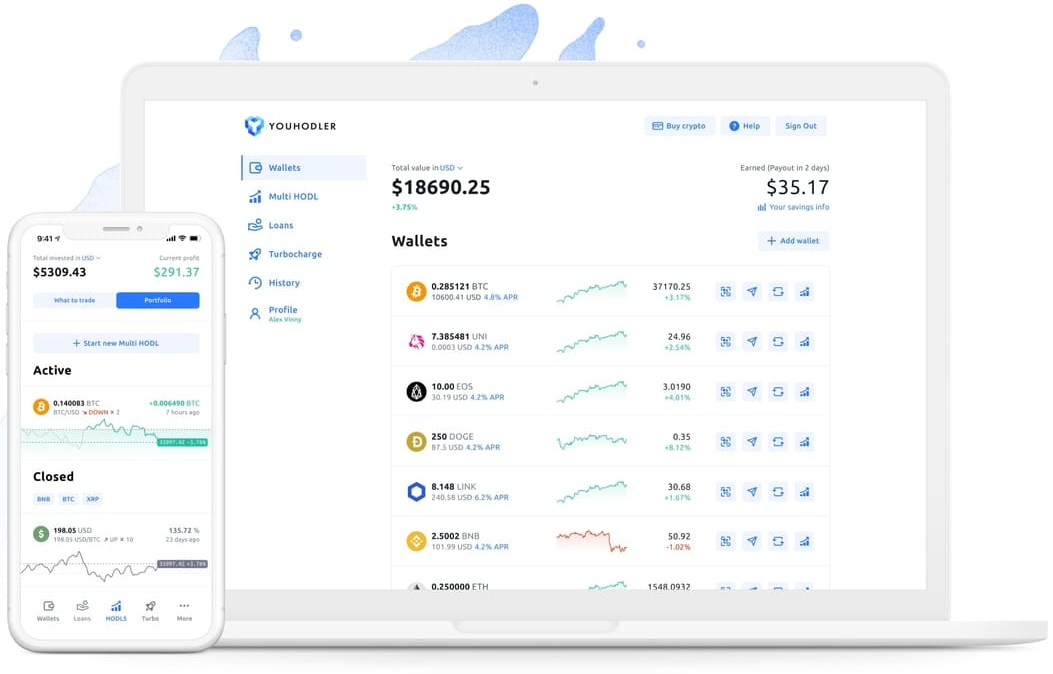

Youhodler works just like a bank account with a desktop platform you can log in to from your internet browser, and wallet style app you can open your mobile phone – find links to download it on the App Store or Google Play on the Youhodler website.

The Youhodler introduction video above from the Youhodler Youtube channel gives an overview of their mission statement – to make it so that holders don’t need to sell and experience FOMO (fear of missing out) by converting their crypto into cash, if they don’t want to.

YouHodler Supported Cryptos

Below are the almost 60 coins Youhodler supports currently- and more are continually added over time.

What stands out to us is that the stable coin yield is higher than on its main competitor Crypto.com exchange, known for its Crypto Earn program. That platform only pays up to 10% stablecoin APY and also requires staking CRO and committing to three-month fixed terms.

Your capital is at risk.

The addition of some low market cap altcoins that it’s difficult to earn interest on elsewhere, is also a welcome addition. For example Pancakeswap (CAKE) and Zilliqa (ZIL) are not yet supported by crypto lending platforms like Nexo, BlockFi, Celsius, Aqru or Crypto.com.

Synthetix (SNX) is also a lesser known crypto asset. Youhodler has attracted a wide user base by supporting a range of DeFi coins and utility tokens, as well as meme coins like Dogecoin.

The highest APY is offered on Polkadot (DOT), which is also the case on Crypto.com.

Crypto Loans

As well as earning interest on crypto, you can also take out crypto loans on Youhodler. Platforms like Youhodler and the ones mentioned above are crypto lending platforms – that’s where the interest they pay you is derived from.

When you deposit money into a high street bank, they lend deposits out to institutions – fractional reserve banking – while making sure everything is collateralized in case there’s ever a run on the banks. Crypto lending platforms do the same thing – and the people that borrow your crypto (selectively, with collateral and insurance in place) pay an APR to Youhodler.

Youhodler then pay you part of that as crypto interest – which is APY (annual percentage yield) because you also earn interest on the interest you’ve received, i.e. compound interest.

You have the option to sit back and collect that interest, or also take out crypto loans yourself, or both. The loan to value ratio (LTV) is one of the highest in the industry at 90% – by comparison, Crypto.com’s is only 50% – meaning you can take out up to 90% of the value of your crypto holdings as a loan.

So if you ever need money in the short term to pay for something, you don’t need to sell your crypto – you can still get liquid cash via a crypto loan, which you sell instead of your own crypto.

Youhodler loans range from 30 days to 360 days – the longer durations have a lower LTV. Everything is transparent, with no hidden fees like when using a credit card company, payday loan or similar provider.

NFTs (non-fungible token) backed loans are also available – i.e. you can use blue chip NFTs as collateral for crypto loans, such as Bored Ape NFTs or CryptoPunk NFTs.

Multi HODL

The Multi HODL feature of Youhodler is essentially margin trading on low leverage – it allows you to boost your interest when the market goes up or down – a long position or short position.

It comes with no order placement fee, and no hidden fees like profit share fees. You can instantly leverage your crypto portfolio with real-time execution, and get online support 24/7 on how to do so safely.

You can still also keep earning interest while using Multi HODL.

YouHodler Team

The founders and owners of YouHodler are fully transparent – Ilya Vokov is the CEO and can be found on Linkedin and Twitter.

He’s a CVA board member (Crypto Valley Association) and Western Chapter Chair. Learn more about the team on the Youhodler blog.

Is Youhodler Safe?

Youhodler has an excellent 4.3/5 rating on TrustPilot based on 716 reviews of satisifed customers and has been operating since 2018. Its wallet and crypto conversion services – you can also buy crypto and swap crypto on the site or mobile app – are provided by Naumard Ltd.

As mentioned Youhodler is also a member of the Crypto Valley Association a reputable blockchain organisation in Switzerland, and the Youhodler company is a legal operation under the umbrella of the Swiss Federal Money Laundering Control Authority.

Most importantly, a message on the Youhodler website reads:

‘YouHodler uses Ledger Vault’s industry leading information technology infrastructure to securely control its crypto assets with a multi-authorization self-custody management solution and $150 million pooled crime insurance.’

The Youhodler site goes on to explain all transactions are 100% data encrypted with industry-leading Fireblocks security, and fiat funds are stored in top-tier banks.

Its crypto lending operations fall under PCI Security Standards, in accordance with the CCSS (Cryptocurrency Security Standard) and are regularly audited. YouHodler is also an active member of the Blockchain Association Financial Commission.