Join Our Telegram channel to stay up to date on breaking news coverage

Since the pro-crypto candidate’s victory in the 2024 U.S. Presidential election on November 5, both XRP and Hedera (HBAR) have emerged as standout performers in the cryptocurrency market. XRP has seen a 328% increase, while HBAR surged by an impressive 457%.

According to CoinMarketCap, XRP climbed to third place among digital assets and reached multi-year highs in early December. However, it has since slipped to fourth place, even as the number of active wallets for the altcoin has risen by 28% over the past two years. Meanwhile, other altcoins are experiencing positive trends, prompting investors to search for affordable tokens, particularly the best cheap crypto to buy now under 1 dollar.

6 Best Cheap Crypto to Buy Now Under 1 Dollar

Polymesh (POLYX), ranked #263 with a market capitalization of $257.29 million, has experienced notable growth of 44% over the past year. Analysts predict MVL could reach $0.012204 by January 22, 2025, marking a potential increase of 160.33% from its current price. Meanwhile, STMX has displayed high volatility in the past 24 hours, fluctuating between $0.0055 and $0.0060.

Solaxy ($SOLX), the first-ever Layer-2 protocol for the Solana blockchain, recently secured $3.5 million in its presale within just three days. NEM (XEM), an early blockchain platform, is currently valued at $0.02581, reflecting a 5.15% gain over the last 24 hours. Siacoin has risen by 2.45% within the same period, trading at $0.005665. In other news, Bitcoin has recorded its first weekly decline since the U.S. presidential election in 2016.

1. Polymesh (POLYX)

Polymesh (POLYX), currently ranked at #263 with a market cap of $257.29M, has shown significant growth over the past year, increasing by 44%. This performance places it ahead of 51% of the top 100 cryptocurrencies. The coin’s liquidity is notably high, a positive sign for traders and investors.

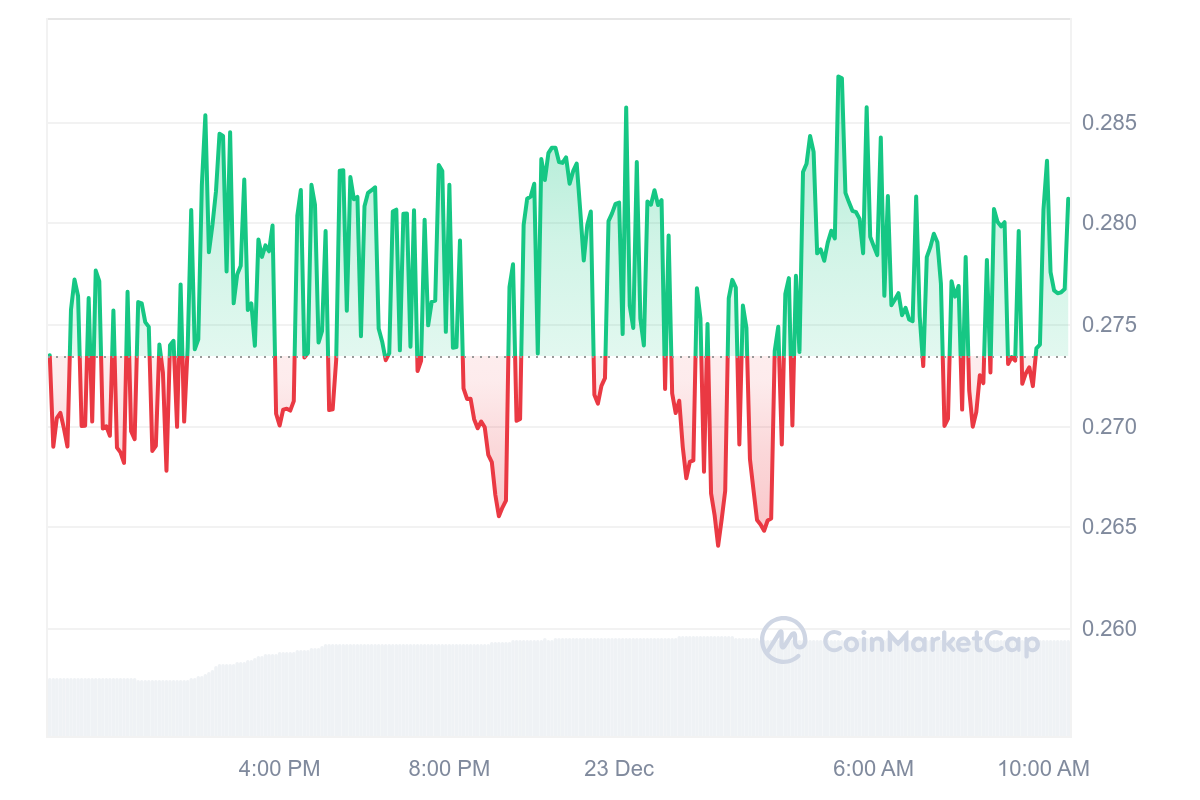

Analyzing recent market trends, POLYX has experienced price fluctuations within a narrow range over the past 24 hours, as depicted in the chart. Despite these short-term movements, the asset has maintained a generally stable trajectory with a slight upward trend.

Predictions for December 2024 suggest that POLYX might trade between $0.27816 and $0.411739, potentially offering a 22.74% increase from its current price. This could translate to a profit of around 46.57% for investors holding the asset.

How does utility token $POLYX circulate in the POLYX ecosystem to drive utility?

For starters, it fuels activities like voting and #staking that are critical to a secure and operational network. It's also used to incentivize entities to build on Polymesh and reward node… pic.twitter.com/wZ62I98qWV

— Polymesh 🅿️ (@PolymeshNetwork) December 19, 2024

For 2025, the outlook appears even more optimistic, with forecasts indicating a trading range from $0.388473 to a peak of $1.303101. The average expected price during the year is around $0.747476, hinting at a robust growth potential. In summary, Polymesh’s performance indicates resilience and potential for growth. Its high liquidity and solid one-year performance make it an interesting asset for mid- to long-term investments.

2. MVL (MVL)

Mobility Value Lab (MVL), operating on the Ethereum blockchain, is an innovative project integrating mobility services with blockchain technology to create a shared value system for all participants. MVL’s ecosystem is designed to harness data from vehicles, batteries, charging stations, and ride-sharing services and store it in the Decentralized Physical Mobility Infrastructure Network (DePIN). This data is then utilized to develop new services and products, fostering growth within the mobility sector.

Price predictions for MVL are optimistic, forecasting a rise to $0.012204 by January 22, 2025, representing a 160.33% increase from its current value. This projection is based on technical indicators that currently show a neutral sentiment, with a Fear & Greed Index indicating a level of greed at 70, suggesting cautious optimism among investors.

[23th December Weekly News]

✅New BNB-bMVL LP Staking Pool Open

✅MVL Moved to Bybit's Adventure Zone

✅TADA Singapore Celebrates Hong Kong Launch with Discount EventPlease join us on MVL official channels

➡️ https://t.co/5NVp7k3jy0 pic.twitter.com/P1sPwmbL4a— MVL (@mvlchain) December 23, 2024

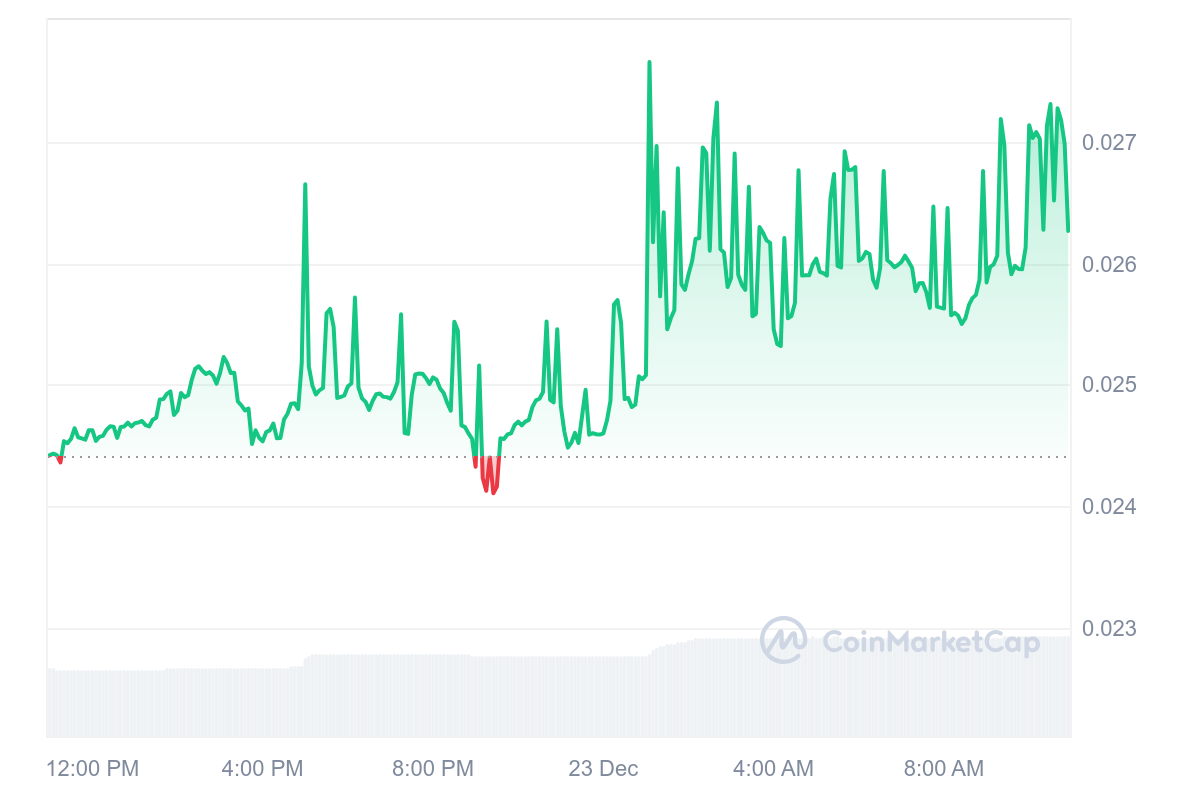

The chart provided shows MVL’s price movements over 24 hours. The price hovered around $0.004729 and exhibited a slight upward trend of 9.44% on the last day. This indicates short-term volatility but upward momentum, aligning with the longer-term growth predictions.

3. StormX (STMX)

StormX (STMX), currently ranked at #544, has a market cap of $72.98M and a trading volume of $36.74M over the last 24 hours, indicating high liquidity relative to its market size. The token’s price is $0.005917, with a minor increase of 1.32% over the past day.

Examining the chart, STMX has shown significant price volatility within the last 24 hours, oscillating between approximately $0.0055 and $0.0060. The chart highlights periods of gains (green areas) and losses (red areas), with 17 green days in the last 30, suggesting the price closed higher than it opened more than half the time.

The total and maximum supply of STMX is capped at 12.5 billion tokens, which could influence its market dynamics due to the fixed supply. The trading volume to market cap ratio at 50.4% further underscores the token’s liquidity, making it a potentially attractive option for traders looking for assets that can be bought or sold without significantly affecting the price. Overall, StormX’s market performance indicates a level of investor interest and trading activity, with a slight upward trend in the short term.

4. Solaxy ($SOLX)

Solaxy ($SOLX) is the first-ever Layer-2 solution on the Solana blockchain, raising $3.5 million in its presale within three days. It aims to resolve critical issues like network congestion, scalability challenges, and failed transactions arising from Solana’s rapid growth and popularity.

Solana has become a hub for meme coins, offering faster and cheaper transactions than Ethereum. However, its success has led to inefficiencies, with spam transactions and failed operations causing network strain. Solaxy addresses these challenges by introducing an application layer that operates alongside the main chain, improving scalability and reducing congestion.

What sets Solaxy apart is its multi-chain capability, bridging Solana with Ethereum. This allows it to combine Solana’s speed and affordability with Ethereum’s liquidity and security. Developers and traders could benefit from seamless interaction between the two ecosystems, creating new opportunities for decentralized finance (DeFi) and other applications.

In addition to supporting Solana’s upgrades, such as the QUIC protocol and Firedancer initiative, Solaxy offers immediate solutions to ongoing problems like transaction failures and spam activity. While still in its early stages, Solaxy’s potential lies in enhancing Solana’s ecosystem while tapping into Ethereum’s strengths.

5. NEM (XEM)

NEM (XEM), one of the pioneering blockchain platforms, is trading at $0.02581, reflecting a 5.15% increase in the past 24 hours. With a market cap of $232.31M and a 24-hour trading volume of $46.65M (a 50.48% increase), it boasts a liquidity ratio (Vol/Mkt Cap) of 20.1%, indicating strong activity.

The platform introduced innovations such as user-defined tokens (mosaics), namespaces, and multisignature accounts. Currently, NEM is trading above its 200-day SMA, suggesting bullish momentum despite the broader bearish sentiment reflected in price-prediction models. Interestingly, the Fear & Greed Index indicates a “Greed” level of 70, showcasing strong investor interest.

Over the last 30 days, NEM experienced 16 green days (53%), hinting at reasonable price stability. Technical indicators suggest the asset is oversold, which could lead to a price rebound in the short term. With a total and max supply of 8.99B XEM, no further dilution is expected.

6. Siacoin (SC)

Siacoin (SC) recently underwent the Siacoin V2 upgrade, introducing key features like account separation, real-time contract notifications via webhooks, and streamlined account management.

Siacoin is priced at $0.005665, up 2.45% in the past 24 hours. It has a market cap of $327.08 million and a 24-hour trading volume of $47.34 million. It trades 0.16% above its 200-day SMA of $0.005723, suggesting upward momentum.

This past week we released renterd v1.1.0, meaning…

⚡ Faster upload/download speeds

⚖️ Improved stability with better host selection

👍 More user-friendly setupReady for the #Sia V2 code drop in 2 weeks? Make sure you install renterd v1.1.0 today ✅ #datastorage #dataprivacy pic.twitter.com/LbEuHqO28A

— Sia Foundation (@Sia__Foundation) December 17, 2024

Over the past month, Siacoin recorded 15 green days (50%) and moderate price volatility of 10.44%. However, market sentiment remains bearish, even as the Fear & Greed Index registers 70 (Greed). Forecasts predict that Siacoin could rise by 3.72%, reaching $0.005891 by January 2025.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage