Join Our Telegram channel to stay up to date on breaking news coverage

Finding the best crypto to buy right now is a never-ending task, with dozens of tokens launched on CEX and DEX platforms daily.

Within the cryptocurrency space, decentralized finance (DeFi) activities constitute $4.22 billion in trading volume, comprising 10.77% of the total market volume for the day. Most of the market’s liquidity is attributed to stablecoins, accounting for $34.26 billion, or 87.48% of the 24-hour trading volume.

Best Crypto to Buy Now

These metrics indicate a relatively stable market but with subtle nuances. These modest changes in total market capitalization, Bitcoin’s performance over the past day, and a noticeable decrease in overall trading volume may be important metrics to investors. The observed decline in Bitcoin dominance suggests potential shifts in the broader cryptocurrency landscape, prompting further analysis to uncover the underlying market dynamics.

1. MultiversX (EGLD)

MultiversX has partnered strategically with Google Cloud to strengthen its presence in the Web3 domain. The collaboration integrates MultiversX with Google Cloud’s BigQuery data warehouse. This integration empowers Web3 projects and users, enabling them to extract valuable insights using robust data analytics.

Additionally, it enables the use of artificial intelligence tools within the Google Cloud ecosystem. It enhances the capacity to derive meaningful information from the combined capabilities of MultiversX and Google Cloud’s data infrastructure. Developers will benefit from access to vital information, including addresses, transaction amounts, smart contract interactions, and on-chain analytics.

The goal is to enhance the efficiency and accessibility of key data points for developers within the blockchain ecosystem. MultiversX has seen a 6% price rise in the past year. It presently trades above the 200-day simple moving average, indicating positive performance.

Big step in progressive decentralization.

Beginning today, the #MultiversX community decides on every significant protocol-level change.

Voting for the Sirius upgrade is now LIVE 🟢

Perhaps the most feature-rich since SCs & tokens. Have your say: https://t.co/TqPCAIFOIH pic.twitter.com/vwOAXtdciL

— MultiversX (@MultiversX) November 23, 2023

Moreover, it exhibits positive performance, with 18 green days in the last 30 days, indicating a 60% positive trend. The token boasts high liquidity based on its market capitalization and is actively traded on the Binance. Furthermore, the yearly inflation rate is reported at 0.19%.

In conclusion, the collaboration between MultiversX and Google Cloud represents a significant stride in facilitating data-focused blockchain projects, providing developers with accessible tools and insights.

2. Optimism (OP)

Over the past 24 hours, Optimism has seen a 4.28% price uptick, reaching $1.85. This bucks the recent week-long trend, where it faced a 1.0% dip from $1.85. The coin’s historical peak stands at $3.22.

Trading-wise, a significant 33.0% drop in volume has occurred over the past week. Simultaneously, the circulating supply nudged up by 0.24%, now at 880.92 million, around 20.51% of the 4.29 billion maximum supply. Optimism holds the #41 spot in the market cap, clocking in at $1.59 billion.

OP has doubled in price in the year-long view, outperforming 77% of the top 100 cryptos. Optimism consistently stays above its 200-day simple moving average. It has recorded positive trading results on 17 out of the last 30 days, representing 57% of that timeframe.

As the @apecoin DAO considers building an “ApeChain,” we think there’s a strong opportunity to call the Superchain its home.

Read on to learn why or check out the full proposal by our very own @ben_chain in the ApeCoin forums.https://t.co/WbZ7TtRFbW pic.twitter.com/nkm7KbIX2P

— Optimism (@Optimism) November 21, 2023

Notably, it’s trading close to its cycle high. Adding to its allure, Optimism boasts high liquidity based on market cap and actively trades on Binance.

3. Kava (KAVA)

Kava, a cryptocurrency prominent in the DeFi coins sector, has experienced notable fluctuations in its trading history. On August 30, 2021, Kava reached its highest price at $9.18, while its lowest point was recorded on March 13, 2020, at $0.256383.

Following its all-time high, Kava saw a cycle low of $0.513796; its highest post-low price was $1.314440. The sentiment for Kava’s price prediction is neutral, and the Fear & Greed Index suggests a level of 66 (Greed). KAVA’s current circulating supply is 960.05 million KAVA out of a maximum supply of 324.13 million KAVA.

The yearly supply inflation rate is 196.20%, creating 635.92 million KAVA last year. Kava holds the 10th position in the DeFi coins sector and ranked 36th in the Layer 1 sector. The project has demonstrated resilience with 17 green days in the last 30 days, constituting 57% of the observed period. This performance, coupled with high liquidity based on market cap metrics, positions Kava as an active player in the market.

Proposal for integrating #Kava EVM with The Graph has been posted.

Check out the details on their forum👇 https://t.co/Vy8AJKOyV6

— Kava (@KAVA_CHAIN) November 16, 2023

In summary, Kava’s journey in the cryptocurrency market showcases notable volatility, with a range of price movements. Investors should consider these factors, along with the current market sentiment and inflation rate, when assessing their stance on Kava.

4. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix is a cloud mining platform that recently introduced tokenization to combat third-party mining scams. This initiative enhances trust and reliability in the mining process. The project aims to provide a secure and transparent avenue for individuals to engage in Bitcoin (BTC) mining in a decentralized manner. One noteworthy aspect of the project is its substantial participation, with over 400,000

BTCMTX tokens locked in staking. The reported annual percentage yield (APY) stands at 103,225%, although it is expected to decrease as more tokens are staked.

Bitcoin Minetrix allocates 42.5% of the BTCMTX tokens to fund mining operations, while 35% is for marketing efforts and overall growth. Additionally, 15% is reserved for community rewards to acknowledge active participation, and 7.5% is earmarked for BTCMTX staking rewards. The project has garnered attention through an ongoing BTCMTX presale, raising over $4,304,865.77 by offering BTCMTX tokens at $0.0118 per token.

Furthermore, the minimum investment requirement is $10, making this opportunity accessible to many participants. Investors considering participation should know the three-day window for the current token pricing. It is crucial to weigh the potential benefits against the inherent risks associated with cryptocurrency investments.

Only 4 days left until #BitcoinMinetrix Stage 9 wraps up! ⏳ pic.twitter.com/UPw1QjUgFB

— Bitcoinminetrix (@bitcoinminetrix) November 23, 2023

BTCMTX positions itself as a cloud mining platform seeking to enhance security and transparency in Bitcoin mining through tokenization. While the reported APY is noteworthy, potential investors should conduct thorough research, considering the project’s goals and the broader cryptocurrency market landscape.

5. Toncoin (TON)

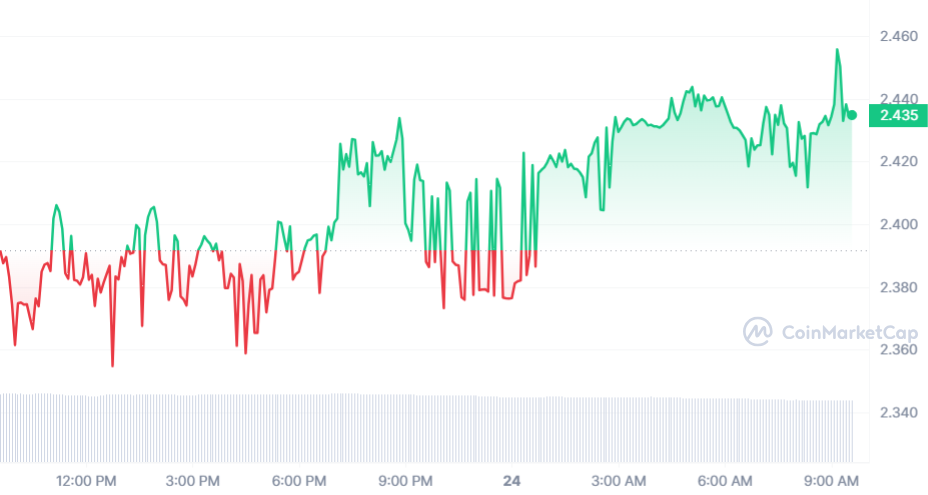

Toncoin is valued at $2.44 and has experienced a modest 1.93% uptick in the last 24 hours. Its trading volumes stand at $37.34M, contributing to a market cap of $8.36B and a market dominance of 0.58%. Toncoin peaked at $4.91 on December 25, 2021, and touched its lowest point at $0.523925 on September 21, 2021.

Since reaching its all-time high, it bottomed out at $0.757304, while the highest post-cycle low reached $3.06. The market sentiment is optimistic, as reflected in the bullish price prediction and a Fear & Greed Index of 66 (Greed). With a circulating supply of 3.43B TON, the coin has experienced a yearly supply inflation rate of 180.98%, creating 2.21B TON over the past year.

🎉 Phase 2 of the @Bybit_Official x #TON Odyssey event has kicked off!

Trade $TON to join the Trading Competition and grab a share of the $56K prize pool, along with other benefits and bonuses. Terms and conditions apply.

Details👇https://t.co/iME2bDL9Er pic.twitter.com/KnboBpouJX

— TON 💎 (@ton_blockchain) November 23, 2023

Toncoin holds the 5th position in the Proof-of-Stake coins sector and 9th in the Layer 1 sector. Key highlights include a 40% price increase in the last year, outperforming 62% of the market during this period. Over the past 30 days, Toncoin consistently traded above the average, with a frequency of 57%. Noteworthy is the coin’s presence on the KuCoin platform for trading activities.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage