Join Our Telegram channel to stay up to date on breaking news coverage

LTC Price Prediction – January 27

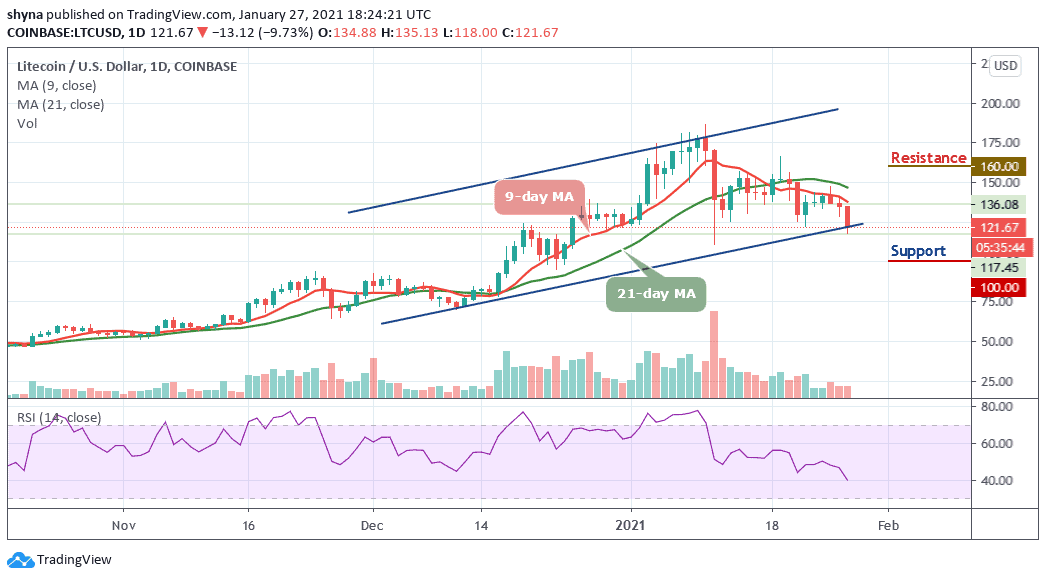

Looking at the daily chart, we can see that the Litecoin price is ready for a short-entry level near the $120 level.

LTC/USD Market

Key Levels:

Resistance levels: $160, $170, $180

Support levels: $100, $90, $80

LTC/USD is seen hovering below the 9-day and 21-day moving averages as the technical indicator RSI (14) prepares to slide below the 40-level. Meanwhile, a decreasing volume index also suggests a breakdown but a death cross is likely to come into the picture as the red-line of the 9-day moving average remains below the green-line of the 21-day moving average in the daily chart.

What is the Next Direction for Litecoin?

As the coin crosses below the lower boundary of the channel, support is expected at $120, but LTC/USD might revisit the $115 level if the declines persist. The RSI (14) is currently flashing a sell signal aiming to cross below the 40-level which may be adding weight to the bearish outlook.

More so, should in case the daily bearish candle closes below $112, there is a high probability that the price may reach the support levels of $100, $90, and $80. Moreover, if the market price closes the day above the moving averages, the bearish outlook may be invalidated. Such a price action will encourage investors to hold still and stop panic selling. An increase in buy orders might create enough volume to support gains beyond $150. Any further bullish movement may reach the resistance levels of $160, $170, and $180 respectively.

Against Bitcoin, the Litecoin price keeps moving sideways, trading below the 9-day and 21-day moving averages. Should in case a trend rebounds, there could be an upsurge in the market. Now, the coin is trading around the 4052 SAT, moving below the channel may cause it to hit the support at 3500 SAT and below.

However, if a bullish move occurs and validates a break above the moving averages, the price may likely hit the potential resistance at 4600 SAT and above. Meanwhile, the RSI (14) is seen moving below the 45-level to increase the bearish momentum.

Join Our Telegram channel to stay up to date on breaking news coverage