Join Our Telegram channel to stay up to date on breaking news coverage

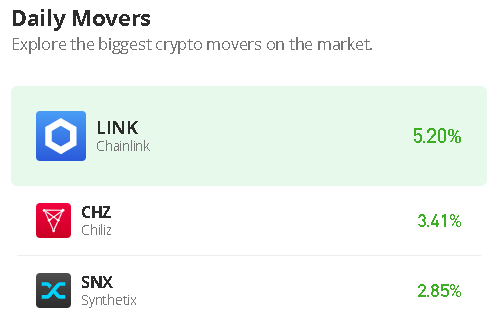

The LINK price is recovering from the daily opening price at the $7.65 level as the price heads to the upside.

Chainlink Prediction Statistics Data:

- Chainlink price now – $7.96

- Chainlink market cap – $3.9 million

- Chainlink circulating supply – 491.5 million

- Chainlink total supply – 1 billion

- Chainlink Coinmarketcap ranking – #23

LINK/USD Market

Key Levels:

Resistance levels: $10.0, $11.0, $12.0

Support levels: $6.0, $5.0, $4.0

LINK/USD is trading above the 9-day and 21-day moving averages after touching the daily high at the $7.99 resistance level. At the time of writing, Chainlink is changing hands at $7.96, having gained over 4.01% since the beginning of the European session. However, with latest the recovery, the digital asset is likely to head towards the upper boundary of the channel to increase the bullish movement.

Can LINK Break Above $8.0 as TAMA Prepare for a Strong Rally?

The Chainlink price stays above the 9-day and 21-day moving averages at the price level of $7.96. However, if the bulls maintain the upward trend, LINK/USD may touch the resistance levels of $10.0, $11.0, and $12.0 to keep the price on the upside. In other words, any strong selling pressure below the 21-day moving average may drag the price towards the lower boundary of the channel.

However, should in case Chainlink trades below the lower boundary of the channel, and a bearish continuation could bring the price to the supports of $6.0, $5.0, and $4.0. Meanwhile, the technical indicator Relative Strength Index (14) is moving to cross above the 60-level, indicating a bullish movement.

When compares with Bitcoin, the Chainlink price is heading to the north as the coin moves above the 9-day and 21-day moving averages. However, following the recent positive sign, the current market movement may continue to follow the upward movement if the buyers push the price above the upper boundary of the channel.

Moreover, as the technical indicator Relative Strength Index (14) moves into the overbought region, the market price could hit the resistance level of 4500 SAT and above. Meanwhile, a retest below the moving averages could lower the price to the support level of 3500 SAT and below.

The Tamadoge team said that the move aims to make investing in TAMA easy and safe. These users can be confident in transferring fiat into crypto, hence the need for Tamadoge to secure this deal with Transak. One of the strongest pillars of any project in the web 3.0 & crypto sector is having a solid team to see the project succeed. The TAMA website has revealed Thomas Seabrook as the Tamadoge lead developer and Carl Dawkins as the head of growth. The other members of the Tamadoge team include Neil Palethorpe and Siphamandla Mjoli, who have joined as the Senior Interaction Designer and the Senior Blockchain Developer, respectively.

Related:

Join Our Telegram channel to stay up to date on breaking news coverage