Join Our Telegram channel to stay up to date on breaking news coverage

The Justice Minister of South Korea has formally announced the formation of a domestic bill that would seemingly seek to ban cryptocurrency trading on exchanges in the nation. The bill has apparently been coordinated with input from numerous agencies, ministers, and regulators.

Also read: Bitcoin Cash Changes Address Format to Prevent Costly Confusion With BTC

Join the Bitsonline Telegram channel to get the latest Bitcoin, cryptocurrency, and tech news updates: https://t.me/bitsonline

Crackdown Bill in Progress

During a January 11th press conference, South Korean Justice Minister Park Sang-ki formally announced the creation of an inter-governmental bill that will seek to ban cryptocurrency trading in South Korea.

Contradicting previous reports that South Korean regulators were mainly focused on de-anonymizing cryptocurrency use, Park seemed to note cryptocurrency exchanges in general would be targets:

“There are great concerns regarding virtual currencies and justice ministry is basically preparing a bill to ban cryptocurrency trading through exchanges.”

The news comes at a time when FOMO (“Fear on missing out”) has seemingly reached a fever pitch in South Korean cryptocurrency markets. With bitcoin, ether, and altcoin prices in the nation considerably higher on average in recent weeks than in other markets the world over, the speculative mania has finally drawn the formal ire of regulators.

Justice Minister Park noted that more details would be forthcoming, but that the bill in question would engender measures that would require coordination between numerous domestic agencies.

Prices Plunge

As FUD (“fear, uncertainty, doubt”) spread through the cryptoverse upon the announcement of the ban bill, such fear quickly was reflected in the markets.

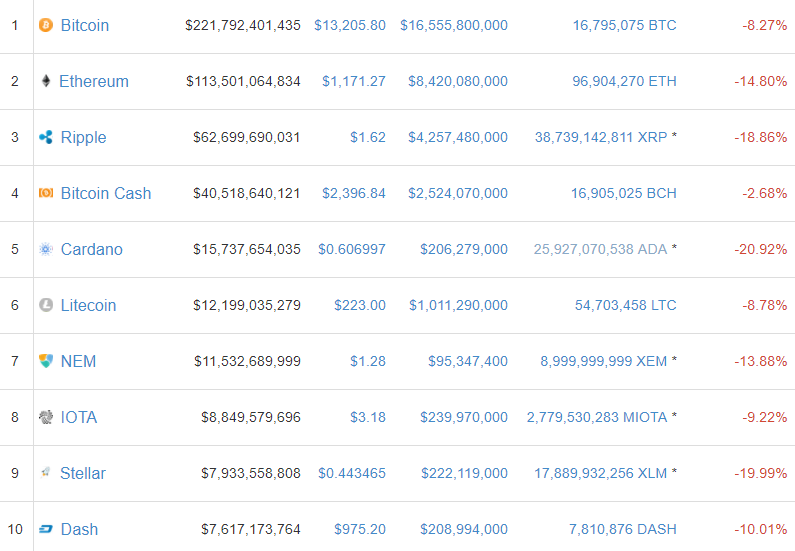

At press time, all but a handful of cryptocurrencies in the top 100 projects by market capitalization lie in the red.

The top 10 is bleeding out for now.

It’s not the retracement we expected, but perhaps it’s the retracement we’ve been waiting for. With the incredible surge of altcoins over the past several days, it was only a matter of time for the markets to take a significant dip.

But this is a news-driven dip, to be sure, so prices will likely continue trending down as long as the proposed ban dominates news cycles. Could this be the beginning of the “crash” that Charles Hoskinson predicted for the space a few days ago?

It’s impossible to tell this early on — it may just be that the market recovers smoothly in time, just as it did after China’s regulatory crackdowns in October 2017.

But for now it’s South Korea on every crypto traders’ mind, for better or for worse.

Exchanges Raided in South Korea

Hindsight is 20/20, as exchange raids throughout South Korea this week now put the Justice Minister’s proposed cryptocurrency trading ban into better focus.

Popular South Korean crypto exchanges like Bithumb and Coinone were targeted during the raids in question. The raids were greenlighted on the pretext of tax evasion suspicions.

After the fact, a Coinone official confirmed to Reuters that a “few officials from the National Tax Service raided our office this week,” while a Bithumb official confirmed “paperwork” had been seized.

The intensified investigations come on the heels of the South Korean Financial Services Commission’s December decision to bar domestic cryptocurrency exchanges from registering new customers.

When it comes to digital assets, then, it looks like South Korea is following China’s lead — not Japan’s — going forward.

Some Are Saying Not to Worry

For every person who panic sells in crypto, there’s another who says to hold strong.

Accordingly, already on social media, many commentators are trying to calm the anxieties that have exploded around the alleged ban, arguing that the Reuters report is overblown.

For example, Ran

Join Our Telegram channel to stay up to date on breaking news coverage